California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Henrik Wesemann Lekkas, Torben Antretter, and Rachida Justo

Image Credit | Purichaya

While social ventures make up only 3% of all startups, they are crucial for the global economy and sustainable business development: social ventures employ more than 200 million people with social missions, are a crucial driver of female business ownership, and the top 500 social ventures alone have improved more than a billion lives over the past 25 years (World Economic Forum, 2024). However, despite their relevance for solving the world’s grand challenges, social ventures face a funding gap of more than $1 trillion in 2024 alone. This gap is particularly problematic for early-stage ventures, as only 2% of the already limited social funding goes to new ventures (Hand et al., 2023).

Ebrahim, A., & Rangan, V. K. (2014), “What impact? A framework for measuring the scale and scope of social performance,” California Management Review, 56(3), 118-141.

Lingens, B., Böger, M., & Gassmann, O. (2021), “Even a small conductor can lead a large orchestra: How startups orchestrate ecosystems,” California Management Review, 63(3), 118-143.

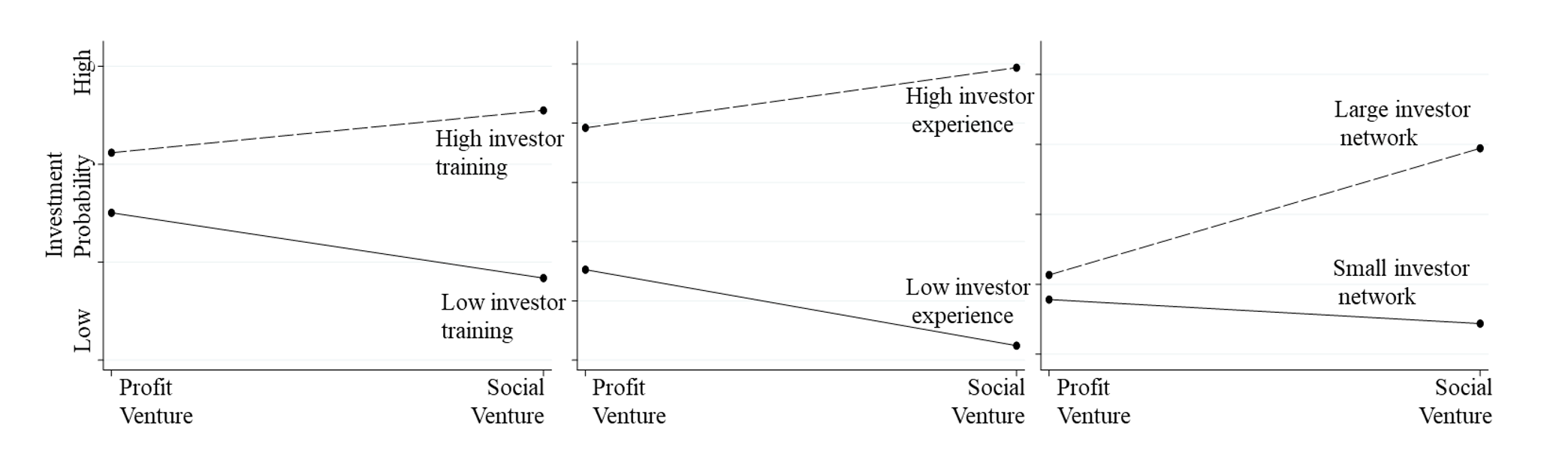

The social venture funding gap is commonly blamed on financially motivated investors who refuse to accept the typically lower financial returns of social ventures. However, new research on the topic (Wesemann & Antretter, 2023), based on a quantitative analysis of 19,757 early-stage investment decisions and interviews with private investors and entrepreneurs, suggests that greed for financial returns is not the main reason for the lack of social investments. In fact, most early-stage investors will accept lower investment returns from social ventures, but do not invest in them because they struggle to assess their impact and goal hierarchy. One investor told us:

“I understand the business side; that’s easy. When I built my company, I was the CFO. But I struggle to understand the true social impact of a venture when I invest in it. Like, does it really work? How much good can I buy for a dollar?”

The difficulty of communicating social missions is also visible on the entrepreneurs’ side, where the CFO of a clean water venture from Uganda told us about his struggle:

“With the rather intangible focus […], it is quite challenging to convey our message effectively.”

This company only managed to get fundraising off the ground once they adopted an integrated Enterprise Resource Planning (ERP) approach that also quantified the social bottom line.

Overall, our research identified three factors that are associated with low social investment rates.

Social ventures do not have to offer higher returns to investors; they must communicate their purpose better and integrate investors in the impact space.

Ventures can take several steps to improve their chances of investment:

For investors, it is perfectly normal to be hesitant to start with social investments. The underlying logics are different, the goals are hard to quantify, and prioritization between social and financial goals is unclear. While social ventures really tend to have more complex and ambiguous goals, uncertainty can still be reduced through mentoring and the use of proven frameworks.

Collectively, our research shows that low social investment rates by angel investors are not due because they demand impossible profits but because of communication issues. Fixing this can help us close the social venturing gap and get investor money where it is most needed.

Hand, D., Sounderji, S., & Prardo, N. (2023), “2023 Impact Investing Allocations, Activity & Performance.”

Wesemann, H., & Antretter, T. (2022), “Internationalization, Co-Investment Networks, and Business Angel Investment Returns,” Venture Capital, https://doi.org/https://doi.org/10.1080/13691066.2022.2082898

Wesemann, H., & Antretter, T. (2023), “Why don’t you like me? Exploring the social venture funding gap in angel investing,” Journal of Business Venturing Insights, 20, e00433.

World Economic Forum (2024), “10 million enterprises putting people and planet first.”