California Management Review

California Management Review is a premier professional management journal for practitioners published at UC Berkeley Haas School of Business.

by Anish Purkayastha

Image Credit | CoWomen

“Boards should ensure that purpose and ESG considerations are regular parts of their discussions. Furthermore, one of the board committees should include purpose as part of its oversight.”

- McKinsey Quarterly Report, 2020

“Linking Executive Compensation to Climate Performance” by Robert A. Ritz. (Vol. 64/3) 2022.

More than 50 years ago, economist Milton Friedman summarized role of business in society as “There is one and only one social responsibility of business—to use its resources and engage in activities designed to increase its profits” in his landmark piece, ‘The social responsibility of business is to increase its profits’ in the New York Times. Role of the business in the society has changed a lot since then as above mentioned quote from 2020 McKinsey Quarterly Report is just a simple example of change in company’s governance orientation towards sustainable practices. The strategic and societal importance of business-led reform to go beyond quarterly capitalism is reflected in thought leaderships,1 in the form of shift in scholarly focus to creating shared value from profit maximization,2 as well as in increasing investment into funds that publicly set environmental, social, and governance (ESG) investment objectives.3

Though there is an increasing debate on the ‘true’ motive (commonly known as ‘Greenwashing’) behind ESG concerns of some of the firms4 and not so impressive economic performance of the highest rated funds in terms of ESG orientation,5 investors and executives have realized that a strong ESG proposition can safeguard a company’s long-term success. One of the recent McKinsey reports based on more than 2000 studies indicates that a strong ESG proposition correlates with higher equity returns in 63% cases.6 Hence, it is not surprising that global sustainable investment now tops $30 trillion—up 68 percent since 2014 and tenfold since 2004.7

Though each of the individual elements (environmental, social, and governance) of ESG distinctly captures different criteria of sustainable orientation of a company, its individual elements are themselves intertwined. To illustrate, environmental criteria e.g. the energy your company takes in and the waste it discharges will have direct effect on the social criteria such as the relationships your company has and the reputation it fosters with people and institutions in the communities where you do business. The third leg in ESG – governance criteria connect the environmental and social criteria as setting up appropriate governance structure will ensure that the company is getting in front of violations before they occur or ensuring transparency and dialogue with regulators instead of formalistically submitting a report and letting the results speak for themselves.

Considering that corporate board is in-charge of the governance of a company, defines the company’s path towards targeted goals, and helps the management to navigate through the process, the corporate board plays an important role in governance of ESG orientation of the company. As board of directors provide guidance to the management so that company’s strategic decisions are in-line with the shareholder’s expectations, directors not only shape up environmental and social elements of ESG, but also overlay require governance for smooth execution of ESG strategy.

One such mechanism to implement ESG governance in a company is to create Corporate Social Responsibility (CSR) committee as a focus group within the corporate board. In corporate governance guidelines, the creation of board sub-committees has been strongly advised for a better board effectiveness by delegating some tasks to fewer decision makers.8 Hence, CSR committee within the board is a smaller group of directors who are focusing on ESG related decisions / activities of the company e.g. formulation and recommendation of a ESG Policy to the Board, review of ESG initiatives with the management, constitute Management Committee for implementation and execution of ESG initiatives/ activities etc. The effectiveness of CSR committee in driving positive corporate social performance is empirically supported in a firm-level analysis on 177 non-financial companies within the Bloomberg World Index of year 2012.9 What still remains as open questions- (1) what drives the formation of CSR committee specially when it is not mandated by the regulators in most of the countries and (2) what ensures the appointment of adequate number of qualified board members in the CSR committee.

One possible answer could be lied in the presence of women on corporate board. Despite constituting a large part of the labor force, particularly in developed countries, the percentage of women holding top leadership and management posts, such as CEOs and directorships, has traditionally been very low. This is an important strategic issue because boardroom homogeneity can result in sub-optimal board decisions.10 But the influence of women on leadership positions especially corporate board is not free of debate. Existing psychology literature suggests that women are more risk-averse than men, irrespective of ambiguity, costs, familiarity and/or framing.11 On the other hand, social-based theories drawing insights from behavioral, ethical and social role theories suggest that men and women differ when it comes to ethical judgment, and that women are, on average, more ethical than men.12

Therefore, there are two equivocal possibilities on the influence of women on corporate board in shaping up company’s CSR committee. One possibility is based on women’s communal behavioral traits which suggests that women tend to lean more towards social performance issues compared to men.13 Women are also typically more concerned with long-term outcomes and the interests of stakeholders, relative to men, even if that means sacrificing short term profits.14 Therefore, greater presence of women on corporate board will influence formation of CSR committee and nomination of appropriate board members in CSR committee.

The opposite possibility (i.e. women on corporate will discourage formation CSR committee or fill the CSR committee with lesser experienced board members) is driven by the contextual uniqueness of emerging economies like China and India, where agency costs pose a critical problem for male-dominate boards. Therefore, women directors have a significant role in the companies in the Asian economies to increase the decision-making quality and stopping unreasonable waste of corporate resources.15 Hence, we can expect that unlike developed economies where it has been suggested that women directors tend to support corporate philanthropy,16 in some Asian economies’ women directors have a negative effect on corporate philanthropy to conserve valuable human capital on corporate board for strategic committees.17

To find answer to this open question (what is the role of women on corporate board in shaping up company’s CSR committee) and derive possible managerial implications, we have analyzed company’s corporate board and CSR committee data of twelve Asian countries namely China, India, Indonesia, Japan, Malaysia, Pakistan, Philippines, Singapore, South Korea, Sri Lanka, Thailand, and Vietnam. Together these 12 countries cover 27.23 trillion USD or 31.1% of world GDP and 3.79 billion or 48.9% of world population in 2022.

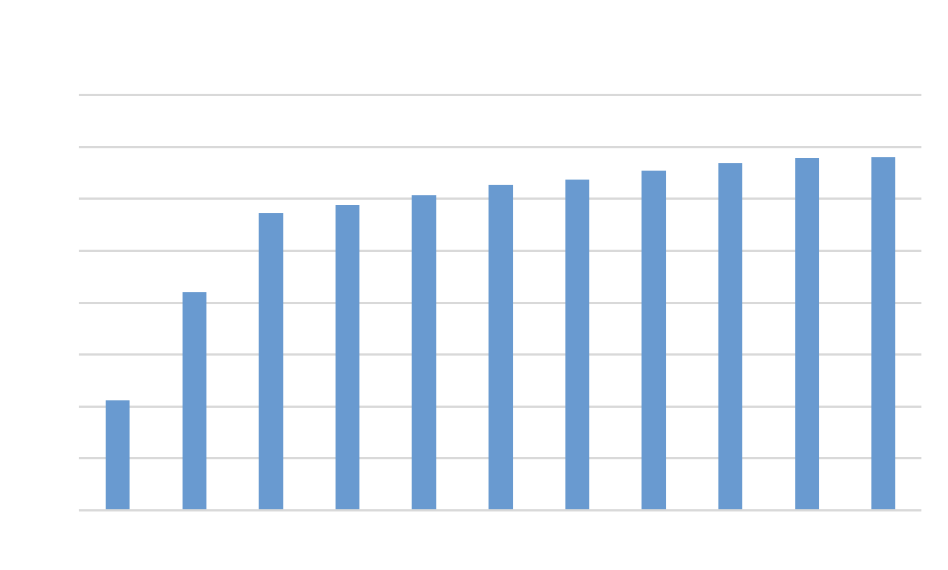

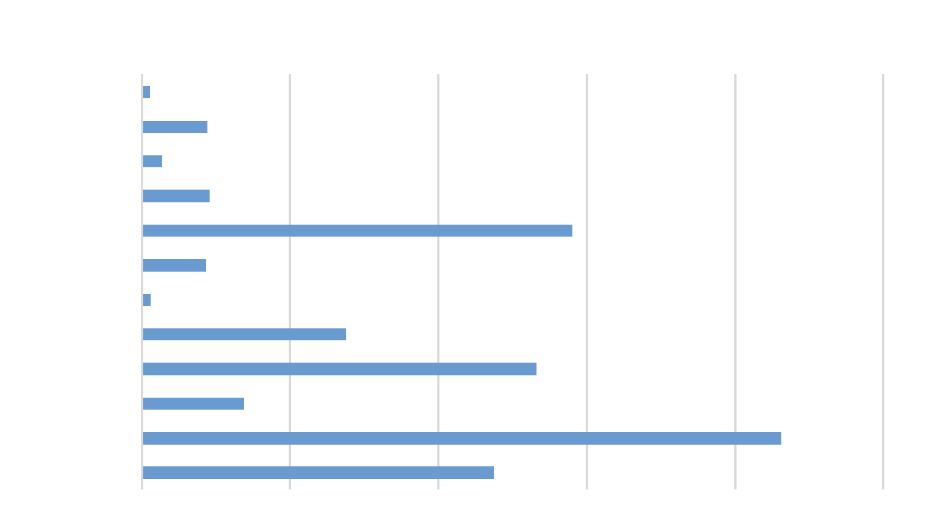

We source board of directors related data from the BoardEx global leadership database (BoardEx) available at Wharton Research Data Services (WRDS). BoardEx provides the biographical profiles of board members and senior executives associated with over 800,000 global organizations. To understand longitudinal pattern of the trend, we extract eleven years (2010-2020) of board of director specific data for all the twelve Asian countries. We augment board of director data with the company specific financial data that are sourced from ORBIS database (available from Bureau van Dijk). The final dataset has 31,769 firm-years across eleven years and twelve countries. The distribution of the observations across years and across countries are captured in Figure 1 and Figure 2 respectively.

Figure 1: Distribution of the observations across the years

Figure 2: Distribution of the observations across the countries

Drawing upon this data, we first measure presence of women on corporate board as the number of women on the board compared to total number of board members.

BoardEx also provides committee related information such name of directors who is present in a specific committee namely CSR committee for certain durations. As a CSR committee can also be named as an ethics, sustainable development, environment, health and safety, or a public responsibility committee, we have included all such committees as CSR committee. To unfold our research inquiry, we measure three different aspects of CSR committee – (1) likelihood (or presence / absence) of forming a CSR committee within the board, (2) number of directors nominated in the CSR committee, and (3) qualification of CSR committee members.

Subsequently, we ran a series of different regression models to empirically explore the effect of gender diversity (or greater presence of women) on corporate board on (1) likelihood of formation of CSR committee, (2) number of board members on the CSR committee, and (3) the level of qualification of CSR committee compared to overall board’s qualification. Considering the binary nature of the likelihood of formation of CSR committee, we use logit model in the first regression model. As number of board members on the CSR committee is a count variable, we use negative binomial in the second regression model. Lastly, due to continuous nature of the level of qualification of CSR committee compared to overall board’s qualification, we use fixed effect panel regression in the third model.

The board of directors is the paramount mechanism for effective corporate governance. Therefore, we control for the following board related factors that might have influenced CSR committee related decisions of the company: (1) total number of directors; (2) total number of board committee; (3) total number of board members nominated for various board committees; and (4) whether company has a women CEO. All these data points are sourced from BoardEx. We also control for multiple company specific financial attributes that may influence its decision on CSR committee namely (1) company’s economic performance based return on assets; (2) company’s investment into innovation based on R&D investment; and (3) size of the company based on the total sales. Finally, we control for multiple fixed effects - (1) year (to control the effect of global business cycle and other intertemporal macroeconomic changes over our sample years), (2) industry (to control the effect of competition and common practices within specific industries), and (3) country (to control the effect of time-invariant home country-level omitted variables).

Our empirical analysis indicates the following pattern and effect:

Greater presence of women on corporate board increases the likelihood of forming CSR committee within the board.

Every 1% increase in the presence of women directors on the corporate board increases the probability of forming a CSR committee by 0.58%. Even when there is only single woman member on the board, it increases the chances of forming CSR committee by 20% compared when it is all men board.

Greater presence of women on corporate board increases the number of board members as part of CSR committee.

Every 1% increase the presence of women directors on the corporate board increases the probability of staffing CSR committee with greater number of board members by 0.56%. Even when there is only single woman member in the board, it increases chances of forming CSR committee by 37% compared when it is all men board.

Greater presence of women on corporate board increases the nomination of more qualified board members as part of CSR committee.

Considering that the national context in which organizations operate may alter the outcomes of agency-driven governance arrangements, we also explore the contingent effect of the institutional norms surrounding societal gender roles and women in top corporate positions. Hence, we use World Economic Forum (WEF) Global Gender Gap Index, which measures the relative gaps between women and men across the areas of health, education, economy, and politics, to quantify the magnitude of gender-based disparities in each country.18 Possible scores of Global Gender Gap Index range from 0 to 1, where a score of 1 corresponds to higher gender equality. We match the country where the organizations in the sample were located and the year the sample data were collected, with the country and year of the gender gap index.

Three subsequent regression results of the contingent analysis are as follow:

Greater Global Gender Gap Index reduces the positive effect of women on corporate board on the likelihood of forming CSR committee within the board.

Greater Global Gender Gap Index reduces the positive effect women on corporate board on the increasing number of board members as part of CSR committee.

Greater Global Gender Gap Index reduces the positive effect of women on corporate board on the nomination of more qualified board members as part of CSR committee

We infer multiple company level governance and country level policy implications. Considering that creating a board CSR committee is beneficial while it is yet to be mandated by the policy makers, the next question is what could be done to facilitate CSR committee formation and staff the committee with the appropriate board members.

First, breaking the “old boys club” characteristics of corporate board is not free from countering viewpoints and ideas. Though most of the narratives in popular press and academic research remain consistent on removing gender discrimination in workforce, they conclude that females on average have higher levels of risk aversion, lower level of overconfidence, and less competitive desire than males. Unfortunately, these inferences do not help to find strategic reasons to incorporate more women on the leadership positions. Our analysis provides some important reasons to increase gender diversity on corporate board. As ESG orientation of the company creates value on multiple dimensions namely top-line growth, cost reductions, reduces regulatory and legal interventions, productivity uplift, investment and asset optimization,19 improving gender parity on corporate board provides a pathway to reap the benefits to the company –improving governance structure in the form of effective CSR committee formation.

Second, our analysis also indicates that country level institutional norms linked to societal roles of women is another important consideration. A more gender inclusive environment as a whole remove some of the burden on the shoulder of women board members to be a champion of creating meaningful CSR committee. Governance of a company is a complex activity where both the organizational leadership and policy makers are equal stakeholders. Though company can take initiative to incorporate greater women board members to charter effective CSR committee formation and in turn, navigate the company to a greater level of ESG orientation, policy makers as well can take the necessary steps to improve gender equality in society. That way even policy making bodies can indirectly facilitate greater ESG orientation in the organizations.

ESG orientation has become a hygiene factor in the organizational goal. We suggest that it starts with the putting together and facilitating formation of CSR committee with qualified board members. Therefore, it is important to find what it takes to make that happen, and incorporating more women on corporate board is the answer.

Dominic Barton, “Capitalism for the Long Term,” Harvard Business Review 89, no. 3 (2011): 84–91.

Michael E. Porter and Mark R. Kramer, “Creating Shared Value,” Harvard Business Review 89, no. 1/2 (2011): 62–77.

Sanjai Bhagat, “An Inconvenient Truth About ESG Investing,” Harvard Business Review, 2022, https://hbr.org/2022/03/an-inconvenient-truth-about-esg-investing?fbclid=IwAR3eHpMKoZ_hVaBs2PqGIaSA-lKAImepsbphoQwD2IVVtho8Jj81vBn3mqw.

Magali A. Delmas and Vanessa Cuerel Burbano, “The Drivers of Greenwashing,” California Management Review 54, no. 1 (2011): 64–87.

Samuel M. Hartzmark and Abigail B. Sussman, “Do Investors Value Sustainability? A Natural Experiment Examining Ranking and Fund Flows,” The Journal of Finance 74, no. 6 (2019): 2789–2837.

Tim Koller, Robin Nuttall, and Witold Henisz, “Five Ways That ESG Creates Value,” The McKinsey Quarterly, 2019.

Global Sustainable Investment Alliance, “Global Sustainable Investment Review 2018,” 2018, https://gsi-alliance.org.

Laura F. Spira and Ruth Bender, “Compare and Contrast: Perspectives on Board Committees,” Corporate Governance: An International Review 12, no. 4 (2004): 489–99.

Edina Eberhardt-Toth, “Who Should Be on a Board Corporate Social Responsibility Committee?,” Journal of Cleaner Production 140 (2017): 1926–35.

Renée B. Adams et al., “Board Diversity: Moving the Field Forward,” Corporate Governance: An International Review 23, no. 2 (2015): 77–82.

Hichem Khlif and Imen Achek, “Gender in Accounting Research: A Review,” Managerial Auditing Journal 32, no. 6 (2017): 627–55, https://doi.org/10.1108/MAJ-02-2016-1319.

Renée B. Adams and Patricia Funk, “Beyond the Glass Ceiling: Does Gender Matter?,” Management Science 58, no. 2 (2012): 219–35.

Kristin B. Backhaus, Brett A. Stone, and Karl Heiner, “Exploring the Relationship between Corporate Social Performance and Employer Attractiveness,” Business & Society 41, no. 3 (2002): 292–318.

David A. Matsa and Amalia R. Miller, “A Female Style in Corporate Leadership? Evidence from Quotas,” American Economic Journal: Applied Economics 5, no. 3 (2013): 136–69.

Ming Jia and Zhe Zhang, “Agency Costs and Corporate Philanthropic Disaster Response: The Moderating Role of Women on Two-Tier Boards–Evidence from People’s Republic of China,” The International Journal of Human Resource Management 22, no. 9 (2011): 2011–31.

Mike Adams, Stefan Hoejmose, and Zafeira Kastrinaki, “Corporate Philanthropy and Risk Management: An Investigation of Reinsurance and Charitable Giving in Insurance Firms,” Business Ethics Quarterly 27, no. 1 (2017): 1–37.

Jia and Zhang, “Agency Costs and Corporate Philanthropic Disaster Response.”

World Economic Forum, “Global Gender Gap Report 2021,” 2021.

Koller, Nuttall, and Henisz, “Five Ways That ESG Creates Value.”