California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Dan Prud'homme, Xiaoyuan Zhao, and Tony Tong

Western firms are recognizing that digitization is transforming the way business is conducted in China, the world’s largest online market, just as much if not more than in their home markets. However, the importance of what we call the “Relational Digital Ecosystem” – a fundamental determinant of online competition in China – remains overlooked by many Western firms. By applying the concept of the Relational Digital Ecosystem to understand the workings of the “wanghong” economy in China – a sweeping recent digital phenomenon still largely unheard of in the West – we illustrate how digital competition is different in China than in the West. We then discuss how Western firms can respond to this ecosystem by more strategically engaging Chinese consumers.

The meaning of the Chinese term “wanghong” (literally “Internet red”) has co-evolved with the digital transformation in China. During the past few years, the term has been used to describe widely popular yet previously unknown Internet personalities. Wanghongs design and deliver original/quasi-original digital content through blogs, short videos, or online streaming and directly or indirectly promote their own or others’ products/services in the process.

While exact estimates differ, there appear to be hundreds of, or even substantially more, wanghongs currently in China. About 86% of wanghongs, according to Sina Technology, are typically young females. Xue Li, for example, is a young female wanghong who recommends clothing choices and is followed by more than 8 million people on Weibo, a multi-purpose Chinese digital media platform. But wanghongs can also be males or even animals. For example, Li Jiaqi, a young male wanghong who recommends cosmetics, is one of the most popular wanghongs with more than 12 million followers on Weibo. Guapi, a cat gifted with an unusual face, is one of the most popular animal personas on the Chinese web (whose owner, of course, creates content about her) with more than 7 million followers on Weibo.

Based on our research, we identify four major types of wanghongs:

Wanghongs often fit neatly into these categories. But sometimes a wanghong may start out in one category (e.g., a DIY Wanghong) and transition to another (e.g., a Sponsored Wangong).

The economic and social impact of wanghongs in China is immense. According to CBN data, China’s wanghong economy has surged in recent years and is now worth tens of billions of USD. A recent survey by Chinese Internet firm Tencent found that 54% of college-age respondents in China chose “online celebrity,” a term now synonymous (in Chinese) with wanghongs, as their first career choice. And according to the 2018 Global Future Consumers Study by A.T. Kearney, receptiveness to brand recommendations by online celebrities/wanghongs among social media users in China (63% of respondents) ranked higher than in any country surveyed.

A recent survey by Chinese Internet firm Tencent found that 54% of college-age respondents in China chose “online celebrity” as their first career choice.

No mistake should be made: wanghongs are not merely another name for conventional key opinion leaders (KOLs). In contrast to conventional KOLs, who have developed legitimate expertise and trust from their audience over an extended period, wanghongs became famous quickly online and their opinions may not necessarily be considered by their followers as more professional than those of conventional KOLs.

Nor are wanghongs merely another name for A-list celebrities or “micro-influencers”/”micro-celebrities” (i.e., bloggers, vloggers, and other “amateur” influencers). In contrast to A-list celebrities, wanghongs’ fame has typically been entirely cultivated on Chinese digital platforms and in many cases wanghongs have become even more influential over Internet consumers’ everyday-life decisions in China than A-list celebrities. Further, in contrast to micro-influencers, who by definition have less than a million followers, wanghongs can have millions of Internet followers. Wanghongs have become popular through various means. But Janet Chen, founder of Tophot, a leading wanghong incubator in China, nicely sums up in a BBC interview how wanghongs have already outperformed A-list celebrities and conventional KOLs in the minds of Chinese Internet users: wanghongs are “more down-to-earth and approachable” than conventional influencers and they “look like someone you can be friends with.” At the same time, based on our interviews with Chinese consumers, wanghongs are often viewed as among the most attractive and/or inspiring people “within” most young Chinese consumers’ social networks. In order to understand the unique wanghong phenomenon in China and its implications for business, we think about it in terms of “China’s Relational Digital Ecosystem.”

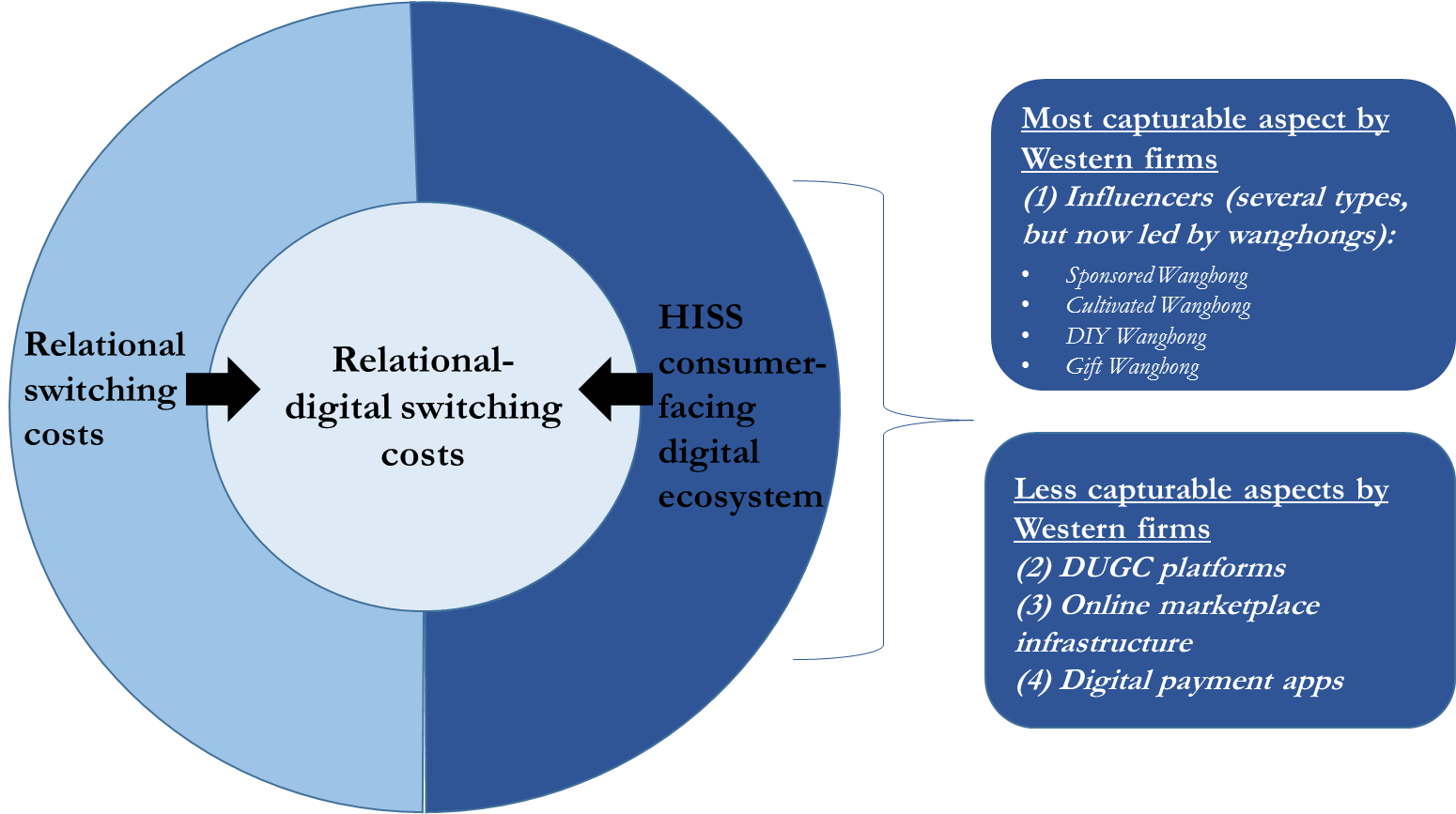

Wanghongs thrive as part of China’s Relational Digital Ecosystem. Our research indicates that this ecosystem is comprised of three components. The first two components are (1) a “highly-integrated-supply-side” consumer-facing digital ecosystem unique to China and (2) relational switching costs. When these components interact, they form the third component in the Relational Digital Ecosystem, what we call (3) “China’s relational-digital switching costs.” While we show that wanghongs most directly reside in the first component of China’s Relational Digital Ecosystem, they are further embedded in the ecosystem at large due to the other two components. China’s relational-digital switching costs afford a handful of domestic Chinese firms who have moved early and successfully into China’s digital ecosystem a set of competitive advantages unlike those gained from traditional network effects and switching costs in the West.

These advantages are especially difficult for Western firms to overcome.

Figure 1: China’s Relational Digital Ecosystem and the emerging role of wanghongs

1. Highly-integrated digital ecosystem unique to China

The first component of China’s Relational Digital Ecosystem is (what we call) a unique “highly-integrated-supply-side” (“HISS”) consumer-facing digital ecosystem. Based on our research, this supply-side component of China’s Relational Digital Ecosystem is comprised of four major aspects: (1) influencers, currently led by wanghongs; (2) digital user-generated content (DUGC) platforms; (3) online marketplaces for products and/or services; and (4) digital payment applications.

We have already briefly discussed different types of influencers in China’s consumer-facing digital ecosystem. Wanghongs have emerged to often be the most important influencers, measured in terms of numbers of followers of the original/quasi-original content they provide and purchases of the products/services they promote.

The most common DUGC content platforms in China which afford wanghongs an audience are Douban, Douyin, Taobao Live, Bilibili, Huajiao, Panda, Xiaohongshu, Kuaishou, and Weibo. Yet there is segmentation in the consumer groups reachable by these platforms. For example, Bilibili supports livestreaming and has been primarily targeted at those interested in “cutesy girl” culture (inspired by kawaii culture from Japan and a similar culture in South Korea), anime, and video-gaming. Xiaohongshu supports photo-blogging and short videos and is focused on advising girls how to be more physically attractive. Weibo, which has been around longest and supports blogging, videoblogging, and most recently livestreaming, appeals to a mix of interests.

Online marketplaces (i.e., the infrastructure for e-commerce) are directly (via blatant advertisements) or more indirectly (via passing suggestions from wanghongs and other content they provide) linked to specific products and/or services from specific brands. The most common online marketplaces receiving wanghong-driven traffic are Alibaba’s Taobao and JingDong’s JD.com.

The digital payment applications most commonly used on these online marketplaces are WeChat and Alipay.

All of the aforementioned aspects of China’s mainstream digital consumer-facing ecosystem are highly-integrated. This means, as we define it, that they are technologically compatible with one another and/or that users of one component of the ecosystem also nearly always use another aspect of the ecosystem. This level of integration appears partially owed to the greater willingness of the average Chinese consumer to adopt new innovations via online purchasing: in fact, a 2018 KPMG survey of 25,000 consumers around the world indicates that Chinese consumers are more likely than those from other nations to be early adopters of new innovations and to only shop online. Further, unlike other countries’ respondents, 79% of Chinese answering the same survey indicated that it is important for brands to have an engaging social media presence to ensure customer loyalty. Somewhat inter-related to the prior points, the uniquely high level of integration in China’s consumer-facing digital ecosystem is also attributable to the timing of entry and alliances made by current incumbents in China’s digital ecosystem, as well as to a lack of constraining infrastructural legacies in the evolution of some aspects of the system (e.g., adoption of mobile payment apps has not been seriously constrained by prior credit card use). A relatively hands-off approach by the Chinese government to regulation in some areas (e.g., governance of some firms’ monopolistic behavior and aspects of data protection) and significant regulation in other areas (e.g., censorship and business licensing) also plays a role.

Collectively, these four different aspects of China’s HISS consumer-facing digital ecosystem distinguish it from the digital ecosystems in other countries. Moreover, these four aspects in effect reward earlier movers into this particular ecosystem with significant network effects and switching cost advantages that are not apparent in the same way in mainstream digital ecosystems in the West. As noted again later, among these four different aspects, wanghongs are the most capturable by Western MNCs (i.e., there are relatively more opportunities for Western MNCs to strategically engage with and leverage them).

2. Relational switching costs in China

The second component of China’s Relational Digital Ecosystem is relational switching costs. This demand-side component of the ecosystem is comprised of China’s large network of Internet-using consumers who share a high-context, collectivist culture.

More so than in the individualistic cultures of the West, in China’s high-context, collectivist culture there is serious anxiety – sometimes even cripplingly so – about standing out from others in the community in a negative way. Further, the “community” used as a reference in China is typically broader, and includes more distantly-related individuals than the reference groups that individualistic cultures rely upon when constructing a sense of belonging. To avoid alienation, a typical Chinese will trust others’ opinions in many domains of life, including consumerism, before one’s own – and will often follow the advice and behavior of others perceived as being socially adept. In individualistic cultures, there is generally less of a consensus about what normative behavior entails across as many domains of life and about who to look to as a reference for such behavior.

Although not often thought about as such, these cultural attributes effectively form a type of “relational” switching cost: the psychological and emotional discomfort associated with behavioral change due to identity loss and breaking of bonds. To be sure, we are not suggesting that relational switching costs in China necessarily lock-in local customers to any single commercial platform, product, service, or brand per se. In fact, China is notorious for having highly-demanding, fickle customers that crave new innovations fast. Instead, the relational-switching costs we speak of lock in Chinese customers to homogeneous preferences more generally, and to reliance on societal influencers such as wanghongs as a reference from which to form these preferences.

China’s digital transformation has, in some ways, magnified relational switching costs in the country. According to estimates by Jeffrey Towson of Peking University, China’s online consumer network is 17X larger than the one in the US (when considering Metcalfe’s law of network effects). This massive network serves as an easily accessible, de facto online community / reference group - often heavily influenced by wanghongs - for many, especially young, Chinese.

3. Relational-digital switching costs in China

The third component of China’s Relational Digital Ecosystem is the interaction between the unique HISS consumer-facing digital ecosystem and relational switching costs. This interaction creates what we call China’s “relational-digital switching costs”: the psychological and emotional costs of turning to alternative venues outside the current HISS consumer-facing digital ecosystem in China for information and in order to purchase products and/or services.

Our research suggests that relational-digital switching costs deeply embed Chinese consumers in the digital ecosystem in China in ways that may not be fully appreciated by Western executives. In fact, consumers in many other countries, especially those without collectivist cultures, do not always appear to be as deeply embedded in their respective local digital ecosystems.

As a consequence of all this, the local Chinese firms who have entered early and successfully into any of the three core infrastructure-related supply-side aspects of China’s Relational Digital Ecosystem (i.e., those outside of wanghongs: including DUGC platforms, online marketplaces for products and/or services, or digital payment applications) have tapped into a market with competition barriers that are not apparent in the same way in mainstream digital ecosystems in the West. These strategic footholds cannot be easily upended by Western firms.

All this supply-side lock-in in China’s Relational Digital Ecosystem may sound like bad news for Western firms. But it does not mean that there is not an opportunity for Western firms to still exploit the ecosystem in some ways to market and sell their own products and/or services. In fact, Western firms can find their niche within this system by employing several strategies – all of which involve engagement with the system’s demand-side (i.e. Chinese consumers) via its supply-side aspect that is most capturable by Western firms (i.e., wanghongs). In particular, we recommend that Western firms consider four practical strategies to engage with wanghongs:

1. Monitor and sponsor wanghongs.

Western firms may be able to better engage with Chinese consumers by forming strategic alliances with what we earlier called the “Sponsored Wanghong.” In order to limit risk and maximize influence, many promising wanghongs should be sponsored.

Of course, wanghongs that are already sponsored by established firms may have already signed non-compete agreements (NCAs) (which, unlike in some US states, are in fact legal in China). But not all wanghongs will have done so. Western firms should approach a mix of wanghongs: those who produce content relevant to their target market and are highly popular (and therefore may have already signed NCAs), but also those that appear to be newly rising to fame.

At the same time, merely monitoring the wanghong landscape – identifying who has become popular and why, and who has fallen from fame – will provide Western firms a critical form of marketing intelligence. Wanghongs’ popularity can be short-lived. And recently there have been quite a few cases where products and/or services promoted by wanghongs (especially new restaurants) have flopped miserably and resulted in significant lost sales. A general lesson here is that products/services with a more intangible emotional appeal are probably best promoted by (the best) wanghongs. It is also possible that today’s DIY Wanghongs and Gift Wanghongs will later change to being Sponsored Wanghongs. Being aware of this dynamic can create opportunities if exploited early on, or threats if ignored and rivals move first.

2. Cultivate wanghongs.

In addition to or instead of engaging a Sponsored Wanghong, Western firms can benefit from engaging wanghongs well before they become famous (what we earlier called the “Cultivated Wanghong”). Similar to the prior strategy, to limit risk and maximize influence, many promising wanghongs should be cultivated. To do so, Western firms can form strategic alliances with professional incubators specializing in grooming Cultivated Wanghongs. According to some estimates, there are more than 200 wanghong incubators in China, including the firms Ruhnn, Tophot, and ParkLu. Western firms already working with Tophot, for example, include Diesel, L’Oréal, Max Factor, and Puma.

It is possible that Cultivated Wanghongs could also be groomed from within a Western firm, especially its affiliate(s) in China. But it still seems sensible to seek some form of specialized advice when determining if such a candidate indeed has potential and guiding him/her through the process to become the most influential wanghong possible.

3. Leverage local Multi-Channel Networks to complement your wanghong strategy.

Western firms can also benefit from engaging Multi-Channel Networks (MCNs), which are firms specializing in promoting their clients in Chinese social networks. There are more than 2,000 MCNs in China at present, and most popular wanghongs usually collaborate with these agencies. Some MCNs are responsible for creative content and social messaging, others focus primarily on digital distribution. Leveraging MCNs can nicely complement a strategy of sponsoring or cultivating a wanghong.

4. Ensure ex-employees do not turn into competitor wanghongs.

Lastly, Western firms should institute company policies to prevent employees turning into competitor wanghongs. Ex-employees can turn into a rival’s Sponsored Wanghong or Cultivated Wanghong, or a DIY Wanghong (which we defined earlier). Keeping employees in China happy with smart human resource policies and competitive pay can go a long way in averting this risk. But well-drafted confidentiality agreements and NCAs will also provide much needed security.

In order to best take advantage of China’s rapid digital transformation, Western firms need to understand the unique aspects of the Chinese Relational Digital Ecosystem. This ecosystem is defined by the interaction between a unique HISS consumer-facing digital ecosystem and relational switching costs. Together, these components form relational-digital switching costs, which provide a handful of domestic firms who have moved early and successfully in China’s digital economy a set of unique competitive advantages that are difficult for Western firms to overcome. However, even though it may be too late for Western firms to claim much of the supply-side infrastructure underpinning China’s Relational Digital Ecosystem, they can still establish a foothold for themselves in this new ecosystem if they act more strategically. Engaging wanghongs is one useful and practical strategy that can help Western firms gain important resource advantages in this battle for China’s digital consumers.

1. A.T. Kearney, 2018. Global Future Consumers Study, available at https://www.kearney.com/web/thefutureconsumer/insights.

2. Burnham, T., Frels, J., Mahajan, V., 2003. Consumer switching costs: A typology, antecedents, and consequences. Journal of the Academy of Marketing Science 31, 109-126.

3. CBN Data figures available (in Chinese) at https://www.cbndata.com/home.

4. Cennamo, C., Dagnino, G., Di Minin, A., Lanzolla, G., 2018. Managing digital transformation: in search for new principles. California Management Review. (call for papers, available at cmr.berkeley.edu).

5. Cheung, M., 2018. Influence marketing in China: What you need to know about KOLs, wanghongs and the platforms they use. eMarketer Report.

6. Gulati, R., Kletter, D., 2005. Shrinking core, expanding periphery: The relational architecture of high-performing organizations. California Management Review 47, 77-104.

7. Hall, C., 2018. Welcome to China’s KOL clone factories. Business of Finance (available at https://www.businessoffashion.com/articles/global-currents/welcome-to-chinas-kol-clone-factories (quoting Kim Leitzes of ParkLu)

8.KPMG, 2018. Me, My Life, My Wallet. available at https://home.kpmg/xx/en/home/campaigns/2018/09/me-my-life-my-wallet.html.

9. Li, F., 2018. Why Western digital firms have failed in China. Harvard Business Review.

10. Li, S., Candelon, F., Reeves, M., 2018. Lessons from China’s digital battleground. MIT Sloan Management Review.

11. McKinsey, 2017. Winning in digital ecosystems. McKinsey Quarterly.

12. Prud’homme, D., von Zedtwitz, M., 2018. The changing face of innovation in China. MIT Sloan Management Review 59, 24-32.

13. Prud’homme, D., 2019. How digital businesses can leverage the high cost for consumers to switch platforms. London School of Economics Business Review.

14. Prud’homme, D., 2019. 3 myths about China’s IP regime. Harvard Business Review.

15. Sina Technology, 2018. Report on the occupation of ‘Zhubo”, available (in Chinese) at http://tech.sina.com.cn/i/2018-01-08/doc-ifyqkarr7926437.shtml.

16. Tencent survey (in Chinese) available at https://www.tencent.com/zh-cn/business.html.

17. Towson, J., 2020. Digital China and Asia’s Latest Tech Trends, available at jefftowson.com.

18. Tsoi, G., 2016. Wang Hong China’s online starts making real cash, BBC News, available at https://www.bbc.com/news/world-asia-china-36802769 (quoting Janet Chen of Tophot).

19. Whitler, K., 2019. What Western marketers can learn from China. Harvard Business Review.

20. Williamson, P., de Meyer, A., 2012. Ecosystem advantage: how to successful harness the power of partners. California Management Review 55, 24-46.

21. Williamson, P., Yin, E., 2014. Accelerated innovation: The new challenge from China. MIT Sloan Management Review 55, 27-34.