California Management Review

California Management Review is a premier professional management journal for practitioners published at UC Berkeley Haas School of Business.

Image Credit | Suriya

One of the most upcoming applications of blockchain technology is in Decentralized Prediction Markets (DPMs), which allow users to bet on the outcomes of future events. These DPM platforms operate without central authority, enhancing transparency, security, and resistance to censorship (Matmuller, 2024).

“From Buzzword to Biz World: Realizing Blockchain’s Potential in the International Business Context” by Juan Du, Bo Bernhard Nielsen, and Catherine Welch, 66/1 (Fall 2023).

“Prediction Markets: A New Tool for Strategic Decision Making” by Adam Borison and Gregory Hamm, 52/4 (Summer 2010).

DPMs enable users to make predictions by buying and selling tokens representing possible outcomes of an event. The value of these tokens fluctuates based on market consensus, reflecting the likelihood of each outcome.

At the core of DPMs are smart contracts and oracles (Peterson et al., 2019). Smart contracts are self-executing contracts with the terms directly written into code, which automatically enforce and execute the agreement when predefined conditions are met. Oracles serve as bridges between the blockchain and the real world, providing smart contracts with external data necessary to determine outcomes.

In a DPM, participants buy and trade tokens representing different outcomes of an event. For instance, in a sports match prediction, users might buy tokens for “Team A wins” or “Team B wins”. The price of these tokens fluctuates based on market demand and supply, reflecting the collective belief in the likelihood of each outcome .

When the event concludes, the oracle provides the result to the smart contract, which then redistributes the pooled funds to the holders of the winning outcome tokens. This mechanism ensures transparency and fairness, as the entire process is governed by code rather than a central authority.

There are several advantages to decentralized prediction markets over traditional centralized prediction markets (Clear Chain Capital, 2021):

One of the leading DPM platforms today is Polymarket. It is built on the Ethereum sidechain Polygon and uses the Universal Market Access (UMA) oracle. It allows users to bet on various topics, such as political events (e.g. the upcoming US elections) or sports events (e.g. the 2024 Olympics) or cryptocurrency prices.

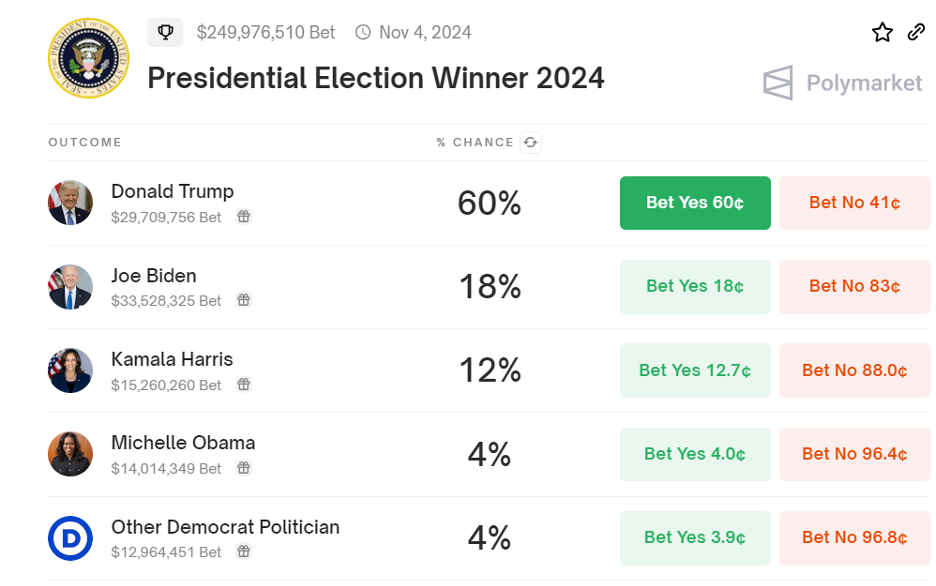

In the last few months, Polymarket has shown significant activity in the run-up to the US presidential elections in November, with new markets emerging on odds of President Joe Biden’s potential withdrawal from the race. As of July 12th 2024, there are ~$250m worth of bets in “Presidential Election Winner 2024,” which consists of individual “Yes” or “No” bets across 17 possible contenders. Donald Trump is currently the favorite, with 60% odds that he will win the U.S. election, with a total of $29.7m in bets for and against him. Joe Biden and Kamala Harris have $33.5m and $15.3m in bets for and against them.

Political bets make up ~70% of all Polymarket activity, with bets ranging from $1,000 to $100,000. Monthly user inflow in June 2024 hit 29,432, with 3,590 daily active traders adjusting bets. Open interest grew to over $46M, and daily trading volume reached $4.6M (The Crypto Times, 2024).

The path ahead for decentralized prediction markets (DPMs) is poised with promising advancements and emerging trends. As blockchain technology continues to evolve, several key areas are likely to shape the future of DPMs:

As these trends unfold, decentralized prediction markets have the potential to redefine the landscape of betting and forecasting.

Insight

Anindo Bhattacharjee et al.

Insight

Anindo Bhattacharjee et al.

Insight

Shaun West et al.

Insight

Shaun West et al.