California Management Review

California Management Review is a premier professional management journal for practitioners published at UC Berkeley Haas School of Business.

Tushar Sarkar and Neeraj Pandey

Image Credit | Seksan

Network expansion is part of business growth strategy. The channel network expansion facilitates seamless distribution of goods and services to the customers. Maintaining strong business relationship with channel partners is essential for the sustenance and growth of the business.1 However, the network expansion may lead to conflict situations which are popularly known as “channel conflict” in the industry. The channel conflict occurs when the same brand is selling at different prices in same or different distribution channels. The product availability issues in different channels, some channel partners (distributors/retailers) getting it early and others receiving it late or manufacturer deciding to sell through its direct-to-consumer (D2C) channel and competing with existing channel partner can also lead to a channel conflict situation.2The channel competition and unrealistic business goals may weaken business-to business channel synergy.

F. V. Cespedes, “Channel Management Is General Management,” California Management Review, 31/1: 98-120.

S. Gallino & R. Rooderkerk, “New Product Development in an Omnichannel World,” California Management Review, 63/1: 81-98.

The channel conflict, beyond a point, can lead to customer confusion or dissonance, purchase postponement, reduced sales, and negative impact on brand reputation in the marketplace. The technological advancements such as Industry 4.0, enterprise resource planning (ERP), and other digitization initiatives have enhanced demand on the manufacturers by their channel partners. The increase in number of product and services in the product portfolio is making it challenging for companies to track the channel conflict phenomenon. The adoption of strategic pricing techniques and adequate utilization of channel mediums are two methods by which a competitive edge can be gained in B2B channel disputes. The conflict can happen at vertical and horizontal channel distribution level.

Manufacturers and distributors often have a hard time working together due to vertical channel conflict. It occurs due to non-congruence of aspects like pricing, promotion, etc. at different distribution levels. Few organizations have used collaborative models to improve the pathway interactions between suppliers and resellers. Vertical constraint examples include fees levied on franchises, price discipline, exclusive deals, and segregated regions.3 This type of methods usually supports channel-partner relationship which can be sustainable for both manufacturers and distributors. Technological innovation and their appropriate implementation have enabled collaboration between manufacturers and distributors for inventory management and data sharing on a real time basis reducing the conflict. These strategies enable the identification of shared interests and the development of solutions that benefit both manufacturers and distributors fostering the relationship within the value chain (Figure 1).

Horizontal channel conflict refers to disagreements between distribution partners at the same level of distribution chain. A typical case of horizontal conflict is that when a distributor or retailer starts offering the same brand in the same region at lower price leading to disadvantage to another distributor/retailer of the same manufacturer. Horizontal channel conflict is mostly caused by competition among various distributors for market share, profit, and consumer loyalty.4 Firms within the same channel often compete for the same customers and areas, which can lead to disagreements over pricing, promotions, distribution strategies, and expanding into new territories. If both sides stick to their own plans, methods, and goals, this disagreement could get worse. Horizontal conflict may provide impetus to vertical conflict.5

Channel conflicts have many causes and require a holistic investigation. Internal conflicts occur due to employee unrest, incompatible organizational goals, and overambitious plans.6 External conflicts occur due to organizational dynamics and structure, including resource scarcity and unethical practices.7 Exploring multiple scenarios for analysis helps build a framework for understanding and reducing channel conflict dynamics.

Scenario 1: Distributor-retailer channel conflict dilemma

Retailers contribute significantly to the firm revenue as the manufacturer’s last touch point channel partner. Retailers are reliant on the distributors for irregular weekly and monthly demand. Many retailers, especially in emerging economies like China, India, and Brazil, keep limited stocks at the outlet. These retailers depend on their respective distributors for credit sales, working capital concerns, and inventory capabilities. The retail industry has major interlinkages with the economy. For example – In India, retail industry contributes to 8 percent of employment and ten percent of country’s GDP.8 The retail industry in China employs approximately 7 percent of the population9 with a market size USD 1.94 trillion.10 Conflicts between retailers and distributors depend on critical factors like product availability, credit cycle period, financial aspects, market reach, and customer base. Most disputes arise from cross-selling, where distributors enforce non-branded products alongside popular brands exploiting the retailer’s vulnerability and reliance besides issues like non-uniform pricing for retailers, direct selling by distributors, and delayed inventory supply.

Scenario 2: Power play by established distributors

The established distributors leverage their robust infrastructure combined with their agility to analyze the market and make better predictions. Such distributors aim to assert their supremacy over the fledging distributors. With strong financial set-up, logistics capability, and strategic acquisitions, these dominant distributors are set to redefine the distribution landscape. These established distributors, who are mostly larger in size in terms of revenue turnover and network, would play on the volume game by increasing the discounts and lowering the prices to retailers. They work on ‘low margin and high volume’ power game. This reduces the sales volume of other distributors selling the same product. All these actions lead to channel conflict situations among the established and emerging outlets while emphasizing the narrative of ‘survival of the fittest.’ For example – In India, the B2B trading player “Udaan” buys products directly from the manufacturer and sells it at a competitive price to the retailers who are registered on its platform.11 This price, for many products, is lower than the retailers could have got from the manufacturer’s licensed distributors.

Scenario 3: Bargain by old players

The continuous price disparities have led to distributors in Maharashtra, a state in the western part of India, to boycott well-known FMCG organizations like Unilever and Colgate Palmolive. The increasingly popular B2B companies like Jio-mart, Metro Cash & Carry, and Udaan who buy in bulk from FMCG companies directly compete with traditional distributors. The conflict highlights the importance of fair and transparent business practices since distributors accuse FMCG firms of favouring B2B channels over traditional distributors by allocating inventories at lower prices. Generally, these B2B companies purchase much larger stock volume than traditional distributors. All-India Consumer Products Distributors Federation (AICPDF) demanded for immediate intervention from the respective firms to ensure fair and transparent opportunities for all the stakeholders.12

Scenario 4: The double-edged sword: brand equity and organizational conflicts

The organizational conflicts within firms, caused by a lack of proper communication and coordination, lead to inconsistent branding messages and complex brand identity. These conflicts can manifest in various ways, such as aggressive marketing tactics, legal disputes, or negative public relations campaigns. Conflicts arising from divergent goals and lack of mutual interest among the channel members significantly diminishes brand equity. Intra-firm disputes over allocation of resources, pricing strategies, or product-line extensions can erode brand consistency and market positioning. Inter-firm conflicts with distributors, loyal retailers, or suppliers due to challenges viz., territorial rights, franchise expansion, profit margins, and demotivated sales team can tarnish brand reputation. Poorly managed conflicts strain business relationships, leading to reduced cooperation, breach of trust, poor customer experience, and even termination of partnerships. Strong brand equity acts as buffer, but excessive conflicts dilute brand associations and perceived quality.

Harmonious channel convergence ensures that all the manufacturer’s distribution channels work in synergy to provide seamless service to the customers and create a strong brand image in the marketplace. This will ensure that there is minimum channel conflict and various channel share information, promotion, and support services. The congruence of services by an organization will lead to better customer service. It is crucial to minimize the conflicts across the commercial dyads even within the organizations through fostering collaboration, communication, proactive business acumen, and effective compliance taking into consideration the ethical standards.13 The organizations can adopt the following strategies to minimize channel conflict between the intermediaries.

Pricing strategy

The transparent pricing policy and the alignment of channel incentives are key to constructive business relationships in the network. The pricing policy of the organization should document the tiered pricing which should clearly delineate the discount given as per volume, type of customer, region, delivery schedules, and other industry relevant parameters. A consistent pricing policy ensures organic revenue growth for the manufacturers and channel partners. The pricing is the spoke of business and if there are issues in it, the entire business network can feel the turbulence in terms of negative impact on customer experience, revenue, and growth. The companies like KoRo Drogerie and Everlane have created a positive brand name due to their transparent pricing strategy.14

Setting ground rules

The organization should share ground rules with all channel partners especially regarding pricing. The Minimum Advertised Price (MAP) policy mentions the lowest price any channel partner can charge. This helps to prevent aggressive price undercutting. Firms like Apple, Bose, GoPro, Sony, etc., issue MAP to their channel partners.15 It reduces price wars and builds brand credibility. The organization should follow selective distribution strategy which aligns with the company’s brand image and objectives. Firms should also analyze the market operating price (MOP) which reflects the typical selling price in actual marketplace. MOP aids in deciding the MAP policy which goes a long way in addressing the channel conflict related issues.

Emulating use cases in channel conflict management

Organizations should learn from mistakes and experiences of other companies in the industry. It should follow the best practices in channel conflict management strategy. The use cases provide insights about different approaches like direct-to-consumer (D2C) approach, technology infusion, omni-channel strategy, and use of artificial intelligence (AI) in minimizing channel conflict. Most of B2B companies use D2C channel for sales to large customers which buy over a certain volume and the rest through their distributors. It enabled firms to obtain first-hand customer information besides having greater control over the customer experience and earning larger profit margins. Ceat Tyres did D2C channel sales post-covid which helped it get lot of customer data besides insights about their tyre related preferences.16 Blockchain technology can be used to store pricing data so that there is trust among the channel partners. Blockchain, being an immutable record, will deter channel partners to undercut prices more than the range given by the manufacturer.

Business-to-business (B2B) networks need to manage and reduce channel partner disputes by using technology. Companies use variety of technical tools and platforms to improve transparency, coordination, and cooperation inside their distribution networks. Technology integration has revolutionized this field by empowering seamless communication and information exchange among the channel partners. Cloud-based collaboration platforms, supply chain integration, and real-time data analytics help in better data management, optimization of inventory, and prudent pricing, besides providing valuable insights.

Channel Convergence has potential to enhance performance and productivity as it would minimize channel conflict issues. Besides technology, leaders with good gasp of team management skills and business acumen, will be required to achieve channel convergence. Smart pricing algorithms aligned with progressive business transformation ensures price discipline across all points of sale, minimizing price undercutting and conflict. Insights derived from data driven techniques and analytics empower channels to optimize their sales strategies through segmenting appropriate markets and customers. Technology helps us to understand consumer preferences in advance further tailoring the approach to address the target customer.

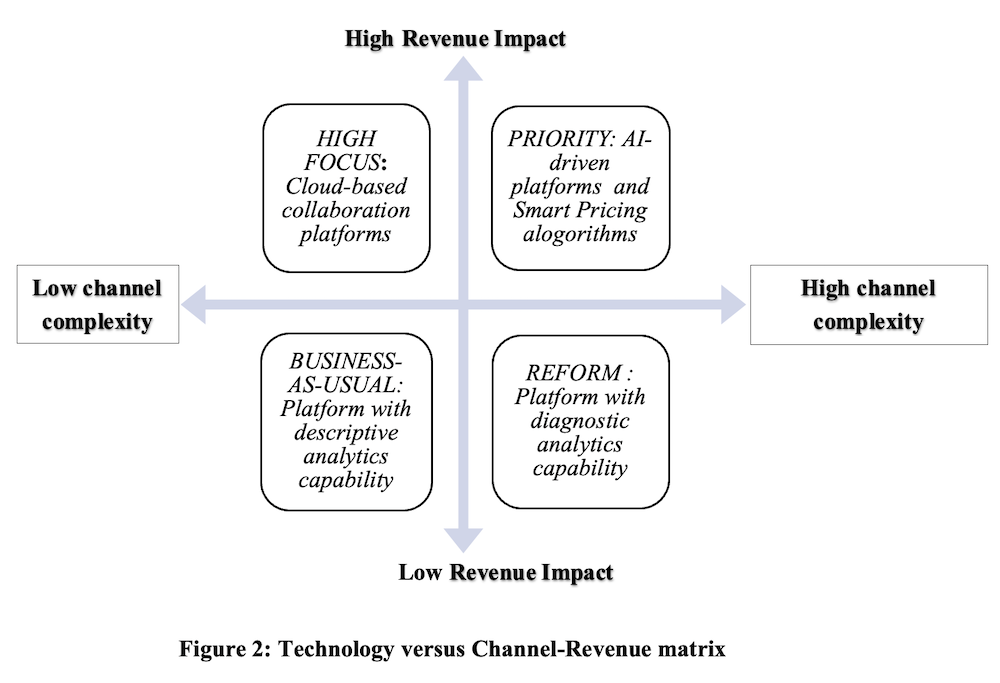

The firm-based strategy can be derived from channel complexity- revenue impact framework analysis (Figure 2). In cases of low complexity of channels and low impact on revenue, it would be ‘Business-as-Usual” strategy. There is lesser need for reforms in this quadrant. The “Priority” quadrant has high revenue impact and high channel complexity firms. These require state-of-the-art AI-driven platforms to manage the channel dynamics with smart pricing algorithm capabilities. Artificial Intelligence (AI) and Smart Pricing Algorithms empower businesses to analyse data, anticipate demand, and determine suitable prices, leading to strategic and uniform pricing choices. These technologies are becoming more feasible and easier to integrate into existing commercial structures.The focus would be to lower the channel complexity using predictive and prescriptive analytics capabilities of the platform. The firms coming in ‘High focus’ quadrant would have high profitability potential as there is lower channel complexity and high revenue impact. The firms have to invest in technology and training to ensure that the channel complexity is manageable. The quadrant with low revenue impact and high channel complexity requires lot of ‘Reform’ to be undertaken. The firm should analyze data using diagnostic and predictive analytics to find reasons for low revenue impact. This would provide insights regarding required changes in the channel design and ways for increasing the revenue.

It is responsibility of the manufacturer to aspire to acheive channel convergence is planned by leveraging appropriate AI-driven technology platform. These platforms raise red flag whenever tired pricing, MAP, MOP fluctuations, etc. or any other aspect of the firm’s pricing policy is violated beyond certain pre-determined range in any of sales regions. This has become more relevant as omnichannel is being adopted by many product and service companies[17]. Social media analytics integration with the channel management platforms can provide real-time marketplace feedback and highlight brand impact related to channel conflict issues. Thus, AI-powered technology is crucial in reshaping the future of channel management through rapid optimization, reducing the information asymmetry gap among the dyads, motivating the channel partners, and enhancing brand equity in an increasingly competitive marketplace.

Cespedes, F. V. (1988). Channel management is general management. California Management Review, 31(1), 98-120.

Cespedes, F. V., & Corey, E. R. (1990). Managing multiple channels. Business Horizons, 33(4), 67-78.

Liu, Y., Liu, Z. Y., & Li, J. (2021). Supply chain channel conflict coordination with consumer network acceptance. Asia Pacific Journal of Marketing and Logistics, 33(3), 846-868.

Xu, G., & Qiu, H. (2020). Pricing and distribution strategies in a dual-channel supply chain. International Journal of Information Systems and Supply Chain Management (IJISSCM), 13(3), 23-37.

Webb, K. L., & Hogan, J. E. (2002). Hybrid channel conflict: causes and effects on channel performance. Journal of Business & Industrial Marketing, 17(5), 338-356.

Dant, R. P., & Schul, P. L. (1992). Conflict resolution processes in contractual channels of distribution. Journal of marketing, 56(1), 38-54.

Sharma, D., & Parida, B. (2018). Determinants of conflict in channel relationships: a meta-analytic review. Journal of Business & Industrial Marketing, 33(7), 911-930.

https://www.ibef.org/industry/retail-india

https://www.statista.com/statistics/277809/number-of-retail-employees-in-china/

https://www.mordorintelligence.com/industry-reports/retail-industry-in-china

https://udaan.com/about-us

https://economictimes.indiatimes.com/industry/cons-products/fmcg/predatory-pricing-deep-discounting-by-q-commerce-to-impact-brand-value-aicpdf-to-fmcg-makers/articleshow/113675363.cms?from=mdr

Eshghi, K., & Ray, S. (2021). Conflict and performance in channels: a meta-analysis. Journal of the Academy of Marketing Science, 49, 327-349.

https://www.omniaretail.com/blog/how-e-commerce-brands-and-retailers-are-building-trust-with-transparent-pricing

https://gopro.com/en/us/legal/authorized-reseller-program-us-minimum-advertised-price-policy

Pandey, N. (2021). Digital marketing strategies for firms in post covid-19 era: insights and future directions. The new normal challenges of managerial business, social and ecological systems in the post covid-19 era(pp. 107–124). Bloomsbury Publishing.

Gallino, S., & Rooderkerk, R. (2020). New product development in an omnichannel world. California Management Review, 63(1), 81-98.

Spotlight

Sayan Chatterjee

Spotlight

Sayan Chatterjee

Spotlight

Mohammad Rajib Uddin et al.

Spotlight

Mohammad Rajib Uddin et al.