California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Jonathan Zhang and Scott Neslin

Image Credit | Philippe Yuan

E-commerce has grown rapidly over the past decade, and retailers of all types have embraced it enthusiastically. The trend has accelerated during the pandemic.

“Blurring the Lines between Physical and Digital Spaces: Business Model Innovation in Retailing” by Milan Jocevski

“Configuring the Last-Mile in Business-to-Consumer E-Retailing” by Stanley Frederick W. T. Lim & Matthias Winkenbach

In today’s omnichannel retail environment, retailers such as Macy’s and Walgreens are closing physical stores (Business Insider 2020). At the same time, digital-native online retailers such as Amazon, Alibaba, Blue Nile, Warby Parker, Bonobos, Google, and Indochino are opening them (Digital Commerce 2019).

Given these mixed trends, we find it natural to ask the following:

“What is the role of the physical store in today’s omnichannel environment? Does it enhance customer value?”

Such curiosities are echoed by the marketing practitioner community. According to the Marketing Science Institute – an organization serving as a bridge between 50 world-class companies and marketing academia – one of the biggest challenges senior marketers face today is “understanding and prioritizing customer value at all touchpoints during the omnichannel customer journey”. (MSI 2021). The physical store is certainly a touchpoint but has an avaricious appetite for human and financial resources. Does it pay off in generating incremental customer value?

We set out to answer this question by statistical modeling transaction data involving over 50,000 customers. Our goal was to understand how customer purchase behaviors evolve due to purchase experiences in the physical store vs. online. We followed up with two lab experiments to investigate the psychological mechanism underlying our findings.

These findings, forthcoming in the Journal of Marketing, suggest that a critical role of the physical store is to enhance customer value by providing physical engagement customers need to purchase “deep” products – products that require ample inspection in order for the customer to make an informed decision. The physical store provides the right engagement (“physical engagement”) at the right time (when customers buy deep products).

E-commerce has an important limitation: it falls short in physically engaging customers – a task that physical stores are well-equipped to do.

This capability is crucial because many products require physical engagement in order for the customer to make an intelligent, informed decision. Customers need to touch, feel, and try on clothing, shoes, bags, and jewelry. They need to sit on that new couch. They need to hear and feel the power of that TV soundbar. They need to smell the perfume. They need to take that iPhone 12 through its paces. In essence, they need to “kick the tires” for many products. These are all examples of physical engagement.

Exclusively online retailers lose this opportunity to develop customer profitability. This may explain why some online retailers are increasing their offline footprint by opening physical stores.

Not all products require physical engagement, and some require a lot. Those products that require a lot we call “deep inspection” products; those that require little we call “shallow inspection” products (hereafter abbreviated as “deep” and “shallow” products).

The physical store provides customers with a concrete, tangible multi-sensory buying experience – exactly the physical engagement deep products require. Customers learn that the retailer enables them to make better purchase decisions, enhancing their satisfaction and their loyalty to the retailer. This increases customer profitability.

Some practitioners intuitively grasp the concept:

“After opening its first bookstore in 2015 Amazon now has 23 bookstores. These bookstores are located in major cities across the US. Amazon’s CFO Brian Olsavsky said that Amazon’s bookstores are a ‘really great way for customers to engage with our devices and see them, touch them, play with them and become fans. So we see a lot of value in that as well’”. (Indigo9Digital 2020)

[Alibaba’s physical stores are] “providing an option for consumers to physically inspect, touch and feel products before purchase. This appears to be the right strategy. The physical store should attract … online shoppers, who want a more human shopping experience” (Forbes 2016).

“With certain products, seeing and feeling makes a difference … even the most elegant descriptions and images can’t replace the feel of organic, high thread count cotton sheets.” (Digital Commerce 2019).

Furthermore, industry surveys show many consumers still prefer physical stores: “half of the customers surveyed stated that they preferred to shop with online retailers who also operated physical stores” (Kantar Retail 2015, PwC 2017, New York Times 2017).

Apple is getting the message by expanding its physical footprint, opening up “mini-shops” in Target stores:

“The new concept doubles Apple’s footprint in select Target stores and brings displays for iPhone, iPad, Apple Watch, AirPods and other accessories together in one space “designed for guests to experience new products through demonstrations,” Target said in a news release, adding its tech employees are receiving specialized training from Apple “ (USA Today 2021a)

We provide the rigorous analysis to back up and expand the above insight and provide guidance to the retailer who is pondering whether it needs a physical footprint in today’s marketplace. If the retailer is selling deep products, it does.

Our goal was to measure the ability of the physical store to increase customer value, derive managerial guidance for how to leverage this capability, and understand the psychological mechanism that drives it.

We did this by conducting three studies. Study 1 used transaction data from a national multichannel outdoor-product retailer representing over 50,000 customers. Studies 2 and 3 were lab experiments where we could hone in on the psychological mechanism.

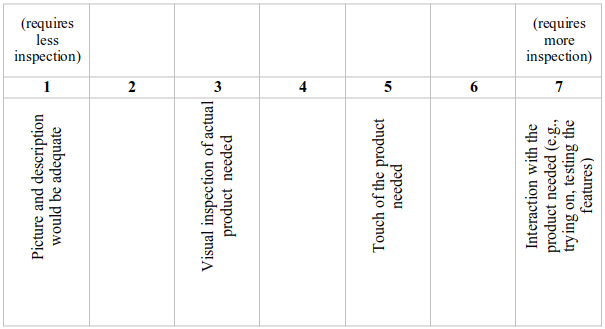

Our first task was to classify products as either deep or shallow. Following common practice, we asked independent judges to rate products on the scale depicted in Exhibit 1. Products rated 3 or lower we classified as shallow; 4 and above we classified as deep.

Exhibit 1 - Scale for classifying products into deep and shallow categories

Products differ in how easily they can be evaluated from a website picture and description vs. requiring physical inspection in a store or showroom. For the following product, what would be the amount of inspection needed in order for you to feel comfortable making a purchase decision?

We used these classifications to guide our research. Following are the insights we generated and the implications for managerial best practices.

1. Deep Products + physical store generates higher future customer value

Research Insight:

Purchasing deep products in the physical store increases customer value more than any other product/channel purchase combination.

Our results demonstrate that a “deep products in-store” promotional strategy can elevate the customer’s relationship with the retailer and increase customer value – in Study 1 we found that over two years, buying deep products in-store increased average total customer spending by 20%, and increased customer profitability by 22%.

Managerial Best Practices:

Retailers need to maintain a physical presence if they have one, or build it if they don’t already have it. This requires investment, as Apple is doing. Yes, this entails risk. Retailers like Macy’s and Walgreens arguably over-invested in huge stores housed in outdated shopping malls. Bath and Body Works is closing stores in malls and opening stand-alone physical stores. (USA Today 2021b)

Retailers also need to realize that there is more work to do than just opening the store. The store must provide quality physical engagement. Retailers need to make it easy for the customer to touch, feel, and try products. Retailers need to train sales personnel to help the customer physically engage, and ensure personnel has the expertise to help the customer interpret that experience. The store needs to be designed as a physical engagement venue. Electronic retailers need to let the customer inspect and try out the new gadgets. Food stores need provide a sample of that exotic flavor enhancer.

2. Successful physical engagement motivates customers to “generalize” beyond the specific product they bought in the physical store.

Research Insight:

Customers who purchase a deep product in-store are: (1) More likely to buy that same product online in the future – once they buy a shirt in the physical stores, they learn the merchandise, trust the retailer to deliver, and are willing to buy another shirt, online. (2) Also more likely to buy “adjacent product categories” online in the future - they not only buy a shirt online, but a sweater and other apparel online as well.

Consumers thus generalize what they learn from the physical store experience to other purchase channels and product categories. Generalization to multiple channels is especially valuable: Research supports that multichannel customers are more profitable than single-channel customers.

Managerial Best Practices:

Encourage customers who buy deep products in-store to access the convenience of your website. Use messaging, email, in-store salespeople, and promotions to nudge the customer to the website. This practice exemplifies the best of “omnichannel marketing.”

However, keep monitoring the customer. Our evidence suggests that continuous online buying can erode loyalty. If managers find the customer is buying online but starting to buy less frequently and spending less per purchase, route the customer back to the physical store for “loyalty replenishment” – offer promotions for purchasing deep products in-store.

Onboard new customers with in-store deep product purchases. That is, “jump-start new customers in the store, then migrate them online.” View the physical store as an acquisition channel.

3. “Experiential learning” drives the process by which the physical store increases customer value.

Research Insight:

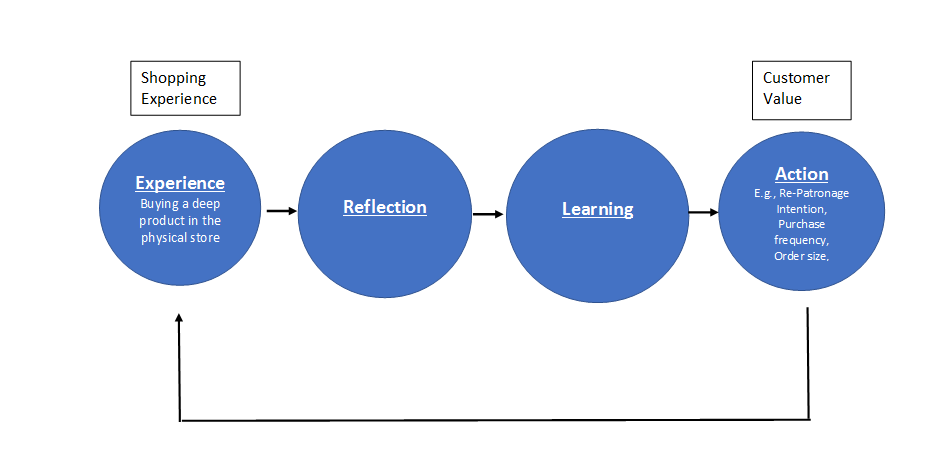

The process by which the physical store generates customer value is called “experiential learning” - learning from experience. The more tangible, concrete, multi-sensory experiences, the better. The process is: deep product / physical store experience &rarr physical engagement &rarr favorable learning &rarr re-patronage.

The deep/store experience provides physical engagement, and customers recognize this. Since physical engagement ensures they make a more informed purchase, they are more satisfied and learn that the store suits their needs. They trust the store, and thus are more likely to re-patronize the store. The process is illustrated in Exhibit 2.

Exhibit 2 - Customers learn better through concrete shopping experiences when buying deep products in the physical store

Managerial Best Practices:

The general lesson is for retailers to create a concrete, tangible, and multi-sensory experience for customers buying products that require this physical engagement. This sets the stage for favorable experiential learning and increased customer value.

Because physical engagement is the driver, the physical store can be a showroom, not an inventory-laden money drain. The apparel retailer Bonobos carries only a limited inventory in-store. The idea is for the customer to touch and feel the merchandise; highly qualified sales personnel provide feedback and answer questions. They come armed with a tablet and can execute the customer’s purchase as an online order. Making the visit an engaging and memorable event should be the main focus of the store.

Another example is Target, which in recent years made significant improvements by remodeling over 100 locations, adding new lighting, changing displays, and making the store more sensorily attractive to visit. As noted earlier, Target and Apple are planning to provide the floor space and sales personnel for customers to try (and buy!) Apple products in Target’s physical store. (Target 2021).

In addition to touch and visual, stores could be intentional in engaging another consumer sense: sound. According to a 2017 survey, 84% of surveyed consumers said they felt a store was more enjoyable when the retailer played music (Mood Media 2017). Of course, the type and volume of this music need to be consistent with the retailer’s branded experience.

What about online retailers who do not operate physical stores? They should mimic the physical engagement found in-store to make the online experience more concrete, tangible, and multi-sensory. They can do so through a combination of videos, chat, user testimonials, virtual reality, augmented reality, and other interactive features. The exact implementation of these features will differ of course by product type.

A notable example is the virtual tasting experience offered by wine.com. This program encourages customers to order a featured wine ahead of time, then go online and share a wine-tasting experience with the wine’s vintner or renowned critics. Assuming the execution is good, the customer will likely buy the featured wine in the future and generalize to other varietals offered by the vintner. This effectively compensates for in-person wine-tasting events discouraged by the pandemic. Furthermore, by combining the rich experience of physical engagement with the convenience of online, it very well could be a long-term feature of wine.com. This example illustrates shows how online marketing can use technology to creatively facilitate sensory engagement.

The digital era has fundamentally shifted assumptions for how people buy and engage with retailers.

However, marketers must understand and remember that customers are real people who crave a tangible, multi-sensory experience when buying products that require it. Such experiences translate to higher future loyalty and customer value. This is why physical engagement is so important, especially in the digital age.

As the pandemic gradually comes to an end, many consumers are longing to return to physical stores. A recent study found that 78% of US consumers would shop more in-store than before, and in particular, 42% said they miss being able to touch and feel products (Chain Store Age 2021).

As retail becomes more e-commerce driven, marketers must not forget about the store and the physical engagement it offers. Rather, they should use a combination of product/channel strategies and technologies to produce engaging and meaningful connections with their customers.

1. Chain Store Age (2021), “Study: Consumers miss shopping in-store; Target No. 1 for in-store experience “ (March 23), https://chainstoreage.com/study-consumers-miss-shopping-store-target-no-1-store-experience.

2. Computerworld (2016), "Thanks to Tech, Stores Are Evolving into Showrooms," (January 18), https://www.computerworld.com/article/3023345/thanks-to-tech-stores-are-evolving-into-showrooms.html

3. Digital Commerce (2019), "Are the Online Retailers Opening Stores Losing Their Minds?" (October 24), https://www.digitalcommerce360.com/2019/10/24/are-the-online-retailers-opening-stores-losing-their-minds/

4. Forbes (2016), "Alibaba Opens A Physical Store: Eyeing A Broader Market?" (January 18), https://www.forbes.com/sites/greatspeculations/2016/01/18/alibaba-opens-a-physical-store-eyeing-a-broader-market/

5. Kantar Retail UK (2015), "The Multichannel High Street: Winning the Retail Battle in 2015," http://www.kantarretail.com/wp-content/uploads/2015/01/Retail-Report-2015.pdf

6. Indigo9Digital (2020), “8 Ways Amazon is Expanding Offline (More Bookstores, Amazon Pick-up Locations & Other Store Formats)”. https://www.indigo9digital.com/blog/eight-ways-amazon-is-expanding-offline

7. Mood Media (2017), “The State of Brick and Mortar, 2017”, https://us.moodmedia.com/assets/2017-state-of-brick-and-mortar-low-res.pdf

8. New York Times (2017),“The Incredible Shrinking Sears,” (August 11), https://www.nytimes.com/2017/08/11/business/the-incredible-shrinking-sears.html

9. New York Times (2020),“ Does the Shoe Fit? Try It On With Augmented Reality,” (December 22), https://www.nytimes.com/2020/12/22/technology/augmented-reality-online-shopping.html

10. PwC (2017), "Total Retail Survey," https://www.pwc.com/gx/en/industries/assets/total-retail-2017.pdf

11. Target (2021), “Press Release: Target Debuts Apple Shopping Destination With Expanded Footprint, Extended Assortment and Enhanced Services,” (February 2021), https://corporate.target.com/press/releases/2021/02/Target-Debuts-Apple-Shopping-Destination-With-Expa

12. USA Today (2021a), “Target to open 'mini Apple shops' in select stores, offer more products online. Will your location get an upgrade?” https://www.usatoday.com/story/money/shopping/2021/02/25/apple-target-stores-iphone-ipad-shopping-experience-upgrade/6806584002/

13. USA Today (2021b), “Victoria's Secret store closings: Retailer to close up to 50 stores while Bath & Body Works opens new locations” https://www.usatoday.com/story/money/shopping/2021/02/24/victoria-secret-store-closures-2021-bath-body-works-opening/6806159002/

14. Zhang, Jonathan Z., C.W. Chang, & Scott Neslin (2021). How physical stores enhance customer value: the importance of product inspection depth. Journal of Marketing, Forthcoming.