California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Shashi Buluswar

Fueled by the dramatic proliferation of mobile-/smart-phones, the plummeting cost of solar photovoltaics, Moore’s Law, the growth in the technology capabilities of many developing countries, and the increasing influence of tech billionaires armed with both vision and impatience, the social impact ecosystem is on the cusp of a technology revolution unlike anything witnessed before. Indeed, by our informal count, there are no fewer than a dozen $50+ million funds currently in various stages of realization, dedicated exclusively to technology innovations for social or environmental impact largely in the developing world, with some exceeding even the $1 billion mark—all accompanied by the parlance, ethos, and expectations of Silicon Valley and the commercial venture capital world.

However, despite the unprecedented levels of funding and media coverage there are surprisingly few examples of truly impactful technologies. With exceptions like the HIV antiretrovirals, the M-Pesa mobile payment system, and India’s Aadhar biometric ID system, it is difficult to identify many technologies with objectively assessed impact or financial sustainability at a genuinely large scale. The typical success story is one with a reasonably competent technology, but with a product that is too expensive for the intended users. A few thousand people are positively impacted and there is considerable media coverage, but ultimately, the product does not scale beyond the few thousand (except through accumulation over the course of a decade or longer); nor does the technology-enabled business sustain without ongoing grant funding. Not surprisingly, funders are often disappointed, left to wonder where their due diligence fell short; funders who expect strong financial returns, much more so.

In that context, this research note examines the experience of fifteen technologies across the health, agriculture, energy and household/appliance sectors. Across these technologies—the way they were funded, their business models, and their successes and challenges to date—a number of clear themes emerge, with important implications for how innovators and funders, alike, can make more thoughtful decisions as the ecosystem matures.

The technologies in this study were selected because they are (or were) advertised by the innovators, funders or the media, as having the potential to make a substantial difference in the lives of millions of low-income people. The specific selection criteria were:

The technologies are:

Health: (1) Infant care device; (2) Medical curative device; (3) Insecticide-treated bednet; (4) Prosthetic limb.

Agriculture: (5) Manual irrigation pump #1; (6) Manual irrigation pump #2; (7) Agricultural refrigeration system;

Energy: (8) Small household battery; (9) LED light; (10) Electricity meter; (11) Solar home system;

Household: (12) Cookstove; (13) Household composting toilet; (14) Water purifier (community); (15) Water purifier (individual).

Note that we did not select any software or pharmaceutical (e.g., vaccines) technologies because such technologies do not face the same challenges faced by physical or hardware products with regard to market dynamics and barriers to scale.

We assessed the technologies along three dimensions:

Across the fifteen technologies, three clear themes emerge.

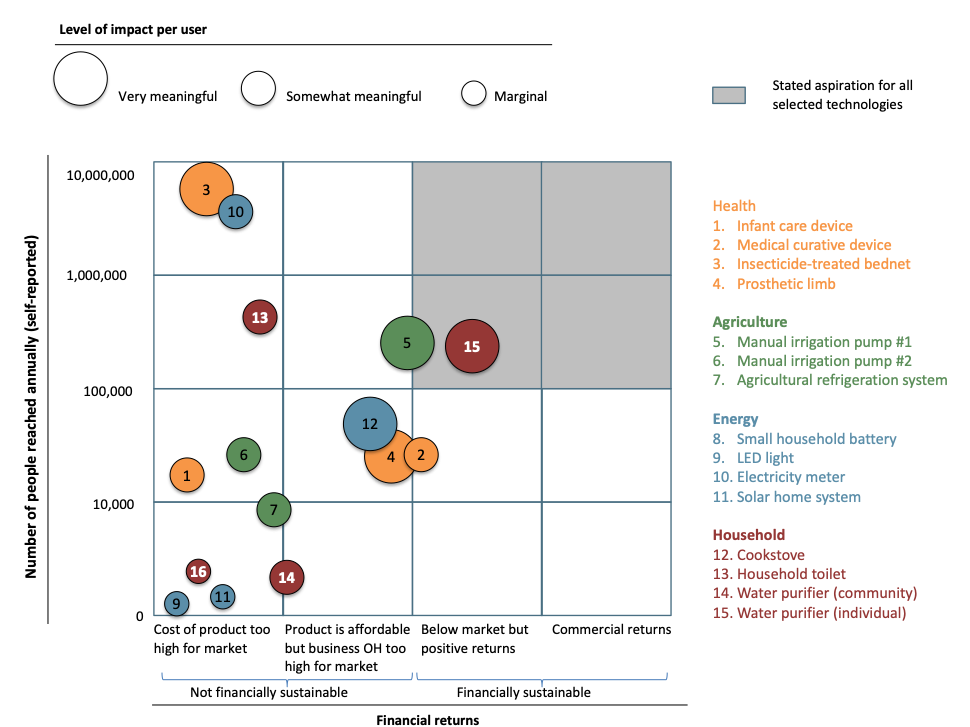

In summary, the majority of the innovations are in the bottom-left quadrant—neither impacting a large number of people, nor achieving financial sustainability. It is worth reiterating that these technologies were selected on the basis of public recognition with respect to significant, large-scale impact; they also all seemingly aspired to being financially sustainable or profitable. As such, the presumption would be that the majority of them would be clustered in the top-right corner of the matrix shown in Exhibit 1.

Exhibit 1. Across 15 well-known technologies assessed, the majority have struggled to reach either impact at scale, or financial sustainability. Our assessment finds that only one of the 15 technologies is squarely in the top-right quadrant, with a second one on the cusp of being in the quadrant. Given that these technologies were selected from seemingly successful examples, it is fair to conclude that a randomly selected, unbiased sample of technologies would yield even more disappointing results.

Across these innovations, we found that the most common—usually avoidable—mistakes were:

Assuming that the “low-income” market is monolithic. The analyses for many technologies use “the global poor,” “Africa,” “the number of children who die of condition X,” or a similarly over-generalized base as the total addressable market. There does not seem to be nearly enough segmentation of the market; this issue is exacerbated by a severe lack of data on the (likely hundreds or even thousands of) population segments which would be needed for a sophisticated market assessment.

Confusing “need” for “want”. The fact that millions of people die due to indoor air pollution does not mean that there is much demand for clean cookstoves. Far too many business plans make logical leaps which equate missing basic needs with demand for solutions; by extension, they presume that their solutions will adequately meet that demand, simply because the solutions technically address the need.

Falling in love with an exciting technology, with a wholly inadequate understanding of the underlying problem and dependencies for success. Even if a technology is perfectly suited to a problem and the intended users, there will always be a number of critical dependencies before it can be viable in a market (beyond the common challenges like market fragmentation, limited access to financing and weak distribution/supply chains). Technologists and funders alike often take a “technology-first” approach. Common manifestations of this problem include an inadequate understanding of important questions such as (a) what complementary products and services are necessary for their technology to succeed, (b) existing supply chains for components and servicing, and (c) market price elasticity. Indeed, a technology-first approach can lead to an inadequate exploration of non-technology-based solutions to the problem, which may actually be more effective. It is also not uncommon to see an extraordinarily level of [clearly false] precision in financial (and other) projections, even as major gaps remain in fundamental assumptions.

Expecting single-technology social enterprises to scale, even for non-software innovations. A large number of organizations are created around an individual technology or product, with promises and expectations of scale based on early successes in limited contexts. Even in industrialized markets, it is unusual to see startups with hardware technologies reach scale unless they are acquired by companies with large supply and distribution footprints. The dearth of incumbent companies in emerging markets to acquire startups means that there are fundamental limits to how much any technology can scale. Social enterprises make things even harder for themselves when their leadership teams are based in high-cost markets, driving up overhead costs. These costs typically cannot be passed on to price-sensitive customers; as a result, the organizational overhead has to be perpetually grant-funded.

The ecosystem is motivated by the wrong measures of success; specifically, funding levels and sources, and media coverage. In the absence of rigorous market analyses and timely/tangible results, the technology-for-impact ecosystem is driven too often by endorsements by funders (who sometimes take cues from each other about what to fund) and the media (which is always looking for a compelling story, with a limited ability to examine true impact).

Our analysis also identified a number of practices that can help guide new innovators and their funders.

A. Selecting and desiginging the right technologies

1. Don’t spend a penny on technology development without a thorough understanding of the underlying problem we’re trying to solve, the full solution set (including non-technology solutions) and where the technology solution fits in, the market context, and the use cases.

The majority of technologies in the social impact space are “hammers looking for a nail”: interesting technologies which are developed by technologists without a deep enough understanding of the problem, and propped up by media hype more than credible path to impact.

2. Often, the path to cost reduction is in moving markets for existing technologies, rather than building a new technology.

Most serious technology solutions have to go through an extended lifecycle before reaching market maturity. Sometimes, it is easier to push an existing product from industrialized markets to emerging markets, than to build a technology specifically for the developing world and wait for it to mature.

3. Design for existing large-scale supply chains

One of the critical success factors in developing quality, low-cost technologies/products, is to use components that are (or can become) available as part of existing supply chains which have already made large capital investments; usually, these supply chains are for unrelated products and markets, but can be leveraged for reliable, quality, low-cost components.

B. Structuring the right partnerships

4. Don’t take the wrong kind of funding. It is difficult—but essential—to determine the balance between grant funding vs. subsidized/patient PRIs vs. commercial investment.

One of the critical success factors in developing quality, low-cost technologies/products, is to use components that are (or can become) available as part of existing supply chains which have already made large capital investments; usually, these supply chains are for unrelated products and markets, but can be leveraged for reliable, quality, low-cost components.

5. Avoid partnerships unless they serve a specific and strategic reason, and the partner organization can truly deliver.

The social sector is replete with pointless partnerships. While many of them are benign, non-strategic partnerships can be a major distraction, especially when partners tack on technologies and projects which are tangential to the core agenda.

C. Managing internally for execution

6. Hire a team of exceptional, generalist in-country operators, with technical experts in CTO/advisory roles.

Perhaps the single biggest determinant of successful execution is having the projects/businesses led by exceptional operators who (a) are from the country where the program is being implemented; (b) can balance excellence in execution with sharp strategic decision-making; (b) are really good people leaders, with external stakeholders as well as internal staff. Technical experts should be heavily leveraged, but in CTO/advisory roles.

7. Trust process over genius or personality, and ruthlessly employ project management best practices.

The social sector tends to reward big personalities, and does not employ effective project management discipline. While such an approach can be a good for inspiration and fundraising, it usually does not necessarily lead to the gritty, consistent execution required to reliably achieve results.

8. Leverage as much as possible.

Much has been made of the need for startups to be lean. To maximize the results-to-funding ration, we believe it is essential for social sector organizations—startups or otherwise—to be very lean. This means that they need to keep their core team very lean, and be exceptionally resourceful in leveraging infrastructure, expertise, as well as personnel as much as possible. Further, they need to do this without compromising results.

D. Going to market

9. For many technologies, there is neither a ready market, nor a critical mass of influential users willing to be early adopters. In such cases, some credible entity needs to be brought in to launch the downstream service/business.

Simply building the technology and hoping the market will catch up, won’t work. ITT has made the strategic decision to launch joint ventures with organizations in a position to work with us to launch innovative technology-enabled services. This often requires additional funding, which needs to be planned for in the early stages of technology development.

10. Structuring the right handoff to the downstream partnership is perhaps the most challenging aspect of reaching scale. Social enterprise startups typically struggle to scale up, and large established companies (in a position to take the technology to market) typically lack the nimbleness required to develop innovative business models.

ITT uses a build-operate-transfer (BOT) model in which we embed a startup team within a large company, and gradually hand off the business. The broader applicability and long-term success of this approach is to be determined.

While being critical of the technology-for-impact ecosystem, it can be easy to lose sight of the fact that finding success is always going to be difficult because of intrinsic complexity of the problems and market context. That said, we believe the above steps can help innovators and their funders can do to improve the chances of success.