California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Alessandro Lanteri

Image Credit | Saurav S

In the lexicon of business, few buzzwords have gained as much traction as VUCA, a term appropriated from the military realm to describe environments characterized by Volatility, Uncertainty, Complexity, and Ambiguity. However, the use and implications of this acronym warrant closer scrutiny.

“Management Innovation in a VUCA World: Challenges and Recommendations” by Carla C. J. M. Millar, Olaf Groth, & John F. Mahon

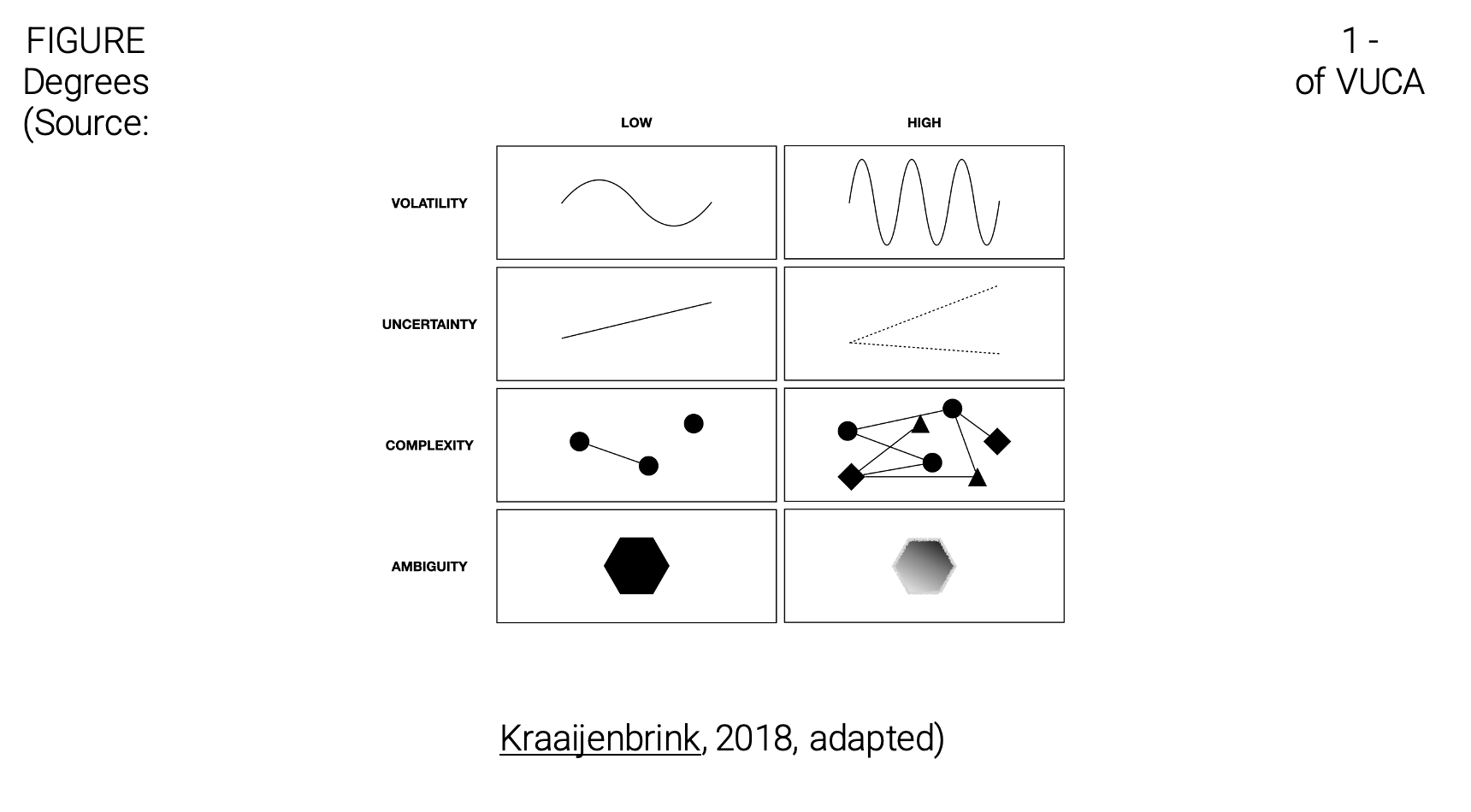

Applying VUCA as an umbrella term can be misleading since not all elements are present in every situation. To illustrate, let’s delve into each component of VUCA separately:

Volatility refers to the frequency and intensity of change. The oil and gas industry often experiences high volatility due to fluctuations in global demand and supply. However, this does not always imply a high degree of uncertainty or ambiguity in the industry.

Uncertainty arises when it’s difficult to predict outcomes due to lack of reliable information. During the early days of the COVID-19 pandemic businesses grappled with uncertainty due to the unknown trajectory of the virus. Yet, this specific challenge did not necessarily increase the volatility of the situation.

Complexity refers to the number of factors that organizations need to consider and the intricate relationships among these factors. Global supply chains, with their myriad interconnected players spanning multiple jurisdictions, exemplify this complexity. However, complexity in this context does not always coincide with volatility or ambiguity.

Ambiguity refers to the lack of clarity about the interpretation of an event. A classic example here is the advent of new technologies, like quantum computing. While their potential to disrupt various industries are recognized, there is considerable ambiguity about how this will unfold. Yet, this ambiguity does not make the situation inherently volatile.

These examples show that while the components of VUCA can coexist, they can also occur independently, requiring distinct strategies for management.

VUCA conditions are not unique to our times. The industrial revolution, for instance, was a period of remarkable volatility and complexity as new technologies upended established industries. We perceive our era as more VUCA than the past, much like generations before us who faced their unique challenges. This perception influences our decision-making processes. It is not the presence of VUCA conditions per se, but the degree to which they alter the status quo, that necessitates a change in our decision-making techniques.

In the face of VUCA, organizations are often advised to embrace strategies that go beyond traditional management principles. While the strategies outlined below can help organizations navigate a VUCA environment, not all will be effective in every situation and some could backfire depending on the specific element of VUCA present or absent. Here are a few examples:

Agility In a volatile environment, the ability to quickly adapt to change is crucial. Organizations should foster agility in their processes, decision-making, and strategy execution. Yet, agility can lead to hasty decision-making in contexts of uncertainty or ambiguity. Decisions made with incomplete or unclear information may lead to unfavorable outcomes.

Collaborative Problem Solving Complex problems often require diverse perspectives for effective solutions. Organizations should encourage collaboration and cross-functional problem solving. Building diverse teams and promoting a culture of open communication can help in tackling complex issues more effectively. However, collaboration can slow down decision-making. In a volatile environment that requires immediate responses too much collaboration could lead to paralysis, where consensus-seeking implies that no decision is made.

Data and Technology Advanced analytics can help make sense of complex situations and predicting future trends. However, in an ambiguous situation, data may be unavailable, unreliable, or misinterpreted, leading to misguided decisions.

The VUCA narrative often glosses over opportunities and can inadvertently limit our thinking. The term typically implies a defensive posture, suggesting that we are victims of our environment. Instead of viewing the electric vehicle industry as uncertain, Tesla saw it as an arena of untapped potential. The uncertain regulatory environment, the volatile oil and gas markets, and the complexity of creating a new type of vehicle were not seen as threats but as opportunities. Tesla broke new ground and became a dominant player in the auto industry.

Yes, there are elements of volatility, uncertainty, complexity, and ambiguity in business. However, these elements are not always pervasive or as insurmountable. McDonald’s operates in 119 countries. It faces a plethora of uncertainties and complexities. Despite this, McDonald’s has been incredibly successful in predicting consumer behavior and adapting its menu and operations to suit various markets. This success is due in large part to their robust systems, consistent processes, and a firm commitment to understanding and responding to customer needs.

Using VUCA as a descriptor can be a distraction from the real issues that businesses face. While volatility, uncertainty, complexity, and ambiguity exist to varying degrees, the primary challenge is not the existence of these factors but our ability to respond effectively. Let’s take Nokia. Once the dominant mobile player, it failed to respond to the rise of smartphones. One could argue that this was due to a VUCA environment. The reality is that Nokia’s downfall was largely due to internal factors such as a failure to roll out innovations and a reluctance to respond to changing customer preferences.

Rather than as a static descriptor, we should see VUCA as a dynamic tool for sensemaking, a lens through which to understand the nature of different situations and determine appropriate responses. VUCA, and its more recent variants like BANI (Brittle, Anxious, Nonlinear, Incomprehensible) or TUNA (Turbulent, Uncertain, Novel, Ambiguous), are not factual descriptions of the world. They are conceptual tools that aid decision-makers in sensemaking, fostering a better understanding of the business environment. These frameworks should not define our approach, but rather serve as starting points to carefully evaluate the specific context and then tailor their strategies accordingly.