California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Frederik Dahlmann, Jens K. Roehrich, and Stephen Brammer

Image Credit | Chris LeBoutillier

Deadly wildfires on the islands of Rhodes and Maui, hail storms that sent ice flowing through the streets in Italy, and a heatwave in the United States that may have killed as many as 300 people in the city of Phoenix as temperatures topped 43C for 54 days – the extreme weather patterns that have ravaged the world this year are a stark reminder of the urgent need to respond to global climate change. In fact, 2023 is almost certainly going be the hottest year ever recorded (EU Copernicus, 2023).

“The Future of Global Supply Chains in a Post-COVID-19 World” by Rajat Panwar, Jonatan Pinkse, & Valentina De Marchi

“Sleepwalking into Catastrophe: Cognitive Biases and Corporate Climate Change Inertia” by Daina Mazutis & Anna Eckardt

Firms have long faced pressure to play their part by measuring and disclosing their corporate carbon footprint to investors and the wider public (Berkey and Orts, 2021). These have typically been divided into Scope 1 emissions – Green House Gases (GHG) a firm creates itself, for example, from its industrial combustion processes or by using fossil fuel powered vehicles – and Scope 2 emissions, which are produced on its behalf when it buys energy to electrify, heat or cool its buildings and plants.

Now there are growing calls for firms to do the same for greenhouse gas emissions occurring up- and downstream in their supply chains (Haski-Leventhal et al., 2021; Villena and Dhanorkar, 2022). The number of firms currently disclosing these Scope 3 emissions is still comparatively low (CDP, 2022). After all, the process is entirely voluntary (Hoffman, 2005) for now but may become mandatory in the USA if a proposed amendment is adopted (SEC, 2022). Elsewhere, Scope 3 emissions disclosure is already included in its latest EU Corporate Sustainable Reporting Directive (CSRD) (EU, 2022).

Even so, Scope 3 emissions disclosure is fraught with ambiguity and complexity (Caro et al., 2013). Accurately reporting the emissions data for 15 different business activities across the lifecycle of a product, as well as for employee travel and commuting, is a time-consuming and challenging task (GHG Protocol). On top of this, many firms fear the arduous process could backfire and lead to claims of greenwashing if disclosing Scope 3 emissions produces unfavorable new insights on the scale of their total environmental impacts compared to their smaller direct carbon footprints (Andrus et al., 2023).

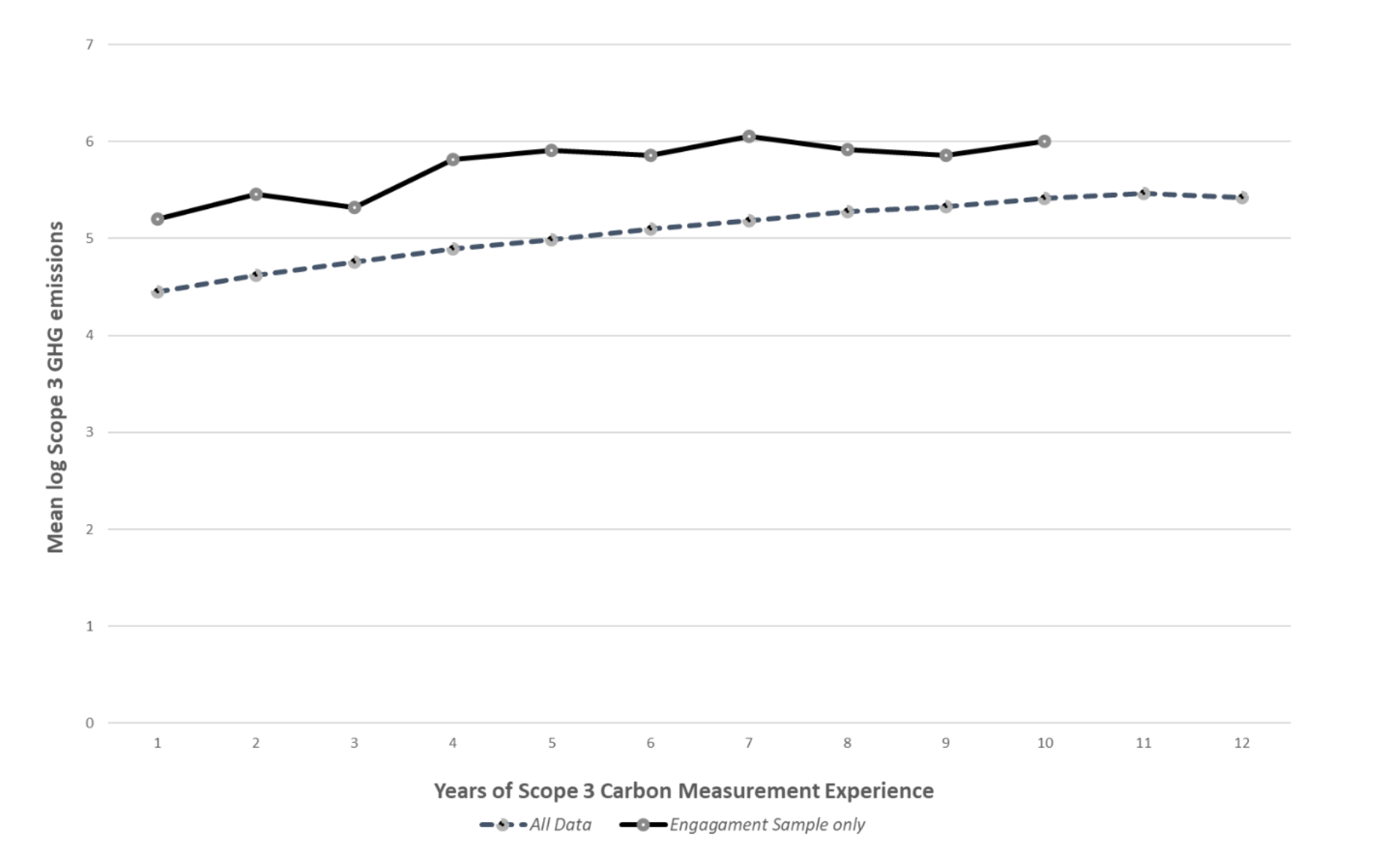

Indeed, drawing on large-scale longitudinal data from firms based in different countries and industries, our in-depth research suggests that after firms begin the process of measuring their Scope 3 emissions, their emissions disclosed to the public increase year-on-year, even when controlling for firm growth (Dahlmann et al., 2023). In addition to many well-known biases deterring firms from taking climate actions (Mazoutis and Eckhardt, 2017), the risk of a subsequent backlash from activists and investors thus creates a potentially strong deterrent for other firms to follow suit. Based on our rich data insights, we developed a framework to aid managers and firms’ understanding of the implications of engaging with supply chain partners when seeking to measure and manage Scope 3 emissions.

Initial reporting of Scope 3 emissions leads to an increase in emissions: This is why firms need to understand the organizing-performing paradox.

Yet, there are good reasons for why we should expect Scope 3 emissions to increase on a yearly basis, at least for the initial years that firms disclose their emissions. As they begin measuring their indirect emissions on an annual basis, the efforts invested in providing a more accurate picture is likely to reveal exactly that – a larger figure summarizing GHG emissions from all elements covered under this particular but wide-ranging scope.

While many firms initially rely on own estimates or widely available conversion tables to provide Scope 3 emissions data, our in-depth research shows that over time they are likely to move towards more accurate figures based on data directly obtained from their suppliers and customers (Blanco, 2021).

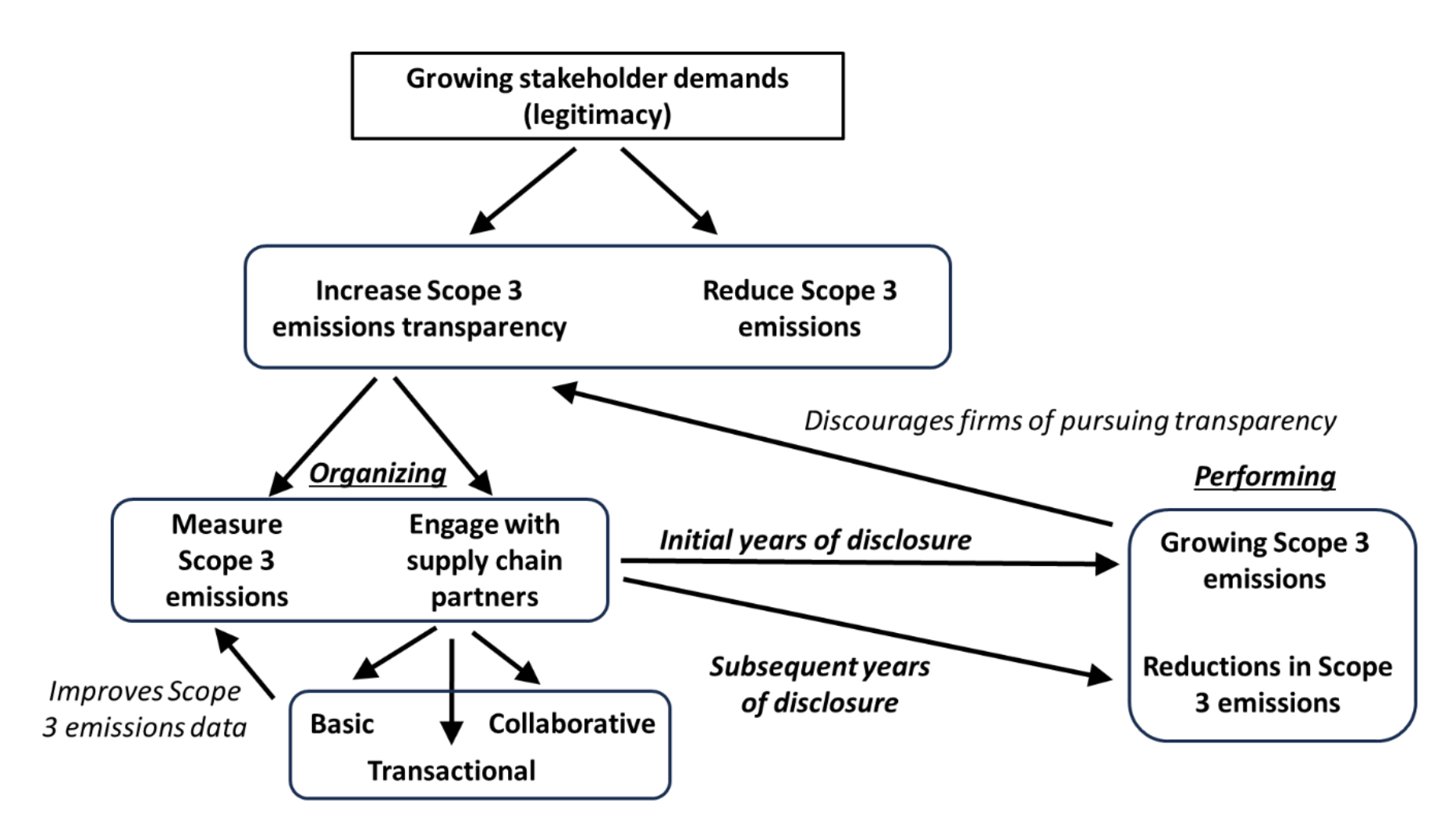

To achieve this, firms employ a variety of formal and informal processes of collecting such data from their different supply chain partners (e.g., customer, suppliers, sub-suppliers). In previous research, we characterize such engagement processes as basic, transactional, and collaborative, depending on the depth and breadth of interactions with supply chain partners regarding climate change data and information (Dahlmann and Roehrich, 2019).

The transactional form of engagement, for example, includes firms requesting emissions data during tender stages and later demanding annual performance improvements by enforcing this through their supply contracts and other procurement policies. In other contexts, firms draw on more collaborative forms of engagement involving more supportive supplier training and development courses, briefings, summits, and award ceremonies to identify joint development and innovation projects (Dahlmann and Roehrich, 2019). The Transform to Net Zero initiative, for example, illustrates how firms from different industries can work together on taking climate action, especially impacts from their supply chains, through open and innovative forms of engagement.

As these vendors and buyers begin to up their game in terms of more accurately accounting for their own Scope 1 and 2 emissions, the overall effect is that the emissions reported under Scope 3 are equally prone to increase. This is primarily the result of making more comprehensive efforts of measuring such emissions, rather than emissions themselves growing. Therefore, the same investors, analysts, and other stakeholders who originally demanded that these firms disclose their Scope 3 emissions – to better assess their risk exposure and efforts to move towards net zero emissions – may become concerned if they interpret those figures out of context, without recognizing the relative stage of Scope 3 emissions disclosure a firm is in.

However, our research also suggested that after about five to six years of reporting Scope 3 emissions, firms begin to show year-on-year improvements compared to firms that are at an earlier stage in this journey (Figure 1). It turns out that greater experience of Scope 3 emissions disclosure, combined with a broader, more collaborative approach towards engaging suppliers and customers in the process of measuring and reporting GHG emissions data, are also key for driving performance improvements. In fact, both are essential for identifying and implementing technological and organizational changes needed to help eventually reduce Scope 3 emissions.

Figure 1 Mean Scope 3 emissions trends for all firms & firms that engage with customers and suppliers on taking climate action by years of measurement experience

In other words, firms face a “performing-organizing” paradox as a consequence of seeking to achieve different stakeholder goals while managing supply chain challenges (Smith and Lewis, 2011). Specifically, there are tensions between the means and ends involved in satisfying both demands for greater transparency, whose inherent and necessary measurement and engagement processes contribute to initially worsening performance, and actually demonstrating reductions in such Scope 3 emissions for greater legitimacy (Lewis and Smith, 2022); a classic “catch-22”. On one hand, measuring and engaging with supply chain partners initially reveal a larger footprint. But over time, the same are necessary precursors as part of wider experiential learning and organizational transformation processes towards net zero and sustainability more generally (Spicer and Hyatt, 2017).

So, what are the implications for managing Scope 3 GHG emissions, and how should firms handle this paradox? As Figure 2 illustrates, the processes involved in understanding and improving supply chain related impacts from climate change contain multiple steps and decision points. Some of these are complementary in their impacts, but others may create temporary disincentives. Managers need to understand that achieving societal and firm goals of transparency and legitimacy have to be underpinned by different organizational practices and policies which will reinforce each other over time.

Figure 2 The process of managing the Scope 3 emissions

As stakeholders and regulators’ demand for greater Scope 3 greenhouse gas emissions transparency grows, firms must therefore become comfortable with navigating the organizing-performing paradox by anticipating that their best efforts will initially make them look worse if data are considered without reference to their extent of disclosure experience. They should prepare to manage this effectively with clear communications to both internal and external stakeholders.

Equally, analysts, investors, and stakeholder looking from outside the organization onto Scope 3 emissions should take this into account, and avoid comparing Scope 3 emissions footprints from different firms without acknowledging that these may be at different points on this journey. Referencing years of disclosure experience in addition to Scope 3 performance may provide greater transparency and potentially better comparability across different firms.

Finally, firms should remember that their efforts will eventually enable them to demonstrate reductions in emissions, especially if they are calculated as changes over time rather than static footprints.

We don’t yet know whether it is possible to speed up the process depicted in Figure 2, so firms do not have to wait for five to six years before emissions are likely to fall. However, firms may be able to accelerate the wider transition towards sustainability by sharing the insights they have gained from measuring and reducing their own footprints.

It is also likely that firms will experience similar tensions in other complex and ambiguous sustainability areas of their supply chains, such as the CDP’s new annual and voluntary survey on firms’ plastic waste (CDP, 2023). If so, the lessons learned on Scope 3 emissions should help firms to manage their own and stakeholders’ expectations accordingly.

Climate change poses significant and urgent challenges for business and society. Substantially reducing both direct and indirect GHG emissions is essential for meeting the climate targets of the Paris Agreement and avoid large-scale negative consequences for our economies and society. While initiating changes take time and substantial efforts, firms should see them as a natural part of improving their organizational performance, reducing operational risks, and playing their role in addressing complex societal challenges (Kano et al., 2022; Panwar et al., 2022). Managing supply chain related Scope 3 emissions may be paradoxical but becoming comfortable with these tensions is key to achieving greater sustainability generally (Carmine and De Marchi, 2022).