California Management Review

California Management Review is a premier professional management journal for practitioners published at UC Berkeley Haas School of Business.

Ashish Sinha, Kiran Pedada, Anish Purkayastha, Rajendra Srivastava, and Sandeep Balani

Image Credit | Pan Yunbo

The past twenty-four months have seen a heightened interest in digital transformation. The shutdown of physical operations has forced several companies to adopt digital technologies necessary to keep their employees working from home and seamlessly connecting with their customers, clients, and stakeholders who prefer interactions through digital channels. Business leaders have realized their organizations need to be digitally savvy as their markets, customers, and workers have adopted digital transformation. As a result, many firms are embarking on digitalization for the future-proofing of their businesses.1 It is business as usual for firms way ahead in adopting digital transformation, while it is a rude awakening for uninitiated businesses. Such businesses realize the need to adapt quickly to cope with an ever-changing pandemic environment. Effective digital transformation, which delivers agility, adaptability, and customer-centricity, is now a managerial mantra and leadership inspiration.2 According to a recent consulting report, it is not surprising that 80% of companies are set to accelerate their digital transformation efforts in the coming months and days.3 Commenting on this pace of adoption, the Chief Executive Officer of IBM, Arvind Krishna, said, “Every company will become an AI company.”

“Designing a Future-Ready Enterprise: The Digital Transformation of DBS Bank” by Siew Kien Sia, Peter Weill, & Nila Zhang. (Vol. 63/3) 2021.

Despite the accelerated adoption of digital technologies, repeated studies point to the failure of digital transformation at many organizations. For instance, a recent Boston Consulting Group (BCG) study shows that 70% of all digital transformations fail.4 Our involvement in several open and custom executive education programs on artificial intelligence (AI) and digital transformation proves this figure correct. Hundreds of executives who have taken our executive education courses share their first-hand experiences, frustrations, and disappointments while implementing digital transformation. According to the report, only 10% of firms have seen significant financial gains from this transformation. Experts weigh in that two-thirds of the funds (approximately $900 billion)5 expended on digital transformation projects are wasted. Interestingly, in contrast, several companies have digitally transformed their organizations successfully and, in turn, substantially increased both revenue and shareholder value.6 Despite these gains, no available framework links digital transformation to shareholder value.

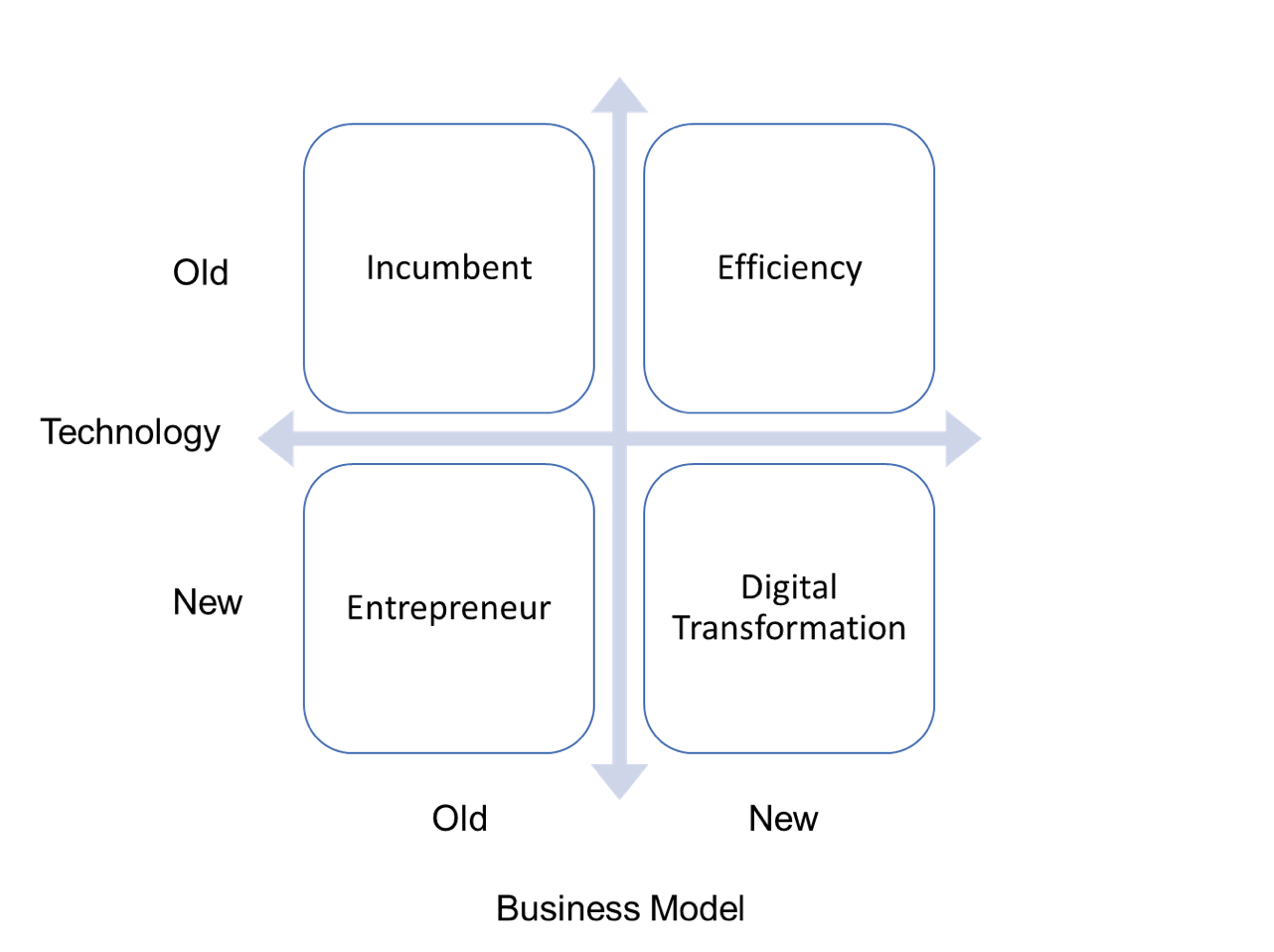

Genuine digital transformation comprises adopting emerging technologies, including AI and deep learning, enabling a company to implement an innovative business model to create value for existing customers and/or target new customer segments that their competitors have often ignored. As shown in Figure 1, we use a four-quadrant approach to describe the digital transformation, in which the different quadrants are defined by the interaction of technology and business models.7 Incumbent firms are in the old technology-old business model, while digitally transformed firms that experience growth and substantial shareholder value rise are in the new technology-new business model.

Figure 1: Balancing Technology and Business Model in Adopting Digital Transformation

At the heart of digital transformation lies a company’s ability to monetize digital technology and data, which occurs at the business models and technology interface.8 The native digital companies in the fourth quadrant of Figure 1 are Uber, Airbnb, Facebook, Flipkart, and Alibaba.9 These are a few examples of companies that already use digital technology to create a competitive advantage. However, the more interesting examples are the likes of Microsoft, Apple, and Disney, which have transformed themselves from the old-world business to the new digitally transformed business.

Even before Satya Nadela started as the CEO, Microsoft was not a small company; it was worth $250 billion. The digital transformation from the old world, built around windows and office platforms, to the new world changed Microsoft and made it what it is today. Using data and AI, the company transformed from a Windows system to a cloud-based system. The Azure Analytics platform is an integral part of that transformation. Microsoft made this journey approximately over the last decade, raising it to a two trillion-dollar company. Apple also undertook a similar transformative journey. After his second coming, Steve Jobs transformed Apple from a computer software and hardware legacy business into a digital powerhouse, launching a litany of thriving products. Whether an iPod, iPhone, or iPad, each product has a different business model. As a result, Apple now is worth close to three trillion dollars, equivalent to the GDP of the UK.

The examples mentioned above are companies that have moved from the top left-hand to the bottom right-hand quadrant in Figure 1. The top left-hand quadrant represents the old-world incumbents, while the right-hand bottom quadrant represents the new world of digitally transformed businesses. The companies that successfully made this transition have experienced exponential growth in market capitalization. However, only a few companies have digitally transitioned successfully because an effective transition requires an organization to possess certain capabilities that many firms lack.10

This article shows: How does digital transformation impact revenue and shareholder value? Based on decades of collective research, practice, and experience in conducting executive education on digital transformation and strategies, we offer a framework that helps companies realize the strategic and financial benefits of the digital transformation process.

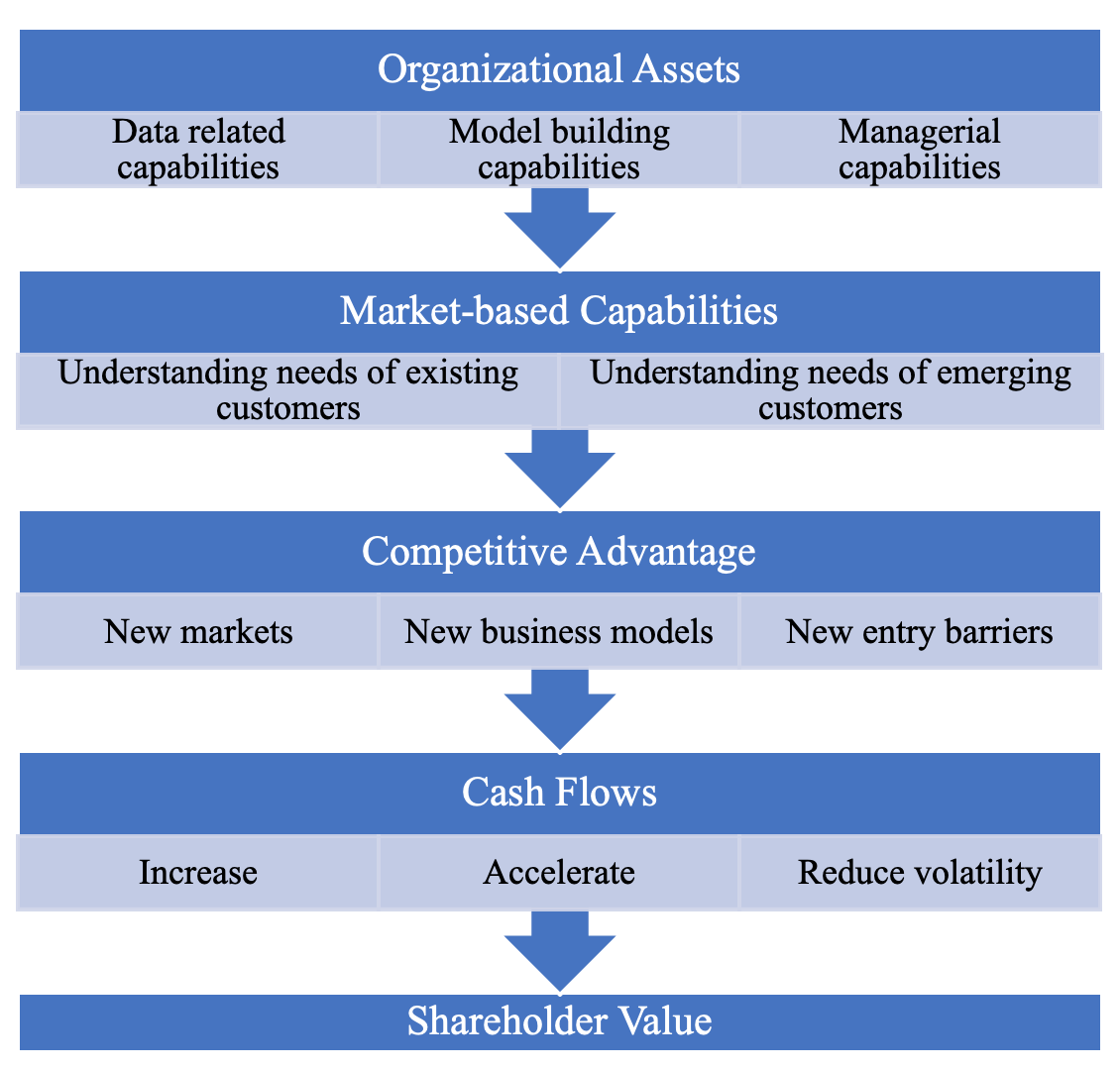

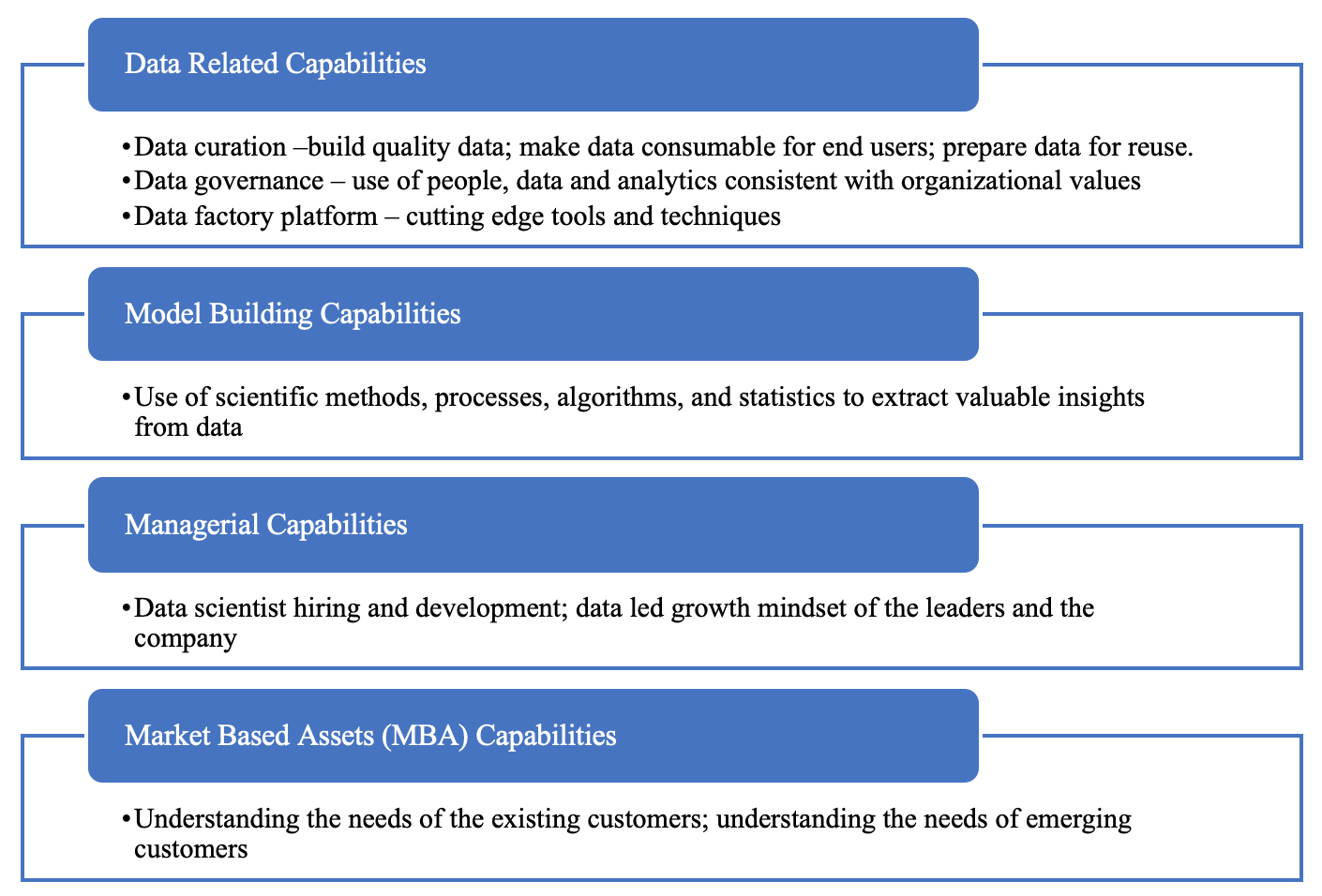

Consistent with the resource-based view of the firm,11 the framework shown in Figure 2 assumes that organizations can be described as bundles of assets and capabilities. Our framework builds on the recent developments in research at the interface of marketing and finance, in which acquiring and possessing the right assets and capabilities will increase the shareholder value.12 Specifically, for digital transformation, using both reviews of the relevant literature and inputs from executives, we identified a set of four capabilities: 1) data related, 2) model building (or modeling), 3) managerial, and 4) market-based assets (MBA) or market-based.

In the case of digital transformation, key assets and capabilities are data and modeling related. However, it is not enough for companies to own these assets as it is equally important for them to possess managerial capabilities to leverage these assets. We argue that these capabilities, in combination, help companies gain MBA capabilities in the marketplace to understand changing needs of existing customers and evolving needs of emerging customers. Developing new business models helps firms attain a competitive advantage. They can now identify novel ways of creating, delivering, and appropriating value to existing or ignored segments and markets, thereby turning their competitors’ ability into a disability as the competitors cannot serve the needs of these customers. It has the potential for unlocking growth as the focal firm can now target a set of customers who did not buy into the category.

Apart from accelerating innovations, the digital transformation strategy increases and accelerates revenue. In addition, digital transformation removes pain points for existing customers, provides new touchpoints for digital engagement, and identifies unique ways of delivering and appropriating value, leading to a bigger pie. Moreover, digital transformation decreases the risk associated with the revenue stream due to enhanced customer experience and increased brand loyalty.13 In a nutshell, digital transformation increases and accelerates cash flows while reducing their volatility. It helps several firms like Microsoft, Apple, Best Buy, and Target significantly increase their shareholder value.15

Figure 2: Digital Transformation Monetization Framework

We conducted interviews and a survey with Indian executives to unpack the underlying issues with digital transformation. These executives are in charge of digital transformation in their respective organizations and participated in multiple executive education programs we offered. The study results and insights from the analysis were provided back to the participants as useful inputs for digital strategy development in their companies.

Altogether, we connected with 115 Indian executives, of which 30% are CXOs or senior management title holders. They are dominantly from information technology (IT) and financial services backgrounds and represent 14 different industries. We received a total of 87 usable survey responses. As a part of the survey, first, we asked the executives to categorize their companies in one of the four quadrants provided in Figure 1. Then, the executives had to rate their companies on a set of measures capturing the data-related capabilities, modeling capabilities, managerial capabilities, and MBA capabilities. Also, the executives rated the perception of their respective companies’ preparedness to adopt and deploy AI and emerging technology and their competitive advantage. Figure 3 represents the six measurable items used to gauge the capabilities of digitally transformed organizations. The framework presented in Figure 2 indicates that digitally transformed organizations possess the four capabilities illustrated in Figure 3. In other words, firms in the bottom right quadrant of Figure 1 should score higher on the six items than those that fall in the other quadrants.

Figure 3: Capabilities of a Digitally Transformed Organization 1

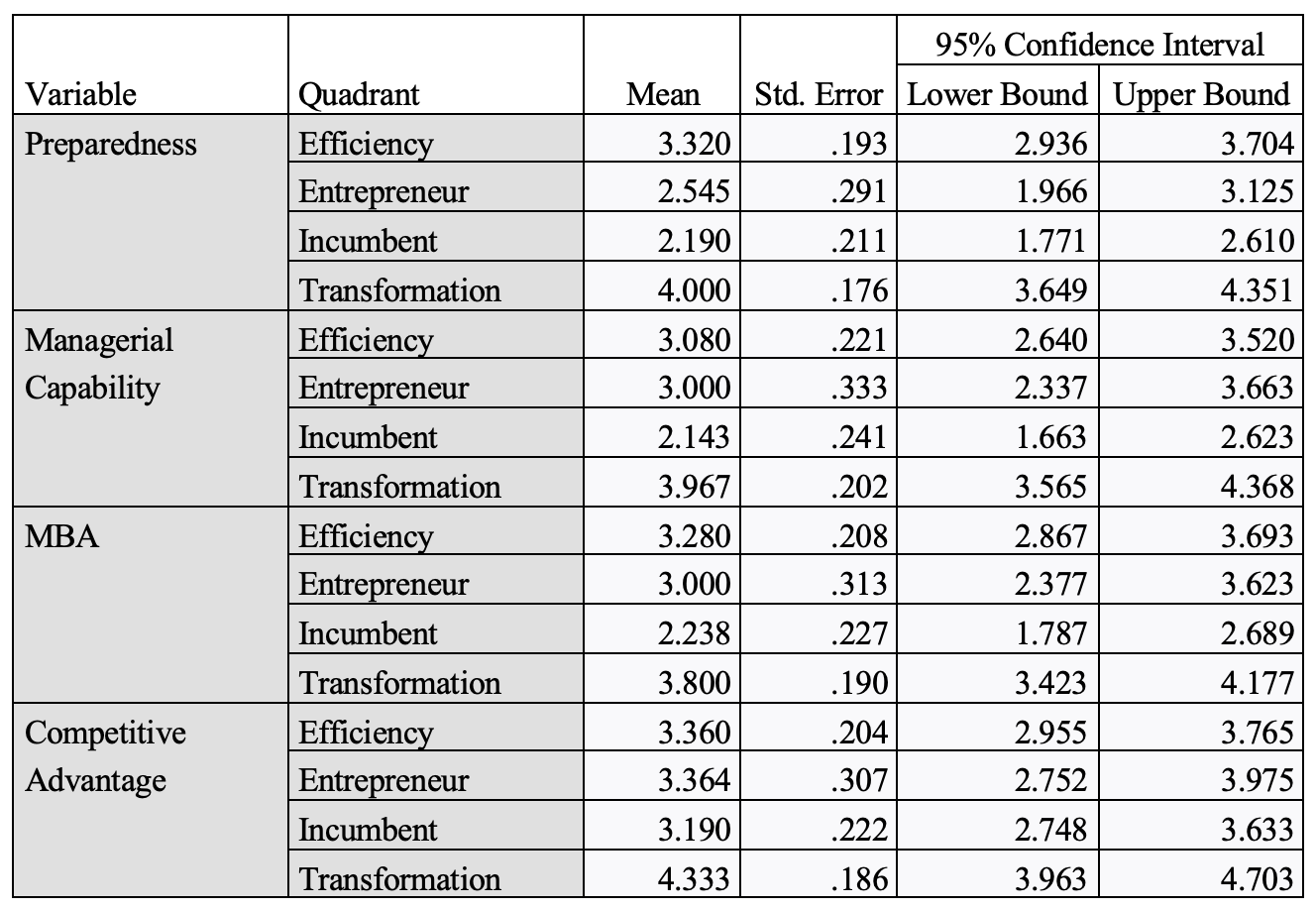

The companies in the two right quadrants of Figure 1, i.e., (1) efficiency and (2) digital transformation, represent those further along on the digital transformation journey. Our survey analysis clearly shows that companies in these two quadrants are perceived to possess better data, modeling, and emerging technology-related capabilities than those in the left quadrants. Moreover, as shown in Table 1, the companies in the digital transformation quadrant are, on average, perceived to be better prepared to adopt and deploy emerging technologies, to have a higher focus on customer-centricity in terms of value creation for both new and existing customers. Furthermore, these companies enjoy a greater competitive advantage than those in the other quadrants of Figure 1. This further provides evidence to our assertion that a fundamental difference exists between digitally transforming an organization and adopting digital technology for efficiency gains and cost reduction.2

We ran a series of regressions to test some of our prior predictions based on the framework presented in Figure 2 about the relationship between various capabilities and competitive advantage. First, we regressed MBA capabilities on preparedness and managerial capabilities. Then, we regressed competitive advantage on preparedness, managerial capabilities, and MBA capabilities.

Table 1: Quadrant Means for the Perceived Levels of Capabilities

The results of our analysis using advanced statistical techniques confirm that the extent of an organization’s preparedness to adopt and deploy emerging technologies and its managerial capability does not directly affect competitive advantage but creates an impact through creating MBA capabilities. This implies that on their own data, modeling, and managerial capabilities of an organization do not create competitive advantage. They impact competitive advantage by focusing on an explicit strategy of creating value for existing customers or ignored segments using emerging technologies such as AI. These findings support our digital transformation framework presented in Figure 2.

What can executives who focus on their organizations’ digital transformation learn from our findings? We offer the following important insights.

Focus on customer-centricity: Our results (MBA capabilities are translating preparedness and managerial capabilities into a competitive advantage for firms) show the importance of customer-centricity for firms focusing on digital transformation. Firms far ahead in the digital transformation journey are better prepared to adopt and deploy emerging technologies and focus on customer-centric value creation for new and existing customers. In fact, the focus on customer-centricity is the reason why organizations like Microsoft, Apple, BestBuy, and Target have prospered despite the pandemic, with large absolute and relative increases in market capitalization. As a case in point, Target has transformed itself for the digital age providing a seamless experience to its customers who could shop across offline and online channels by adding several new options for customer engagement.15 Target has modernized its supply chain while integrating its demand management for the offline and online channels to reduce stockouts, added Drive-through service allowing customers to order online while picking up the products from a Target store located at a convenient location, upgraded its logistical capabilities to allow the use of Target stores as a fulfillment center reducing delivery cost and time, making it difficult for e-commerce giants like Amazon compete with Target. While many other retailers have faltered throughout the pandemic, Target has seen a two-and-a-half times increase in its market capitalization. Target’s experience is not an exception; rather, it is a norm for companies focusing on digital transformation.

Identify ways to use digital technology to create, deliver, and appropriate value differently from the competitors: Companies that are more likely to prosper from digital transformation are the ones that are harnessing digital technology to identify new ways of creating value for existing or ignored segments by building and developing new business models. The difference between the efficiency and the digital transformation quadrants in Figure 1 is that both the MBA capability and competitive advantage are a lot lower in the former than the latter, pointing toward the importance for organizations to create new business models to serve the needs of existing and new customers better. This will help build sustained competitive advantage, leading to accelerated and enhanced cash flows and increasing the shareholder value. For example, Indian over-the-top (OTT) streaming service company Hotstar was initially a tiny player in the digital entertainment ecosystem. However, it identified a new way to create value by acquiring Indian Premier League (IPL) content, ensuring access to registered user data of a large base of Indian viewers passionate about the game. Hotstar created tremendous shareholder value by focusing on an ignored segment. In 2019, Disney was planning to scale up its operations in India and acquired Hotstar, primarily to access the data of Indian users the OTT company collected from the IPL content.16 Hotstar is the only company that grew quickly in India alongside Google and Facebook.

Leverage data and emerging technology to create entry barriers for competition: Developing MBA capabilities through data and emerging technologies help digitally transformed firms to create entry barriers for competition. For example, Amazon leverages data and AI to increase the value creation to existing and unserved customers by offering a wide range of products and reimagining loyalty economics. The company then manages to make them a part of the Amazon Prime program to enhance the customer lifetime value. This, in turn, increases the organization’s shareholder value, reducing the cost of customer acquisition and retention. Moreover, increased customer loyalty creates a higher wallet share, increasing entry barriers for competitors and new entrants. Similarly, Indian online retailer Flipkart built a robust delivery mechanism using data that helped the company become the most prominent player by disrupting India’s e-commerce market and increasing the barriers to entry for the competition.

The Indian IT giants TCS and Infosys are bullish about their revenue for 2022, with Infosys predicting a 20% increase in revenue largely attributable to the unabated spending on digital technology.17 In a virtual news briefing, Infosys’s Chief Executive Officer Salil Parekh commented, “The amount clients want to spend on technology is going up.” While IT firms worldwide benefit enormously from digital technology adoption, unfortunately, the same cannot be said about their clients. Only a tiny fraction believe that they receive the returns on their investment, with more than 70% of the digital transformations failing as per a recent BCG report. Our research shows that the focus on technology by both IT firms and clients is misplaced, as it leads to companies being stuck in the efficiency quadrant of Figure 1. To digitally transform their organizations successfully, companies have to identify ways by which they can use digital technology to create, deliver, and appropriate value differently from their competitors to cater to the needs of existing or unserved customers better. Companies will thus be able to unlock growth and achieve enormous increases in shareholder wealth.

Sia, S. K., Weill, P., & Zhang, N. (2021). Designing a future-ready enterprise: the digital transformation of DBS bank. California Management Review, 63(3), 35-57.

Schrage, M., Pring., B., Kiron, D., & Dickerson, D. (2021). Leadership’s digital transformation: leading purposefully in an era of context collapse. MIT Sloan Management Review.

Chakraborty, S., Charanya, T., Laubier, R., & Mahesh, A. (2020). The evolving state of dgitial transformation. Boston Consulting Group.

Forth, P., Reichert, T., de Laubier, R., & Chakraborty, S. (2020). Flipping the odds of digital transformation success. Boston Consulting Group.

Gatherer, G. (2021). 70% of organisations’ digital transformations fail – here’s why? Available at https://albertonrecord.co.za/304952/70-of-organisations-digital-transformations-fail-heres-why/ (Accessed: 11 Jan 2022).

Morgan, B. (2019). 7 Examples of how digital transformation impacted business performance. Available at https://www.forbes.com/sites/blakemorgan/2019/07/21/7-examples-of-how-digital-transformation-impacted-business-performance/?sh=6fae7ad851bb (Accessed 11 Jan 2022).

Sinha, A., Purkayastha, A., & Srivastava, R. (2022). How to harness Artificial Intelligence and Disruptive Technology to Benefit Society. California Management Review Insights.

Venkatesan, R., & Whitler, K. (2021). How marketers can address data challenges to drive growth. MIT Sloan Management Review.

Bonnet, D., & Westerman, G. (2021). The new elements of digital transformation. MIT Sloan Management Review, 62(2), 82-89.

Bonnet, D., & Westerman, G. (2021). The new elements of digital transformation. MIT Sloan Management Review, 62(2), 82-89.

Barney, J. B., Ketchen Jr, D. J., & Wright, M. (2021). Resource-based theory and the value creation framework. Journal of Management.

Ramaswami, S. N., Srivastava, R. K., & Bhargava, M. (2009). Market-based capabilities and financial performance of firms: insights into marketing’s contribution to firm value. Journal of the Academy of Marketing Science, 37(2), 97-116.

Westerman, G., Bonnet, D., & McAfee, A. (2014). The nine elements of digital transformation. MIT Sloan Management Review, 55(3), 1-6.

Morgan, B. (2019). 7 Examples of how digital transformation impacted business performance. Available at https://www.forbes.com/sites/blakemorgan/2019/07/21/7-examples-of-how-digital-transformation-impacted-business-performance/?sh=6fae7ad851bb (Accessed 11 Jan 2022).

Kohan, S. (2020). Target’s Big Investments, From Small-Fromat Stores to Digital, Prove Successful. Available at https://www.forbes.com/sites/shelleykohan/2020/03/04/targets-focus-on-employees-and-customers-delivers-revenue-growth-of-37-for-2019/?sh=4e64a53854fa (Accessed 21 Jan 2022).

Gadgets360 (2019). Disney now owns Hotstar after buying Star India as part of $71 billion Fox deal. Available at https://gadgets.ndtv.com/entertainment/news/disney-now-owns-hotstar-after-buying-star-india-as-part-of-71-billion-fox-deal-2010926 (Accessed 21 Jan 2022).

Majumdar, R. (2022). TCS says India growth will be platform driven. Available at https://economictimes.indiatimes.com/tech/information-tech/tcs-says-india-growth-will-be-platform-driven/articleshow/89027275.cms (Accessed 21 Jan 2022).

The first four items measure data and modelling related capabilities. PCA shows that all four items load on to one latent factor, which we term “Data and Modelling Capabilities”. A regression analysis shows that there is a linear relationship between “Data and Modelling Capabilities” and the preparedness of an organization to adopt and deploy AI and Analytics. Therefore, we focus on the preparedness of the organization. The factor loadings for the first four items are .87, .77, .84 and .85, with 71% of the variance being explained by the latent factor. ↩

We ran pairwise t-tests, and multivariate ANOVA for statistical testing the difference in the means between firms that lie in various different quadrants. ↩

Insight

Ashley Gambhir et al.

Insight

Ashley Gambhir et al.

Insight

Michele Sharp et al.

Insight

Michele Sharp et al.