California Management Review

California Management Review is a premier professional management journal for practitioners published at UC Berkeley Haas School of Business.

by Francis D. Kim and Rajendra Srivastava

Image Credit | Worawut

The last decade has seen an acceleration in the rate of innovation. No industry from Agri-tech to moviemaking (computer graphics) to hospitality (asset light Airbnb) to pharmaceuticals (precision medicines) to Edu-tech to fin-tech has been immune to disruption by technological innovations and new business models. The rate of innovation is, however, not uniform. While many innovations have been incremental, “radical” and “discontinuous” innovations are more disruptive and require both vendors and users to make major investments. This article proposes a strategic framework for product-market development and growth for discontinuous innovations.

“A Better Way to Forecast” 2014. Don Moore and Uriel Haran, California Management Review Volume 57, Issue 1.

Some innovations can be painfully slow in their ability to penetrate the market, but once adopted they can radically alter an industry. AI laboratories were set up in the 1950s, but it took more than 70 years for a product like ChatGPT to become a household name. Similarly, when personal computers were first introduced no one really knew how the market would evolve in both hardware and software applications. For discontinuous innovation to succeed, multiple vendors have to coalesce to form an ecosystem that enables a customer solution. The greater the novelty of the product and the greater the attendant complexity of the solution, the longer the time for product-market evolution and the greater the costs and risks associated with innovation to both sellers and users. This is typically the case when both technological and product developments are necessary to develop an entirely new market.

Discontinuous innovations, often referred to as “disruptive innovations,” are significant and groundbreaking advancements or changes in products, services, technologies, or business models that disrupt existing markets or industries. These innovations are characterized by their transformative nature, as they often introduce entirely new ways of doing things, challenge established norms, and can lead to the displacement of incumbent products or services. In this paper we examine:

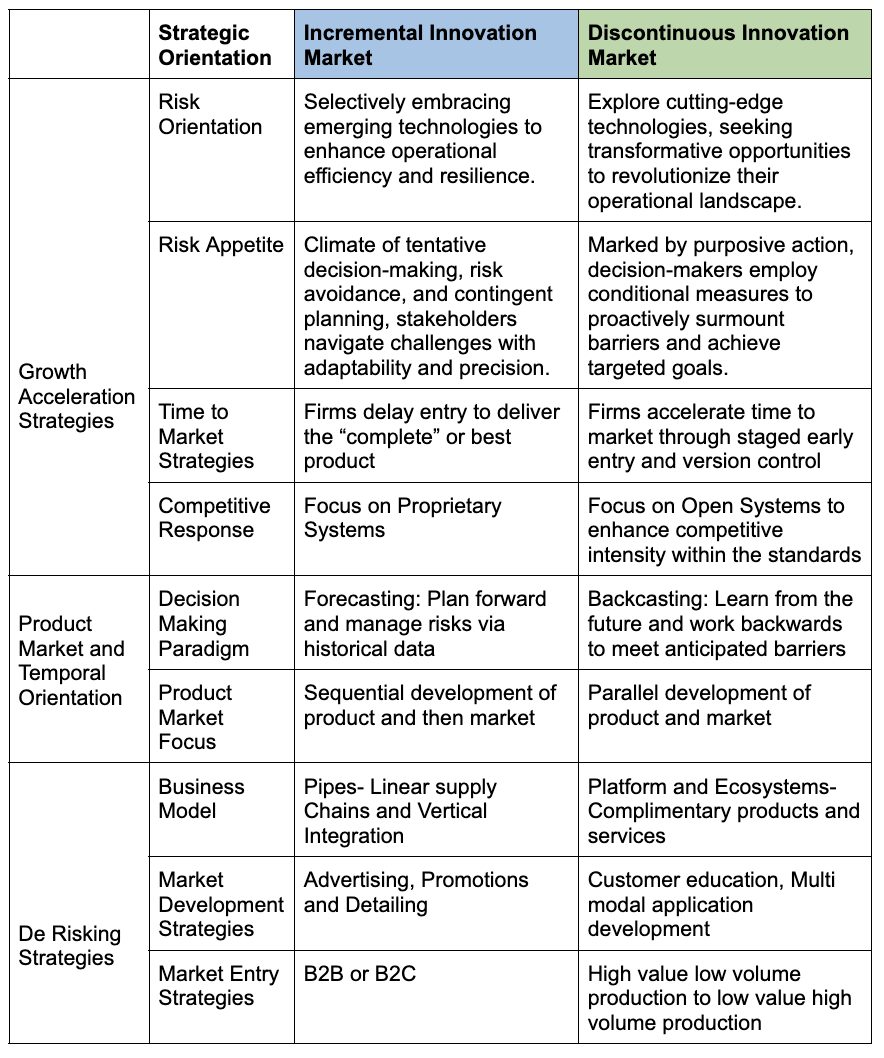

Accelerating Technology Adoption - Strategies that enable earlier take-off points for technology diffusion “S-Curves” and acceleration of growth vectors.

This will typically require mechanisms for reducing risks perceived by buyers (via mechanisms such as customer education, product warranties and services) and incentives for manufacturers (e.g., Government subsidies and establishment of product standards).

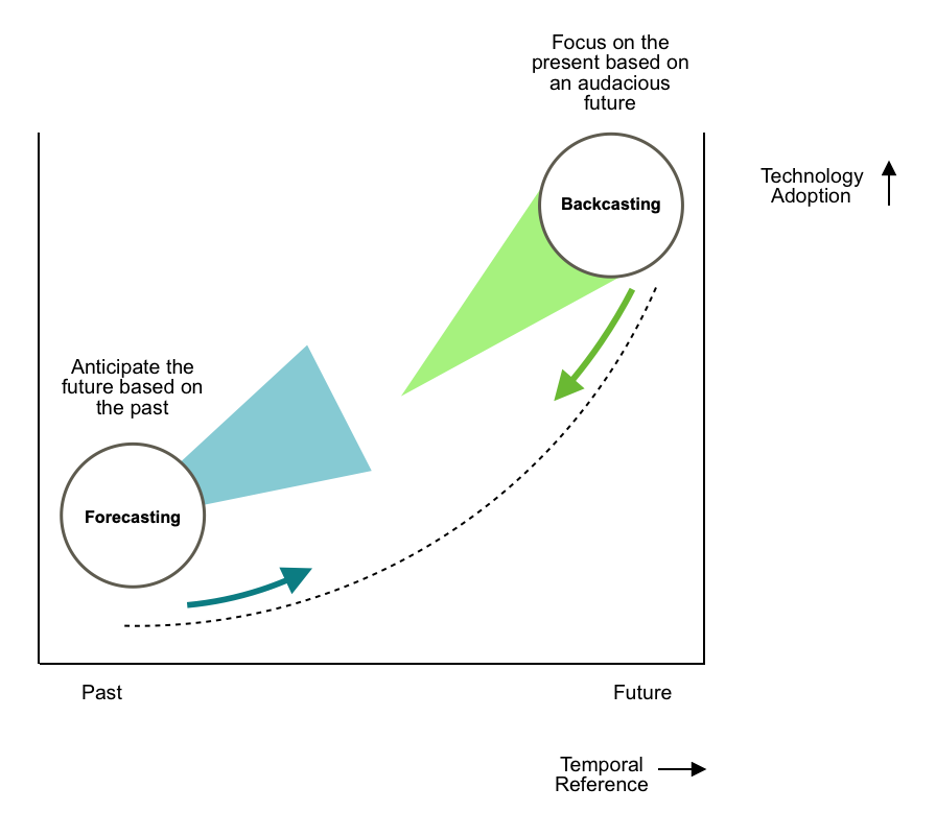

Temporal and Technological Change Strategies that allow us to migrate from traditional Forecasting methods to “Backcasting” for innovations that embrace both new technologies and new (non-existing) markets.

An entirely new product introduced to the market to perform a function that no previous product has performed requires new uses for the product to develop and for customers to embrace them. It therefore becomes important for innovators to “imagine the future” regarding how the products would be used and work backward to enable such applications. The roadmap for such discontinuous innovations is hard to predict and traditional market forecasting and demand estimation methods are challenged.

Detailed strategy framework as to how radical, discontinuous innovations “learn” from visions of the future to work backwards develop:

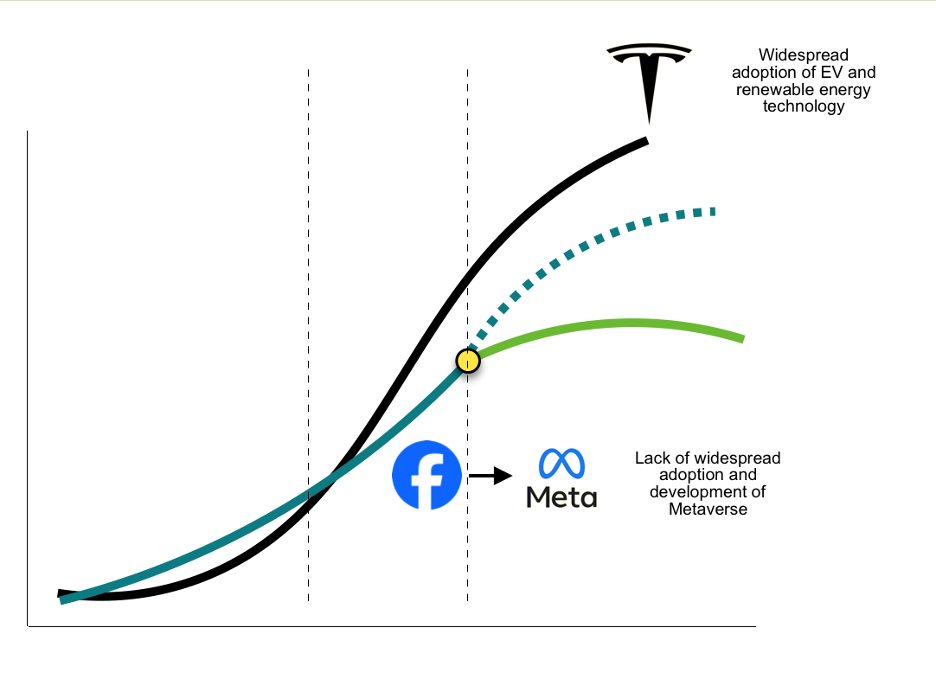

Take the multiple technology diffusion curves illustrated in Figure 1. The “take-off” point for the traditional “S-Curve” is painfully slow as potential buyers mull over the need for the product, trying to figure out the best option. The contrasting take-off points and the subsequent growth of discontinuous technologies of Electric Vehicles by Tesla and the Metaverse by Meta (formerly Facebook) (see Figure 1) are dependent on:

Figure 1: Accelerating Adoption of Discontinuous Innovations

A variety of other factors weigh in to support faster adoptions in the marketplace. Some companies may use a licensing strategy to lower perceived entry barriers to competitors. The larger number of end products using the same/similar technology in the market allay buyer’s perceived risk. The initial targeting of B2B customers for cellular phones at the front end of the life cycle reaches buyers who are higher on the affordability list. Introduction of new technology by trusted vendors (e.g., branded vendors such as Apple or Microsoft) tends to reduce perceived risk related to newer technology – as does distribution with right-to-return warranties with no questions asked. These are the fodder of a discontinuous technology strategy.

This article shows: How do firms manage discontinuous innovations with uncertain outcomes? Based on research, practice and education on strategies and transformation, we offer a framework that helps companies realize the benefits of the innovation process.

Managing truly Discontinuous Innovations requires higher levels of risk as these innovations require the simultaneous development of technology and the market. Zuckerberg pitched Metaverse as the next logical step for social networking in 2021. The marketing experts critiqued the problem from the marketing perspective that Facebook rebranded as Meta, raised concerns to both marketing experts and investors of the change with no real substance and no clear delineation of applications and markets for Metaverse. For example, Metaverse could be useful in providing education and skill training. However, to both users and investors, the size, and benefits in targeted market segments and hence the opportunities created by Meta were not obvious. By adopting a brand name based on the future potential capabilities, the company set itself up to confuse people at best. In contrast, Google rebranded well as Alphabet in 2015, after its business had expanded well beyond its search engine. The brand change helped minimize the associations between Google and its experimental sister companies.1

There remain questions whether the vendor or the users knew the directionality of Meta. After 36 billion dollars were spent, big investors say Meta lost the investors’ confidence. Zuckerberg himself acknowledged the difficulties. “Although our direction is clear, it seems that our path ahead is not quite perfectly defined”.2 Was it due to technological uncertainty (will it work?), or also its market uncertainty (will people buy it)? Meta assumed that the Metaverse would be an incremental innovation to social media users, however the logic may not be consistent with the perception of consumers and developers. On top of that, It is hard to develop products when designers are not conversant with user needs. And users do not want to buy if they are not sure where the product/technology is headed. We posit that the core issue of Meta goes beyond a marketing problem, and touches upon the underlying challenge common to discontinuous innovation projects high with both technological and market uncertainties, lacking clear outcomes and ability to illustrate clear value in and use cases in the social networking solutions market. To summarize, if the technological and market outcomes are not known the successful adoption of discontinuous innovation becomes very challenging. In response to these challenges, this article proposes a strategic framework for firms embarking on future-oriented discontinuous innovation journeys.

In contrast, Tesla developed and implemented a clear “Backcasting” strategy since its inception in 2004. A Backcasting Strategy requires a visualization of the expectations of the future. This includes anticipation of challenges and opportunities by developing solutions by “imagining” the future and working backwards to take care of anticipated barriers and opportunities in the present (Figure 2).

Figure 2: Backcasting and Forecasting for Discontinuous Innovation

For discontinuous innovation, the Backcasting exercise requires two clear roadmaps, and one common focus on de-risking:

Tesla articulated the global warming story in its favor. The company argued that Electrical Vehicles (EVs) could be a globally impactful solution in the automotive sector even if it was an audacious claim considering Roadster which came years later did not compete squarely well with gas-fueled cars on dimensions such as range. By initially targeting this sustainability-focused segment, with clear benefits (price subsidies and the privilege to drive in high-occupancy lanes, and conveniently located and reserved parking-super charging stations). While Tesla initially developed a high value, low volume sports car that was targeted at celebrities who could afford higher prices, the company bought time to focus on the next market segment through product improvements – longer battery life, reduced cost structure. Tesla has been able to convert a discontinuous innovation into a mainstream product where the market impact of incremental innovations and price reductions on existing segments are more predictable, thereby supporting activities from Backcasting to eventually Forecasting. Use of Backcasting strategies involves three distinct changes in strategic orientation (Table 1):

Table 1: Backcasting Strategies for Discontinuous Innovations

Tesla’s success and its future is subject to many factors that include:

To summarize, Tesla has successfully leveraged Backcasting strategies to develop a strong differentiated brand with significant pricing power.3, 4 Investors value growth in both revenue and profits (more than Earnings Per Share).5, 6, 7 Its exponential growth and government subsidized grants have contributed to profitable expansion. Valuation research clearly underscores this growth in scale and profits which has resulted in amazingly high price to book and price/earnings ratios (15.5 and 70.9 respectively on September 29, 2023). Importantly, the company has anticipated challenges, developed solutions in advance – in effect learned from the future to work backwards to manage the present.8 Helping investors and customers understand and articulate the future clarifies the roadmap of where and why a company might go as the competitive dust clears.