California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Jonathan Hughes, David Chapnick, Isaac Block, and Saptak Ray

Image Credit | UX Indonesia

Customer-centricity has become a hot topic, and our recent survey of 250 individuals at 180 B2B companies demonstrates why. Over the past five years, companies reporting a “very mature” level of customer-centricity experienced 2.5X revenue growth compared with those reporting their company was “very immature.” Previous research from Forrester similarly showed that market leaders in customer experience enjoyed ~450% greater CAGR, compared to market laggards, during the period of 2010-2015.

“A Better Way to Manage Customer Experience: Lessons from the Royal Bank of Scotland” by Stan Maklan, Paolo Antonetti, & Steve Whitty

“Customer-Centric Leadership: How to Manage Strategic Customers as Assets in B2B Markets” by Christoph Senn, Axel Thoma, & George S. Yip

“Blurring the Lines between Physical and Digital Spaces: Business Model Innovation in Retailing” by Milan Jocevski

Despite the buzz, there is a great deal of confusion about what customer-centricity is and how to put its principles into practice. At too many companies it is mostly hype — a rebranding of traditional marketing, sales, and customer service that involves no fundamental change and delivers little benefit. Genuine customer-centricity requires transforming all enterprise functions that affect customers, breaking down the silos between those functions, and building a culture that rewards behaviors aligned with customer success.

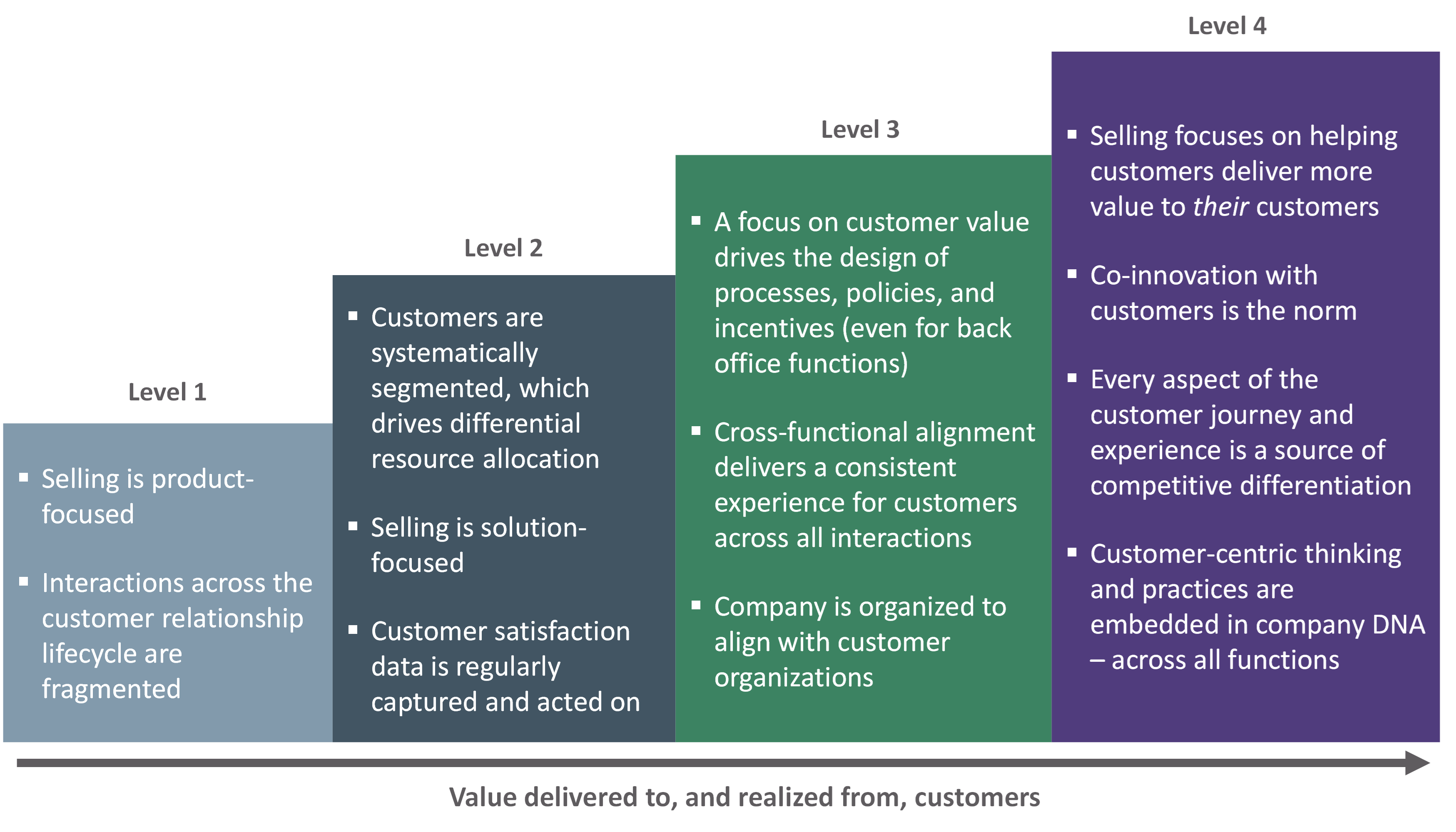

To help companies assess their efforts and guide their investment and transformation, we have developed a model (Figure 1 below) that defines four distinct levels of customer-centricity. Based on our research and extensive work with clients on customer-centricity initiatives, a majority of companies function at levels two or three. Only about 9% of companies operate in a truly customer-centric manner, with manufacturers (5%) at the low end and high-tech companies (19%) at the high end, on average. These numbers indicate an attractive opportunity for companies to differentiate themselves by enhancing the way they engage with and deliver value to their customers.

Figure 1

Here is what market leaders do to put the customer at the center of their business.

R&D organizations are staffed by bright, innovative people, but they are usually far removed from customers, and often more energized by new technology and solving technical problems than meeting customer needs.

Product management teams are closer to customers than R&D, but their view of customers is aggregated by market segment, not individualized. They are measured and rewarded based on the sales and profitability of their products – and thus see customers primarily through the lens of those products. That’s not necessarily inconsistent with a focus on customer value, but it is certainly not the same thing. As customer needs evolve and change, the incentives of the product management function often create inertia that impedes innovation and responsiveness to customers

Marketing and sales teams use voice-of-customer surveys and interviews, customer focus groups, customer journey analysis, and various market research techniques to seek out information about what customers want. At the same time, incentives based on sales growth and account profitability often compromise a truly customer-centric focus, when they are not balanced by a deep commitment to delivering value to customers and enabling their success.

Wholesale change in how these functions operate is neither realistic nor necessary, nor even desirable. Completely replacing sales quotas with incentives based solely on customer satisfaction or success is, in most cases, a good way to drive your company out of business. Attempting to turn researchers, developers, designers, and engineers into salespeople or customer service professionals would be likewise misguided.

Nonetheless, the silos that exist in most companies between functions need to be breached. Functions from R&D, to Product Management, to Marketing, to Sales, need to expand their traditional priorities and measures of success with unifying metrics focused on customer value and success.

Too often, noncustomer-facing personnel feel disconnected from, and unaccountable for, customer outcomes. This leads to decisions and priority-setting focused on the needs of suppliers, not customers. Companies should implement policies that help employees (including those who do not touch the customer directly) understand how their work contributes not only to the delivery of specific products and solutions but to the customer’s overall business strategy.

Product designers and managers should regularly join account teams in customer meetings. Sales leaders and managers should be actively involved in the earliest stages of R&D and new product development. In practice, this often leads to a significant amount of debate and argument. R&D teams often dismiss salespeople as technically ignorant; sales teams view R&D as overly theoretical and detached from marketplace realities. But customer-centric leadership can ensure that such clashes do not lead to dysfunctional conflict, but rather serve as a source of creative abrasion that drives practical innovation.

By now, most companies have embraced the practice of mapping customer journeys. According to Salesforce, 56% of companies with 2,500+ employees have adopted a “customer journey strategy” — but just 29% rate their strategies as “very effective” or “effective.”

Market leaders distinguish themselves in two ways. First, unlike many companies that manage solution implementation, service delivery, and customer service as cost centers, leaders treat them as value drivers. Rather than focus primarily on the internal efficiency of these functions, they relentlessly search for ways to improve the customer experience across every touch point. They are willing to add internal costs when doing so will reduce complexity for customers, accelerate time to revenue, and increase customer retention and cross-selling opportunities. Customer service and support teams at customer-centric companies probe for opportunities to deliver unexpected value — versus simply solving the immediate problem. (Note that this is quite different from the common, and often counter-productive, practice of mandating that customer-service reps engage in direct cross-selling or upselling.) Such an approach requires close partnership between Sales leaders, and leaders in Operations who are responsible for many of the systems and resources that shape a customer’s experience.

Second, market leaders also balance investment in automation with continued focus on human interactions with customers. While customer journeys are becoming more automated, 75% of global consumers still want to interact with human counterparts. Why? Even as customers appreciate the ability to quickly select from a catalogue of online offerings, or self-configure a solution, when they have complex or unique needs, customers prefer to deal with a knowledgeable, consultative sales team. Self-service tools are spreading as they become more powerful, but human judgment, ingenuity, and — when things go wrong, empathy — cannot be replaced. Best-in-class companies understand the interdependence between systems and people, and optimize the customer experience by making complementary improvements to both, and by ensuring their seamless integration.

Research and development at most companies are inwardly focused, but market leaders realize that successful innovation requires deep customer empathy. Consider GE Healthcare IT, which made a point of visiting hospitals to understand how they (and their patients) experienced GE equipment. After noticing that children would often cry when they saw MRI machines, GE reps decided to visualize the rooms as children would, even kneeling to be at a child’s height. They ended up helping hospitals transform MRI rooms into adventure experiences, such as a pirate ship — and patient satisfaction scores increased by 90 percent.

Joint innovation centers, where technical staff from a company collaborate closely with technical staff from top customers or suppliers, are also a powerful practice. Innovation labs, embraced by companies across industries (e.g., Amazon, Huawei, FICO), give customers the opportunity to work closely with dedicated cross-functional teams of technology and solution development experts.

Even if, as Apple co-founder Steve Jobs famously remarked, customers themselves do not yet realize they have a need, R&D teams should be trained in customer-centric thinking — they should embrace collaboration and co-innovation with customers and partners as a key component of solution development and demonstrate how new products and features will meet real and pressing customer needs.

Traditional sales approaches focus on educating customers about the features and benefits of a company’s products, and then explaining why they are superior to competing offerings. Consultative selling, and a focus on becoming a trusted advisor to customers, represent attempts to go beyond a transactional “push” model of selling to something that is more collaborative, and that ideally leads to better outcomes for both customers and suppliers.

But a truly customer-centric approach to selling requires something more radical. The goal of customer-centric selling is not to close a sale. It is to help the customer make the best decision – for them. This does not mean salespeople should not educate customers on their company’s solutions and the value they can add to their customers – that is the essential role salespeople play in helping customers make informed decisions. But customer-centric selling does entail a paradigm shift, one that calls for new ways of talking about, and measuring, success and failure.

Customer-centric sales organizations do not focus primarily on sales “wins” or “losses.” Closing the sale of a product or solution that is not the ideal fit for customer’s needs is a Pyrrhic victory that comes at the expense of trust and future sales opportunities. Conversely, working with a customer all the way to the point of disengagement without a sale, and perhaps even advising that customer that your solution does not appear to be the best fit for them, is no loss. It is an investment in a relationship that maximizes opportunities for future sales.

For an extreme case of what happens when sales practices and incentives become untethered from a focus on what is best for the customer, consider Wells Fargo. Between 2002 and 2016, a hyper-aggressive pursuit of sales devolved into outright fraud, resulting in $3B in fines, the resignation and lifetime ban from banking of the CEO John Stumpf, and sanctions by the Federal Reserve. Contrast that with Zappos, where if a customer calls for a product and Zappos does not have the product in stock, staff recommend a competitor who has it.

As with many business disciplines, customer-centricity is about more than systems and tools. At root, it is about cultural transformation, and successful execution ultimately depends on people. The simple truth is that you cannot expect employees to treat customers better than they themselves are treated.

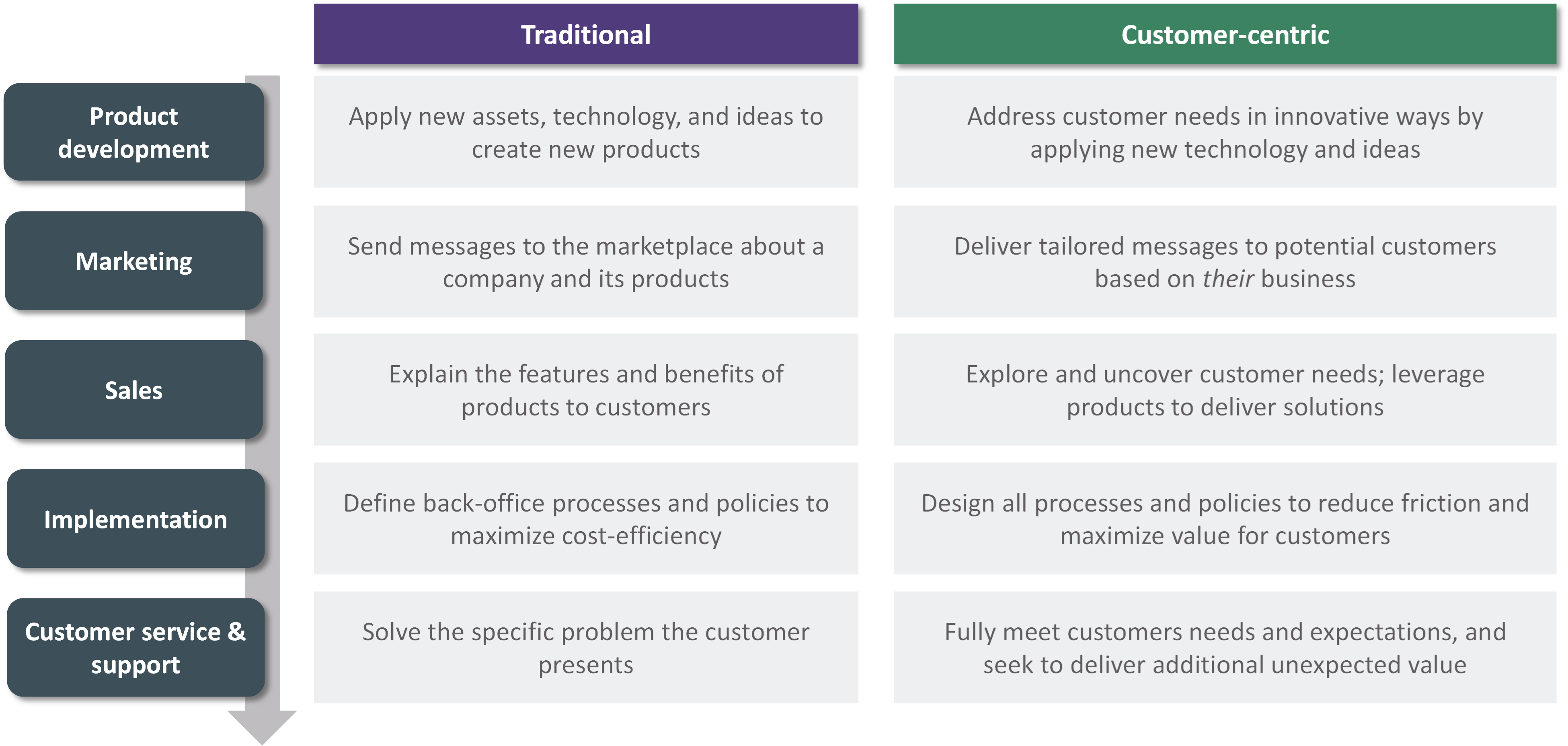

Market leaders in customer-centricity ensure the entire company keeps customers and their needs at the forefront of planning, decision making, and day-to-day execution. (Figure 2 shows how this differs from traditional practices.) Three key practices enable them to do so.

Figure 2: Transforming a company’s value chain for customer-centricity

Years ago, David Packard of Hewlett-Packard observed that “marketing is too important to be left to the marketing people.” In today’s hyper-competitive economy, customer relationships are too important to be left to sales teams and customer-service organizations.

Building a customer-centric enterprise requires a commitment to delighting customers that cuts across functions and departments. Intuit launched its Design for Delight initiative in 2014 by encouraging its employees to “fall in love with” its customers’ problems. Since launching this program, based on deep customer empathy and rapid innovation with customers, Intuit’s stock price has risen more than 450 percent.

How many of your company’s customers work with you primarily because they lack a better current alternative — because they feel like they have to, not because they want to? The answer to that question is likely to determine your company’s future.