California Management Review

California Management Review is a premier professional management journal for practitioners published at UC Berkeley Haas School of Business.

Mark V. Cannice

Image Credit | Wikimedia Commons

The entrepreneurial journey is often met with unexpected challenges. Today, the volatile political environment has created treacherous new obstacles that entrepreneurs must overcome. A particularly caustic election year in the U.S. has collided with disastrous military conflicts around the world. Despite the direct and indirect difficulties imposed on entrepreneurs by the highly charged political landscape, they continue to ply their craft, pursue their vision, and seek the help and support of venture investors to build a better future we can look forward to.

J. Birkinshaw, A. Zimmermann, and S. Raisch, “How Do Firms Adapt to Discontinuous Change? Bridging the Dynamic Capabilities and Ambidexterity Perspectives,” 58/4 (Summer 2016): 36-58.

To understand and illuminate the challenges that entrepreneurs are facing and the alternative strategies they may pursue in the volatile political environment, this research relies on the insights of venture capitalists (VCs) from the Silicon Valley Region. Silicon Valley VCs have for decades financed and guided the paths that entrepreneurs have taken through multiple environments to build new companies and new industries. In this century alone, entrepreneurs have navigated through an Internet Bubble & Burst, the Great Recession financial crisis, the Pandemic,1 and rampant inflation.2 Still, the current political environment has brought on new challenges that must be surmounted.

Existing literature on the impact of political uncertainty on entrepreneurial efforts provides a valuable lens to view the current environment. Adams et al. (2023)3 found differences in entrepreneurial activity between Scotland and Ireland at the end of the 19th century due to political upheaval within the UK. The authors found that what was called the ‘Home Rule’ period in Ireland appeared to reduce risk tolerance and entrepreneurial efforts. Their article asserted that political uncertainty, the anticipation of change of the ‘rules of the game’, diminished entrepreneurial success during this period. O’Rourke (2007), studying the same phenomenon in late 19th century UK, found political uncertainty slowed the diffusion of innovation.4 Applying a comparable lens, Sohns and Wojcik (2020), researching the Brexit impact on London’s entrepreneurial ecosystem, found that the prospect of institutional change had a direct impact on entrepreneurs’ attitudes.5 With a similar aim, this current study, focused on the Silicon Valley entrepreneurial ecosystem, explores the impact of significant political volatility on entrepreneurial activity.

To best understand the relationship between political uncertainty and entrepreneurial success, I sought the guidance of venture capitalists to weigh in with their views. For this paper, 13 VCs from the Silicon Valley Region provided their rating of the current political environment, their observations on the challenges that startup entrepreneurs are encountering that emanate from the political environment, and their advice on how entrepreneurs can best maneuver through these unique challenges. (The survey for this research was conducted in October 2024). Please see Table 1 for a list of participating venture capitalists for this study. They all agreed to be identified as participants of this study and most provided citable commentary.

Table 1: VC Respondents in this Research on Political Uncertainty’s Impact on Entrepreneurship

| VC Respondent | VC Firm |

|---|---|

| Alex Fries | Digital Twins Capital |

| Bill Reichert | Pegasus Tech Ventures |

| Dag Syrrist | Vision Capital |

| Howard Lee | Founders Equity Partners |

| Jeb Miller | Icon Ventures |

| Kurt Keilhacker | Elementum Ventures |

| Mark Kraynak | Acrew Capital |

| Robert Ackerman | AllegisCyber |

| Robert Ethier | Impact Science Ventures |

| Safa Rashtchy | Think + Ventures |

| Sandy Miller | Institutional Venture Partners |

| Shomit Ghose | Clearvision Ventures |

| Steve Harrick | Institutional Venture Partners |

The VCs participating in the survey collectively judged the current level of political uncertainty at 4/5 (with 5 indicating a high level of uncertainty and 1 a low level of uncertainty). (There exist a number of measures and indexes of uncertainty, for example, the World Uncertainty Index;6 however, they do not directly measure the assessment of venture investors.)

While VCs are notoriously independent on their evaluation of startups and the challenges they face, some common themes did emerge from the venture investors who participated in this study.

Political uncertainty leads to caution among startup investors and less VC investment. For example, Sandy Miller of Institutional Venture Partners commented that “Uncertainty always creates caution in investing markets. So, there could be a chilling effect on private capital availability and the exit market. That said, I don’t think it will be severe.” Likewise, Howard Lee of Founders Equity Partners explained “Political instability will likely dampen M&A activity, reducing acquisition opportunities in certain regions. In regulated sectors like renewable energy, policy shifts—such as reduced incentives—may stifle demand, while currency fluctuations and rising interest rates limit funding and complicate market entry strategies.” Striking a similar chord, Safa Rashtchy of Think + Ventures stated “The political and economic uncertainties make the VC less willing to deploy capital or take risks that they normally take in stable times.” In this same theme, Alex Fries of Digital Twins Capital wrote “The challenges that entrepreneurs are seeing, is that venture capitalists are being extremely cautious with investing until the US elections are over. Venture capitalists are investing in companies that have a certain revenue and are profitable. That way, regardless of who wins the elections, the company will still be around.” Another VC survey respondent who commented under condition of anonymity, acknowledged that due to “policy uncertainty and fundraising uncertainty - many (VCs) are withholding cash until after the election and likely until after the transfer of power.”

Political uncertainty is disrupting startup ecosystems. Sandy Miller of Institutional Venture Partners suggested that “The most obvious concern is the environment in Israel which is an important part of the global technology startup system.” Bob Ackerman of AllegisCyber also confirmed “Geopolitical conflict in the Middle East is adversely affecting the Israeli innovation ecosystem.” Another VC participant warned that “companies which have had any intersection with China or Russia have had to actively dissociate their operations from these countries, and especially from investors with ties to those countries.”

Political uncertainty between nation states is complicating cross border innovation. Bob Ackerman of AllegisCyber specified “Big Power Competition between China and the U.S. (the West) are creating uncertainty around the capitalization of Western Innovation while focusing additional scrutiny on the protection of IP.” However, another VC argued “Middle Eastern and Ukrainian conflicts haven’t affected the US capital markets, as we continue to see through the repeated all-time highs in the equities markets. Thus, startups seem to be remaining largely unaffected by the geopolitical conflict.”

Uncertainty in domestic regulatory and tax regimes is influencing startup entrepreneurs’ decision on where to build their startups. Jeb Miller of Icon Ventures reported seeing “uncertain regulatory, trade, and tax environments.” Howard Lee of Founders Equity Partners detailed “The cost of resources, such as engineering and other talent, is increasingly volatile, with changes in immigration laws further complicating local hiring. In addition, unanticipated regulatory changes can affect the sourcing of raw materials or alter market demand, impacting the cost of goods. Entrepreneurs may feel compelled to relocate headquarters away from politically volatile regions and limit market entries to more stable countries. Geopolitical trade wars can disrupt supply chains, and access to affordable engineering talent in low-cost countries may diminish. Privacy regulations can restrict data collection, while the threat of corruption in international business complicates expansion.” Bob Ackerman of AllegisCyber said “Comments around materially increasing long-term capital gains rates in the US may create uncertainty for would-be entrepreneurs regarding building their next startup in the US as well as investors who would be subject to higher tax rates with a corresponding reduction in their potential returns. Capital and talent are both highly mobile and are drawn to geographies which reduce their risks, enable degrees of creative freedom, and heighten their potential rewards.” Another VC respondent countered (prior to the U.S. elections) “As to the looming US presidential elections, this too does not seem to have had an effect on entrepreneurial sentiment. I think people assume that if Harris wins then the economy continues on its upward trajectory, which is good. If Trump wins, given the tech execs who’ve aligned with him by now, I think people assume that the startup economy will get favorable treatment from Trump, which is also viewed as being good.”

A complex organizational level of political uncertainty is developing from the cross border and domestic levels. To this point, one VC respondent assured “There are so many layers to this issue. At the layer of company culture, there seems to be something of a backlash against DEI and woke. That raises a challenge for founders to figure out if they need to adjust their statement of company values to attract the investment and the talent that they need. At the layer of company strategy, founders need to assess the risks they may face from dramatic shifts in regulations and market sector forces. Some sectors are experiencing significant tailwinds because of the current geopolitical environment. For example, climate tech and decarbonization technologies are receiving substantial government and investment support, but that may not necessarily continue at the same level, depending on politics and economics. Defense technology is also experiencing tremendous tailwinds, both from domestic politics and global conflicts. Similarly, the new wave of AI technologies has been receiving huge support from both government and private sector sources. But at the same time governments domestically and internationally are becoming increasingly pressured to implement regulatory controls over AI, and these regulations could span a very broad swath of sectors.”

A growing individual level of political uncertainty impacts entrepreneurs directly. One corresponding VC observed “Politics have become a no win situation for many. Even avoiding taking a position can be a negative event for some companies. Furthermore, with the potential swing between one party and another in the U.S. and the resultant swings in regulatory regimes (e.g. rule changes, Supreme Court invalidations of prior rule changes) make it hard to plan long-term business strategies.” Another VC respondent argued that entrepreneurs should “Try to avoid taking a public position and avoid situations in which you’ve been put on the spot regarding a political question.” Howard Lee of Founders Equity Partners recommended “A well-managed social media presence is crucial for maintaining control over the company’s message and responding to potential political pressures.”

Table 2: Challenges to Entrepreneurs Due to Political Volatility

| Increased VC caution and ultimately less VC investment |

| Distressed startup ecosystems |

| Nation states’ conflicts and resulting diminished cross border innovation |

| Need for entrepreneurs to reconsider where to locate their startups |

| Global and domestic uncertainty driving organizational levels of political uncertainty |

| Individual level of political uncertainty that restricts entrepreneurial action |

Given the challenges created by high levels of political uncertainty, VCs were asked to share their advice on how entrepreneurs can best navigate the treacherous course to startup success. They offered the following.

Ensure efficient operations that enhance startup performance whatever the level of political uncertainty. Shomit Ghose of Clearvision Ventures reminded “Startups always have to be driven by the mantra of cash-efficiency, whether or not it’s a booming economy. The startup business is just too risky to do otherwise. So I would redouble — retriple? — my advice to focus on business model validations while stewarding every last penny.” Similarly, Jeb Miller of Icon Ventures tells entrepreneurs to “Focus on building to profitable growth and create enduring value.” Sandy Miller of Institutional Venture Partners emphasized “Entrepreneurs are well advised to keep cash in reserves to weather any hiatus in private capital availability.”

Broadening the notion of financial resource management, Dag Syrrist of Vision Capital explained “The only significant difference from now and ‘before’ I think is the amplified impact highly public technology and venture capitalists have in their views with regards to regulation, politics and technical macro trends. Especially, as some early entrants in new markets have such massive capital resources which have an obvious chilling impact for new entrants. It’s less politics per se, and more the capital advantage.”

Diversify geography of operations to counter nation state friction. Alex Fries of Digital Twins Capital contends “Until the election I would recommend not to do any drastic investments. Also, look at international markets sooner rather than later, set up an office or move the HQ. There is a sense of protectionism among certain countries/regions and that may limit the startups later on to sell abroad. Conserve cash and have an AI strategy, otherwise, you will not get funded for a while.” Bob Ackerman of AllegisCyber directed entrepreneurs to “Focus on geographies with geopolitical and financial stability to build their companies. Capital (both human capital and investment capital) are averse to unpredictability and risk without a significant return premium.”

Build optionality into your growth strategies so that your startup can thrive in evolving environments. Bill Reichert of Pegasus Tech Ventures shared “More than ever before, startups need to identify and consider the impact of potential shifts in regulatory policies and cultural forces on their businesses at every level – recruiting and HR, product/market strategy, investor outreach, and global expansion. In some cases, these shifts could open up new opportunities, but in most cases these shifts are likely to be challenges.” Another VC respondent told entrepreneurs to “focus on building a company that works in any environment.” Howard Lee of Founders Equity Partners said “Startups and entrepreneurs should focus on agility, strategic planning, and network-building in navigating the challenges of volatile political environments.” Dr. Lee, continued, saying “Entrepreneurs should also develop contingency plans for core operations, including engineering, R&D, and supply chain, and sales channels, to ensure resilience. Raising additional capital when possible can provide a financial buffer, while diversifying customer bases, supply chains, and sales channels can reduce dependency on any one market. Implementing hedging strategies, particularly for currency fluctuations, can protect against financial instability, and on-going geopolitical risk.” More broadly, Kurt Keilhacker of Elementum Ventures confirmed “Agility is not optional. It must be designed into every strategy.” These investor perspectives on entrepreneurial adaptation are consistent with previous research on firms’ dynamic capabilities and discontinuous change that requires adaptation.7

Finally, monitor political issues, but focus on startup milestones. Safa Rashtchy of Think + Ventures encouraged entrepreneurs to “Acknowledge these risks and show that you are aware of them but you want to look beyond the next few years.” Dag Syrrist of Vision Capital counseled “Don’t worry about what you can’t control, especially for new startups whose product will not be in the market for years.” Mr. Syrrist continued, saying “Ignore the noise, ignore the Twitter feeds, especially ignore the established players – focus on what your goal is, work towards realizing it, and ignore everyone else.” Thus, like Odysseus8 sailing beyond the Sirens – startup entrepreneurs should be aware of the political winds but carefully navigate beyond them to avoid the rocks.

Table 3: Recommended Entrepreneurial Strategies During Political Volatility

| Ensure efficient operations whatever the level of uncertainty. |

| Diversify geography of operations to counter nation state friction. |

| Build optionality into growth strategies of startups that can thrive in evolving environments. |

| Acknowledge political issues but focus on startup milestones. |

Two frameworks for the entrepreneurial impact and response to political uncertainty began to take shape from the collective experience and commentary of the venture capitalists who participated in this research. First, a framework of primary and secondary effects of political uncertainty emerged. For example, in a stepwise manner, political uncertainty first increases the caution of VCs, and this additional caution leads to the secondary effect of VCs reducing new investments. The entrepreneurial strategies recommended by the VCs in this study tended to focus on the secondary effects of the observed political uncertainty with the aim of achieving specific milestones for their portfolio firms. Please see Figure 1 for an initial conception of this framework of relationships.

Figure 1: Primary and Secondary Effects of Political Uncertainty and Recommended Entrepreneurial Strategies

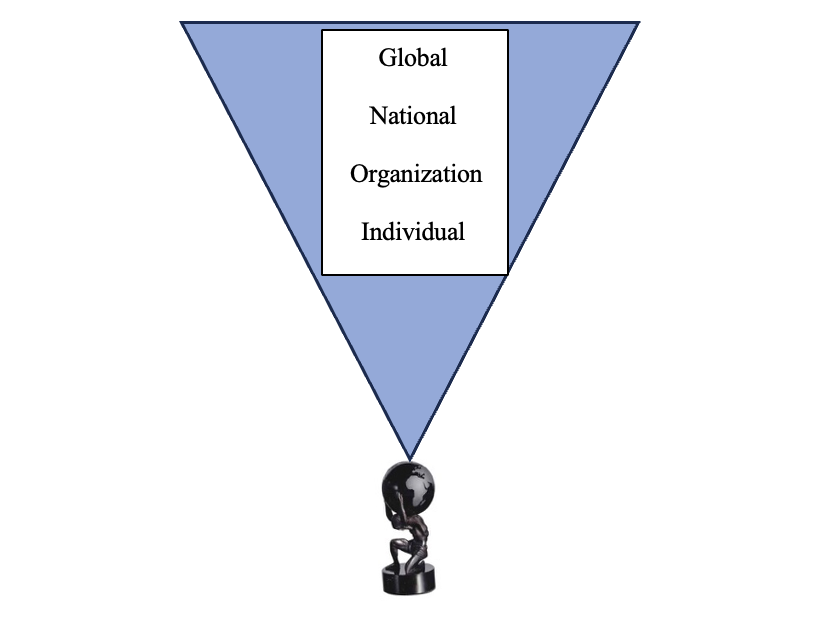

The second framework that emerged from this research is that of the multiple layers or dimensions of political uncertainty that have developed in the current environment. At the highest level is global uncertainty – the friction and conflict between nation states – both active and potential that impacts the startup entrepreneur in terms of shifting restrictions on trade and intellectual property as well as the direct impact on the business ecosystems of those countries directly or indirectly involved in conflicts. At the national level – domestic politics – particularly the recent U.S. elections and their impact on regulatory, tax, and tariff policies, add additional elements of uncertainty. These global and national levels of political uncertainty create an organizational level of uncertainty with respect to the availability of capital, regulatory regimes here and abroad, and social and cultural shifts that envelop the firm. Finally, it is the individual entrepreneur and entrepreneurial team at the nadir of these layers of uncertainty who, like Atlas, must bear the collective weight of the dimensions of political uncertainty.

Figure 2: Dimensions of Political Uncertainty

The entrepreneurial journey is never a straight line. It is fraught with challenges, some expected and addressable with superior execution, and some unexpected that can only be observed and adapted to. Historic levels of political uncertainty have changed the ‘rules of the game’ and created new obstacles for the entrepreneur and the VCs that finance and guide them. Kurt Keilhacker of Elementum Ventures emphasized “Startups will always face dynamics out of their control, but it’s unusual to face so many macro uncertainties simultaneously.” A better understanding of the effects and dimensions of political uncertainty may make them more surmountable by the creative entrepreneurial response.

Valliere, D., and Peterson, R. (2004). “Inflating the Bubble: Examining Dot-Com Investor Behaviour,” Venture Capital, 6(1), 1–22. https://doi.org/10.1080/1369106032000152452

Fairlie, R.W. (2013). “Entrepreneurship, Economic Conditions, and the Great Recession,” Journal of Economics & Management Strategy, 22: 207-231. https://doi.org/10.1111/jems.12017

Cannice, Mark V. (2020). “Entrepreneuring in a Pandemic and Post-Pandemic World: Perspectives of Silicon Valley Venture Capitalists,” California Management Review (Insight – Frontier), August 2020. https://cmr.berkeley.edu/2020/08/entrepreneuring-pandemic/

Cannice, Mark V. (2022). “Entrepreneuring through Inflation: Perspectives of Silicon Valley Venture Capitalists,” Rutgers Business Review, Vol. 7, No. 1, pp. 22 – 29. https://rbr.business.rutgers.edu/article/entrepreneuring-through-inflation-perspectives-silicon-valley-venture-capitalists

Adams, Robin J. C., Gareth Campbell, Christopher Coyle, and John D. Turner (2023). “Business Creation and Political Turmoil: Ireland Versus Scotland Before 1900,” Business History Review 96 (Winter 2022): 709–739. doi:10.1017/S0007680522000885

O’Rourke, Kevin H. (2007). “Culture, Conflict and Cooperation: Irish Dairying before the Great War,” Economic Journal 117, no. 523: 1357–79.

Sohns, Franziska and Wojcik, Dariusz (2020). “The Impact of Brexit on London’s Entrepreneurial Ecosystem: The Case of the FinTech Industry,” EPA: Economy and Space, Vol 52 (8): 1539 – 1559.

Ahir, Hites, Nick Bloom, and Davide Furceri (2024). World Uncertainty Index. https://worlduncertaintyindex.com/data/

Birkinshaw, Julian, Alexander Zimmermann, and Sebastian Raisch (2016). “How Do Firms Adapt to Discontinuous Change? Bridging the Dynamic Capabilities and Ambidexterity Perspectives,” California Management Review, Vol 58/4 (Summer 2016): 36-58. https://cmr.berkeley.edu/search/articleDetail.aspx?article=5825

Homer. The Odyssey (Unknown). London: G.P. Putnam’s sons, 1919.

Spotlight

Sayan Chatterjee

Spotlight

Sayan Chatterjee

Spotlight

Mohammad Rajib Uddin et al.

Spotlight

Mohammad Rajib Uddin et al.