California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Ram Shivakumar

Which economics concepts and ideas are essential for managers? This is a question that I have pondered because I have been teaching a course on microeconomics for MBA students at the Booth School of Business at the University of Chicago for 15 years.

The typical microeconomics course exposes students to a plethora of concepts and models. A short list includes the demand and supply model, indifference curves and budget lines, production functions and cost functions, the perfect competition, monopoly and oligopoly models, risk and information. It is easy for professors to believe that all of these concepts and models are of relevance for the manager. After all, the manager’s task is to decide what to produce, how to produce, and how much to sell at what price - the very questions that microeconomics addresses.

But economists often deliver their ideas in a language that is unfamiliar to many managers - the language of mathematics. So caught up are the managers in the equations and figures that it is not uncommon for them to fail to see the forest while counting the trees. Consequently, many managers query the relevance and utility of economics for real-world problem solving.

But cut through the thicket of models and mathematics and one will find several ideas of deep intellectual and practical significance. None of these ideas require more than a knowledge of basic mathematics and logical thinking.

Many managers query the relevance and utility of economics for real-world problem solving… But cut through the thicket of models and mathematics and one will find several ideas of deep intellectual and practical significance.

Here are six economics lessons that provide clarity to managers in their mission and tasks.

The first lesson centers on the customer demand for products and services. What do customers need, how many units do they want, and how much are they willing to pay for it? Suppose that a customer’s maximum willingness to pay for a single unit of a product is denoted by B, a number. What every manager wants to know is the value of B. Economics demonstrates how to organize one’s thinking on when, why and how much B changes.

The manager’s task is to get as precise an estimate as possible of B. A number of competing methods and models are used to estimate B. Some methods attempt to estimate consumers’ stated preferences through the use of surveys, while other methods attempt to estimate consumers’ revealed preferences through the use of market data and/or controlled experiments. Expert judgment is sometimes used to interpret survey data. And sometimes, analytical models (such as conjoint analysis and discrete choice models) are used to estimate the value of the attributes of the product.

B is altered by many forces. Economics courses tend to emphasize the market/industry/economy wide forces such as changes in customer tastes, shifting income and expenditure considerations and changes in the prices of competing and complementary products. However, many of the forces that shift B are company specific and within its control. Companies often emphasize the functional, emotional and life-changing attributes of their products and service in their advertising and communication campaigns.

For instance, Peloton, the exercise equipment and media-company, emphasizes the life-transforming experience of joining the community of (remote) bicycling aficionados. Amazon emphasizes the functional and transformational experience of Amazon Prime because of the convenience of free two-day delivery of products, and on-demand access to movies, TV, music and books. And the advertising campaign slogan for the first Apple iPhone, “This changes everything” refers to the functional, emotional and life-changing aspects of owning an iPhone.

Managers must also grapple with the question of how best to sell their products and services. Should products and services be sold via an auction (as on eBay) or with posted prices (take it or leave it) or should they be sold via negotiation? Auctions are better when B is widely dispersed which is why auctions are used to sell art, wine and rarely traded products. However, auctions require an investment of time - a luxury in the 21st century economy. Posted prices have become the dominant method of selling standardized products because buyers look for immediate gratification. And negotiation is the preferred mode of selling when products and services must be customized and when there is heterogeneity amongst customers.

For economists, all costs are opportunity costs. Rather than focus only on the direct cost of an activity in the way that accounting does, economists ask, “what must the firm give up to engage in this activity?” Framed this way, lost benefits also count as costs. The fact that a company own assets- such as an office building- does not mean that its cost of ownership are zero. The cost of using an office building includes, in addition to the direct costs of operating the building, the lost rent from leasing it.

In fact, the most significant costs that companies incur do not show up on their income statements. Many companies raise equity capital from investors. On an income statement, the cost of equity is assumed to equal zero since there is no explicit payment that the company must make to investors. However, equity investors do expect a financial return. In fact, if they do not receive an adequate return, they will likely put their money elsewhere. By forcing companies to acknowledge that equity capital carries an implicit cost, economics forces the company to raise the bar on investments that it chooses.

If ignoring implicit costs is an error of omission, counting costs that have been incurred and that cannot be recouped, is an error of commission. This is known as the sunk cost fallacy. The most famous instance of sunk costs distorting decisions is when the British and French governments, after jointly launching the Concorde supersonic passenger airline in 1976, chose to continue investing in the project despite mounting evidence that its economic prospects were not promising. The original budget for the Concorde was £70m. The eventual cost was £1.3b.

One reason why managers fall victim to the sunk cost fallacy is that they are unwilling to accept that their prior investments have failed. Managers often tell themselves that success requires patience and determination. As well as incremental investments! The behavioral economists, Daniel Kahneman and Amos Tversky, proposed an explanation for why people and firms are willing to throw good money after bad. They call it loss aversion- the idea that people prefer to avoid a loss compared to a gain of an equivalent sum. In the corporate world, it is not uncommon for managers to take on more risk so that the company has a shot at salvaging its prior investments, rather than acknowledge losses.

EV = B – C. Figure 1 shows that the wider the wedge between B and C, the greater is the economic value created. If a firm cannot create EV, either because it cannot boost B or because it cannot keep C lower than B, the signals are clear - the firm should contemplate exit.

The task for a manager is to figure out how to create EV. Should the manager spend more money upgrading products, or on advertising campaigns, or on modernizing infrastructure? Or should the manager reduce costs by outsourcing production or by altering its product and input mix?

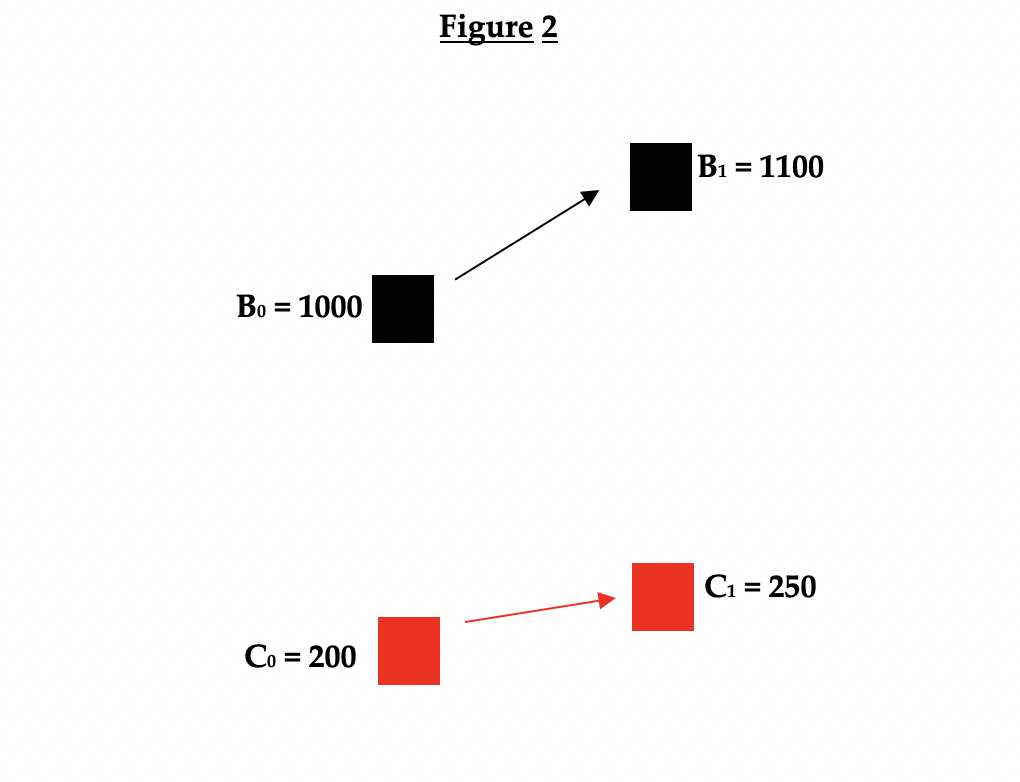

In Figure 2, widening the gap between B and C requires the firm to increase C. Increasing C by $50,000 leads to a $100,000 increase in B. Generally speaking, it is difficult to increase B without increasing C (unless there are many inefficiencies that can be reduced or eliminated). The luxury hotel chain, The Four Seasons, must spend a lot to improve and maintain its facilities and service because it caters to a high B customer. In contrast, the budget hotel chain, Holiday Inn Select, can incur a small C because its customers have a low B.

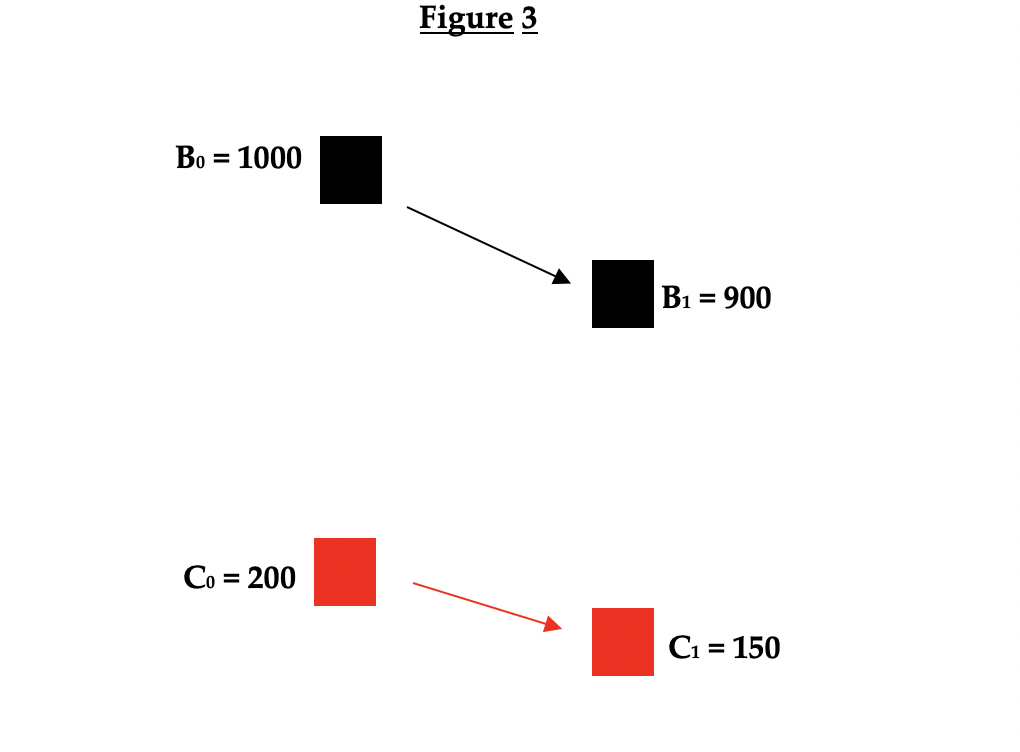

Beware across the board reductions in C. Some components of C can be reduced without consequence for B. But reducing other components of C can be self-defeating. As Figure 3 shows, reducing C by 50,000 leads to a $100,000 reduction in B.

Of course, there is more than one B because people differ in their tastes, incomes and potential choices. Comparisons of EV across customers force managers to narrow the range of target customers. Some target customers may have a higher B than other target customers but may also force the firm to incur high C. Other target customers may require low C but command a small B.

For every firm, the potential to create economic value is greater with some customers than with others. In fact, some customers are best avoided. The manager’s task is to find those customers whose wants, needs and B best match with the firm’s offerings and capabilities.

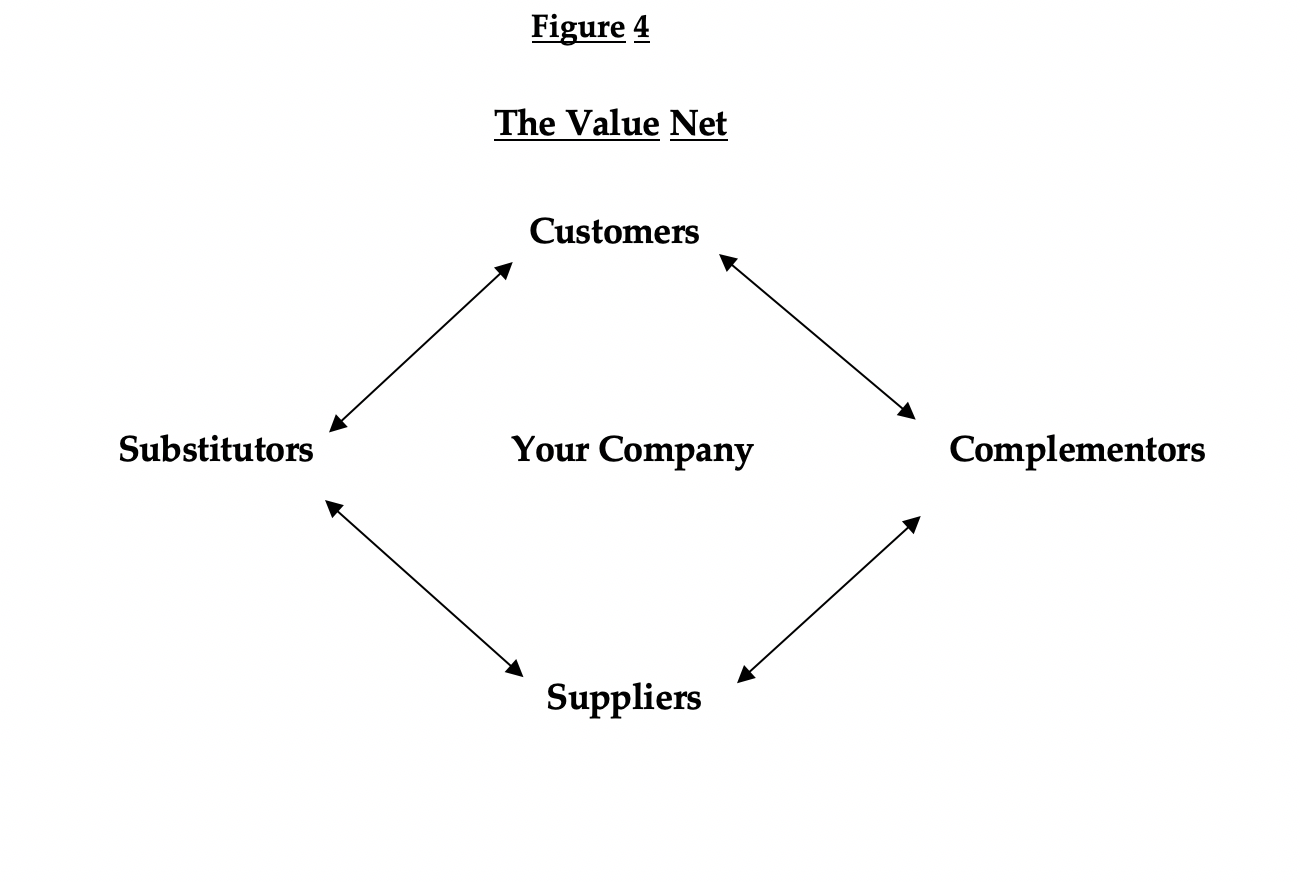

In their book Co-Opetition, Adam Brandenburger and Barry Nalebuff posit that every company’s Value Net - the value created by a company’s network- is influenced by 4 distinct sets of players: customers, suppliers, substitutors and complementors. Each set of players cooperates to increase EV but also competes to capture a greater share of EV.

Figure 4 is a reproduction of the Brandenburger-Nalebuff Value Net map. On the vertical dimension are the players your firm transacts with. Your suppliers provide raw materials, finished goods, labor, services and more. Your customers purchase your finished products, services and more.

On the horizontal dimension are the players you interact, but do not, transact, with. Your substitutors are more than just your closest competitors. They also include those firms whose products are not as closely substitutable but never-the-less command the attention of your customers. For instance, American Airlines is a close substitutor for United Airlines. But Amtrak and the Megabus are also substitutors for United Airlines since your customers may consider trains and buses as alternatives to plane travel. Your complementors are those whose products and services are used with your products and services. They make your products (more) effective. For example, the Apple iPhone has hundreds of apps that are developed by independent firms and that are designed to integrate with the iPhone ecosystem.

Your task is to understand the interdependency among and between the sets of players- to understand your vulnerabilities and strengths as well as those of others. It is a mistake to think that all players’ interests are opposed to yours at all times. Even substitutors, sometimes characterized as the enemy in business narratives, have interests that align with yours. For instance, Hyatt and Marriott have a common interest in seeing a growth in tourism and business travel even as they compete for the customers’ business.

In assessing players, managers should examine their capabilities and intent. Some players may have burning ambitions but lack the capability to execute. Others may have capabilities but lack the vision. It is the task of the manager to discover the pathways- the formal and informal partnerships with players in the Value Net- that offer the most promising avenues for EV creation.

How prices are determined is one of the central lessons of economics. A discussion of competing models of price determination, such as perfect competition, monopoly and oligopoly, often account for between a third and a half of the time spent on lectures during a term. A general lesson from these models is that the (equilibrium) price for a product depends on the intensity of competition between companies, buyers and suppliers as well as the relative bargaining power of buyers, sellers, and suppliers.

Two examples illustrate this lesson. Suppose (as in Figure 5) that two firms are competing to sell a project to one consumer. The customer has a willingness to pay of $1m for the project. And suppose that it costs each firm $200,000 to deliver the project. Where are prices likely to settle?

To answer this question, it is useful to compute each player’s added value (AV). This is the difference between EV when that player exists and EV without that player. The buyer’s AV equals $800,000 because EV with the buyer is $800,000 and EV without the buyer is 0. The AVs for either firm equal 0 because the absence of either firm makes no difference to EV. Consequently, it is assured that competition between the firms will push the price, P, to $200,000.

What if the firm’s costs are not equal? Suppose, as in Figure 6, that two firms, Firm 1 and Firm 2 are competing with firm 1 incurring a cost of C1 = $200,000 and firm 2 incurring a cost, C2, = $250,000. B remains at $1m. The AV of the buyer is still $800,000. The AV of firm 1 is $50,000, its cost advantage versus firm 2, while the AV of firm 2 equals 0. Firm 1 will win the project because it can afford to undercut firm 2. The equilibrium price can fall anywhere between $200,000 and $250,000 and depends on the bargaining skills of the buyer and firm 1.

EV can be rewritten as follows: B – C = (B – P) + ( P – C). The term, B – P, is called consumer surplus (CS), the difference between the customer’s maximum willingness to pay and the price paid. And the second term, P – C, is profit (P) margin. Hence, EV = CS + P.

The creation of economic value is only one element of the manager’s mission. The other element is to capture it. Competing with other substitutors through prices, product differentiation and services, and bargaining with others, is one way for a firm to capture a bigger share of EV. The more effective way is to leverage the strengths of your complementors. Google’s Nest started as a digital thermostat and alarm that allows people to control temperature inside the home and monitor security. By creating the Work with Google Assistant ecosystem, Google has allowed hundreds of complementors to co-create EV by linking with Google Assistant.

The firms that earn the biggest economic profits and the biggest economic losses are often in the news. The financial consulting firm, Stearn Stewart & Co. popularized the concept of economic value added (a proxy for economic profits) by publishing an annual list of the top wealth creators and wealth destroyers. In 2018, the leading wealth creator was Apple with an economic value added of $21.58b while the leading wealth destroyer was General Electric (GE) with an economic value added of - $20.544b.

General Electric’s decline from one of the world’s best managed companies to middling status has been staggering. Between 2015 and 2019, GE’s combined economic value added was -$77.84 billion. By Dec 30, 2019, its market capitalization had fallen to $104.64 billion- a decline of more than $136 billion in five years and a decline of more than $320 billion since 2007! Its bonds, rated AAA in 2001, are now BBB+, three notches above junk. And for the first time in more than a century, GE is no longer included on the Dow Jones Industrial Average.

What went wrong? In his analysis of GE and its CEO, Jeffrey Immelt, Geoffrey Colvin attributes the company’s decline to poor capital allocation decisions. Under Immelt’s tenure, GE spent more than $100 billion on acquisitions and $93 billion in stock buybacks. Between 2010 and 2014, when oil prices were high, GE acquired more than 9 businesses in the oil and gas sector paying top dollar. GE’s 2015 bet on fossil fuels via its $10.6 billion purchase of Alstom was poorly timed since the tide had turned in favor of renewables. Immelt’s worst capital allocation decision was to overleverage GE Capital by more than $250 billion. GE Capital began taking equity positions in commercial real estate- a bet that went south during the 2007 crisis.

It takes the passage of time to appreciate three profound principles at the heart of economics. The first is that the merit of any potential decision must begin with a balancing of the benefits and costs of the decision. The second is that decision-making requires marginal analysis, a comparison of the incremental benefits and costs for small changes from the status quo. And the third is that decision-making requires equilibrium thinking, a consideration of how other rational actors- buyers, suppliers, substitutors, complementors and others - respond to changes.