California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Anish Purkayastha and Igor Filatotchev

Image Credit | Max van den Oetelaar

Financial capital is the critical resource for the growth of any firm. It allows executives to take many strategic initiatives such as fund new projects, invest into differentiation strategy, and expand into new markets. With a rapid globalization of capital markets, the key decision that any CEO / CFO need to take is what would be the most suitable equity market to raise the capital. There was a time when most of the firms used to look only at the domestic equity market as location for raising equity capital. The foreign equity market was off-limit due to various reasons such as difference in corporate governance norms and rules, preference of foreign investors for their domestic firms, complication of taxation across the borders, and fear of the unknown. But over a period of time, foreign equity market became a valuable alternative. There are multiple benefits attached to cross-listing namely improving liquidity, greater analyst coverage, broadening shareholder base, strengthening corporate governance, and access to additional capital.

“Measuring and Disclosing Corporate Valuations of Impacts and Dependencies on Nature” by Jakki Mohr and Carmen Thissen. (Vol. 65/1) 2022.

So, it is a classical dilemma between staying within the domestic financial market or raising capital from foreign stock market. To help CEO / CFO to take that decision, we split this dilemma into two interlinked strategic decisions – first, whether to cross-list in a foreign equity market and if yes, second, which foreign equity market is the most suitable one.

In the context of cross-listing, Depositary Receipts (DRs) present a well-developed mechanism for international equity portfolio construction and trading. Over the years, the growth of the DR offering has given investors convenient access to a broad range of firms across multiple foreign countries. When diversifying globally, investors face settlement, currency conversion, and unfamiliar market practices. But DRs can help them overcome these challenges as they allow institutional investors to access international companies. In fact, DRs are also used by wealth management and individual retail investors.

To illustrate, DR issuers raised a total of $38 billion of equity capital in 2021.1 During that time, 52 new sponsored (Sponsored DRs are issued by one depositary bank appointed by a company i.e., issuer under a deposit agreement service contract) DR programs were established, as issuers continued to tap into global markets via DR programs listed on the NYSE, Nasdaq, and LSE, as well as through OTC programs.2 The total value of DR programs traded by exchange was $8.3 trillion, the total volume was 297 billion shares, and the total number of programs was 2085.3 As per S&P ADR Composite Index (as on 31st August, 2023) which tracks all American DRs trading on the NYSE, NYSE American, and Nasdaq, (subject to minimum size and liquidity requirement), P/E (trailing) value is 12.59 based on 354 firms from 34 different countries. Though this indicator is relatively less compared to P/E (trailing) value of S&P 500 which is 21.53, there is no slowdown in launching new DR programs specially from the emerging market firms.

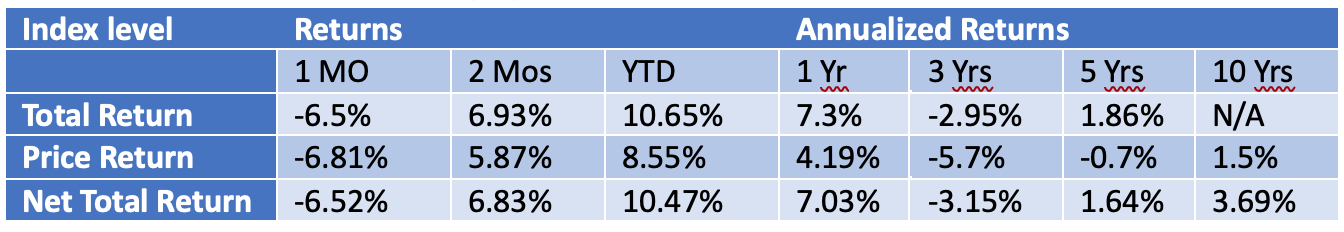

DRs offered by the emerging market firms remains an important component of the growth of cross-listing in the developed market like USA, UK, and some of the Western European equity markets. Despite volatility in the international and domestic U.S. markets, institutional investors in the USA have increased their international equity fund holdings in the first quarter of 2022 with positive flows into both active and passive strategies, including $16 billion invested in diversified emerging market funds. Regionally, the largest number of programs originate from Asia, with China and Hong Kong representing 16% of all programs globally, followed by India with 8%.4 Overall, DR issuers in Asia raised the greatest amount of capital with 64% of the total in 2021. Though short-term performance remains challenging (as they are subject to short-term market volatility), long-term return of S&P Emerging ADR Index as on 31st August, 2023 remains quite impressive (Table 1).

Table 1: Performance of S&P Emerging ADR Index5

In this context of an increasing trend in the popularity of DRs as medium for cross-listing, we intend to provide both understanding and quantitative guideline to the executives specially CEOs and CFOs on the benefits / costs of raising financial capital from the foreign market and a series of considerations that are important to take a well-judged decision.

We analyze6 valuation of 190 Indian firms over 17 years that are cross-listed across five different foreign equity locations (USA, UK, Luxembourg, Singapore, and UAE). Our analysis indicates multiple findings of interest for the executives specially in the firms based out of emerging markets.

First, we find an interesting trade-off when a firm cross-list in the foreign equity market. At the one hand, there is a strong demand for foreign equity offerings from the emerging market firms as part of portfolio diversification strategy of the developed market institutional and retail investors. On the other hand, these equity offerings face difficulty to get positive valuation, as there is significant home bias of foreign investors. So, CEO/CFO of these firms need to compare the benefits and costs of cross-listing based on multiple factors (Take away 1).

Take away 1: CEOs/CFOs need to compare the benefits and costs of cross-listing based on multiple factors.

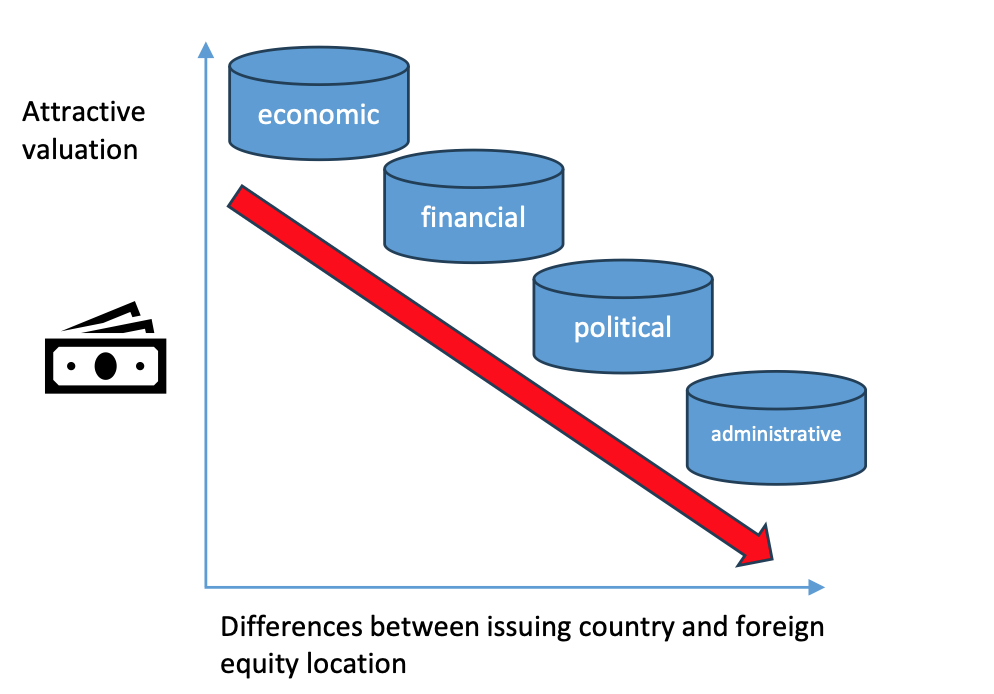

Second, the key driving factors of getting attractive valuation in the foreign equity market is dependent on four distinct differences between the country of origin of the equity offering firm and cross-listing location. First in the list are the economic characteristics which indicate economic development and macroeconomic differences between the firm’s home and host countries. Second factor is financial differences which is dependent on different level of development of the financial sector of two locations. Third factor that we find is the political factor which is based on political stability, democracy, and trade bloc membership differences of two locations. The fourth and last factor that we find is the administrative distance, which is based on prior colonial ties, similarity of spoken languages, dominant religion, and legal system. So, CEO/CFO of these firms need to consider the differences in all four dimensions so that they choose the appropriate foreign equity market location based on data and analysis (Take away 2).

Take away 2: Need to analyze multi-dimensional (economic, financial, political, and administrative) differences between issuing country and listing location.

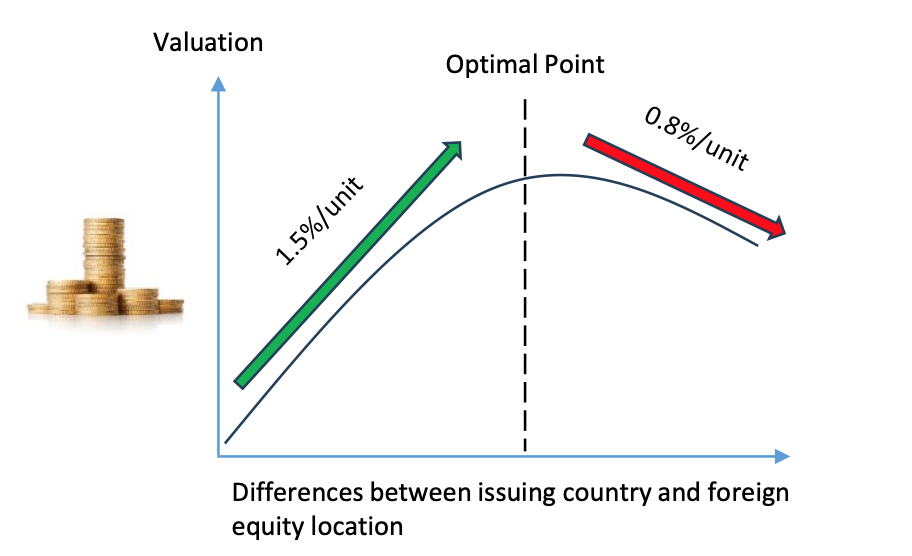

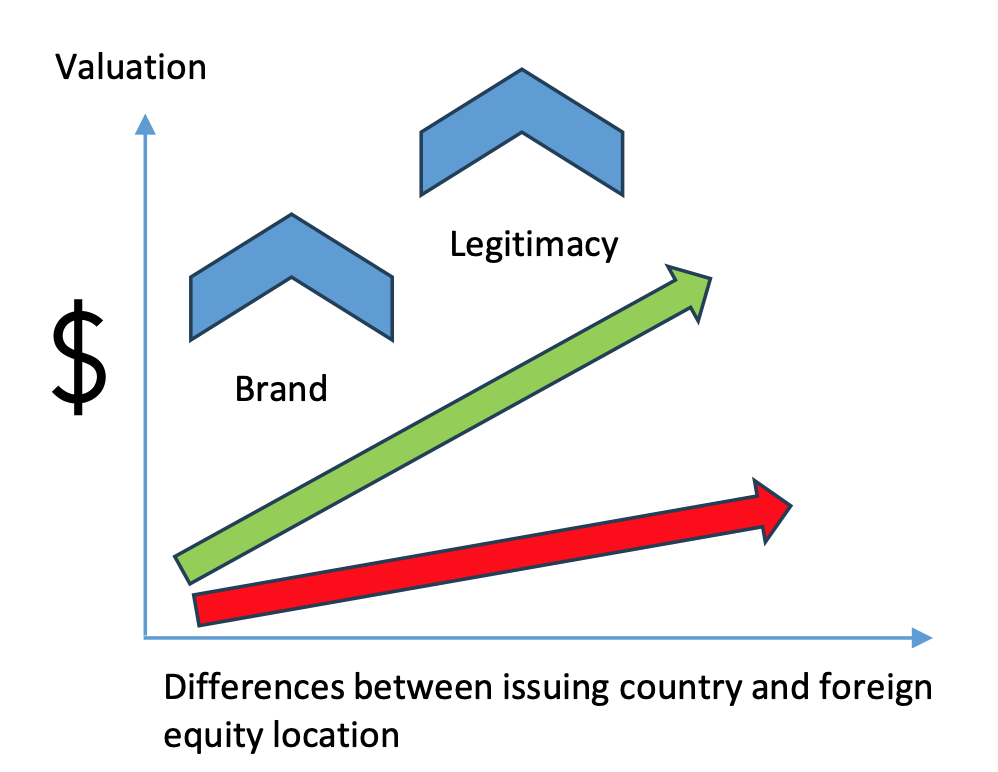

Third, we also calculate the effect of difference across four dimensions and their effect on the valuation of cross-listed firm. Our empirical analysis indicates that the consolidated effect of the difference in all four dimensions between equity issuing country and country of foreign listing improves valuation of at foreign equity market by 1.5%. We also find that beyond a threshold value of the difference, valuation at foreign equity market starts reducing at 0.085% for every additional unit of the difference. Therefore, CEO / CFO need to develop understanding when the difference between home country characteristics and foreign equity location becomes ‘bridge too far’ (Take away 3).

Take away 3: Need to identity optimal point of difference between home country and foreign equity location characteristics.

Fourth, we also explore what CEO/CFO could do improve the valuation of their equity offering in the foreign location, in addition to carefully choosing the cross-listing location,. One such strategy is expanding into the foreign product market beforehand so that local investors and analysts are familiar with the brand identity of the firm. Another approach could be listing the firm in the domestic equity market for some considerable duration. It helps to learn regulatory norms and creates legitimacy when the firm eventually cross-lists in the foreign equity market (Take away 4).

Take away 4: Identify alternative levers that improves brand identity and legitimacy.

Traditionally, executives have considered internationalization strategy in product and capital markets as two separate strategy domains. By focusing on the impact of the distance between home country and foreign equity location on the firm’s valuations in foreign markets, CEO and CFO can develop greater understanding on the information spillover effects between product and factor markets as they are interlinked. Financial capital is the fuel for growth of the firm and hence, senior executives need to carefully choose the foreign equity location that will help to get favorable valuations and fits with firm’s strategic position.

BNY DR Website, data as of July 15, 2022, www.adrbnymellon.com

Bloomberg, as of December 31, 2021

The core idea of this proposal is motivated by a recent publication in the academic journal - Management International Review