California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by G. Tomas M. Hult and Forrest Morgeson

Image Credit | Christiann Koepke

The specter of skyrocketing and dynamic customer expectations has become a warning to companies and a call to managerial action to constantly do better. Many have come to believe that failure to meet ever-increasing customer demands could mean doom for companies. The argument is that with market leaders like Amazon and Apple (companies that transformed product variety and innovations), businesses that fail to keep pace with such market-cap behemoths are not going to be competitive.

“Optimizing Customer Involvement: How Close Should You Be to Your Customers?” Scott E. Sampson & Richard B. Chase. (Vol. 65/1) 2022.

But have customer expectations been spiraling out of control, constantly trending upwards, and pushing companies to strive for new, perhaps unfeasible goals in delivering on experiences in the customer’s journey? The answer is an emphatic no, based on 30 years of data from the American Customer Satisfaction Index (ACSI).

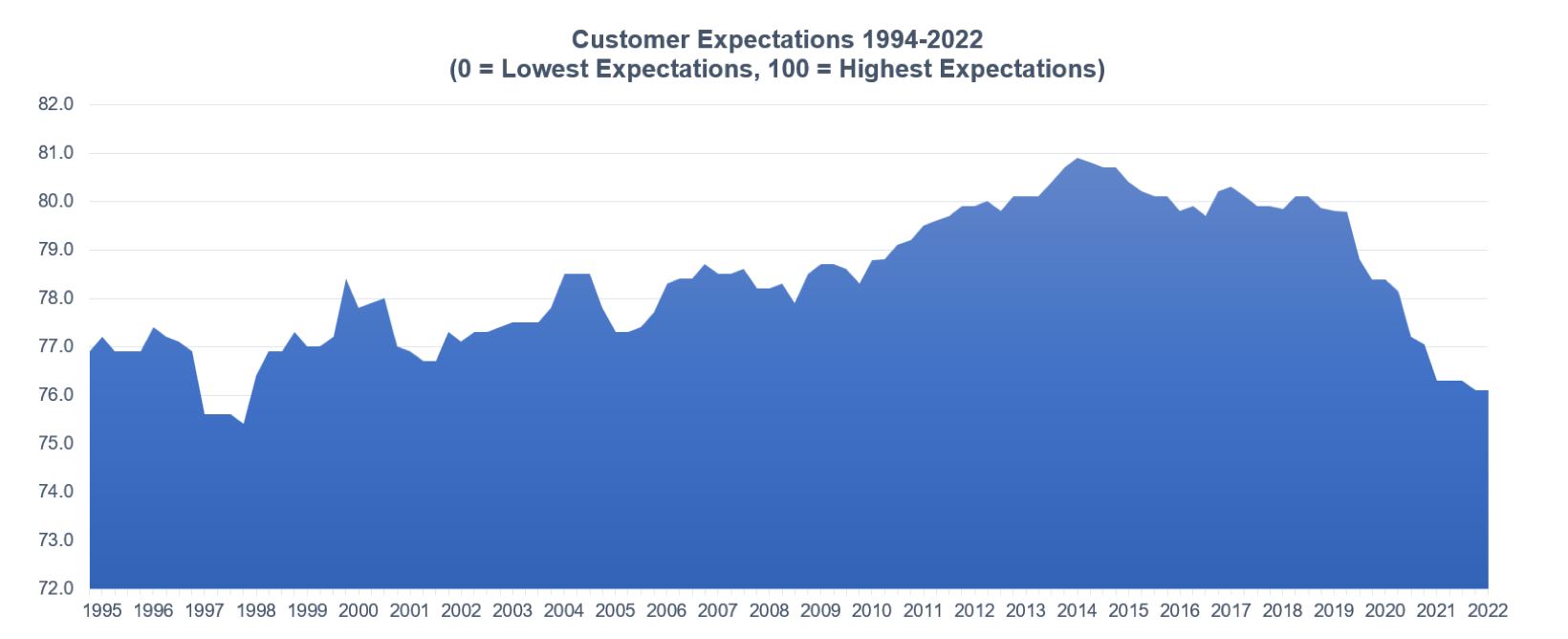

According to national ACSI data, customer expectations scored 76.9 on a 0-100 scale, with 100 being the highest expectations, when first measured in 1994. In the subsequent years, customer expectations generally trended upward for roughly two decades, with a few annual cycles of declines mixed in. Expectations have ranged from a low of 75.4 in 1997 to a high of 80.9 in 2014. The latest data available (from 2022) show that customer expectations now score 76.1, about one percent lower than in 1994.

If we focus on 5-year and 10-year timeframes, customer expectations have decreased more markedly. Expectations were 80.1 in 2013 and 79.9 in 2018, ten and five years ago, respectively (compared with 76.1 in 2022). Customer expectations during the COVID period (2019-2021) ranged from 76.1 to 79.8, with lower scores for each year since 2019. By comparison, expectations during the 2008-2009 Great Recession – considered the deepest economic downturn since World War II – ranged from 77.9 to 78.7.

In other words, for CEOs fretting about unmanageable customer expectations, the trend has stalled and even declined over the last decade, due in part to COVID-19 but also macroeconomic dynamics, as the decline began before the pandemic. There has been a clear reversal in customer expectations. While this dip could portend either a prolonged decline in expectations or just a temporary adjustment followed by renewed growth moving forward, as of now customers’ expectations have flattened out and are at about the level they were in 1994.

Given that the global economy is projected to grow by only 1.7% in 2023 and 2.7% in 2024, customer expectations (and accompanying customer satisfaction) can be forecasted to hold steady around 76.0 to 77.0 on the ACSI metric. According to the World Bank, the economic downturn in growth is going to be pervasive, with forecasts in 2023 revised down for 95% of the globe’s advanced economies and revised down for nearly 70% of emerging market economies.

Are customer expectations equal across industries in the U.S. economy or are expectations to some degree dependent on industry dynamics? If we rely on the perceptions of what customers expect from companies, we find that expectations have not changed equally for all industries. Examining ACSI data – which, at this stage, annually include more than 400,000 customers who evaluate expectations (and related customer metrics) for 426 companies in 47 industries – we find that customer expectations vary substantially across industries (roughly 10 million customer survey responses for expectations are part of the ACSI dataset from 1994-2022).

Customers expect the most from companies in the following industries: soft drinks; computer software; household appliances; and automobiles and light vehicles. These industries score 84 on the 0-100 scale. Food processing; breweries (beer); banks; property and casualty insurance; credit unions; personal computers; televisions and video players; and wireless telephones also have high expectations among customers to deliver satisfaction (expectation = 83). Interestingly, eight of the 12 highest-expectations industries are within the manufacturing sectors (durable and nondurable goods manufacturing).

Customers expect considerably less from the internet social media industry. This industry includes large, global companies like Facebook and Twitter (industry expectations = 73). Perhaps with the political bickering among the public, it is not unreasonable to expect that customers of federal and local government services (public administration) also have low expectations (expectations = 75). Internet service providers (ISPs expectations = 76) is another industry group with low expectations – as are internet news and opinion websites; internet search engines and information; subscription TV (cable and satellite television); and health insurance (each industry coming in at expectations = 77). Interestingly, four of the seven low-expectation industries are central to the digital economy.

As much as every manager thinks that they can exceed expectations relative to the satisfaction delivered to customers, many also aim to outdo themselves and deliver beyond even the highest expectations a customer may have. Naturally, a customer comes to his or her experience and customer journey with a company and its brands with some expectations. These expectations frame the customer’s subsequent experiences, and a long-held cognitive theory (called the “expectancy-disconfirmation theory”) suggests that customer’s end-state satisfaction is largely determined by whether their prior expectations were not met (“negative disconfirmation”), met (“confirmed”), or exceeded (“positive disconfirmation”).

For the Chief Marketing Executive (CMO), Customer Experience (CX) manager, or even Chief Executive Officer (CEO), is it wise to set a goal to “always exceed expectations?” Of course not. Practically, should such an objective be the lynchpin of a customer experience, customer journey, or customer satisfaction system? If the answer is yes, then that goal needs to be constantly measured and tracked, with the idea that it needs to be achieved regularly. For most companies, however, the answer is a simple and definitive “no.” This is the practically sound answer, but why?

While failures in brands, products, and services can be minimized with sufficient attention and investment in operations (e.g., quality management), the complete elimination of failures is extremely difficult and likely impossible. Striving to meet expectations can be difficult, let alone consistently trying to exceed them. Setting a company goal to always exceed increasing expectations is ultimately going to become a drain on the financial performance of the company. Such a focus on meeting and exceeding expectations – at the cost of other core activities – will undermine the economic purpose of improving the customer experience in the first place. The bottom line is that profitable customer satisfaction, retention, and growth can only be achieved by an integrated strategy of realistic expectations being projected by managers, salespeople, and the company.

Forecasting the future is difficult, even with a wealth of historical ACSI customer data. As investment companies keep reminding marketplace actors, “past performance does not necessarily predict future results,” and the same holds for customer perceptions. Nonetheless, considering the expectations trajectory over time (i.e., over the 1994-2022 period of the ACSI, but also the more recent history of the last 5 to 10 years), two developments in customer expectations are likely and can be forecasted.

First, given the general reactions to changes transforming the global economy and the new customers within that modernized economy (i.e., “sky-rocketing customer expectations”), we can (unfortunately) anticipate more of the same from experts and executives. The innovations that have inspired these skyrocketing expectation warnings are likely to continue. If the internet has spawned demanding customers with unreasonable expectations, imagine what automated, less costly, and customized brands that are optimized by machine learning and artificial intelligence (AI) will do. As such, expect more dialogue about runaway customer expectations, even if objective, 30-year trend data do not support such a contention.

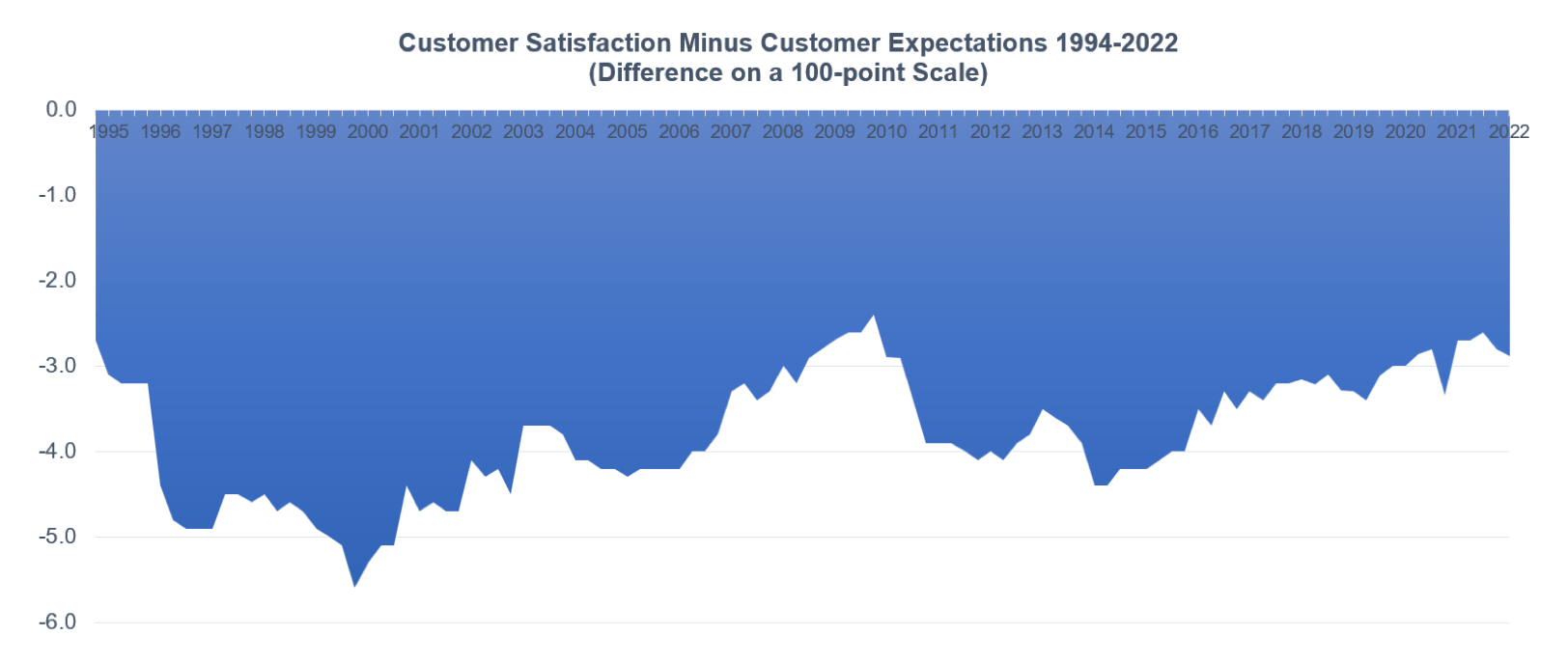

Second, more importantly, and practically determined, data and objective customer expectations will remain grounded in actual customer experiences. On average, companies fall short of expectations by 3.8 points on the ACSI 100-point scale (expectations = 78.3; satisfaction = 74.5) over the 1994-2022 period (and 2.9 points in the most recent data year, 2022). Practically, these expectation scores will change as quality, value, and satisfaction improve and customers adjust their expectations of future experiences upwards. Fretting over customers with out-of-control expectations is a waste of resources since companies are generally very apt at delivering experiences that match customers’ expectations.

As the ACSI data show, customer expectations have not grown out of control. Most positively, current customer expectations are not beyond the ability of companies to manage. Since the dawn of the market economy, customers have come to expect innovations and new products to become part of the regular product assortment of all companies in an industry, even innovations that were once almost unimaginable just a few years prior.

It is also important that we do not overemphasize a few points of decline or improvement in customer expectations from one period to another. Any expectation scores must be viewed relative to changes in other customer perceptions. For example, customer satisfaction was 74.2 in 1994 and 73.2 in 2022 (and peaked at 77.0 in 2018). A year-by-year analysis of customer expectations and customer satisfaction shows that companies (in the aggregate) are keeping pace with expectations. Companies can keep track of expectations by offering value, satisfying experiences, and a customer journey that drives customer loyalty.

In three decades of ACSI data (1994-2022), customer expectations are always higher than the customer satisfaction delivered. The best-aligned expectation-satisfaction year was 2009 (expectations = 78.3 and satisfaction = 75.9; a negative 2.4 points discrepancy). The worst aligned expectations-satisfaction year was 1999 (expectations = 78.4 and satisfaction = 72.8; a negative 5.6 points discrepancy). In 2022, the alignment between expectations (76.1) and satisfaction (73.2) fared better (negative 2.9 points discrepancy) than the average year since 1994 (3.8 points).

Finally, it is important to remember that expectations are created by customers based on their experiences – the satisfaction received previously – or those with whom they interact. These expectations are context-specific (e.g., industry, country). Interestingly, much of the worry about skyrocketing customer expectations seems to be portrayed as all-encompassing and economywide. But industries have their ecosystems, and expectations are often based on the industry ecosystem or best-in-class service providers across industries. Customer expectations are not universally created and nurtured at the macro level of an economy.