California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Ashish Sinha, Anish Purkayastha, and Rajendra Srivastava

Image Credit | Adi Goldstein

“Artificial intelligence has large potential to contribute to global economic activity”

– Notes from the AI frontier: Modeling the impact of AI on the world economy, McKinsey Discussion Paper, 2018

“Artificial intelligence will have a profound impact—on our jobs, our health and possibly our very existence.”

– The Worlds That AI Might Create, The Wall Street Journal, 2019

“Blurring the Lines between Physical and Digital Spaces: Business Model Innovation in Retailing,” by Milan Jocevski; 2020, Volume 63 Issue 1

“Digital Transformation and Organization Design: An Integrated Approach,” by Tobias Kretschmer and Pooyan Khashabi, Volume 62 Issue 4

“Implementing a Digital Strategy: Learning from the Experience of Three Digital Transformation Projects,” by Alessia Correani, Alfredo De Massis, Federico Frattini, Antonio Messeni Petruzzelli, and Angelo Natalicchio, Volume 62 Issue 4

Above mentioned quotes are not exceptional. We have observed similar strong positive opinion about the strategic implications of Artificial Intelligence and Emerging Technologies (AI&ET) when one of the authors asked participants in executive education courses on Emerging Technology, Digital Transformation and Artificial Intelligence at the Indian School of Business (ISB).1 Probing further, these industry leaders are viewing AI&ET as transformational and intelligent general purpose technological opportunities that has the ability to make human like decisions, increase productivity by assisting in problem solving and saving human effort, and provide new ways of creating value, therefore generate competitive advantage. So, in general, there is upbeat and positive opinion towards the potential of AI&ET among business leaders who are in-charge of strategy and/or digital transformation in their organization.

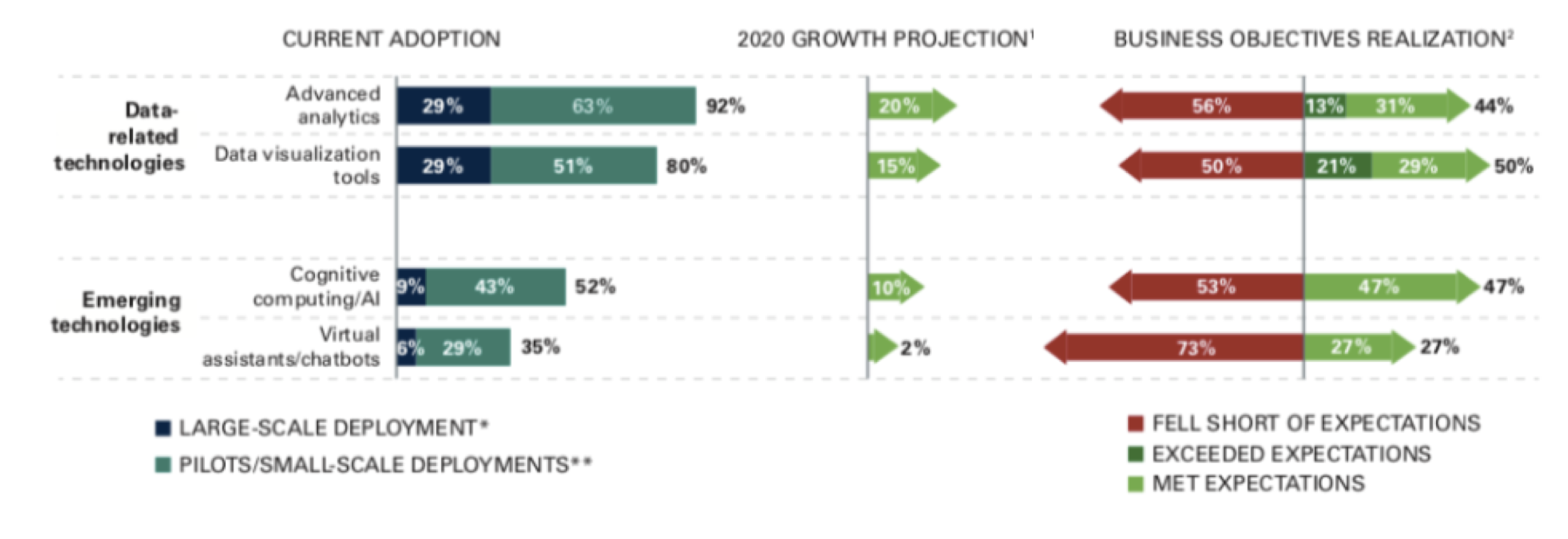

The truth is that the reality is far from this positive mode. A large proportion of companies are dissatisfied with the business outcomes of the adoption of AI&ET, and the extent of this dissatisfaction is at an all-time high (Figure 1).2

Figure 1: Data and emerging technology adoption, 2020 growth and objectives Realization

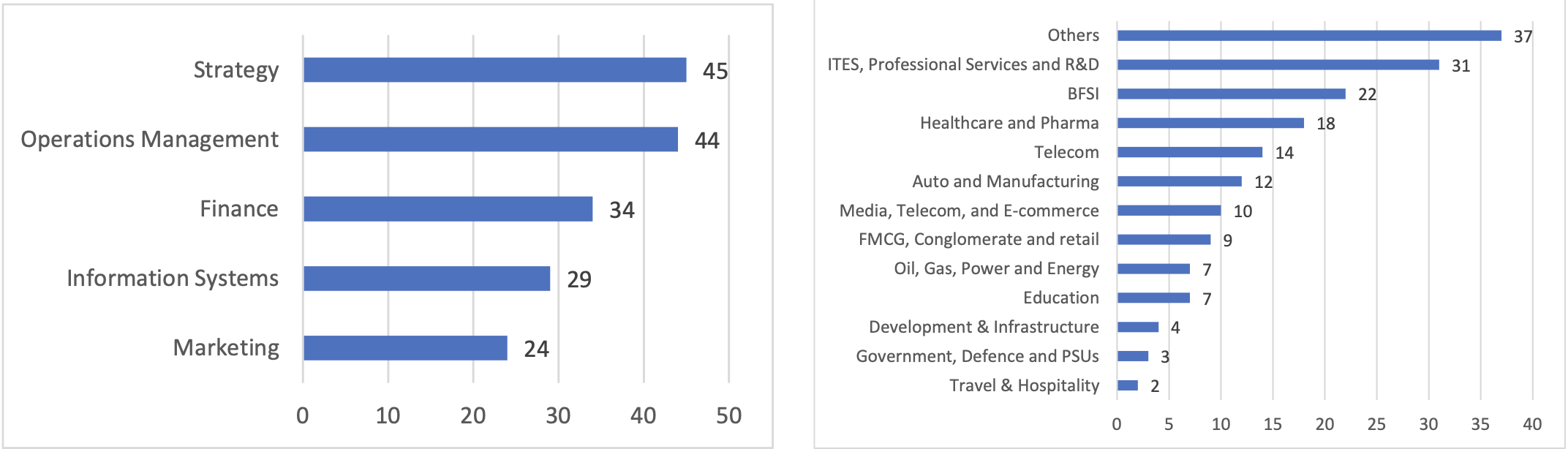

To unfold the underlying issues with this mismatch of expectations, we analyzed survey and interview data from multiple interactions with Indian Executives in-charge of digital transformation in their organization as a part of the multiple executive education programs offered by the authors. All together, we have spoken to 176 Indian executives, 34% of them are CXO or senior management title holder, and represent 13 different industries (Figure 2).

Figure 2: Distribution of 176 Indian executives across departments and industries

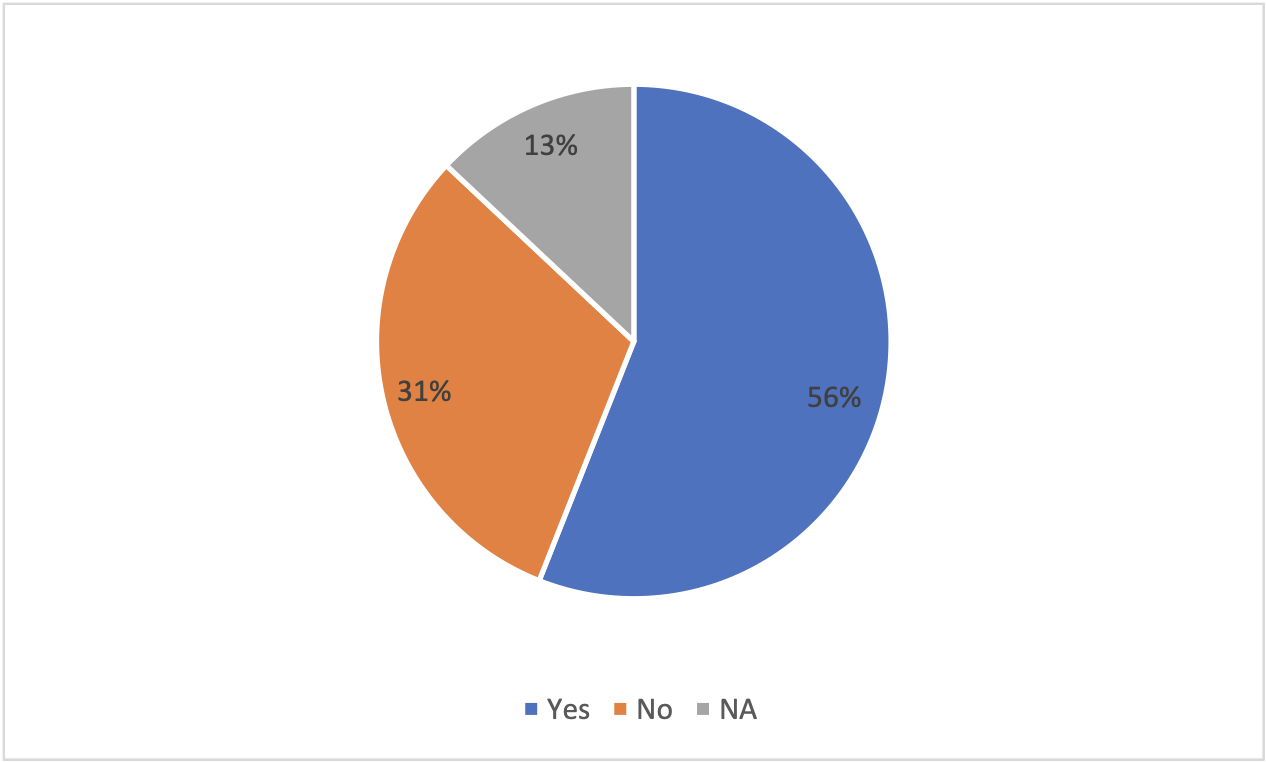

We ran two polls among these business executives: One, in relation to “the current adoption rate of Artificial Intelligence and Emerging Technologies by Firms” and the other is, “if the participants felt that the business objectives of the adoption were met or not”. The representative results for one of the cohorts are provided below, with NA representing executives from those companies that had not adopted Emerging technologies (Figure 3). Our data shows that across the multiple industries, while there is a higher propensity (87%) in adopting data and AI-related technologies, only 56% of the them believes that the business objectives have been met.

Figure 3: How many believe that the business objectives of the adoption where met?*

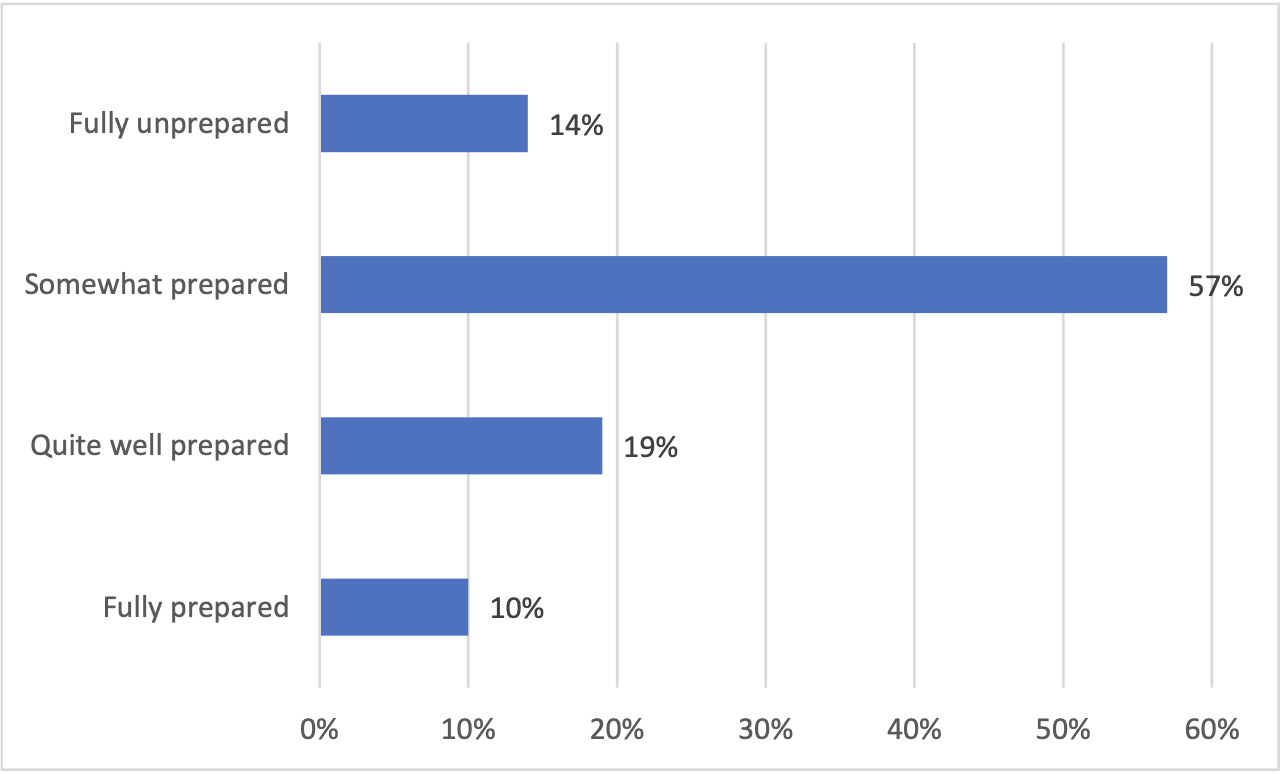

Furthermore, while asking about the preparedness of their company for the business transformation using AI&ET, we gave them four options: (i) fully unprepared, (ii) somewhat prepared, (iii) quite well prepared and (iv) fully prepared. We find the modal response across all cohort was ’somewhat prepared’. The result indicates that less than one-third of the participants felt they are either fully and quite well prepared to adopt and deploy emerging technologies and/or artificial intelligence in their organization (Figure 4).

Figure 4: How Prepared do you think your organization is for AI&ET adoption and deployment?

The participants of the programs, as well as the in-depth interviews that we conducted with few of the participants, confirmed our hypothesis that companies that are not fully prepared for the adoption and deployment of AI&ET are more likely to believe that the business objectives are not being achieved.

There were some examples of the failure of AI&ET provided by the participants of the ISB’s executive management programs as well as those that we conducted in depth interviews with. For instance, one participant who worked for a leading global Information Technology professional service firm, narrated the experience of the implementation of AI&ET at her organization. While there were a few initial easy “runs on the board”, the lack of consistent returns can lead to many organizations becoming disappointed with the adoption of AI&ET. She stated,

“While companies adopt digital technologies to improve efficiency of operations, saving cost and reducing headcount, the initial benefits are seen fairly quick between 3-6 months (say savings of 15-20 FTE), however then the benefits plateau out which makes leaders impatient and anxious often leading to a blame game. These leaders start looking for another tool/vendor/solution that will help them get more efficiency gains, and this vicious cycle continues perpetuating a myth of being on a cycle of never providing enough time for the tool/solution to work”.

This clearly points to a disconnect between the hype about the business benefits from AI&ET and realities on the ground, and is consistent with the several other studies3 that have been conducted to understand the challenges that companies face while adopting AI&ET.

So, it is a fair conclusion that a large number of firms are dissatisfied with what has been achieved by the deployment of AI&ET so far. 4

However, interestingly enough there are some companies that have been able to leverage AI&ET really well. In reality, these companies represent two spectrums of the organizational structure: (i) the big firms such as Facebook, Amazon, Apple, Netflix and Alphabet (formerly known as Google) commonly acronym as FAANGS and Microsoft for instance, and (ii) the small highly agile start-ups that very quickly have begun to grow very rapidly particularly over the last year: the Chinese social ecommerce giant Pinduoduo which is one of the fastest growing companies in terms of the number of customers that was incepted in 2016, the American ecommerce upstarts Shopify and BigCommerce, and one of the most successful Indian Fintech, Cred, that has a valuation of $2.2 Billion.

There is a reason why today the FAANGS and Microsoft combined are worth seven trillion dollars. All the above mentioned three ecommerce upstarts (Pinduoduo; Shopify; BigCommerce) have increased their market cap by an average of 100% over the last 12 months, while Cred in less than three years has acquired 5.9 million users and 20% of all credit card transactions in India. The success of both the large and small companies is largely due to their ability to successfully adopt AI&ET and generate positive market reactions. These companies are able to use AI and data to create competitive advantage as these firms have the capability to leverage data and artificial intelligence better than their competitors.

Unfortunately, the companies in the middle are the ones that are neither large enough to have the capabilities, human capital and data related technologies for instance, nor nimble (like smaller start-ups) to create competitive advantage by leveraging AI&ET. There is a lot to learn from these two sets of companies, the large and the small, particularly the companies who are embarking upon this whole journey of adopting AI&ET.

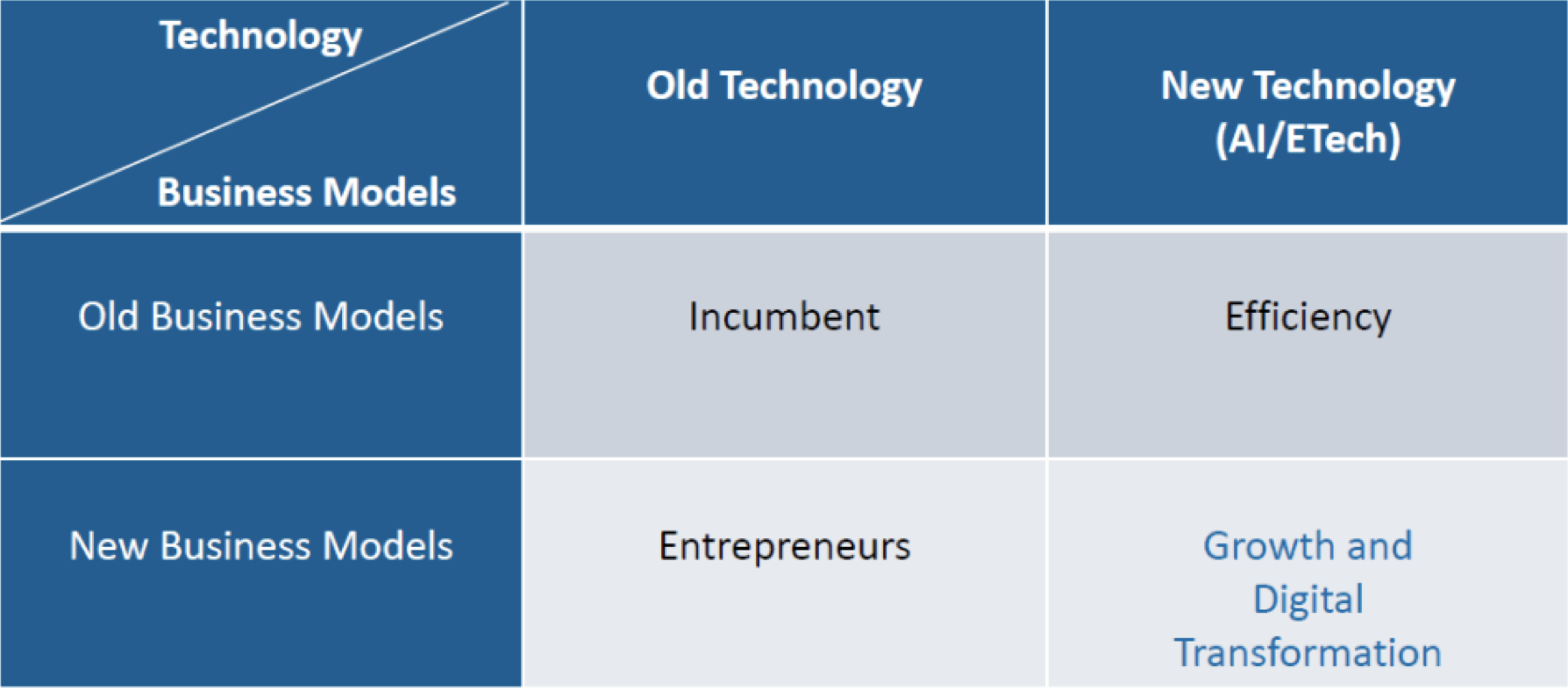

Based on our research, we find that it’s important for these firms to learn how to successfully harness newer technologies and business models and then try and apply that to their own context and also to their own companies (Figure 5).

Figure 5: Balancing technology and business model in adopting AI&ET5

At the heart of digital transformation lies a company’s ability to monetize AI and data, which occurs at the interface of business models and technology. Figure 5 provides a broad overview of the four quadrants that lie at the intersection of business models and technologies. The rows are business models, and the columns are technologies so there are four quadrants in total.

The top left quadrant is old technology and old business models, or the legacy business that still have not adopted AI and data in any meaningful way.

Just beneath that is where the old technology stays the same, but the business models are new. This is where a lot of the entrepreneurs with their new and different businesses are trying to disrupt the existing industries with existing technologies. Yellowtail (https://www.yellowtailwine.com/), an example of an Australian brand that lies in this quadrant, became one of the fastest growing wine labels in the United States. Within a period of six years, it became the number one wine label, something that French wines were not able to do for many decades in the United States, primarily for the reason that yellowtail targeted the beer drinking segment rather than the wine drinkers. This quadrant that combines old technology and new business models is where you see a lot of these entrepreneurs launching their new business in an existing industry.

The top right quadrant represents companies that have adopted new technology, but the business model stays the same and this is where lot of companies exist today because they are adopting digital technologies while still retaining the existing business model. In essence they are pushing the efficiency frontier. This could be either or both digitization and digitalization. Digitization is from paper to everything being in a digital form perhaps stored in the cloud, while digitalization is the use of automation, for instance RPAs (robotic process automations) to reduce costs and increase efficiency. Several legacy traditional organizations, like banks, use digital technology largely to enhance and improve the efficiency and lower cost. To illustrate, an executive who was one of the participants of the Executive Education program at ISB provided an example of a very large global consulting firm that employs over three hundred thousand people, has a market cap of over $35B with a revenue base of $16B has restructured its organization to benefit from the deployment of digital tools and assets. While they have retained the business model with numerous business verticals (representing its several business lines), it has a digital technology solutions group that works across these verticals. The scale provides many opportunities to this group to deploy digital tools successfully.

The fourth quadrant is one where there’s an explosion of growth through digital transformation. This is the quadrant where technology is new and so is the business model. It is the bottom right quadrant. Our research indicates that the digital transformation is not only about adoption of new technology but also developing a new business model. Firms that are able to use new technology to create new business models generally tend to be the most successful of them all.

It is important to recognize the underpinnings of often explosive growth in this fourth quadrant where the power of technology-enabled new business models is reflected in tremendous growth and resilience. Integrating technological capabilities and new business models has enabled platform companies such as Alipay, Wechat and Amazon to grow across both geographies and product markets (ranging from retailing, to cloud computing, to entertainment, to financial services, to advertising to e-pharmacies). This growth has been accelerated by the pandemic as direct to customer (DTC) marketing and sales has led to hyper-activity in tech-enabled order-delivery systems.

Because of product market turbulence due to economic, competitive, technological or environmental factors, proactive and agile companies can be off and running where giants falter. Yongqianbao is a case in point which is a digital native AI-based financial service APP that provides small amount, short term loans to the underbanked population in China. It has in total raised $91 million dollars, most recently series C funding, and has received investment from Sinovation ventures, the technology venture capital firm headed by the famous AI researcher and enthusiast, Dr Kai-Fu Lee. Yongqianbao, which literally means ‘Need Money Pal,’ uses unstructured Big Data scraped from smartphones of its many users to assess the risk profile of the borrowers within a few seconds. It is able to mine large amounts of data through Conan, its AI enabled engineering model, to predict with accuracy the likelihood of loan delinquency of a borrower in a matter of seconds. The data and AI capabilities are a source of competitive advantage that has helped Yongqianbao to disrupt the micro-lending market in China, as both traditional banks and the three technology giants, BAT – Baidu, Alibaba and Tencent, are unable to meet the needs of the underbanked segment through the financial products they provide.

Digitization is necessary but not sufficient for digital transformation: Many companies have focused extensively on digitizing, which enables and enhances their ability to automate processes to increase efficiency and reduce cost. Moderna’s ability to respond quickly to COVID-19 pandemic was largely an outcome of its investment in AI&ET related capabilities. As a digital BioTech, it is able to leverage its digital capabilities to enable rapid drug discovery and development that has seen a forty fold increase in the number of candidates that are nominated for development. At the heart of this development lies a research engine, a drug design studio which is a digital twin of a modern day biotech lab, that allows scientists to digitally design and order mRNA constructs. Its data and digital strategy helps it to target cures for multiple diseases at the same time increasing its portfolio of options, thereby derisking its product strategy. However, focusing only on these benefits misses the challenges of digital transformation. Moderna has invested extensively in developing the data curation and cleansing and modeling capabilities, apart from the human capital required for the successful deployment of a AI&ET led company strategy.6 Furthermore, Moderna has gone one step further by democratizing data science to upskill its employees. Moderna considers data science so critical for sustaining its competitive advantage that it has launched an AI academy in partnership with Carnegie Mellon University to provide AI skills and capabilities to all its employees. Adoption of digital technology is only a part of the puzzle, building capabilities that will allow a company to leverage these digital and data assets is paramount.

Digital Assets should help a company to develop a new business model: A Business Model is how a company creates, delivers and appropriates value for the chosen market and segment. AI&ET should help a company redefine its existing business model.7 One such example is Afterpay, an Australian Buy Now Pay Later (BNPL) company, has flipped the credit card model on its head. Afterpay is a digital platform in the ‘Fintech sphere’ that allows consumers to gain instant gratification by purchasing a good on the spot, and paying it off in instalments. In contrast to lay-by, consumers are able to receive the product instantly, and in perfect scenarios the consumer will not have to pay interest. Afterpay connects merchants and consumers to benefit both. Moreover, it subsidizes one side, the customers, to extract revenue from the other, the retailers.. Consequently, instead of charging interest to consumers, Afterpay charges a commission from the retailer worth 4% - 6% of the transaction’s value. This handover of charges drops the risk and price for the customer, providing a superior value proposition. Afterpay’s digital platform enables them to redefine its business model.

Digital transformation should allow companies to disrupt industries by targeting new and ignored market segments: The new business models should enable companies to create value for the ignored and new segments by targeting the underserved and unserved customers. As discussed above, Yongqianbao is one of the many Fintechs that uses a digital platform aided by AI&ET to link financial institutions with the unbanked segment of the population who do not have to access to financial products, such as credit. The unique business model that uses data as collateral combined with digital platform that connects financial institutions with the underbanked segment allows Yongqiabao to disrupt the current day credit market and challenge the hegemony of the banks and existing players in the credit market. Yongqiabao is a case in point that digital transformation involves the development of data and modeling related capabilities to enable companies to leverage data and digital assets to assist in the development of a new business model that will allow them to target the new and ignored segments who didn’t have access to these products before.

The reasons for the failure of companies at digital transformation8 is because most of them are not on the journey of digital transformation. AI&ET may increase efficiency (through reduction of costs and time-to-market) and enable stronger customer relationships. But they only create short-term growth and unsustainable competitive advantage. Our recommendation is that companies need to often jettison the old legacy business models aloing with adoption of AI&ET. Unless they do so, digital transformation will be nothing more than a pipe dream.

ISB is one of the leading business schools in India. Worldwide, the Financial Times has ranked ISB 23 in its Global MBA Ranking 2021. The QS Global 250 MBA Rankings 2020 ranked ISB at No. 98 worldwide and No. 12 in Asia. ISB has secured the 7th position globally in the Forbes Best Business Schools 2019 rankings.

R. Pastore, Spires M. and Key C. (2020),”Achieving IT excellence in the Age of Digital Disruption,” The Hackett Group.

What ever happened to IBM’s Watson, downloaded on 21st July, 2021. https://www.nytimes.com/2021/07/16/technology/what-happened-ibm-watson.html

Matthew Doan (2021), “Don’t Let Digital Obsession Destroy Your Organization”, MIT Sloan Management Review

We asked one of the cohorts taking our Digital Transformation course to identify the quadrant in which they believe the companies they work for fall into. 40% percent of the respondents believed that their companies had not even started the digital transformation journey, 34% were of the opinion that their companies were in the growth and digital transformation quadrant, while 26% were in the efficiency quadrant. Probing further, those who choose the fourth or the growth and digital transformation quadrant stated that they perceive that data and AI was a source of competitive advantage for their firm.

Alessia Correani, Alfredo De Massis, Federico Frattini, Antonio Messeni Petruzzelli, and Angelo Natalicchio (2020), “Implementing a Digital Strategy: Learning from the Experience of Three Digital Transformation Projects”, California Management Review, Volume 62 Issue 4

Milan Jocevski (2020), “Blurring the Lines between Physical and Digital Spaces: Business Model Innovation in Retailing”, California Management Review, Volume 63 Issue 1

Tobias Kretschmer and Pooyan Khashabi (2020), “Digital Transformation and Organization Design: An Integrated Approach”, California Management Review, Volume 62 Issue 4