California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Karthik Ramanna

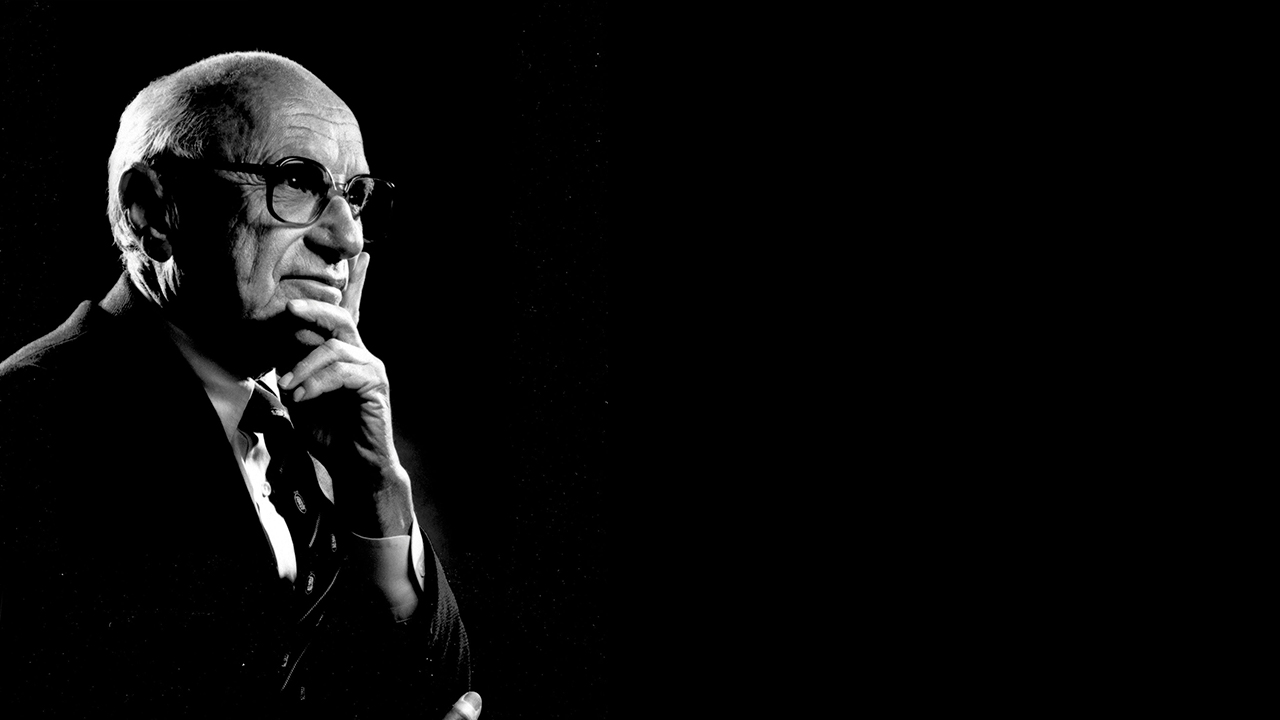

Fifty years ago Milton Friedman famously argued that the social responsibility of business is to increase its profits, which today are at record highs. And, as public institutions falter, business is now offering to step into the void. We must resist this (further) intrusion of business into the public sphere, as it will further depreciate civic institutions. The business of business is business, and so it should be. Business’ track record in public politics has been to engineer the rules of the game to its own advantage.