California Management Review

California Management Review is a premier professional management journal for practitioners published at UC Berkeley Haas School of Business.

Maximilian Richter, Nikolaus Lang, Markus Hagenmaier, Andreas Herrmann, and Michael D. Johnson

Image Credit | Roberto Nickson

Today’s cities are plagued with substantial growth in populations and jobs, huge traffic delays, and poor driving conditions. These problems have pushed technology companies and original equipment manufacturers into disruptive innovations in autonomous vehicles which could change how we think about mobility in cities of the future. How autonomous vehicles affect cities is important for up-and-coming disruptive innovators and traditional vehicle manufacturers alike.

“A Brief History of Artificial Intelligence: On the Past, Present, and Future of Artificial Intelligence” by Michael Haenlein & Andreas Kaplan (Vol. 61/4) 2019.

The question is whether the disruptions in autonomous vehicles will succeed in cities of the future? The answer is not necessarily. Because cities are so different, disruptive innovations in autonomous driving must be analyzed from a city-specific point-of-view. Amsterdam, for example, is both a very old city with historically narrow streets and a very active city, where about 60% of people use active forms of transportation that include biking and walking. Los Angeles, in contrast, is a newer city where more than 80% of people drive their own car.

Most of the traditional equipment manufacturers are committed to bringing autonomous vehicles to cities by 2026 and have invested heavily in autonomous driving and robo-vehicle innovations, such as robo-shuttles, robo-pods, and robo-taxis.1 Companies are investing heavily because they expect a high return on investment. Spending on different types of autonomous modes of transportation by traditional industry players and newcomers alike is forecasted to grow to a cumulative $85 billion through 2025, on top of spending for electric vehicles per se.2

Although it is important to cut down on traffic volume, fatalities, energy consumption, parking areas, transportation costs, and commute times in cities, autonomous vehicles also stand to disrupt other forms of transportation. Even though replacing private vehicles is greener, cheaper, and safer than keeping them on the road and may decrease commute times, changing modes of transportation to achieve the smart city concept is complicated and risks increasing traffic volume.

We present the results of a research project conducted by the University of St. Gallen and the Boston Consulting Group that examines whether our cities are suited to the revolutionary technology that enables autonomous driving. We clustered 44 major cities into five archetypes and modeled how advantageous different types of autonomous vehicles will be for these archetypes. The results reveal that autonomous vehicles are not the optimal solution for every city’s condition, meaning that companies will need to develop city-specific strategies.

Our research is based on expert interviews with industry leaders, policymakers, and researchers as well as a large-scale database with information on city construction, including exact mappings of city zones, homes, workplaces, etc. We use this input to conduct advanced simulations of the consequences of introducing technology innovations related to robo-vehicles in different types of cities. The simulations apply criteria used to cluster cities in prior research, such as congestion time, route time, population density, land concentration, urban development pattern, and work and leisure activities, to identify five city archetypes.

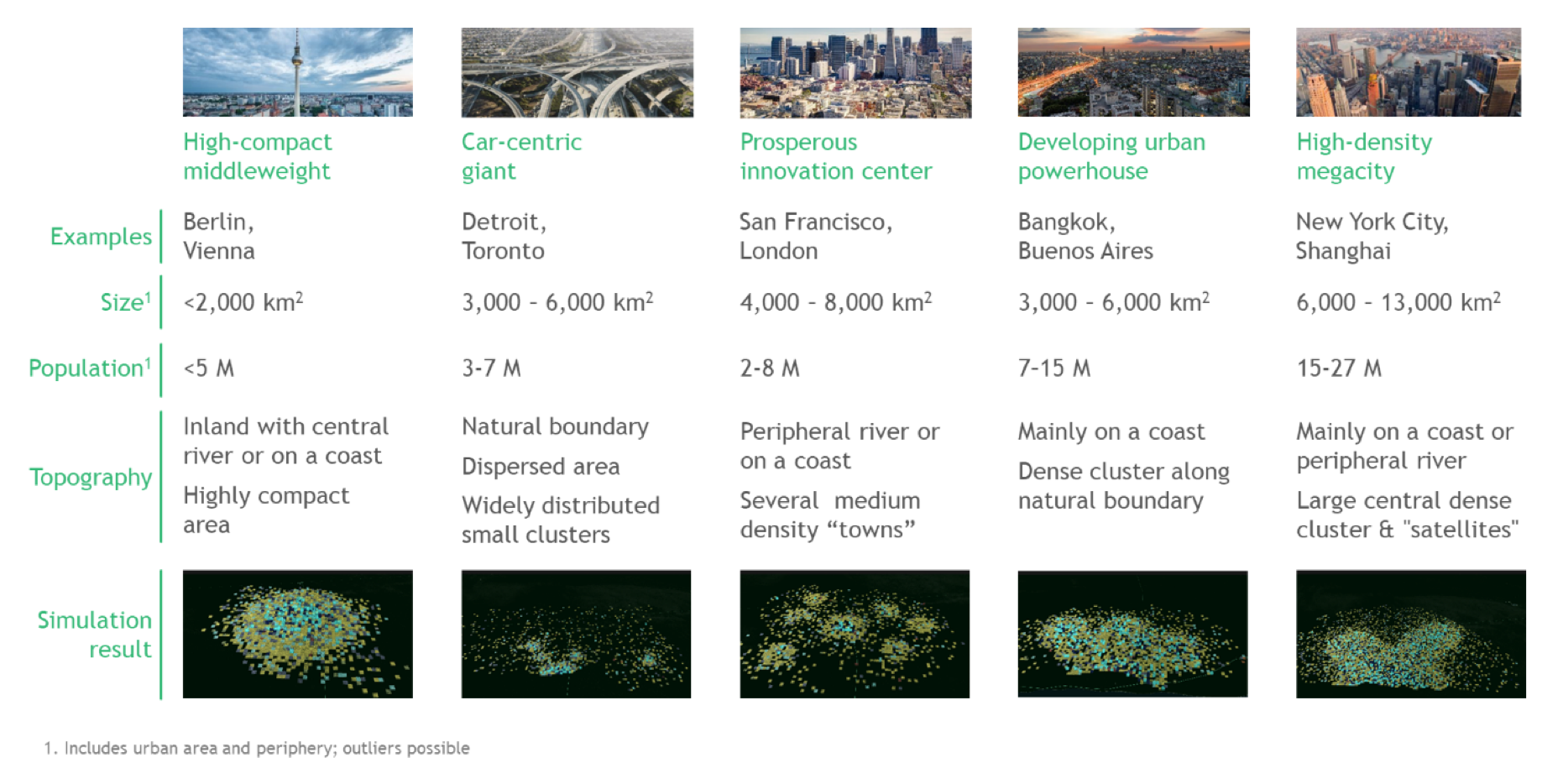

Figure 1 shows the characteristics of the five archetypes. For example, highly compact middleweights, such as Berlin and Vienna, have a high population density with people living within a well-defined central area. Developing urban powerhouses, such as Bangkok, also have a high population density, while individuals live in multiple distinct hubs.

Figure 1: Five City Archetypes Form the Basis for the Simulation Tool

The simulations are based on a very comprehensive travel-demand simulation model that was tested on data from 44 real cities. The model incorporates city layouts and their underlying characteristics, such as residential, employment, and shopping districts. It also includes several underlying characteristics that drive mobility behavior, such as employment rates, school enrollment, household income, and household size. These characteristics are used to calculate the change in transit volume, number of trips, and mode of transportation (private cars, including motorcycles; public transportation; taxi/ride hailing; micro-mobility, including bikes and walking) due to the implementation of autonomous vehicles. To the five existing modes of transportation, we added innovations related to the three autonomous vehicle modes: robo-pods (which seat up to two passengers), robo-taxis (up to five passengers), and robo-shuttles (up to 15 passengers). Depending on area size, population, and economic forecasts, our tool estimates the distribution of trips and the number of trips made to and from each city zone. The number of daily trips as well as real inputs from 44 cities are then used to derive key performance indicators (KPIs), including annual fatalities, energy consumption, total parking area, transportation costs, and average journey time. Based on this simulation procedure, the modeling was repeated for each archetype and scenario. In total, we modeled 1.7 billion daily trips, which allowed us to compare the suitability of autonomous vehicles for the different city archetypes.

Overall, using this procedure, we investigated how implementing the three types of autonomous vehicles will likely influence cities’ existing transportation modes along the defined key performance indicators such as fatalities, energy consumption, total parking area, transportation cost, and average journey time.

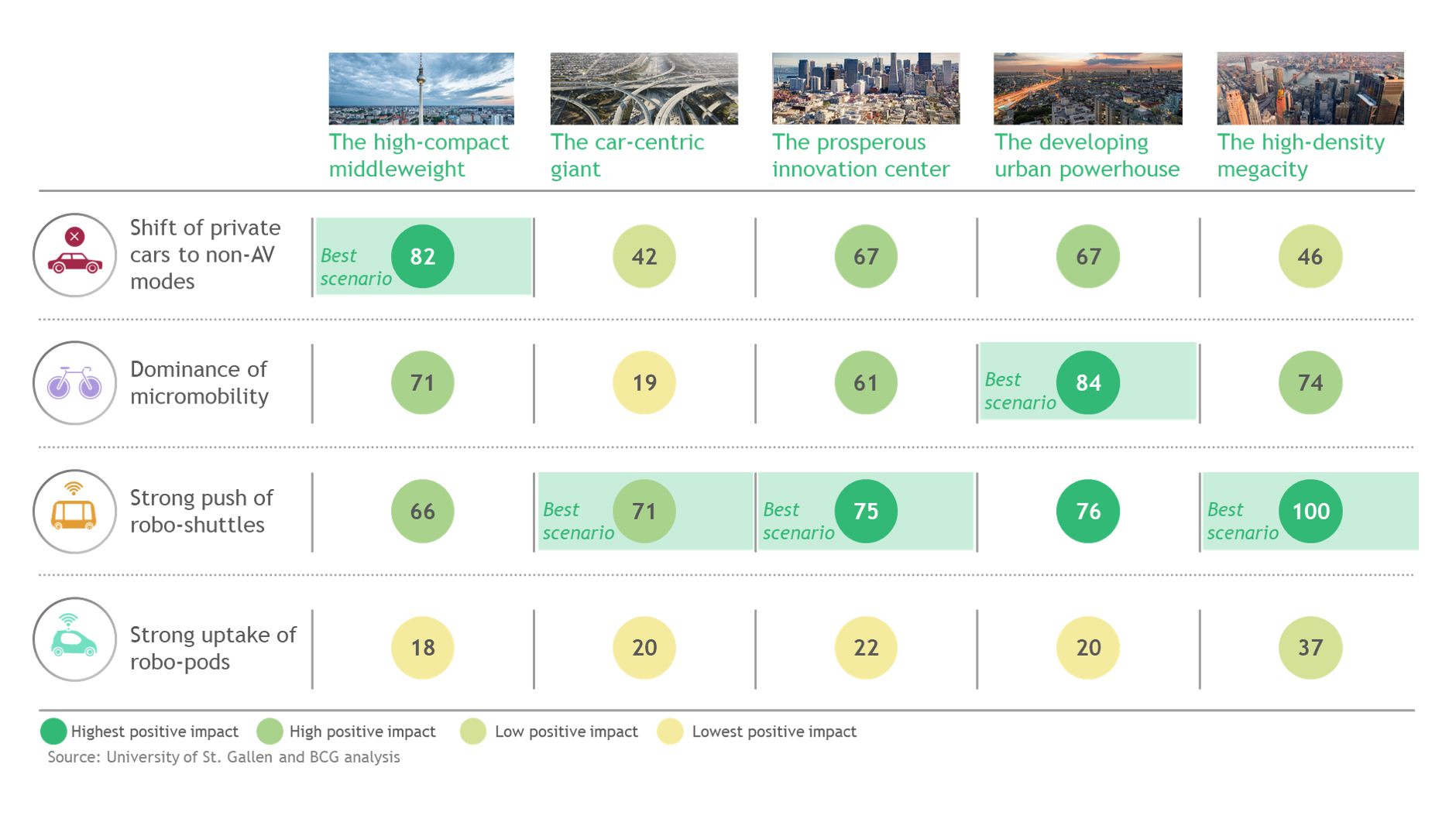

For the mathematical computations underlying our model, we used a scenario-based approach focusing on the most prominent innovations for future mobility in cities as well as current regulatory frameworks. In total, the simulation modeling considers four scenarios (see Figure 2).

Figure 2: Scenarios Will Play Out Differently Depending on the Archetype

We modeled the influence of implementing the three sets of autonomous vehicles for the above scenarios using the previously discussed KPIs: annual fatalities, energy consumption, total parking area, transportation costs, and average journey time. Overall, the results indicate an improvement in cities’ traffic situation (in terms of the KPIs considered) from implementing autonomous vehicles regardless of the scenario. With respect to the scenarios with the most significant changes, however, this means reductions of up to 22% in traffic volume, 60% in fatalities, 21% in energy consumption, 58% in total parking area, 27% in transportation costs, and 8% in average journey time. Only in the strong uptake of robo-pods scenario is an increase in traffic volume (up to 19%) observed. Thus, this scenario has the least positive influence due to the low occupancy rate and persistently high level of individual traffic.

To illustrate our findings from the simulations and to identify core principles that can be executed in city transportation strategies, we created a mobility index. This index is helpful for understanding the match between the different city archetypes and the different types of scenarios involving autonomous vehicles. Based on the mobility index city planners and policymakers can develop city transportation strategies. All scores show a positive impact from implementing autonomous vehicles and range from zero (the lowest positive impact) to 100 (the highest positive impact). We marked the scores indicating a positive above-average impact in darker colors and scores indicating a positive below-average impact in lighter colors (see Figure 3).

Figure 3: The Mobility Index Provides an Overview of the Model’s Results

Shifting from private cars to non-autonomous vehicle modes is the most effective measure to reduce the number of private vehicles within highly compact middleweights. These cities (e.g., Berlin, Seattle, and Vancouver) will likely profit the most from this scenario and profit the least from introducing autonomous driving. The relatively low improvement from introducing robo-vehicles is due the large number of short trips, dense city center, and good access to public transit characterizing this archetype. However, robo-shuttles and robo-pods cannibalize public transportation, which leads to relatively poor improvement in traffic volume.

Developing urban powerhouses (e.g., Bangkok and Seoul) benefit from the dominance of micro-mobility scenario the most. Micro-mobility perfectly complements the high share of short-distance trips and will likely switch people from private cars and taxi/ride hailing to greener, safer, and cheaper transportation modes. Furthermore, micro-mobility complements good access to public transit very well. Even though a strong uptake of robo-pods leads to a fast average journey time as streets dominated by autonomous vehicles enable smoother traffic flow, the shift from today’s shared transportation to individual transportation increases traffic volume and weakens the positive effects of energy consumption, total parking area, and transportation costs.

The strong push of robo-shuttles scenario is beneficial for car-centric giants, prosperous innovation centers, and high-density megacities. Car-centric giants (e.g., Atlanta, Detroit, and Dubai) profit from a strong push of robo-shuttles since missing alternatives in their widely distributed urban patterns can be compensated by these new emerging transportation modes. The disproportionately high reduction in parking space and in fatalities arising from this scenario lead to the best positive changes compared to the other scenarios. Prosperous innovation centers (e.g., Amsterdam, London, and Sydney) are characterized by several medium-density hubs contained within city boundaries. An uptake in robo-shuttles delivers the greatest positive impact as such shuttles connect hubs with each other, thereby reducing parking space and traffic volume. High-density megacities (e.g., New York City, Beijing, and Paris) profit the most from introducing robo-shuttles, which present an excellent option for evenly distributed medium- and long-distance journeys. Shared autonomous mobility replaces private cars and taxi/ride hailing and simultaneously fosters walking, thus eliminating the high costs of individual transportation in lieu of lower cost robo-shuttles.

What the current modeling and our expert interviews with city planners, industry experts, and policymakers reveal is that managers and companies who are investing heavily in autonomous vehicles cannot ignore contextual knowledge. The fact that cities have different characteristics is important to consider when implementing disruptive innovations, and especially new autonomous driving technologies. Bringing autonomous vehicles and the required infrastructure into urban environments come with a variety of new challenges. An uncontrolled introduction of autonomous vehicles may induce significant deterioration in traffic and travel conditions within cities. Based on our research, several lessons come to mind.

Consider what value autonomous driving will offer different cities

According to 45% of our expert interviews, autonomous vehicle services will likely be operated by leading tech companies such as Mobileye, NuTonomy and Waymo. Nevertheless, traditional vehicle manufacturers and ride-hailing companies such as Uber and Lyft are candidates to be the first operators since they all have autonomous driving strategies in place. One of the first issues managers of these companies should address when considering autonomous vehicles is the value proposition. Based on our analysis, it will be important for management to acknowledge that the most beneficial scenarios will be different for different cities and that a winner-take-all scenario will not materialize. For example, a strong push of robo-shuttles is likely the best scenario for highly dense megacities like New York City and Shanghai. In cities like Berlin or Vienna, city planners and policymakers should not bet big on autonomous vehicles since their public transportation systems are well developed and the benefits from this new transport mode are rather small. Autonomous driving will fundamentally change cities and will force city planners and policymakers to rethink how their transportation should be reorganized to unleash the highest benefits from autonomous driving. Consequently, companies must ensure that autonomous vehicles add value. Otherwise they risk not being adopted by customers or policymakers, which means that high investment costs will not yield a return on investment.

Make sure to have a sustainable and forward-looking business models

New business models for mobility are emerging. We are seeing a move from owning a “one-size-fits-all” vehicle toward the use of shared, flexible, on-demand mobility. Thus, managers need to adapt and formulate their business as an integrated product and service model involving autonomous vehicles. Managers who understand and embrace this trend will benefit from the change in mobility. This means that traditional car manufacturers will have to find their place in autonomous vehicle production and supply in a new way. They need to think carefully about the role they want to play and adjust their current offerings to meet the needs of the stakeholders and customers in the urban mobility ecosystem of the future, for example, by changing vehicle designs to accommodate new use cases. Other stakeholders within the mobility ecosystem must adapt and develop new business models. In the case of New York City, for example, about 14,000 licensed medallion cab drivers and more than 80,000 drivers for non-taxi ride providers such as Uber and Lyft need to prepare for lower volumes according to the experts we interviewed.

Experiment, look for win-win partnerships, and engage in collaboration

Autonomous driving presents both a difficulty in developing vehicles and operating a fleet within cities once the technology is area wide available. This suggests the need for strategic experimentation involving traditional car manufactures, tech-companies, and cities. Tech companies need original equipment manufacturer knowhow to build hardware at quality and scale, while vehicle manufacturers need tech-company’s know-how to build applications, backends, and data analytics. Once autonomous vehicles are developed and can be offered as on-demand services, it is important for companies to cooperate with cities. Based on our simulations, simply offering a mobility platform such as Uber does in 73 countries will not work with autonomous vehicle services. Cities will need to set frameworks for implementing autonomous vehicles to benefit the most from the new technology. To do so, experimenting with forms of collaboration among stakeholders is important. The way to realize autonomous vehicles requires a dynamic that includes all stakeholders.

Be picky and target the right pilot projects

Trying to compete in the autonomous vehicle space requires exploration with different pivots. Here, the selection of pilot projects will be particularly important to all stakeholders. Pilot projects allow different stakeholders to gain experience at various levels before offering autonomous vehicles on a large scale while creating awareness for a city’s population, government, and regulators.

This awareness will be important to engage in a dialogue with the public about any plans to implement autonomous vehicles because citizens will almost certainly be the primary customers in this market. In our expert survey, 80% believe that acceptance can be a barrier if citizens are not involved in the autonomous driving integration process. A good example of how to create awareness is the city of Boston which is piloting autonomous driving with three different tech companies—nuTonomy, Optimus, and Aptiv. One of the key principles of Boston’s autonomous vehicle strategy was to involve citizens.

Beyond creating awareness, pilots help to adapt the service of the autonomous vehicles to customer needs. Perhaps the most important decisions will be choosing the appropriate vehicle(s) for each city to implement and determining how cities’ initial concepts can be part of a larger expansion process. Making these decisions will ultimately be a question of technologies, partnerships, and knowledge about cities and will entail strategic planning that is quite different from that of today. For example, based on our analyses, for the highly compact middleweights (e.g., Vienna), pivoting would involve a shift from private cars to non-autonomous vehicle modes. Technically, this business model would mean banning private cars in city centers, strengthening existing public transit networks, and providing last-mile options for short trips. Here, the value proposition is to compete by creating seamless intermodal connections for end users by closely linking public transport and last-mile transportation. Such a value proposition will take close collaboration between partners to achieve and could involve a variety of solutions, including companies only providing last-mile transportation to companies taking full transportation responsibility by teaming up with vehicle providers. Vehicle manufactures have the chance to reinvent themselves and engage early in city pilots to test new business cases.

Be willing to invest

It should be noted that even though numerous companies are competing in the autonomous vehicle race, this race will take time. The payoff for investments will also take time, and forming the right constellation with patience is important for meaningful progress. Companies need to be aware of high initial investment costs and slow amortization. Assuming a city like London needs about 340,000 robo-vehicles (robo-pods, robo-taxis, and robo-shuttles combined) in its metropolitan area, this means an investment cost of about $30 billion according to our simulation tool. Beyond investing in an autonomous vehicle fleet, 90% of our experts think an autonomous mobility on demand-friendly infrastructure has to be in place (e.g., separate lanes for autonomous vehicles, smart signals, curb-space management) before autonomous driving will be seen in cities.

This means that pure investments in vehicle technology is not enough. Cities must adapt the existing infrastructure to the new technology. According to the majority of our surveyed experts a legal framework can speed up the introduction of autonomous driving because such a framework will ensure a smooth transition from manual traffic to autonomous driving. While Silicon Valley was early in implementing such frameworks, many are watching what is developing in China, while European and American players are adopting major stakes as well.

Autonomous vehicles are not a concept without context. They are disruptive and will happen. But companies that fail to adopt city-specific strategies will miss out on the race, and existing vehicle providers will be disrupted by new entrants. Existing business models will most likely become obsolete, and cities will play an important role in the success of autonomous vehicles. It is important to understand cities and their differences when crafting the next generation of strategies for vehicle providers and manufacturers more broadly. This issue goes far beyond the traditional auto industry, which will soon be confronting one of the largest challenges in its history.

CB Insights, “40+ Corporations Working on Autonomous Vehicles”, Retrieved from https://www.cbinsights.com/research/autonomous-driverless-vehicles-corporations-list/#.

AlixPartners (2019), “The Auto Industry is Entering a ‘Profit Desert’ as Heavy Spending on New Mobility and Stagnation in Key Markets Take Hold Simultaneously”, Retrieved from https://www.alixpartners.com/media-center/press-releases/alixpartners-global-automotive-industry-outlook-2019/.

Spotlight

Sayan Chatterjee

Spotlight

Sayan Chatterjee

Spotlight

Mohammad Rajib Uddin et al.

Spotlight

Mohammad Rajib Uddin et al.