California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Massimo Garbuio and Aaron D. Hill

Image Credit | Christina @ wocintechchat.com

Much of the academic and practitioner literature on boards extolls the benefits of, and government regulations require, directors being independent of undue influence from the management of the firms they serve (Boivie et al., 2016). What constitutes being independent as a director and the required degrees for boards as a whole of course vary by country. Generally, however, the understanding is that to perform their fiduciary duties, directors and thus the boards they are members of as a whole need to be independent from the managers they are tasked with monitoring. What independence really means in practice, then, is that directors primary role is one of monitoring/policing management to make sure things don’t go astray in the organisation rather than active involvement in the management of their firms. While directors may still provide resources to the firm such as advice and counsel, this role seemingly plays a secondary role after independence is established first (Boivie et al., 2016).

“Creating Incentives for Innovation” by Gustavo Manso. (Vol. 60/1) 2017.

“The Strategic Use of Corporate Board Committees” by J. Richard Harrison. (Vol. 30/1) 1987.

Yet, there are two points to recognise that make independence and the related boundaries a bit blurry - either by design or by necessity. By design, we mean the situation of being independent does not necessarily mean the directors cannot be actively involved in their firms but rather than they are not unduly influenced by managers to such an extent they do not properly perform their monitoring roles. Consider, for example, how private equity and venture capital backed firms blur independence by design as the funders typically both have seats on the board and work with the management team very closely on strategy and implementation matters (if for no other reason than to protect their investments). In such cases, the funders/directors may indeed blur independence but ultimately, their interests appear to be aligned with management in wanting the firm to do well and thus, will both police managerial actions that do not benefit the firm and actively help the firm. In fact, entrepreneurs are often told not to simply chase money – but to chase ‘smart money’ – that is, to find investors who can principally help the firm with the knowledge and connections that come from venture capital or private equity organizations as well as their money. Arguably, the wealth of modern economies is built on the backs of innovative and entrepreneurial ventures, which thus questions whether the venture capital and private equity approach to boards of directors and the benefits they pose for dealing with monitoring while also being actively involved in strategy and execution is not only working may also be helpful. Similar is the case of an incumbent purchasing a stake in a startup or scaleup company as part of a partnership agreement: the incumbent would have almost by default a seat on the board of the startup or scaleup company.

Beyond design, there are also situations where boundaries of independence are blurred by necessity. When we talk about independence in academic and practitioner publications, we are generally talking about large boards of established firms with very busy directors who serve the interests of shareholders and thus, appoint very knowledgeable and capable executives (or, at least try to). Of course, most of these publications will list the use of data from large publicly traded firms as raising issues of generalizability that future research should address by gathering data in other firms; such inquires are difficult, however, as directors may not wish to participate in research for various reasons. The executives in these established firms also generally have access to large resources allotments which they can use to engage consulting firms and external partners to help supplement their own knowledge and implementation capabilities. However, such resource allotments are not always the case for smaller companies or not-for-profit organizations and thus, the boards of such organization often – by necessity – ask directors to work along with management further in the strategizing phase as well as to provide some sort of support during implementation.

All that said, the point of this note is not simply to raise awareness of the need to rethink the way we look at independence but also to provide an account from one/two large samples from Australia with directors from a variety of sectors and industries to support our point. In those studies, one done prior to COVID-19 emerging and one done in 2022 after extensive issues brought on by the related pandemic such as government mandated lockdowns, we sought to understand whether there was a degree of collaboration between the board of directors and the senior executive team in the development and implementation of strategy, rather than just in the approval of strategy (i.e., monitoring). Further, based on the design benefits we foresee and associated necessities, we investigated if there is any relation between the relaxation of independence and related collaboration in strategy making with the effect of implementation of innovation initiatives which are indeed part of strategy.

In a 2019 study we identified this pattern (see here https://www.aicd.com.au/innovative-technology/disruptive-innovation/sustainable-technology/driving-innovation-the-boardroom-gap.html) which the 2022 study which corroborated the finding. What was evident from the studies was that:

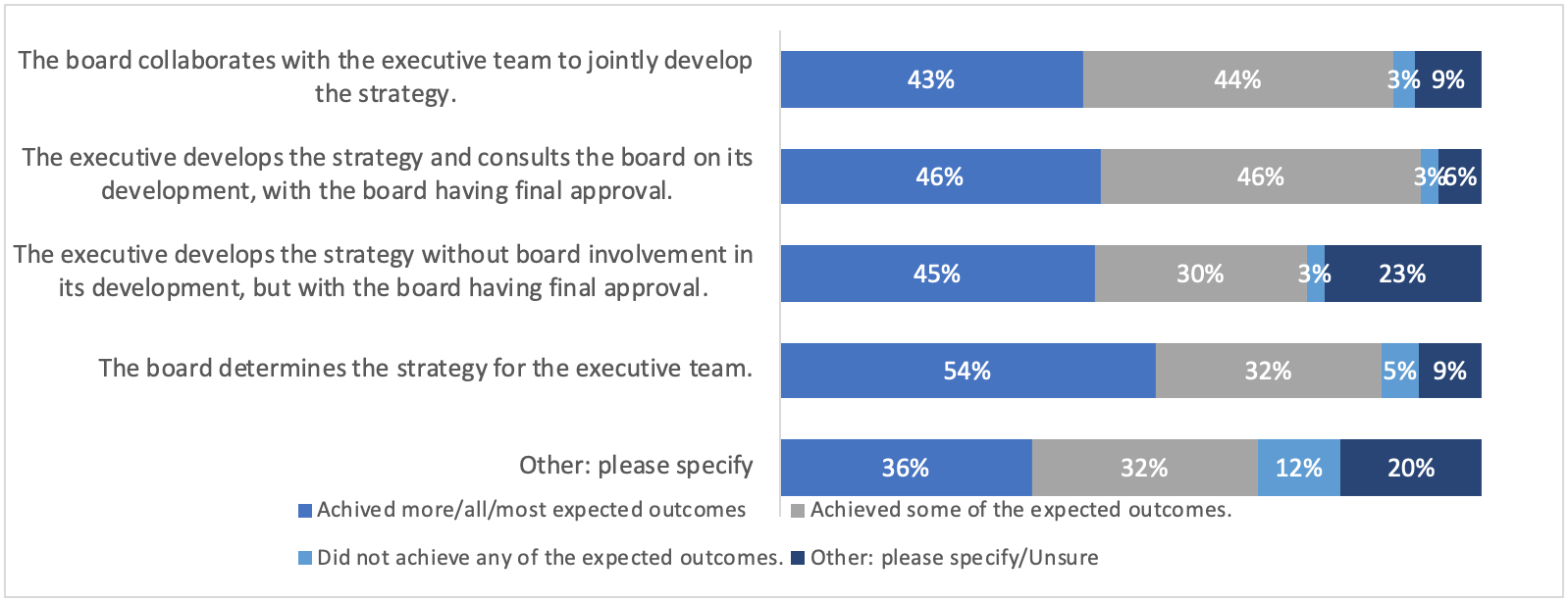

About half of the boards collaborated with management in the development of strategy, with a quarter of respondents saying that they provided inputs to executive in the development of such strategy, and

Some degree of board and executive collaboration in strategy making, or executives consulting boards in the development of strategy (rather than just in getting final approval) does indeed correlate with better outcomes in terms of implementation of innovation initiatives (when you sum all positive responses in terms of achieving outcomes).

Figure 1: Role of the board in strategy and achievement of outcomes from innovation

Percentages may not add to 100 due to rounding. The graph first appeared in “Innovation in the Boardroom: Rising to the Challenge?” 2022 AICD and University of Sydney Innovation Study. Available here: https://www.aicd.com.au/content/dam/aicd/pdf/news-media/research/2022/innovation-in-the-boardroom-2022-web.pdf

Excitingly, four pertinent questions grow from these findings.

Acknowledging that there is a sort of collaboration between management and directors that counters traditional notions of independence, we must firstly ask ‘to what extent are the current cohort of directors equipped to provide advice in strategy making and implementation, especiallyin a world where uncertainty and complexity is increasing?’ While we may think that certain directors, perhaps stereotypically those with primary expertise in accounting or law, are well equipped to monitor (Hambrick, Misangyi, & Park, 2015) but may be less equipped to provide value in strategy-making and implementation. Yet the preliminary evidence from the two studies is providing some indication that directors of varied backgrounds can provide value through collaboration on strategy making and implementation especially in times of great uncertainty and when facing complex problems with complex and varied solutions.

Our second question then is about ‘the effective composition of the boardroom as a whole if boards are more deeply involved in strategy making and, to some extent, in closely monitoring but also providing inputs in implementation’ than originally thought (hence in scholarly terms in the provision of resource and advice may take an equivalent role, or even have primary importance over, monitoring). It’s straightforward in the cases of private equity and venture capital backed directors to see them as taking primary roles in strategy making and implementation because directors are not only associated with financial rewards and obligations but often are previous entrepreneurs who typically are both unafraid to get their hands dirty in day-to-day operations and also tend to have expertise in single product businesses that commonly compromise private equity and venture capital portfolios. The issues are clearly different for a publicly traded organization, however.

Thirdly, with dedicated committees who overlook critical functions such as audits and nominations being commonplace, ‘do we also need committees that are dedicated to strategy making and implementation, particularly environmental scanning, so as to synthesise what is happening external to the organisation and to bring insights back to the boardroom?’. We know the oversight of strategy making and implementation is a matter for the broader board and not a single committee matter alone, but given the complexity on our environments and acknowledging the role directors can and often do play in such tasks, then we need to be also honest as to whether directors at the time for regular discussion in the board room or they need support from a dedicated committee. When the formality of a committee is not necessary, then an Advisory Board might be the solution.

Finally, we turn to the question of whether ‘directors have the time to both fulfill their fiduciary duties and undertake the monitoring responsibilities of their role as well as to be effective in provision of resources in strategy making. In other words – can all directors do it all, or should be revisiting independence more broadly such that some critical threshold may be necessary while others can lapse independence and perhaps monitoring specifically to focus on collaboration in strategy making and implementation? In a similar vein, do directors have the capacity to serve on any new committees that deal with technology or strategy matters, atop existing committees.

As we move into environments of greater uncertainty and complexity, being honest about the fact that directors are not as independent as we have always preached in scholarly circles is not only aligning with what is happening in industry, but is also going to help us to provide more timely and effective advice to boards.

* The study has been funded by the Australian Institute of Company Directors. The authors thank Christian Gergis and Andrew Heath who contributed to the 2022 study.

AICD (2019). Driving Innovation: The Boardroom Gap – 2019 Innovation study.

AICD (2019). Innovation in the boardroom: Rising to the challenge? - 2022 Innovation Study.

Boivie, S., Bednar, M. K., Aguilera, R. V., & Andrus, J. L. (2016). Are boards designed to fail? The implausibility of effective board monitoring. Academy of Management Annals, 10(1), 319-407.

Hambrick, D. C., Misangyi, V. F., & Park, C. A. (2015). The quad model for identifying a corporate director’s potential for effective monitoring: Toward a new theory of board sufficiency. Academy of Management Review, 40(3), 323-344.