California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Daniel Malan, Gemma Aiolfi, Klaus Moosmayer, and Scarlet Wannenwetsch

Image Credit | Lucas George Wendt

On 14 November 2022 the Business Twenty (B20) presented its policy recommendations to the G20 at a summit in Bali, Indonesia. The B20 is the official business voice that communicates with the G20, a strategic multilateral platform connecting the world’s major developed and emerging economies.

“Beyond the ‘Win-Win’: Creating Shared Value Requires Ethical Frameworks” by Gastón de los Reyes, Jr., Markus Scholz, & N. Craig Smith. (Vol. 59/2) 2017.

G20 members represent more than 80 percent of world GDP, 75 percent of international trade and 60 percent of the world population. It was established in 1999, initially to convene finance ministers and central bank governors. It has evolved into a yearly summit involving the heads of state of member countries. The B20 formulates and presents policy recommendations on designated issues to the G20 on an annual basis.

The summit was an auspicious event, with many prominent government and business leaders present. Given his recent acquisition of Twitter, it was to be expected that the presence of Elon Musk as keynote speaker would steal the limelight. In a way, the issues highlighted by the Twitter transaction – privacy, free speech, job security, etc. – provided the perfect backdrop for the recommendations of the B20’s Integrity and Compliance Task Force, which form the focus of this contribution. Musk’s participation turned out to be virtual, and also a bit bizarre because it was via a rather poor phone link and by candlelight, given a power outage in California at the time.

The summit took place in a context where there is an increased focus on environmental, social and governance (ESG) issues. The ESG agenda seems to have overtaken the more traditional corporate social responsibility (CSR) perspective and provides a more holistic approach. It is very difficult to think of any business issue that cannot easily be identified as either an E, S or a G. This can be viewed as both a strength and weakness. Strong because it is holistic, weak because it can dilute focus. If ESG is everything, it can also become nothing.

ESG is driven primarily by the investment community, which also indicates an interesting shift from the moral case to the business case for corporate responsibility. Mainstream investors mostly ignored earlier moral arguments in favour of ESG until the impact of climate change (droughts, floods and fires) and inequality (refugees and political unrest) became tangible business risks. For example, in his 2022 letter to CEOs, Blackrock CEO Larry Fink states that “the tectonic shift towards sustainable investing is still accelerating”, but makes it clear what the driver is: “Make no mistake, the fair pursuit of profit is still what animates markets; and long-term profitability is the measure by which markets will ultimately determine your company’s success”.

Over the last few years there has been a renewed interest in the G of ESG. There is a growing realisation that sound governance and corporate integrity should underpin environmental and social responsibility. This is illustrated by the Agenda for Business Integrity developed by the World Economic Forum’s Global Future Council on Transparency and Anti-Corruption. There is a need to move beyond compliance and to apply behavioural techniques to strengthen corporate culture. In addition, technology (specifically frontier technology) and collective action are both required to increase scale and impact.

Although not addressed directly by the World Economic Forum’s agenda, corporate reporting is also critical. Over the last few years we have witnessed an almost frenetic consolidation of sustainability reporting standards, and the general consensus seems to be that the future lies in the global baseline proposed by the International Sustainability Standards Board (ISSB). This is also acknowledged in the B20 Communique. The Global Reporting Initiative (GRI), which was seen as the leading standard setter in sustainability reporting for decades, remains an important player but seems to have been left behind in the process to establish the ISSB.

The B20 has a number of task forces, including the Integrity and Compliance Task Force, comprising representatives from the international business community. There are also network partners, including the Basel Institute on Governance, Business at OECD, International Chamber of Commerce, International Federation of Accountants, the Institute of Internal Auditors and the World Economic Forum. Examples of companies represented on the task force are Deloitte, Google, GSK, Mastercard, Novartis, Siemens and the World Bank Group. While the activities of the task force are not exactly the same from year to year, the typical process is to prepare a document with policy recommendations, developed through a consultative process, that is then submitted for inclusion in the overall B20 document and eventually presented to the G20 as part of the formal B20 Communique.

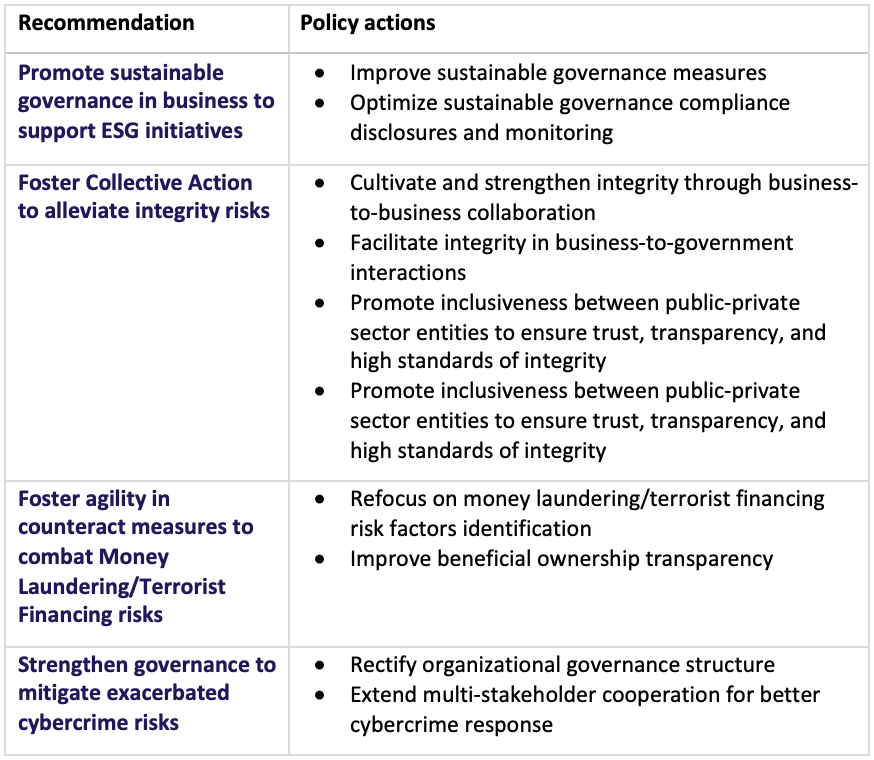

The core recommendations of the most recent Integrity and Compliance task force focused on sustainable governance to support ESG initiatives, collective action to alleviate integrity risks and measures to address risks associated with money laundering, terrorist financing and cybercrime. The recommendations are summarized in the table below.

Table 1: B20 Recommendations and Policy Actions

The traditional way to measure impact of the B20 recommendations is to measure uptake by the G20. According to research performed by the Basel Institute of Governance, the results are mixed, with most progress at high level recommendations, but very little at the country level: “One type of recommendation that has seen very little uptake by the G20 are those that call for specific actions and engagement with the private sector either at the G20 or country level”.

This is not a surprise. The G20 comprises diverse nations, incorporating developed and emerging economies, and with one member – the European Union – comprising 27 member states. Recommendations at the B20 level are mostly generic and might not always take into account that some countries might have regulations in place already and that for others it might not be a short-term priority, especially because host country bias often results in at least some of the recommendations being aimed at domestic agendas. Finally, uptake in the form of eventual regulation and implementation is very complex to track over time. This is particularly relevant for the European Union, where policy decisions have to be transposed into law by individual member countries. In a nutshell, the traditional “top-down” approach is to track recommendations from the B20, through the G20 Communique, and then to follow 46 different countries on a multi-year level, further broken down in terms of government departments and relevant industry initiatives.

We suggest that there is another way in which impact can be achieved and measured. This is not presented as an alternative but rather a complementary approach. This bottom-up approach requires us to view the B20 recommendations as a framework for action, rather than a wish list of policy recommendations. The United Nations Sustainable Development Goals (SDGs) provide an interesting example. The 17 SDGs were adopted by governments as a roadmap to sustainability. The SDGs are accompanied by 169 targets to track country level progress until 2030. However, many companies have aligned their sustainability strategies with the SDGs in order to demonstrate and measure support for the SDGs. Some believe that the achievement of the goals will not be possible without significant backing from the private sector, which includes both companies and investors. In fact, the SDGs also inform the B20 recommendations, with the most important links to Integrity and Compliance being goal 16 (peace, justice and strong institutions). This approach was alluded to by the report of the Basel Institute on Corporate Governance in 2020: “[T]he B20 anti-corruption task force recommendations remain important even if they do not appear in the G20’s work. They provide ideas and inspiration that can also be picked up by others”.

The bottom-up approach starts with companies and what they do, and in addition how they report on what they do. We make the assumption that the B20 will only make recommendations that they believe will be in the interest of the global business community, and that this community will therefore be inclined to take voluntary action. It is interesting to note that the long-term trend of the B20 task force has been to move away from recommendations that require hard regulation. The first two recommendations of the 2022 cycle (sustainable governance and collective action) are more closely aligned with voluntary corporate action, to a large extent dependent on responsible corporate governance and ethical leadership.

We believe that the B20 recommendations can therefore also be viewed as a framework for action. This is not a standards framework (like the ISO standards) but rather a flexible, non-certifiable framework that will allow companies to introduce materiality filters and select areas where they believe they are either at risk, where they can make the biggest contributions or indeed where there are the most opportunities.

And finally, measuring impact requires metrics. The emerging global baseline for sustainability reporting can play a big role. The first standards issued by the ISSB have been in the climate space, but if future metrics for integrity and compliance could be aligned with the B20 recommendations, in addition to other global initiatives, this could become very helpful for all stakeholders.

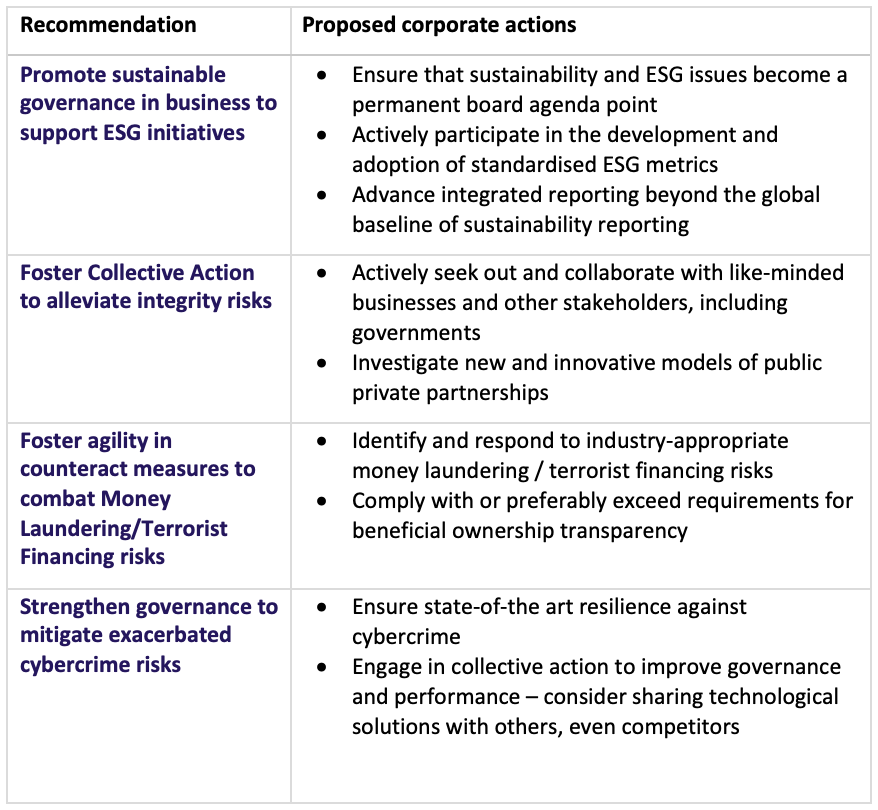

With reference to the core recommendations, the table below provides an initial list of corporate actions that could support the B20 recommendations.

Table 2: B20 Recommendations and Proposed Corporate Actions

Compliance and integrity have always been priorities and a challenge for business to maximize value creation whilst achieving long-term sustainability and legitimacy. Amidst a constantly changing and dynamic environment, embedding and integrating compliance and integrity at the core of business are now more critical than ever for business success. By taking the initiative through innovative voluntary actions, the private sector can make an important contribution beyond its own performance. We believe that the B20 integrity and compliance recommendations provide an important framework for action to support the G in ESG and to move the whole agenda forward.