California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Thierry Warin

Image Credit | Tom Parkes

In May 2022, Dubai Ruler Sheikh Mohammed bin Rashid Al Maktoum introduced the Dubai Metaverse Strategy, which intends to raise the contribution of the metaverse sector to the emirate’s economy to $4 billion by 2030 (Arabian Business, 2022).

“The Boon and Bane of Blockchain: Getting the Governance Right” by Curtis Goldsby & Marvin Hanisch. (Vol. 64/3) 2022.

The word “metaverse” was coined by Neal Stephenson in his 1992 science fiction novel Snow Crash (Stephenson, 2000), where programmable avatars interact with one other and software agents in a metaphorical three-dimensional virtual realm. Stephenson coined “metaverse” to describe an internet replacement based on virtual reality. If anyone missed the novel in 1992, well, recently, it has been impossible to miss the term. Indeed, we have all heard about the Metaverse by now. Thanks to a virtual reality headset, you access a virtual world. Thus, it looks like your Facebook account but in 3D. It should be no surprise why Facebook bought Oculus and renamed itself, Meta. With Metaverse often comes the marketplace addon.

It seems, though, that it has already been created. This does not feel new. The game Second Life developed by Linden Lab has been around for more than two decades. They even offer a marketplace called Tilia. There must be something more profound than just a virtual world, which you access in 3D. Meta, Microsoft, Nvidia, and numerous other companies are pursuing the opportunity in many ways, investing millions of dollars.

The market is potentially huge, ranging from gaming, education or industrial applications. Moreover, to understand the potential markets, we need to dig into the technology behind the Metaverse, the one from Meta, and the one that may compete with Meta based on Web 3.0.

Indeed, more interestingly, we have seen the emergence of new concepts such as Web 3.0, crypto-currencies, and Non-Fungible Tokens (NFT), which have been associated with the appearance of the Metaverse concept.

Sometimes it is tough to locate oneself among all the terminology employed. They overlap, intersect, and produce grey zones. This is the exact effect of the extraordinary innovation occurring before our eyes. Therefore, several dimensions must be considered simultaneously. This is the fundamental tenet of complexity. Therefore, we require a complicated analysis, which should not be mistaken for a muddled analysis. Using several analogies and debunking certain commonplaces or falsehoods using these analogies is beneficial.

We can predict that multiple metaverses will exist, taking different forms, which we will access with VR headsets or other technologies. Those metaverses can be owned by private companies (or other forms of organizations) and be, on the one hand, proprietary or, on the other hand, decentralized.

Let us go back in time to see the origins of the Internet, starting with Web 1.0. Web 1.0 is HTML-based, static, relies on languages such as Java and Javascript, and serves mainly to pull information from it. It was the main framework from 1995 to 2005. Then came Web 2.0, also called the social Internet. It is indeed about social networks, mobile applications, sharing crowdsourced content, and monetizing data. It started in 2006 up to nowadays. Web 3.0 is the semantic Internet. It relies on blockchains, and decentralization allows for the use of fungible tokens (the so-called cryptocurrencies) and NFTs. It is also using artificial intelligence heavily. It started really in 2021 in its most comprehensive definition. Web 3.0 focuses on decentralization, the Internet of Things, virtual reality, and all the usual suspects.

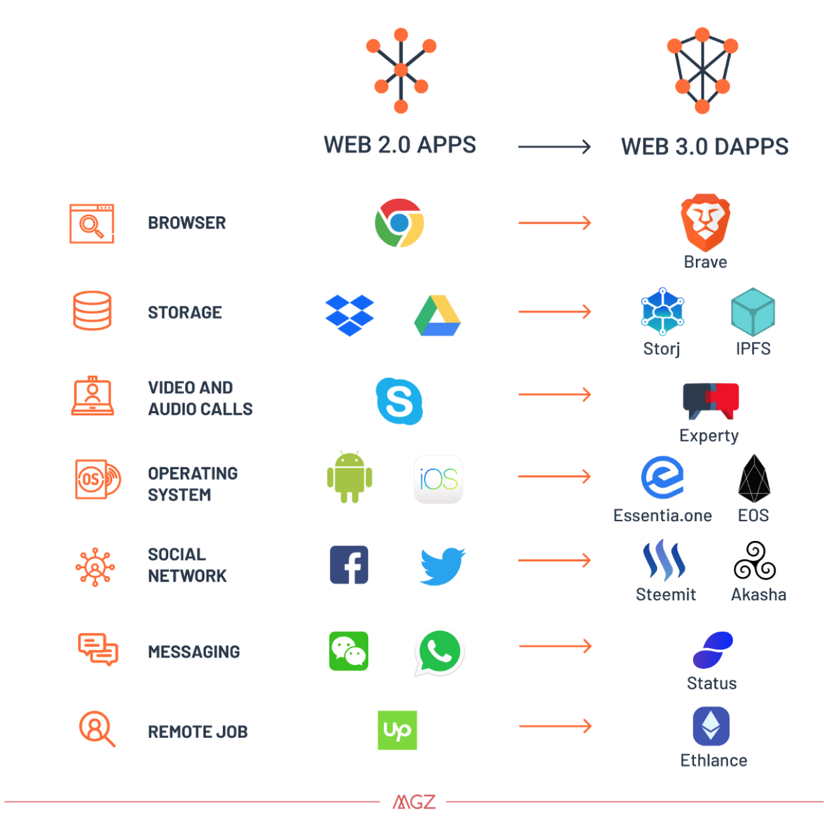

Decentralization is a challenge to our web 2.0-based companies. For instance, many functionalities that we find in apps on a marketplace in the Web 2.0, such as the App Store, can be found in apps on the Web 3.0, called dApps (see Figure 1).

Figure 1: dApps

Source : Kumari, D. (2019, 10 juillet). Web 2.0 Vs. Web 3.0: The Transition to a Decentralised Web. Medium. https://medium.com/@kumaridarpan01/web-2-0-vs-web-3-0-the-transition-to-a-decentralised-web-d1d04007737

The blockchain technology is at the core of The Web 3.0 platform. One of the most well-known uses of blockchain was to run the bitcoin network (Nakamoto, 2008). Let us overlook its relationship to Bitcoin for the time being. Many of the components of blockchains may be found in David Chaum’s vault system from 1979, which was extensively explored in his Berkeley dissertation in 1982 (Chaum, 1982).

A blockchain is a distributed database that computers on a network share. In cryptocurrencies such as Bitcoin, blockchains serve a crucial role in maintaining a decentralized and secure log of transactions (Hayes, 2022). A blockchain ensures the integrity a data record without a third-party verifier.

Applications of blockchain technology can be as diverse as in the health industry, manufacturing, supply-chains, energy, etc. (Bodkhe et al., 2020)

Imagine a corporation with a server farm of 20,000 servers with a database containing all account information for its clients. A natural catastrophe can happen at that location, or an attacker may delete all information, leading to the loss of vital information for the company.

A blockchain facilitates the dispersion of a database’s data over several network nodes in different locations. There is redundancy and thus integrity of the data. Indeed, if someone attempts to update a record, the other nodes will not be impacted, hence preventing the modification. Thus, no one network node may manipulate the network’s data. A block will grow indefinitely as the asset is, for instance, traded on the marketplace. This block includes the item’s whole history. For instance, it is a title deed comparable to what our public notary has for our real estate property.

Let us now define an NFT by comparing it with the definition of a fungible asset. One example of a fungible asset is currency. It is fungible, as the first dollar in your wallet can buy you the same thing as the last dollar in your wallet. A non-fungible asset means that the first item in your wallet has a different value than the last item in your wallet. The value for each item is decided in a marketplace where you have a supply and demand of different items.

Web 2.0 is full of examples of marketplaces. Steam is a well-known one in the gaming industry. It is possible to buy a game or its assets on Steam. Nevertheless, NFTs promise that you can transfer the ownership of this game or asset to someone else easily and securely, relying on a blockchain-based platform. This is the promise of Web 3.0. For example, we can imagine that the online cycling app called Zwift could sell NFTs of bikes used in the game while training. They could sell the idea to the famous road cycling legend Eddy Merckx, and create an NFT of his bike. Then, they could sell Eddy Merckx’ virtual bike to someone who will have full ownership and will be able to sell it again on the marketplace. Suddenly, it opens up a full range of options since marketplaces will develop for any kind of human activity and will be accessible from across the world. Think about what it would do to Zwift’s business model.

Web 3.0 has already raised some eyebrows, however. There are always two sides to a coin. Many stories about bitcoins and NFTs and their risks have been raised.

Indeed, using NFTs in a marketplace comes with potential risks, particularly since people do not all have a Ph.D. in Economics. From the beginning, speculation has always been part of marketplaces. Many users are drawn into crypto assets (cryptocurrencies and NFTs) by looking at past prices. It is simple and does not require knowledge of the industry involved. The Genesis story has not helped. Genesis is a CryptoKitty born on November 22, 2017, sold a few weeks later. The owner of Genesis purchased this CryptoKitty for roughly 247 Ethereum (about $117,000 in 2017), roughly $1,000,000. Other CryptoKitties are going for prices over $1,000,000.

So, people have limited their definition of NFTs to digital assets that look like financial products. NFTs are a digital asset that ranges from images of cats, online social media posts and tweets, and artwork, to name a few. Moreover, it seems they behave like financial products. Stepping back a bit, it must be acknowledged that Web 3.0 is new, develops its own complicated language. In this situation, investors tend to focus only on the movement of price charts. They will also seek information from content creators (influencers?) whose expertise rely on the fact that they have profited from these marketplaces by doing chartist analysis and potentially made money.

However, there is another way to look at them, which is what they are: they are property rights validated by blockchain technology. So, yes, it is a bit crazy at first to think that someone will buy a few pixels at 247 ETH. There are other value propositions: Genesis is an item that serves in a social game, so it has a use beyond the art itself. However, the person is also buying one of the first NFTs the world has created. This has much value. For instance, Quantum was issued for the first time in May of 2014 and is considered by many, including the auction house Sotheby’s, to be the very first NFT. It sold for $1.47 million at Sotheby’s “Natively Digital” auction in June 2021.

NFTs are traded on a marketplace based on a dedicated blockchain-based platform. Blockchain technology serves as the public notary we know in the real world within this platform. The difference is that - this time - NFTs do not apply to assets (houses, etc.) covered by public notaries; they can be property rights of almost anything virtual… and may extend then to the real world. Most of the time, tangible assets are sold in the real world on a local market (houses) with either the invisible hand working well or with hedonic price-based markets or online markets.

Here is how this property title is protected on this platform. It is where the term “decentralization” first emerges. Any computer linked to this platform is notified and serves as a guarantee as a result.. It is as if each building owner could vouch for the legality of a neighbor’s title deed without relying on a higher authority, in this instance, the government and the legitimacy of its institutions. It appears that notaries are no longer required to authenticate title deeds. This eliminates an entrance hurdle, especially in intellectual property, because this is the essence of Web 3.0.

If someone has a brilliant idea for a drawing, she will not visit her public notary to obtain a title deed. She will explore various avenues, including galleries, brand development, name recognition, etc. In reality, it corresponds to the art industry. However, as a fresh graphic artist, there are several barriers to entry. In Web 3.0, she may generate an NFT by visiting a site based on an exchange.

Another influence is quantity and variety (the 3 Vs: volume, velocity, and variety). Suddenly, we unleash humanity’s creation and give it a title of ownership, allowing it to be valued in cold hard cash or digital money. In economics, incentives play a crucial role. It is therefore plausible to foresee a society in which all ideas, good and terrible, will at some time be created and potentially valuable. This will foster endogenous creation. Additionally, it will alter the norms of conventional creative sectors.

It is also possible indeed to imagine some externalities in the real world. Let us come back to our drawing owner. It is a matter of requesting the recognition of an intellectual property right on a work that she created in the physical world, which is traded in the virtual world, and whose value will be recognized and guaranteed thanks to this title of ownership in Web 3.0… but potentially also in the physical world, as we can now prove - on an infallible system - the antecedent of the ownership of this work. There will be gateways that are recognized by case law. We anticipate it. This will have repercussions for intellectual property and intellectual property law in the physical world. As an illustration, consider innovation patents. Any person can register a patent through registration and the relatively complicated - because human - processes of verification of antecedence, etc., with traditional agencies, but a person could also build an NFT on the invented concept, which becomes the Web 3.0 counterpart of a patent. Anticipate upheaval in the industry of intellectual property and copyrights.

All of this information is then applicable to industries, businesses, and governments. We may see an industry that develops its blockchain platform and, by extension, its currency, which enables the integration of supply chains. We may see a corporation establishing its platform for its global suppliers (see Mercedes). We can see the sovereignty concerns and the need for a government to establish its platform with digital money that can be exchanged for its fiat currency. It is government technology. This platform will enable connections to other platforms (therefore regulating - at least a bit) and its physical economy. Without any doubt, it will be a paradigm change of unprecedented magnitude.

Arabian Business, “Dubai’s metaverse sector to support 42,000 virtual jobs and add $4 billion to its economy by 2030”, https://www.arabianbusiness.com/industries/technology/dubais-metaverse-sector-to-support-42000-virtual-jobs-and-add-4-billion-to-its-economy-by-2030. Last checked on May 25, 2022.

Bodkhe, Umesh, Sudeep Tanwar, Karan Parekh, Pimal Khanpara, Sudhanshu Tyagi, Neeraj Kumar, et Mamoun Alazab. 2020. “Blockchain for Industry 4.0: A Comprehensive Review”. IEEE Access 8: 79764‑800. https://doi.org/10.1109/ACCESS.2020.2988579.

Hayes, Adams. 2022. Investopedia, https://www.investopedia.com/terms/b/blockchain.asp, last checked May 25, 2022

Stephenson, Neal. 2000. Snow Crash. Reprint edition. New York: Del Rey.

Chaum, David Lee. 1982. “Computer systems established, maintained and trusted by mutually suspicious groups,” Ph.D. dissertation, University of California, Berkeley (April)

Nakamoto, S., & Bitcoin, A. (2008). A peer-to-peer electronic cash system. Bitcoin.–URL: https://bitcoin. org/bitcoin. pdf, 4.