California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Herman Vantrappen and Frederic Wirtz

Image Credit | Sean Pollock

The organization design of a company evolves through a pattern of emergent hops and deliberate leaps.1 Hops are the minor adjustments to the organization design that companies make continually. For example, a company may carve out its cybersecurity activities from the IT department and attach it to the Risk department. Leaps are the fundamental organizational redesigns that companies make from time to time. A leap may be triggered by a strategic re-orientation, a merger, a major restructuring, the arrival of a new CEO, or any other seminal event. When such a fundamental redesign is on the table, several far-reaching architectural choices must be made. One such choice is about the role of the company’s “corporate parent”, alternatively known as the “corporate center” or the “corporate headquarters”.

Campbell, Andrew, Michael Goold, and Marcus Alexander. “The value of the parent company.” California Management Review 38.1 (1995): 79-97.

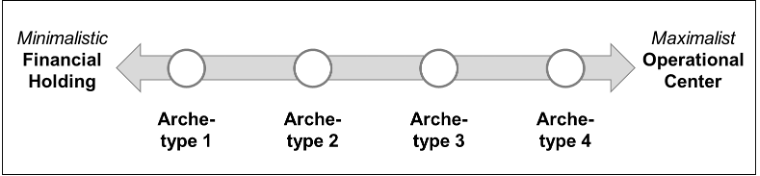

A common approach to define that role is to specify, on a linear scale, where the company should position itself between two extremes (Figure 1). The minimalistic extreme is often called the “financial holding model”: The corporate parent merely acts as an agent of the company’s owners, thereby focusing on business portfolio optimization, the appointment of the heads of those businesses, financing decisions, financial target setting, compliance with fiduciary matters, and occasionally challenging the business strategies. The opposite extreme is often called the “operational center model”: The corporate parent gets involved in all major strategic and operational decisions and provides strong support from the center, while the businesses focus on execution. Between the two extremes is a wide zone of situations in which the parent houses a range of shared support functions and resources, and undertakes company-wide strategic initiatives. Most authors suggest that companies, when rethinking their organization design, should define the desired role of the corporate parent by picking one of a few predefined archetypes positioned along that linear scale.2

Figure 1: Common approach using archetypes on a linear scale

While a classification into archetypes along a linear scale may be helpful for an initial discussion, it has two major shortcomings. First, it assumes that the role of the corporate parent is the same across all areas where it could influence the businesses, i.e., it does not differentiate between, for example, defining standards, approving capital expenditures, providing shared services or kick-starting new programs. Second, it assumes that the role is the same across all businesses in the company’s portfolio, i.e., it does not differentiate between, for example, a mature legacy business, a growth business, an internal corporate venture or a joint venture. These two assumptions of uniformity preclude nuanced and conclusive debate. There is a need for an approach that helps reframe the issue from “should we have more parent or less parent?” to “how can we get a better parent?”

Take, for example, the case of Dover, a diversified global manufacturer and solutions provider with annual revenue of over $8 billion. Most observers categorize the company into the “conglomerate” archetype, i.e., toward the minimalistic extreme of the scale, acknowledging that Dover’s operating companies do run their businesses independently. Nevertheless, the corporate parent influences the businesses profoundly in several areas. For example, Dover opened a digital labs center in the greater Boston area that serves as the company-wide hub for digitization, machine learning, artificial intelligence and digital commerce capabilities. Likewise, the company has a global shared service center for finance and accounting, with locations in the U.S., China, the Philippines and Romania; a joint innovation lab in India; and a global supply chain development program for future leaders.

To enable nuanced debate about changes in the role of the corporate parent, it helps to replace the common linear, archetype-based thinking by a 5-step logic:

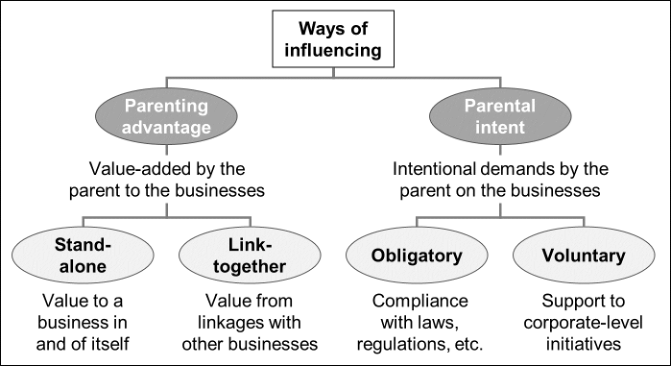

The extant management literature points to some twenty-five ways of influencing.3 These can be grouped in two categories and four sub-categories (Figure 2), which we will explain in more detail.

Figure 2: Types of ways in which the parent can influence the functioning of the businesses in its portfolio

Parenting advantage refers to the value that the corporate parent adds to the businesses in its portfolio.4, 5 When the parent does not add value, one should wonder whether the business is better off – and more valuable – by belonging to another company’s portfolio or being a stand-alone business. A parent may add value by setting up, for example, a corporate center of expertise in a specific domain (e.g., artificial intelligence); if the domain expertise is scarce and the businesses need it only intermittently, they will be better off by using the corporate center than by having such costly experts on their own payroll.

Parental intent refers to the corporate parent’s intentional demands for the businesses to follow certain practices. Those demands may not make the individual businesses better off but the company deems that those demands enable it to better fulfill its own obligations and commitments as the parent company toward lawmakers, owners or other stakeholders. For example, if the company’s corporate strategy is to shift its overall business focus by actively adding and shedding businesses, then the parent may impose practices that facilitate the separation process (e.g., by not introducing a common enterprise resource planning system).

A corporate parent could add value to a single business irrespectively of the other businesses in its portfolio. For example, if the company has a strong corporate brand, any given business could benefit from that brand strength on its own. Conversely a parent can add value to the businesses in its portfolio by establishing linkages between them for their mutual benefit. For example, the parent could orchestrate a talent mobility program that enables employees to move purposefully between businesses.6

A corporate parent may – or even must – demand that the businesses comply with practices that are required by law, regulation, governance code or company statute. This obligatory compliance could be considered the burden of running a company. By way of contrast, a parent may voluntarily set some corporate objectives for itself, and consequently demand that the businesses adopt certain practices in support of those objectives. For example, the company may demand that the businesses contribute resources to a corporate sustainability program, even if that program has very little bearing on the businesses.

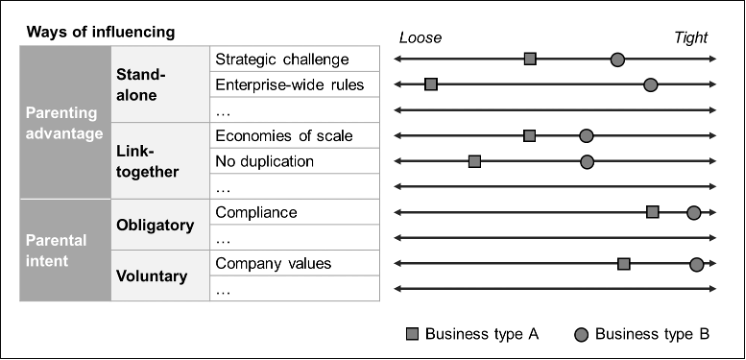

Careful consideration of the various ways of influencing in each of the above categories leads to a rich, nuanced debate about desired and feasible changes in the role of the corporate parent. It enables the CEO to steer the company a bit more toward the left or the right on the loose-to-tight coupling scale, as needed to adjust the organization design to the company’s specific and evolving business priorities.

A tailored and nuanced approach is needed as companies add businesses of an increasingly varied nature to their portfolio. For example, we worked recently for a large infrastructure company with a monopoly position in its fully-regulated home market. It is expanding in non-regulated businesses, both by investing in internal ventures outside its core business and by expanding its core business in overseas markets via controlling stakes in local companies. To decide on the best way for the corporate parent to influence the functioning of each of these businesses, it was unhelpful to reason in terms of a couple of artificial archetypes along a linear scale. Instead, the company listed close to twenty ways of influencing; for each of these ways it defined a loose-to-tight scale for the coupling between the parent and a business; and then it decided, for each business separately, the desired position on that scale (Figure 3). This granular and nuanced approach avoids the often vexing and unproductive discussions about the role of the corporate parent.

Figure 3: Example of choices regarding the influence of the parent on different types of businesses

H. Vantrappen and F. Wirtz, “CEOs Can Make (or Break) an Organization Redesign,” MIT Sloan Management Review 65, no. 1 (2023): 79-84.

Most scholars and practitioners propose between four and six archetypes. Bain & Company, for example, uses a scale with four positions: portfolio manager, challenger, integrator, operator. See M. Blenko et al., “Are You Getting Value from Your Center?” Bain & Company, August 7, 2019.

H. Vantrappen and F. Wirtz, “The Organization Design Guide: A Pragmatic Framework for Thoughtful, Efficient and Successful Redesigns” (New York: Routledge, 2024).

A. Campbell, M. Goold and M. Alexander, “The value of the parent company,” California Management Review 38, no. 1 (1995): 79-97.

E.R. Feldman, “The Corporate Parenting Advantage, Revisited,” Strategic Management Journal 42, no. 1 (2021): 114-143.

G. Westerman and A. Lundberg, “Why Companies Should Help Every Employee Chart a Career Path,” MIT Sloan Management Review 64, no. 3 (2023): 79-84.