California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Seher Yuksel and Jakki J. Mohr

Image Credit | Food Unfolded

Several forces are driving the search for sustainable and ethical alternatives to traditional meat, including concerns about the negative environmental impacts and about the ethics of meat production. Traditional meat production contributes to global climate change through greenhouse gas emissions. With a warming potential that is 23 times greater than that of CO2, the methane produced by cows during digestion and management accounts for 37% of all human-induced methane, with serious consequences for the planet and its inhabitants.1 Moreover, traditional meat production requires large amounts of land, water, and energy, and it contributes to deforestation, soil erosion, and water pollution.

“The Emergence of Emerging Technologies” by Ron Adner & Daniel A. Levinthal. (Vol. 45/1) 2002.

In addition, many people are increasingly concerned about the treatment of animals in factory farms and slaughterhouses. In the United States alone, around 10 billion land animals are slaughtered each year for food.2 Concerns include both the inhumane treatment of animals during their lives and at the time of slaughter, as well as the use of antibiotics and growth hormones. The World Health Organization has raised concerns about the overuse of antibiotics in livestock farming, which can contribute to the emergence of antibiotic-resistant bacteria. The WHO’s recommendation to farmers to discontinue the use of antibiotics in food-producing animals can reduce antibiotic-resistant bacteria in these animals by up to 39%.3

As the world population continues to grow, the demand for meat is likely to increase, exacerbating these problems. The Food and Agriculture Organization of the United Nations forecasts that global meat consumption will increase by 76% by 2050.4 Traditional animal farming may not be able to keep up with this demand in a sustainable way.

Combined, these concerns have contributed to the search for alternatives to traditional meat, including, for example, plant-based meat, lab-grown (“cultured” or cultivated) meat, and even insects as a possible protein source. Cultured meat in particular offers several important benefits. Cultured meat has the potential to generate 78-96% lower greenhouse gas emissions, use 99% less land, and require 82-96% less water compared to traditional livestock farming.5 It offers the potential to eliminate widespread animal slaughter and improve animal welfare. Cultured meat can be produced without antibiotics, and it can be produced in a sterile environment, reducing the risk of foodborne illnesses. Furthermore, the energy requirements for cultured meat production can be significantly lower – between 7-45% lower – than for conventional meat production, suggesting another potential environmental benefit.6

Given its potential to address pressing concerns in traditional meat production, market forecasts for cultured meat are bullish. According to a McKinsey report, the global market for cultivated meat is expected to reach $25 billion by 2030.7

In response to this market opportunity, several different sources of funding are available to cultured meat start-ups, including venture capital, government grants, and crowdfunding. Memphis Meats, a San Francisco-based cultured meat startup, raised $161 million in funding as of 2021, with investors including Bill Gates and Richard Branson.8 The Dutch government has committed $60 million of public funding to create an ecosystem around the cultivated meat and dairy industries, while the U.S. has put $10 million toward the establishment of a National Institute for Cellular Agriculture.9 In 2022, Israel gave an 18 million grant to a consortium of 14 cultivated meat companies as well as 10 universities and research institutions.10 In 2020, the Singapore Food Agency became the first regulatory agency to approve the sale of cultured meat products, specifically chicken bites produced by the company Eat Just;11 Eat Just received U.S. FDA approval in March 2023.12

Given its potential as a viable alternative to traditional meat, it is timely to explore both the technology behind cultured meat as well as the challenges facing this industry. We first explore the emerging field of cultured meat technology, explaining the technology of cultivation and the products’ nutritional value. Challenges and risks are inherent aspects of technological innovations, and the cultured meat industry is no exception. We explore these challenges and offer strategic insights to address them.

Cultured meat, also known as cultivated, lab-grown, or cell-based meat, is produced by growing animal cells in a laboratory setting rather than through traditional animal agriculture. In contrast to plant-based meat that mixes soy or vegetable products to create a meat-like substitute (e.g., Beyond Meat or Impossible Foods), the process to produce cultured meat involves, first, cell isolation, which requires taking a small sample of animal tissue. The source of these cells can vary. For example, Aleph Farms uses a specific type of muscle cell called myoblasts to create its beef products, while SuperMeat creates cultured chicken meat from fat and muscle stem cells.

After the cells are sourced, they are then placed in a nutrient-rich medium. Again, the medium varies by producer. Future Meat Technologies has developed a plant-based growth medium to feed its cultured meat cells, while New Age Meats uses a proprietary culture medium to produce its products.

The cells are cultivated in a “bioreactor,” a vessel designed to provide the cells with the necessary nutrients, oxygen, and growth factors for them to replicate. Memphis Meats uses a specialized hollow fiber bioreactor to produce cultured meat, while Mosa Meat has developed a unique stirred-tank bioreactor system.

Some companies use fetal bovine serum (FBS) to boost cell growth, which raises ethical concerns. Since cultured meat aims to be an ethical alternative to traditional meat production, using unethical processes seemingly contradicts the value proposition. Meatable is using proprietary technology to create cultured meat without the use of fetal bovine serum. Companies that do not use FBS-free processes are more likely to face challenges regarding the ethics of their meat and will need to tread carefully.

As the cells grow and replicate in the bioreactor, they begin to form three-dimensional tissue structures that resemble the muscle tissue found in animals. Once the tissue has grown to a sufficient size, it is harvested from the bioreactor and processed into meat products, such as burgers, sausages, and chicken nuggets. The website, What Is Cultivated Meat (www.whatiscultivatedmeat.com) says that this process takes between five-to-seven weeks.

Depending upon how the meat is processed, cultured meat may be quite similar to traditional meat products. For example, Aleph Farms focuses on creating cultured beef products that have a similar taste and texture to traditional beef. The taste and texture also depend upon whether the cuts are whole-cut meat or ground meat. Besides beef and chicken, other meat options include seafood and even venison. Wild Type is creating cultured seafood products such as salmon, while New Age Meats is focused on creating rare or exotic meat products like venison.

Again, depending upon how it is processed, cultured meat could be marketed as a healthier option as it could potentially be produced with lower levels of saturated fat and higher levels of beneficial nutrients.

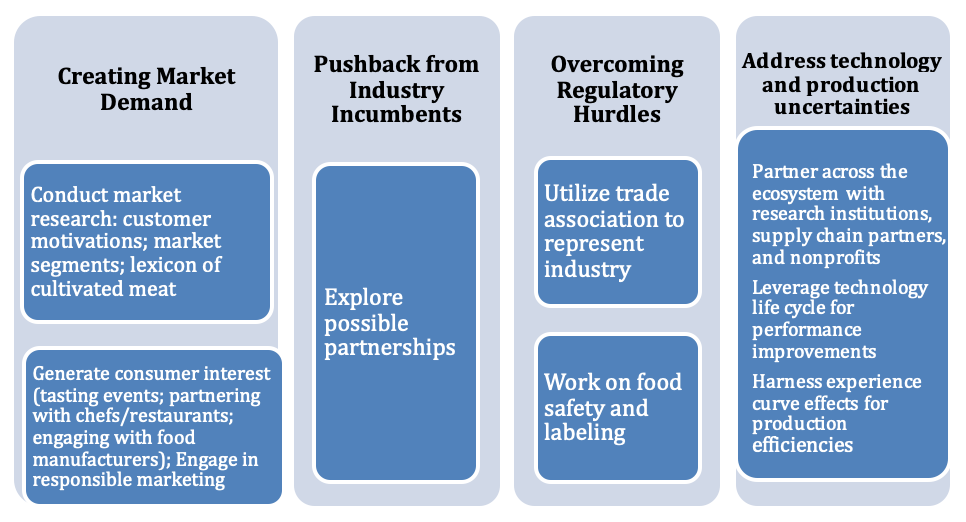

Emerging technologies face a known and familiar set of challenges, regardless of industry. Here we address several of those challenges and offer potential solutions (see Figure).

Figure: Barriers to and Solutions for Challenges Facing Emerging Cultured Meat

As with any new technology, one of the key challenges has to do with market demand. Market research is vital to understand consumers’ attitudes, beliefs, and preferences in order first, to create meaningful market segments and second, to develop targeted marketing strategies and value propositions that resonate with those segments. For example, research on meat consumption shows segments including “devoted meat eaters” with societal, cultural, and personal attachments to the role of meat in one’s diet.13 People who are open to reduced meat consumption might be motivated by environmental concerns or ethical concerns. One such segment is referred to as “flexitarians;” in contrast to vegetarians, flexitarians are interested in reducing their meat consumption by being flexible—including increased plant-based meals. Because cell-based meat can allow people to eat meat without the worry or guilt of planetary or animal impacts, this might be an interesting possible market segment. Furthermore, market research can help inform the lexicon around this new category. For example, public perception of cultured meat as “fake” or “unnatural” may limit demand.14 “Cellular,” “cultivated,” “cell-based,” and “cultured” meat perhaps are descriptive of the technological approach to meat production; however, whether consumers understand that or whether they even need to is another question.

Cultured meat is a relatively unknown product. Consumer interest and awareness can be generated through tasting events and partnering with chefs and restaurants to showcase these new products in a familiar and appealing context, serving as a launchpad for introducing cultured meat to consumers who may not be familiar with it. Indeed, the business-to-business market may prove to be a critical tipping point. In addition to restaurants, food manufacturers that purchase cultured meat for use in their products or for resale to consumers are vital. Above all, cultured meat companies must engage in responsible marketing and communication to ensure that consumers have accurate and truthful information about cultured meat products. This would involve avoiding exaggerated or misleading claims about the benefits of cultured meat and providing clear and transparent information about the product’s production, ingredients, and nutritional content.

Another challenge comes from industry incumbents—here, traditional meat producers. It is common that when incumbents are threatened with an emerging new technology, they mobilize to protect their entrenched market positions.15 The U.S. Cattlemen’s Association has requested that the terms “meat” and “beef” not be used for cellular meat products. Incumbents face “the innovator’s dilemma,” where they wrestle with participating in the new market opportunity or protecting the status quo.16 Many incumbents worry about pursuing the new technology, because it might cannibalize existing revenue streams. However, instead of fighting to keep new competitors out, incumbent producers can participate in the new market opportunity, whether through their own innovation or through investments and acquisitions. The Good Food Institute’s State of the Cultivated Meat Industry Report for 2022 states that the top three meat companies (by revenue) are all active in some form in the cultivated meat industry.17 For example, Tyson Foods invested in Upside Foods in 2018; its chicken products received Food and Drug Administration (FDA) approval in November 2022.

Companies in this new industry also face possible regulatory hurdles. In addition to needing U.S. FDA approval, the United States Department of Agriculture (USDA) weighs in on labeling for meat and poultry (but not seafood). In order to ensure their voices are heard, the companies have formed a trade association, the Association for Meat, Poultry, and Seafood Innovation (AMPS Innovation) to represent a unified voice in Washington D.C. with respect to regulatory guidelines and safety standards.18 Food safety is key to the emerging industry’s success.

In addition, the GFI (Good Food Institute), a non-profit organization, aims to accelerate the development and commercialization of alternative proteins, including cultured meat. It provides support and resources to companies and researchers in the field, as well as advocate for policies that promote the growth of the industry. The GFI also conducts research, hosts conferences, and events, and collaborates with various stakeholders to advance the field of alternative proteins. By taking a proactive approach to engaging with stakeholders, cultured meat companies can build a strong foundation for the long-term success and acceptance of their products.

The industry also faces technology and production uncertainties. Continuous research and development are necessary to improve the technology and production processes, as well as to create new products and flavors. This requires collaboration between scientists, engineers, and food experts. Partnerships with other organizations in the cultured meat ecosystem, such as research institutions and supply chain partners will also be fruitful to collaborate on developing and scaling the technology. High production costs (due to the expensive nature of the technology and the need for specialized equipment and materials) coupled with lack of scale means that prices are still high. Forbes reported in March 2022 that a cultivated-meat burger was about $9.8019—obviously more expensive than a traditional burger. However, evidence from research on technology life cycles (S-shaped curves) suggests that as the technology is better understood, the performance of the technology will improve.20 When technological efficiencies are coupled with increasing production volumes, prices will inevitably decline.

People who both love meat and are concerned about the treatment of animals and environmental sustainability seemingly face an irreconcilable tension. Cutting-edge technology to create ethical meat through cell-based technology can resolve that tension.

Cultured meat technology has the potential to overcome challenges with traditional meat production, including requiring fewer natural resources, producing fewer greenhouse gas emissions, and being produced without the use of antibiotics or hormones. Additionally, cultured meat offers a way to reduce animal cruelty and ethical concerns associated with traditional meat production. In this sense, a meat lover can both enjoy her meat and simultaneously advocate for animals and the planet.

However, several barriers exist that must be addressed proactively. By conducting valuable market research to understand the market segments that this new product will appeal to, presenting a unified voice to compete with industry incumbents and to engage with regulatory agencies, working collaboratively on ongoing research and development with a variety of stakeholders, and generating consumer interest, companies can successfully produce and market cultured meat technology, offering the potential for a more sustainable and humane future for companies and consumers alike.

United Nations News (2006), “Rearing cattle produces more greenhouse gasses than driving cars” UN report warns.” November 29, 2006, https://news.un.org/en/story/2006/11/201222-rearing-cattle-produces-more-greenhouse-gases-driving-cars-un-report-warns

“A Well-Fed World – Factory Farms.” A Well-Fed World, https://awellfedworld.org/factory-farms/, accessed June 6, 2023.

World Health Organization (2017), “Stop using antibiotics in healthy animals to prevent the spread of antibiotic resistance.” November 7. https://www.who.int/news/item/07-11-2017-stop-using-antibiotics-in-healthy-animals-to-prevent-the-spread-of-antibiotic-resistance

Food and Agriculture Organization of the United Nations (2012), “World Agriculture Towards 2030/2050: The 2012 Revision.” p. 49. https://www.fao.org/3/ap106e/ap106e.pdf

Harvey, Fiona (2011), “Artificial meat could slice emissions, say scientists,” The Guardian, June 20, https://www.theguardian.com/environment/2011/jun/20/artificial-meat-emissions; see also Rodríguez Escobar, María Ignacia, rasmo Cadena, Trang T. Nhu, Margot Cooreman-Algoed, Stefaan De Smet, and Jo Dewulf (2021), “Analysis of the Cultured Meat Production System in Function of Its Environmental Footprint: Current Status, Gaps, and Recommendations.” Foods, 10 (12): 2941.

Harvey (2011), Ibid.

Brennan, Tom, Joshua Katz, Yossi Quint, and Boyd Spencer (2021), “Cultivated Meat: Out of the Lab, Into the Frying Pan, McKinsey & Company, https://www.mckinsey.com/industries/agriculture/our-insights/cultivated-meat-out-of-the-lab-into-the-frying-pan

Rowland, Michael Pellman (2020), “Memphis Meats Raises $161 Million Series B Funding Round, Aims To Bring Cell-Based Products To Consumers For The First Time.” Forbes, January 22, 2020.

Believer Meats, “The Big Names Investing in Lab-Grown Meat.” April 17, 2023, https://www.believermeats.com/blog/investing-in-lab-grown-meat

Good Food Institute, “Cultivated meat and seafood: 2022 State of the Industry Report,” p. 70 https://gfi.org/wp-content/uploads/2023/01/2022-Cultivated-Meat-State-of-the-Industry-Report-1-1.pdf

Poinski, Megan (2020),” Eat Just lands first regulatory approval for cell-based meat,” Food Dive, December 2, https://www.fooddive.com/news/eat-just-lands-first-regulatory-approval-for-cell-based-meat/589907/

Poinski, Megan (2023), “Eat Just gets FDA clearance for cultivated meat in US,” Food Dive, March 21, 2023, https://www.fooddive.com/news/eat-just-cultivated-cell-based-meat-fda-approval-good-meat/645600/#:~:text=Dive%20Brief%3A,brand%2C%20is%20safe%20to%20eat.

Dagevos, Hans (2021), “Finding flexitarians: Current studies on meat eaters and meat reducers,” Trends in Food Science & Technology, 114: 530-539, https://doi.org/10.1016/j.tifs.2021.06.021

Chriki, Sghaier and Jean-Francois Hocquette (2020), “The Myth of Cultured Meat: A Review,” Frontiers in Nutrition, Volume 7, https://doi.org/10.3389/fnut.2020.00007

Day, G. S., & Schoemaker, P. J. (2000), “Avoiding the pitfalls of emerging technologies,” California Management Review, 42(2), 8-33.

Christensen, Clayton (1997), The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail, Boston: Harvard Business School Press.

Good Food Institute, “Cultivated meat and seafood: 2022 State of the Industry Report,” p. 82, https://gfi.org/wp-content/uploads/2023/01/2022-Cultivated-Meat-State-of-the-Industry-Report-1-1.pdf

Zaleski, Andrew (2023), “Inside the Battle Between Big Ag and Lab-Grown Meat,” New Republic, April 21, https://newrepublic.com/article/171709/inside-battle-big-ag-lab-grown-meat

Bandoim, Lana (2022), “Making Meat Affordable: Progress Since The $330,000 Lab-Grown Burger.” Forbes, March 8.

Adner, Ron, and Daniel A. Levinthal (2002), “The emergence of emerging technologies.” California Management Review, 45: 50-66.