California Management Review

California Management Review is a premier academic management journal published at UC Berkeley

by Feng Li

Image Credit | Rodion Kutsaiev

The notion of platforms isn’t novel, yet digital platforms have become the dominant business models across various industries. Today, many of the world’s most valuable companies are platform-based, deriving their success from disrupting conventional businesses and innovating new products and services in emerging areas.1

“Managing Multi-Sided Platforms: Platform Origins and Go-to-Market Strategy” By David J. Teece, Asta Pundziene, Sohvi Heaton, & Maaja Vadi

Digital platforms are not exclusive to tech giants or digital startups. Companies in established sectors, such as banking, automotive, pharmaceuticals, airlines, and retail, are increasingly leveraging digital platforms to transform their operations and industries, with many already delivering remarkable results.2

Digital platforms are fundamentally reshaping strategy and competition. Unlike traditional manufacturing or product-centric organizations, the unique attributes of platforms, like network effects and winner-takes-all market dynamics, create a fiercely competitive environment, making it particularly challenging when competing against platform leaders with formidable capabilities and resources and dominant market positions.3

This study delves into critical questions: What are the main strategies used by platforms to gain market dominance? How do emerging platforms challenge and overtake established ones? Under what conditions are these strategies successful? Addressing these questions is essential for business leaders, entrepreneurs, and policymakers, and they constitute the central focus of this research.

Platforms are firms ‘that facilitate transactions and govern interactions between two or more distinct user groups who are connected via an indirect network’.4 The digital foundation of most dominant platforms today leads to their frequent identification as digital platforms. In the past two decades, a substantial body of research has emerged, examining these platforms from both strategic and operational perspectives. For many scholars and business leaders, the emergence of digital platforms is viewed as a paradigm shift, as traditional models of vertically integrated firms with hierarchical supply chains are increasingly replaced by dynamic groups of independent partners working together in an ecosystem to deliver integrated products and services in a growing number of sectors.5

Operationally, most digital platforms do not take ownership of products or production processes. Compared with traditional manufacturing or product platforms, digital platforms enjoy significant competitive advantages. They can introduce new transaction mechanisms more rapidly and at much lower cost; provide access to new capabilities that may be too expensive or time-consuming to build within a firm; scale much faster than an individual business; and enable both high variety and high capacity to evolve simultaneously. The cost-benefit of imitation, incremental improvement, supply chain flexibility and resilience, executional capability and operational excellence also differs significantly from traditional firms.6

However, several gaps still exist in our understanding of platforms and the dynamic competition between them. For example, although digital platforms operate in a setting that calls for highly interdependent decisions, many studies thus far have focused on single design parameters, such as how a new platform feature attracts users, or which mechanism is effective for matching different user groups in a platform. While a growing body of work examines the experience of successful platforms from a small number of industries primarily in developed economies, much less is known about how and why dominant platforms get displaced in different markets, and how such displacements are different from traditional technological disruptions. Importantly, digital technologies enable dominant platforms to identify emerging trends easily and facilitate continuous updating of services, business models and operations, and some established platforms also increasingly envelope adjacent platforms through acquisitions or organic growth. Such capabilities by the dominant platforms have made it harder for new entrants to survive and grow. Yet innovative new platforms continue to emerge and prosper in both developed and emerging economies in a growing number of sectors. To succeed in platform competition, essential questions must be asked: Which approaches are effective, and how are they incorporated into the strategy and operations of these platforms?

This paper is informed by two strands of research with some of the most successful digital platforms in the world. First, a longitudinal study of established global digital champions, including Amazon, Google, Uber, Alibaba, JD.Com and Didi Chuxing, supplemented by further case studies of some once dominant digital platforms that have stagnated, or experienced major setbacks, including Yahoo, eBay, Groupon and Baidu. Second, exploratory case studies of emerging digital champions including Slack and VMWare, and a number of other platform leaders that are yet to become household names, including Imagen, a leading video storage platform from the UK; and Xero, a successful cloud-based accounting platform for small businesses from New Zealand.

Data is primarily gathered through semi-structured interviews with senior and divisional level business leaders, supplemented by comprehensive secondary and archival data from both public and private sources. Ongoing dialogues are maintained with some of the business leaders to ensure data is continuously updated.

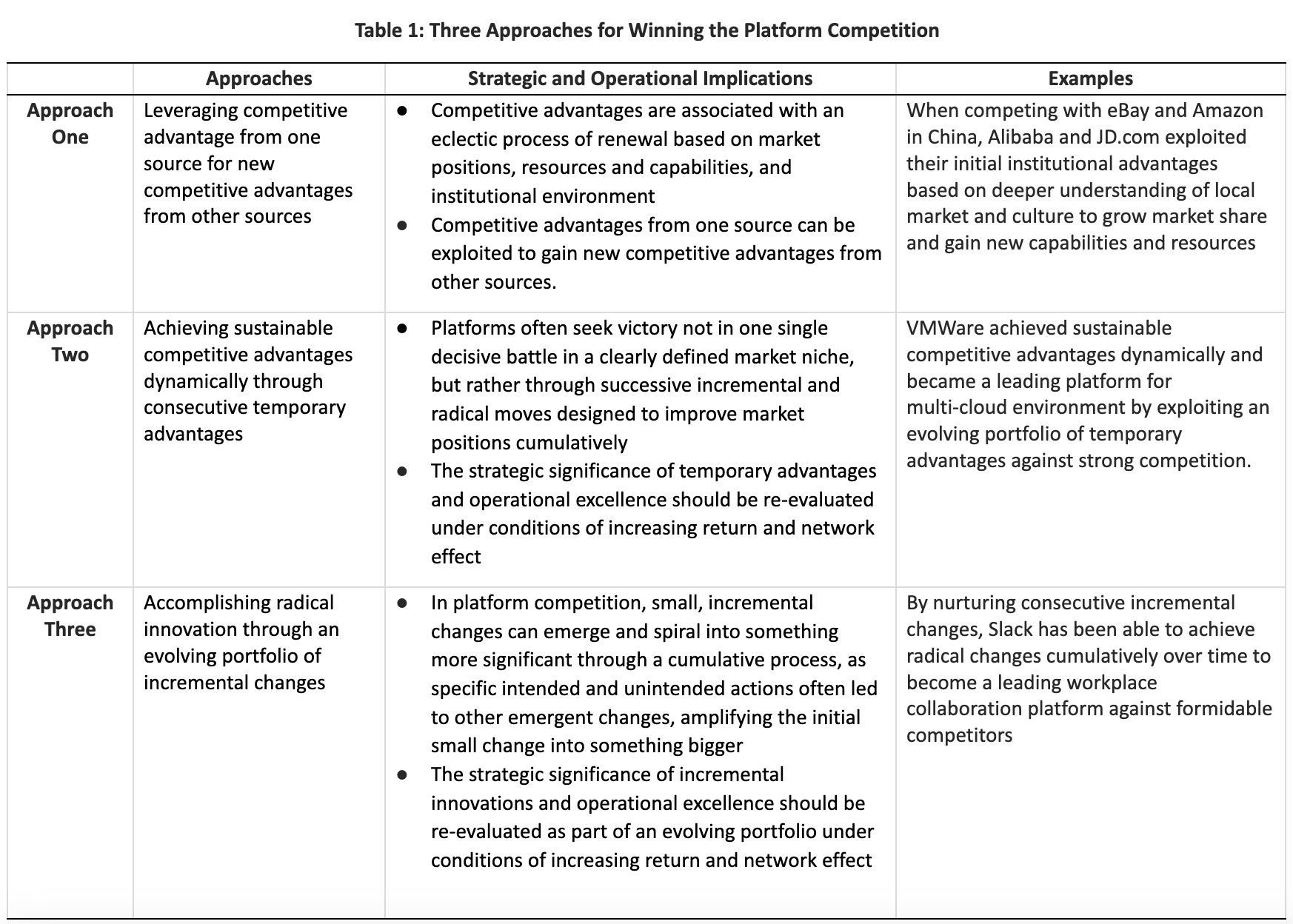

These case studies have unveiled three fundamental approaches that have been effectively deployed in their quest for market leadership. Importantly, these approaches have not only been deployed by platform leaders to maintain their market dominance in both established fields and emerging area, but also offered viable pathways for new or weaker platforms to survive and grow when facing platform leaders with superior resources and capabilities and dominant market positions (Table 1).

Approach One: Leveraging competitive advantages from one source for new competitive advantages from other sources

Strategic management is dominated by three complimentary paradigms, namely, the resource-based view, the industry-based view, and the institution-based view. Competitive advantages can be derived from a firm’s resource and capability, its market position, or its institutional environment. Since few firms possess competitive advantages from all sources in every market, it leaves opportunities open for other players to survive and grow. This allows some weaker firms to build on their unique competitive advantages from one source to gain new competitive advantages from other sources.

In platform competition, the network effect and winner-takes-all dynamics can significantly enhance such a strategy. A competitive advantage, once established, often proliferates more rapidly than in traditional firms, creating new strengths through cumulative processes. In large emerging markets, some native digital platforms have effectively leveraged their deep understanding of local culture and markets to compete against global platforms with superior resources and capabilities. By tailoring products and services more closely to local needs, these platforms can achieve closer institutional fit in home-markets. This allows them to initially survive, then grow market share and develop new resources and capabilities through imitation, product and service refinements, supply chain flexibility, and other operational excellence. These efforts can eventually trigger increasing returns and network effects, enabling these platforms to build new competitive advantages over time to challenge dominant players.

This pattern is evident in the success of some native Chinese digital platforms against American giants in China, with similar trends observed in India, Southeast Asia, South America, and Africa. Examples include Alibaba and JD.com competing with eBay and Amazon in e-commerce in China, Flipkart against Amazon in India, and Didi Chuxing and Grab challenging Uber in ride-hailing in China and Southeast Asia.

Similarly, in developed economies, some emerging digital platforms leverage niche competitive advantages to outperform dominant platforms. Slack exemplifies this, starting as a specialized workplace collaboration tool that quickly attracted a core user base with its standout product. By integrating seamlessly with third-party applications and forming strategic partnerships with specialists like Zoom and Asana, Slack evolved from a chat software into a comprehensive workplace collaboration platform, effectively competing with dominant digital platforms for the workplace.

Slack’s approach has enabled diverse user organizations to efficiently organize their internal processes and external activities. This includes Xero, a cloud-based accounting software provider for small businesses from New Zealand, and Starling Bank, a digital challenger neo-bank in the UK. Both have utilized Slack to streamline their operations in ways their larger incumbents often struggle to replicate.

This strategy has also been employed by VMware, a leader in multi-cloud environment, and Imagen, a top video storage management platform. Both have successfully built on their superior products to grow market share and capabilities to compete effectively against both established and emerging platforms.

This strategy underscores the path-dependent nature of competitive advantages in platform competition. It illustrates how smaller platforms can leverage initial competitive advantages from one source to develop further advantages from other sources, capitalizing on network effects and increasing returns to scale. Key measures such as product innovation, incremental improvement, executional capabilities, and operational excellence are crucial in maximizing the potential of any competitive edge. This approach provides a viable pathway for smaller platforms to survive and grow amidst dominant competitors in both developed and emerging economies.

Approach Two: Achieving sustainable competitive advantages (SCAs) dynamically through consecutive temporary advantages (TAs)

Fundamentally, strategy is a plan for achieving long-term goals by creating sustainable competitive advantages for a firm. However, in the current volatile business climate, lasting competitive advantages are increasingly scarce.7 Most advantages are temporary or transient, a consequence of rapid competitor actions, counter-responses among rivals, imitation, and frequent internal and external disruptions. Empirical studies show that long-lasting competitive advantages are rare and diminishing in duration, with temporary advantages gaining importance especially in new, emerging, high-tech, or fast-paced markets.8

In platform competition, sustainable competitive advantages are typically gained dynamically through successive temporary advantages. This involves introducing new advantages before competitors can overcome existing ones. As observed in the competition between leading American digital platforms (such as Amazon, eBay, and Uber) and native platforms in large emerging markets (like Alibaba and JD.Com in China, Grab in Southeast Asia, and Flipkart and Ola in India), the strategy for native platforms often starts with imitation and adaptation. They then continuously iterate their products and business models based on emerging intelligence, achieving temporary advantages consecutively.

These competitive advantages are usually transient and quickly matched or even imitated by American platforms. However, the cumulative effect of these small, temporary advantages can eventually trigger increasing returns and network effects. Sustaining and enhancing multiple temporary advantages is key to achieving dynamic and cumulative sustainable advantages. Essential in this process is the role of incremental improvement in maximizing the value of temporary advantages, leading to sustainable competitive advantages dynamically.

This strategy has also been successfully employed by emerging digital champions in developed economies, such as VMware and Slack in the USA and Europe. Despite facing strong competitors, these platforms have thrived in highly competitive markets like multi-cloud environment and workplace collaboration platforms.

This approach underscores a shift in the digital market, highlighting the redefined importance of different types of competitive advantages. Temporary advantages and operational excellence gain growing strategic significance in the context of increasing returns and network effects. It presents another viable strategy for smaller platforms to survive and expand against formidable competitors.

Interestingly, some leading platforms like Amazon and Alibaba are also increasingly adopting this approach to maintain their market leadership, countering disruptors in their core markets.

Approach Three: Accomplishing radical change through an evolving portfolio of incremental innovations

Radical innovations, while impactful, are rare and fraught with risk.9 However, they can be progressively achieved through an evolving portfolio of small-scale changes, interspersed with occasional radical shifts. This strategy not only mitigates the risks associated with radical innovations but also allows for continuous refinement based on real-time market feedback, user insights, and operational data.

For instance, in their early competition with eBay and Amazon in China, Alibaba and JD.com engaged in a relentless cycle of imitation, iteration, and innovation. This process, driven by user feedback and experimentation, allowed them to test and scale new ideas efficiently. As highlighted by a senior Alibaba executive, it enables quick scaling of successful ideas and minimal loss on unsuccessful ones. Over time, these small innovations can accumulate into significant changes.

VMware, a leader in multi-cloud platforms, exemplifies this strategy by continually enhancing its services, allowing seamless integration of various cloud services with private clouds. Through strategic partnerships, VMware offers an expanding array of digital solutions, thriving in a competitive market against formidable competitors.

This approach is also evident in other emerging platforms like Slack, Zoom, and Imagen, and in major users like Starling Bank and Xero. It underscores the evolving significance of different types of innovations in digital markets, highlighting the growing strategic importance of incremental innovations. It provides another viable path for smaller platforms to compete against stronger rivals. It is also increasingly used by leading platforms like Amazon and Alibaba to maintain their market dominance.

These approaches have been successfully deployed by different digital platforms under three typical scenarios.10

“David and Goliath”: In markets dominated by one leading platform, weaker platforms often find niche areas to develop unique competitive advantages to survive and grow. Despite the dominant platform’s significant resources, these smaller platforms often focus on superior products or services tailored for specific market segments that might have been overlooked or deemed unattractive by the dominant player. A classic example is Taobao (part of Alibaba) outcompeting eBay in China’s C2C market. By nurturing an evolving portfolio of incremental innovations and temporary advantages, weaker platforms can gradually improve their market fit and resources to survive and expand.

“Tug of War”: In markets with two or several equally powerful platforms, a land-grab strategy becomes crucial. Some platforms may use penetration pricing to build a large user base, hoping to offset early losses with later revenue streams. Here, operational excellence is vital, as even minor advantages can accumulate and shift the market balance. Uber’s competition with Didi Chuxing in China, Grab in Southeast Asia, Ola in India, and many others in global cities like London exemplify this scenario.

“Empire Building”: Both dominant and weaker platforms use this approach to cement their market leadership. Dominant platforms often form strategic partnerships or invest in support services, transitioning from asset-light to asset-heavy business models to create new barriers (“moat”) to protect their market leadership. This is evident in Amazon’s acquisition of Whole Foods, Alibaba’s investments in the Suning retail chain and Cainiao logistics. These strategies highlight the importance of operational excellence and incremental improvement in sustaining market leadership.

In this section, three insights for business leaders and entrepreneurs are highlighted.

Nonlinear Dynamics in Platform Development: Unlike traditional firms with a linear value chain, digital platforms rely on ecosystems where they don’t own the products or processes. The flexibility and scalability with this approach come with low entry barriers and vulnerability to disruption, as they lack exclusive control over technology or standards. This research highlights the nonlinear dynamics of platform development, where small changes can lead to significant outcomes through cumulative processes.

Strategy Making and Execution in Platform Firms: Traditional linear strategy making and execution are challenged in platform competition. For platform firms, strategy is increasingly formed and recalibrated through execution, based on emerging operational intelligence from within the platform and its external networks. This iterative process is vital in a rapidly changing business environment where both the strategy’s path and destination may frequently change.

Limitations of Traditional Competitive Practices: Platform competition redefines traditional competitive practices focused on direct rivalry and head-on confrontations. Platforms often aim for victory not through a single decisive battle but through successive incremental and radical changes. These gradual improvements help platforms to improve market positions over time, eventually leveraging increasing returns and network effects to succeed. This calls for a greater focus on executional capability and operational excellence in the digital economy.

This paper outlines three approaches used by digital platforms in their quest for market leadership. These strategies not only provide survival and growth paths for smaller platforms competing against more resourceful market leaders, but also help dominant platforms maintain their positions. The need for systematic exploration and validation of these approaches in diverse global contexts is highlighted, offering guidance for business leaders and entrepreneurs across various digital platforms. Future research should focus on three areas:

Empirical studies on platform competition: More empirical research is needed to understand the dynamics of platform competition in both developed and developing economies. The focus should broaden from how successful platforms operate to how they emerge, expand, and compete under various scenarios. The role of transient advantages and incremental improvements, in the context of increasing returns and network effects, deserves deeper exploration.

Platform development in traditional industries: Research should extend beyond the emergence and disruption by digital platforms to include how traditional industries leverage digital platforms for strategic and operational transformation. There is also a need to integrate this with established research in areas like modularity, product-service systems, and servitization.

Global context of platform studies: The empirical context of platform studies should extend beyond a few sectors in developed economies. Many innovative practices in emerging economies like China, India, the Middle East, Africa, and South America are influencing global trends. Systematic studies are required to understand and facilitate the

Cusumano, M. A., D. B. Yoffie and A. Gawer (2019). The Business of Platforms: Strategy in the Age of Digital Competition, Innovation, and Power. NY, USA: HarperCollins

Blumberg, S, Bossert, O, Richter, G & Kürtz, K O (2021) The power of platforms to reshape the business. Mckinsey Digital

Li, F & Shi, X (2021) Four Essential Capabilities for Successful Platform Development. California Management Review)

Rietveld J & Schilling, M. 2020. Platform Competition: A Systematic and Interdisciplinary Review of the Literature. Journal of Management, DOI: 10.1177/0149206320969791

Jacobides, M, Cennamo, C & Gawer, A (2018) Towards a theory of ecosystems. Strategic Management Journal. 39 8): 2255–2276.

Li, F (2022). Sustainable Competitive Advantages via Temporary Advantages: Insights from the Competition between American and Chinese Digital Platforms in China. British Journal of Management. https://doi.org/10.1111/1467-8551.12558

Li (2022) op cit.

Dagnino, G, Picone, P & Ferrigno, G (2020) Temporary Competitive Advantage: A State‐of‐the‐Art Literature Review and Research Directions. International Journal of Management Review. Volume23, Issue1: Pages 85-115

Hopp, C, Antons, D, Kaminski, J & Salge, T O, 2018. The Topic Landscape of Disruption Research—A Call for Consolidation, Reconciliation, and Generalization. Journal of Product Innovation Management 35 (3):458–487

Li, F. (2018). Why Western Digital Firms Have Failed in China. Harvard Business Review, https://hbr.org/2018/08/why-western-digital-firms-have-failed-in-china.