California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Mark V. Cannice

As the world has experienced a massive disruption in its social and economic norms during the global pandemic, entrepreneurship persists and even leads to new paths of recovery. In fact, over 20 biotechnology firms based in San Francisco have received financing since the U.S. economy locked down in March. Despite this ray of hope, what can entrepreneurs expect and plan for as we advance further into pandemic and eventually post-pandemic norms of business? To help entrepreneurs reach a brighter post-pandemic future I sought the advice of Silicon Valley venture capitalists as they have financed and guided nascent startups that have created new methods of business and new industries for decades. Their experience in managing and creating disruptive forces has armed them with insights on how new ventures can best navigate externally driven disruptions to business and social practices.

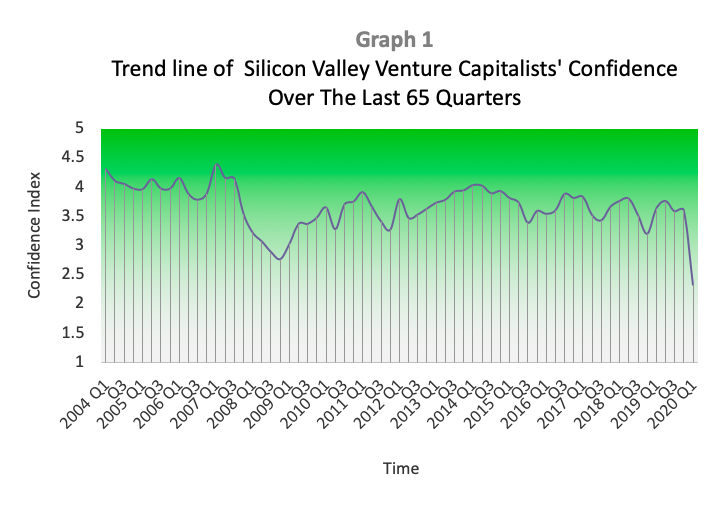

However, the pandemic impacts venture capitalists and their confidence as well. The Silicon Valley Venture Capitalist Confidence Index™ Research Report for the first quarter of 2020 indicated its lowest reading of VC sentiment in the 16-year history of that Index. In commentary explaining the drop in confidence in the Q1 2020 report, Shomit Ghose of Onset Ventures provided context “Speaking from a Silicon Valley startup perspective only, the current economic crisis has a biological cause and will not readily lend itself to an economic cure. Startups should batten down the hatches.” Another VC respondent in the same report added “We will see the rise of new business models and companies – ideas that we have not thought about yet.” While expectations of the pandemic’s shock leading to new models of business were noted, lower VC confidence tends to coincide with less venture finance. In fact, the number of seed stage deals financed in Q1 declined sharply from the previous and year-earlier quarter.

Please see Graph 1 for a trendline of VC confidence over last 65 quarters.

Despite the decline in VC confidence and early stage investments, it is heartening to recall that even during the depth of the Great Recession in 2008 and 2009 the number of angel and seed rounds increased significantly (helping launch firms such as Uber and AirBnb) so there is hope that this pattern of early stage financing may arise in the current economic malaise. Furthermore, firms such as Zenith Electronics and Darigold were established during the Pandemic of 1918. Still, the current pandemic shock has shaken the foundations of most methods of business to the core, with those employing digital models and services thriving and those in many traditional sectors struggling or failing. We have yet to see what new organizations will emerge alongside the advent of the current shock, but we can expect those new ventures will be best suited to the post-pandemic environment.

Previous research has found that entrepreneurs of nascent ventures are not unduly dissuaded by shocks to the macro environment, therefore, VC-recommended strategies to cope with the current shock may bolster entrepreneurial confidence and eventual success. Eight Silicon Valley venture capitalists provided their in-depth responses to two primary questions for this paper. First, they each described what they see as the key challenges to entrepreneurs during the health pandemic. They also provided their recommendations on how entrepreneurs should position their ventures during and after the pandemic. Reviewing the VC responses, common themes emerged that pointed to specific challenges and strategies that entrepreneurs may wish to consider. The direct responses of each of the participating VCs are provided in the following and a summation of themes are provided in Table 1. All of the participating VCs agreed to be cited for this paper and are listed in Table 2.

Uncertainty and Timing. Several high level challenges during the pandemic were identified. Dag Syrrist of Vision Capital indicated “During the crisis the challenges are uncertainty with how and when the economy will recover and what sectors will have been permanently changed. All companies are affected by this, and no one knows the length or depth of the impact. Adjusting one’s business to unknown drivers and parameters is exceedingly difficult, especially given the uneven responses across the country and utter lack of clear government guidance. After the crisis it’s easier from the perspective of more being known.” John Malloy of BlueRun Ventures emphasized “Timing is the bane of every entrepreneur and investor. The earlier the stage the more difficult it is to understand the cycle of adoption for your new solution, product, etc. This timing challenge exists even in the ‘best’ of times. The current pandemic distorts the cadence, perception and the timing of everyday life for everyone. Nobody actually knows the answers to timing around the pandemic. Stay critically focused on the challenges of understanding your venture’s timing without making the uncertainty of the pandemic an excuse for inaction or worse.”

Capital, Customers, Communication, Planning, and Survival. Bob Ackerman of AllegisCyber, predicted “Startup capital will be exceptionally more difficult to come by during the pandemic lockdown and until such time as the economy and the risk capital markets begin to stabilize. The later stage (more mature and less risk) markets will be the first to recover, and over time investor appetite will move to earlier stage opportunities as the later stage companies become fully valued.” Similarly, Shomit Ghose of Onset Ventures estimated “Money will be tight, both from customers and from investors. Survival is key, so cash is king.” Mr. Ghose continued, saying “Think of it this way: If 2019 was The Year of the Unicorn, 2020 is The Year of the Camel. Be cash-efficient; be a camel.” Mohanjit Jolly of Iron Pillar highlighted “Survival will be a prerequisite to eventually thriving for many entrepreneurs. So, making tough decisions to extend runway is what many have been grappling with. Balancing conservatism with respect to cash while continuing to grow their respective businesses is another key challenge that entrepreneurs have been addressing. Many young entrepreneurs and even some VCs have never really experienced a downturn, and definitely not one like this one. So, just being able to take a deep breath and get going ASAP with contingency planning is an unfair advantage experienced entrepreneurs and investors have over those who are in their initial innings.”

Alex Fries of Alpana Ventures specified “The key challenge in my opinion is to come up with a plan to stay alive for the next 12 -18 months. This means having the guts to reduce cost and possibly lay-off people. If you are a first time entrepreneur, it may not be easy to do. Support from advisors and the board are key. The next challenge is to keep the KPIs neutral or even increase them. This will allow the company to potentially raise the needed capital to move forward. Lastly, during the pandemic, you want to make sure to stay RELEVANT and communicate with customers and partners. After the health pandemic, the challenges are the ones they can expect with a normal situation: how to grow and keep growing. Post pandemic, challenges during a normal economy (like fundraising and finding good talent) may be easier, since many startups that were not fundable disappeared and many good people were laid off.”

New Systems and the New Economy. Eric Buatois of Benhamou Global Ventures suggested entrepreneurs should “find new company management operating systems.” Mr. Buatois clarified that entrepreneurs should learn “how to put in place the right management processes and tools to engage a workforce more distributed and working from home part time,” as well as understanding “what will be the meaning of meeting in the office,” along with optimizing “interactions with customers that will be digital and video, and how to master these tools.” Tim Draper of Draper Associates reminded “Entrepreneurs hold the responsibility for the future on their backs. The poor policy decision to shut down the world to fight the virus has pushed reset on the economy. Entrepreneurs will need to get the 41 million Americans and 400 million worldwide back to work. They will also need to show us the future of travel, hotels, transportation, education, healthcare and government (Bitcoin has already shown the way in finance). They will guide us toward a utopia of freedom or a dystopia of government control. Fundraising will be the least of their worries. If they solve some of these problems, I will fund them.”

VC commentary suggests that primary challenges facing entrepreneurs during the pandemic include surviving the rapid change and accompanying uncertainty and constraints in timing, capital, systems, customers, communications, and planning. Entrepreneurs’ adaptation to the new environment is crucial to surviving the external shock and thriving post-pandemic. To paraphrase Shomit Ghose, entrepreneurs should adjust from unicorn to camel mode. In order to provide specific guidance to entrepreneurs, venture capitalist respondents also addressed positioning of ventures during and after the health pandemic given the aforementioned challenges.

Reduce Risk and Cost. Bob Ackerman of AllegisCyber pointed out “Investors will be hypersensitive to ‘risk’ during the pandemic and early phases of economic recovery. In order to successfully raise capital (and build their business), entrepreneurs will need to demonstrate domain mastery (reducing risk), focus on solutions to clear and demonstrated high value problems (a pain killer as opposed to a vitamin) with a very efficient and focused business plan (read that as requiring less capital and a shorter path to revenue).” Mr. Ackerman continued, saying “’nice to have’ and ‘wouldn’t it be nice if’ are not going to get investors’ attention.”

Furthering this advice, Dag Syrrist of Vision Capital explained “During the crises it’s a combination of limiting costs and minimizing cash burn, while accurately adjusting to one’s immediate customer and employee needs. Honestly asking how this effects one’s business, without hoping and pretending it does not, is hard, as well as thinking through derivative effects on customers’ customers and so forth. After the crisis there will be a prolonged period before we return to anything close to pre-crisis economy given the 40 million people who have lost their jobs and will take decades to recover. It took 10 years after 2008 to get back to the same employment level and participation rate. A long and deep recession will impact everyone along the value chain, virtually regardless of sector. While many great companies are formed in hard economic times that can take advantage of increased talent pool, enterprises seeking to lower operational expenses, and to some extent new businesses, have an easier time as they do not need to pivot from pre-crises business models and operations.”

Exude Positivity and Product and Customer Focus. Alex Fries of Alpana Ventures encouraged entrepreneurs, saying “During the pandemic stay positive, work on the product more than on sales, keep communications with customers/prospects active and reduce/stop all non-essential costs. Strive to have a runway for the next 12 months or longer. After the pandemic hire the good talent available and fundraise.” The recommended focus on product development during a crisis is supported by earlier research which found that higher levels of technical resources such as a strong product pipeline tended to mitigate the impact of adverse events. Eric Buatois of Benhamou Global Ventures argued “The pandemic has created a pause button. It is important for companies that are well financed to accelerate their product roadmap and IP barrier to entry and also take advantage of shaping up their go to market (GTM) to be fully ready post recovery. If a company has a strong tailwind like an E-commerce play, then the objective is to grab as much market share as possible.” Mohanjit Jolly of Iron Pillar stated “Those who focus on their existing customers, understand their pain and come up with creative solutions will have customers for life. This is when the resolve, creativity and laser focused execution of the winners will be sharply contrasted with those who unfortunately will be collateral damage post Covid.”

Adapt New Modalities. Shomit Ghose of Onset Ventures contended “The pandemic will force all business models to virtualize, following in the footsteps of e-commerce and fintech. Entrepreneurs should focus their value propositions on virtualized business models. The pandemic has pushed us into a new reality, and this reality will persist even after a vaccine has vanquished the disease.” Mohanjit Jolly of Iron Pillar added “Going forward, entrepreneurs will need to always have a contingency plan in place, focus on gross margins, unit economics along with growth (but without the notion of growing at any and all costs). I fundamentally believe that work from home (WFH) will become part of the hybrid work environment going forward (remote combined with on-premises). The world, at least the tech world, has seen that productivity can co-exist with remote access. Therefore, startups can be more efficient, with reduced travel, real estate and other expenses. At the same time, those companies who treat their employees right, with respect and empathy during these times will reap a significant ROI in terms of employee loyalty and reduced churn.”

Survive, then Thrive and Build the Future. John Malloy of BlueRun Ventures urged entrepreneurs to “Survive and then thrive. Remind yourself that great companies are born in times of stress. You are built for change while most incumbents are not. Continue to focus & build on what you consider your core innovation or North Star. You can adjust your path based on new realities of the pandemic but keep steering towards that future success!” Tim Draper of Draper Associates reiterated “Each venture will be different. Some will need to preserve their cash until they have developed good cash flow from customers. Some may want to expand while the rest of the world is frozen. I think everyone will want to be flexible as to whether they work from home some of the time. In general, I recommend entrepreneurs work toward a free, open world. We all benefit from that.”

Guiding Themes of Silicon Valley Venture Capitalists. In reviewing the commentary of the venture investors, a number of themes emerge. Primary challenges revolve around new uncertainties accompanying the pandemic shock. The pandemic shock has no analogy in modern times and so pandemic driven uncertainties of timing, capital, customer and product variability all need careful assessment and distinct responses. Meanwhile, recommended strategies for coping during and growing after the pandemic center on flexibility and action. Specifically, entrepreneurs must reduce risk and cost while focusing on product and customer and adapt new, primarily digital, modalities of business. Please see Table 1.

Table 1 VC Guidance to Entrepreneurs During and After the Pandemic

| VC Identified Challenges (During Pandemic) | VC Recommended Positioning (During Pandemic) | VC Recommended Positioning (After Pandemic) |

|---|---|---|

| Uncertainty | Stay positive and demonstrate domain mastery (reduce risk) | Startups are built for change – adjust course as more is known |

| Timing | Adjust venture direction, pacing, and flexibility | Focus on core innovation as North Star to stay on course |

| Capital | Reduce costs / Extend runway | Solve problems for new environment; funding will follow |

| Planning | Contingency plan / Stay alive | Startups can adjust direction more easily as they do not need to pivot from pre-crises business models. Thrive |

| Customers’ constraints | Understand customer pain and come up with creative solutions | Leverage domain mastery. Be ready for recovery & growth |

| Shifting markets | Engage with customers andwork on the product more than on sales | Grab as much market share as possible |

| Communication | Communicate with customers / Seek help from Board | Stay relevant |

| New operating systems | Manage distributed workforce | Focus value propositions on virtualized business models |

| Key performance indicators (KPIs) | Focus on gross margins, unit economics along with sustainable growth | Provide flexibility for employees |

| Responsibility for the future economy | Determine new methods of business / Accelerate product roadmap and IP barrier to entry | Hire best talent as more is available due to layoffs Fundraise & build the future |

The health pandemic has brought terrible human suffering and economic carnage throughout the world. As nations and organizations try to recover and adapt to the new environment, guidance from Silicon Valley venture capitalists may enable entrepreneurs to ‘survive and then thrive’ as John Malloy urged. Entrepreneurs, as agents of change, may be particularly well suited to evolve their ventures’ business models as there are fewer institutionalized methods of management in their nascent firms. Many thanks to the venture capitalists who contributed their experience and insights to help entrepreneurs guide their ventures through the pandemic to the new world. Be well.

Table 2 Participating Venture Capitalists

| Participant | Company | Key Insight |

|---|---|---|

| Alex Fries | Alpana Ventures | Focus on product; be positive |

| Dag Syrrist | Vision Capital | Adjust to customer needs |

| Eric Buatois | Benhamou Global Ventures | Accelerate product roadmap |

| John Malloy | BlueRun Ventures | Survive and then thrive |

| Mohanjit Jolly | Iron Pillar | Respect/empathize with employees |

| Robert R. Ackerman, Jr. | AllegisCyber | Reduce risk; show domain mastery |

| Shomit Ghose | Onset Ventures | Be cash efficient; be a camel |

| Tim Draper | Draper Associates | Take responsibility for the future |

1. Crunchbase [https://www.crunchbase.com/search/organization.companies/0da9726675c914b8faa1b1cb4f3a6ee2](https://www.crunchbase.com/search/organization.companies/0da9726675c914b8faa1b1cb4f3a6ee2)

2. NVCA 2020 Yearbook. [https://nvca.org/research/nvca-yearbook/](https://nvca.org/research/nvca-yearbook/)

3. Cannice, Mark (2020). *Q1 2020 Silicon Valley Venture Capitalist Confidence Index™ Research Report.*

4. Cannice, Mark V., and Cathy Goldberg (2009). “Venture Capitalists’ Confidence, Asymmetric Information, and Liquidity Events”, *Journal of Small Business and Entrepreneurship* (Routledge) 22 (2), pp. 141-164.

5. PitchBook-NVCA Venture Monitor Report Data Q1 2020.

[https://nvca.org/research/pitchbook-nvca-venture-monitor/](https://nvca.org/research/pitchbook-nvca-venture-monitor/)6. Cannice, Mark (2020). *Q1 2020 Silicon Valley Venture Capitalist Confidence Index™ Research Report. (VC Confidence Graph used with permission).*

7. PitchBook-NVCA Venture Monitor Report Data Q1 2020.

[https://nvca.org/research/pitchbook-nvca-venture-monitor/](https://nvca.org/research/pitchbook-nvca-venture-monitor/)8. [https://zenith.com/heritage/](https://zenith.com/heritage/)

9. [https://www.darigold.com/about/our-history/](https://www.darigold.com/about/our-history/)

10. Davidsson, P., & Gordon, S. R. (2016). Much Ado About Nothing? The Surprising Persistence of Nascent Entrepreneurs Through Macroeconomic Crisis. *Entrepreneurship Theory and Practice*, 40 (4), 915-941.

11. De Carolis, D. M., Yang, Y., Deeds, D. L., & Nelling, E. (2009). Weathering the Storm: The Benefit of Resources to High‐Technology Ventures Navigating Adverse Events. *Strategic Entrepreneurship Journal*, 3(2), 147–160.