California Management Review

California Management Review is a premier professional management journal for practitioners published at UC Berkeley Haas School of Business.

Donald Potter

Image Credit | ViDi Studio

In today’s dynamic business landscape, understanding customer decision-making is crucial. The Customer Buying Hierarchy (CBH) is a powerful tool for understanding market dynamics and guiding strategic decisions. Based on extensive customer interviews across various industries, this framework identifies four key criteria that customers consistently use in their purchasing decisions: Function, Reliability, Convenience, and Price. These criteria form a hierarchical structure that customers follow to eliminate suppliers until they arrive at a unique choice. The importance of each criterion varies depending on market conditions.

Donald Potter, “Rare Mettle: Gold and Silver Strategies to Succeed in Hostile Markets,” California Management Review, 37/1 (1994): 65-82.

Daniel Potter, “Success Under Fire: Policies to Prosper in Turbulent Times,” California Management Review, 33/2 (1991): 24-38.

This article will describe the criteria of the Customer Buying Hierarchy, demonstrate how it works in customer decision-making and then suggest how it might help a company make better strategic decisions to gain and protect share.

We will use real-world industry data to illustrate the Customer Buying Hierarchy workings in fast growth, moderate growth and slow growth industries. Except for the fast-growing industry example, this data is a few years old and does not represent current industry conditions.

In the complex world of customer behavior, buyers across all segments – whether final customers, channel customers, or those purchasing through distribution channels, rely on four fundamental criteria to evaluate potential suppliers and their products. This set of criteria, we call the Customer Buying Hierarchy, comprises Function, Reliability, Convenience and Price. These four criteria define the value of a product or service. To be effective, and unique, a criterion must be difficult to copy. A criterion that competitors copy no longer can be an effective strategic tool. Let’s review each of these pillars to understand their significance in the purchasing process.

At the core of any purchase decision lies Function – the primary reason a customer seeks out a product or service. Function encompasses the features that directly affect how the customer uses the product. Its specific meaning varies slightly between manufactured products and distribution channels. For manufactured products, Function relates to the product’s operating capability, its suitable environments, and the user’s ability to operate the product effectively. For distribution channels, Function includes the range of product selection offered and the physical presentation of the products for sale.

Function holds paramount importance in the Customer Buying Hierarchy because it serves as the initial gateway in the decision-making process, without which no purchase would occur. Function has its greatest impact in new, fast-growing industries. Here, there are many new customers entering the market and, often, many suppliers offering various versions of the Function of the product. Function is always important, even critical, until some competitor copies the Function of the product. To remain unique, most Functions require legal protection or a strong presence in the customer’s mind.

Reliability refers to a company’s consistency in delivering on its promises, both explicit and implicit, regarding its products and services. Reliability manifests differently across various customer interactions. For manufactured products, Reliability encompasses delivery performance, Functional consistency and stability in the supplier’s market presence. For distribution channels, Reliability pertains to product availability, return policies, and the quality of customer support and problem resolution.

Reliability is a very powerful criterion because it is difficult in the extreme to copy. Reliability must be embedded in a company’s culture and takes years to be recognized by customers.

Convenience reflects the ease with which customers can acquire a product or service. It encompasses the entire purchase journey; from the moment the customer recognizes the need to the point of first product use.

Convenience benefits include advertising to create awareness of the company and its product, differentiation of its product from those of competitors, the location where the sale and delivery take place and any services offered to the customer to find, choose and pay for the product. Once the customer is satisfied that the product has the Function needed and is Reliable, the customer seeks the most convenient source for the product.

Convenience is also difficult to copy. It often implies substantial investments in infrastructure to reduce order cycle time. However, Convenience is always subsidiary to Reliability. A company losing its Reliability will quickly lose its Convenience as well. Still, a company with excellent Convenience has a strong criterion of value for its customers.

Price is the net cash equivalent the customer pays the supplier. It rounds out the product’s expression of value. Price is a multifaceted concept comprising at least three, and usually four, components: the benefit package, the basis (unit) of charge, the list Price for the unit of purchase, and, often, some optional components of Price. These optional components change the effective variable unit Price of the product by using fees, bonuses, payment terms and performance charges.

Interestingly, Price often plays a less significant role than one might expect. In most markets, only a limited sales volume moves based on low Prices alone, and this effect is even more pronounced in slow growing, highly competitive markets. Price is not usually an important criterion over several years because it is so easy for competitors to copy.

In summary, Function is what the product does; Reliability is how consistently the product does it; Convenience is how easy it is to obtain and install; and Price is what it costs. By understanding and leveraging these four criteria of the Customer Buying Hierarchy, companies can better align their offerings with customer expectations, ultimately driving growth and strategic efficiency.

Customers employ a systematic approach to evaluate alternative suppliers, following a specific order of criteria: Function, Reliability, Convenience, and Price. This process, usually iterative, ultimately leads to the choice of a single supplier. The evaluation sequence is crucial in understanding customer preferences and market dynamics.

In the initial pass through the Customer Buying Hierarchy, customers consciously evaluate each criterion. If multiple suppliers meet the minimum requirements across all four criteria, customers repeat the process until a single supplier emerges. Later iterations may involve unconscious evaluations, as customers focus more on differentiating factors such as Reliability Convenience and Price. The same unconscious screen may also apply to Reliability.

The evaluation process is essentially negative, operating as a method of elimination. Customers systematically discard suppliers based on each hierarchical criterion until only one remains. This “last supplier standing” becomes the chosen vendor. In rare cases where multiple suppliers persist, the customer may select a second supplier to fulfill a separate need, such as creating a backup supplier option.

Customer decisions offer valuable insights into both customer needs and supplier offerings. For example, a customer who chooses based on Reliability says that Functional differences among suppliers are not significant enough to be the deciding factor for that customer. A Price-based decision indicates that the customer perceives no meaningful distinctions in Function, Reliability, or Convenience among potential suppliers for that customer’s needs. There may be differences, but they do not create unique value for that customer.

The aggregate of many customer decisions resembles the results of mass voting. The proportion of total purchase volume associated with each criterion reflects its relative importance in overall customer decision-making. For example, if 15% of market purchases are based on Function, while 30% are based on Reliability, the aggregate of customer choices indicates that Reliability is the more critical factor in the industry.

To use this understanding of the Customer Buying Hierarchy, you gather and analyze a representative sample of recent customer decisions. This information will provide a comprehensive picture of market operations and reveal opportunities for strategic advantage.

The Customer Buying Hierarchy guides your plans to gain share and avoid losses. The hierarchy describes your current market strengths and vulnerabilities. It can also help you anticipate how the market is likely to change in the future.

With market evolution, each of the Customer Buying Hierarchy criteria rises or falls in importance depending on competitors’ ability to duplicate competitive benefits. As a market evolves, Function is initially very important. Its value declines as competitors copy unique Functions. Reliability and Convenience then rise in relative importance. These benefits are difficult to copy. They tend to dominate value in industries with average and slow growth. Low Prices tend to have moderate value in industries with average growth and very low value in slow-growing industries.

We will see these tendencies in examples drawn from three industries with varying growth trajectories: one fast-growing, two other industries with average sales growth, and one slow growing. In each case, we will focus on the buying criteria employed by customers changing their allocation of purchases, including customers new to the market and those established customers changing their supplier arrangements.

In the early, fast-growing stage of a market’s development, innovations in the Function criterion lead customer buying decisions. Function innovations often have some form of protection, such as patents, which are difficult for competitors to copy. But competitors usually find pathways to offer their own protected versions of the product’s Function.

To see these observations in action, consider the retail solar industry. Growing at 20% per year, this industry is on a tear, one of the fastest growing industries of the past five years. Let’s consider one of the industry’s strongest leaders, Sunrun, to see what they offer according to the Customer Buying Hierarchy, and, importantly, what benefits make them unique for their customers.

Sunrun offers something in each of the Customer Buying Hierarchy criteria. Its Function offering is a customized design for every customer. Equipment guarantees represent its Reliability contribution. Sunrun also has a large set of solar integrators, sales partners and installers to offer customers excellent Convenience. Finally, its pricing approaches offer its customers lower Prices than competing utilities and better future pricing predictability. All competitors are likely to offer something they claim is unique in each hierarchy criterion.

But what really sets Sunrun apart from its competition? According to its management, it separates itself by offering unique Function and Price propositions. Its proprietary software, BrightPath, provides each customer with a design specific to that customer’s individual location and the customer’s personal objectives to achieve the best results, a Function benefit. It pairs this unique design with a unique higher Price Point option, also developed from its software, to offer the customer a tailored lease package. This package covers the cost of the lease of the solar system and all maintenance over the life of the lease. This lease package is a Convenience innovation that most of its customers find attractive.

Function innovations have led this fast-growing industry. The solar industry invests heavily in research and development for Function innovations in a world where the average industry spends very little on research. Most of the industry competitors tout their unique Functions in their sales propositions.

In moderate growth, more typical, markets, Reliability and Convenience innovations by suppliers drive the majority of market share growth. Unique Function innovations lose their power as competitors copy and neutralize them. Price may also rear its head as a notable contributor to share movement.

We will use two examples in this section. We will use both the contractor home insulation and the truck manufacturing industries from several years ago as our examples. The first illustrates a typical market with moderate growth. The second example is a market with moderate growth but with a large anomaly in customer decisions. This anomaly occurs frequently in markets in transition from a state of normal competition to one of intense competition with low Prices, a hostile market.

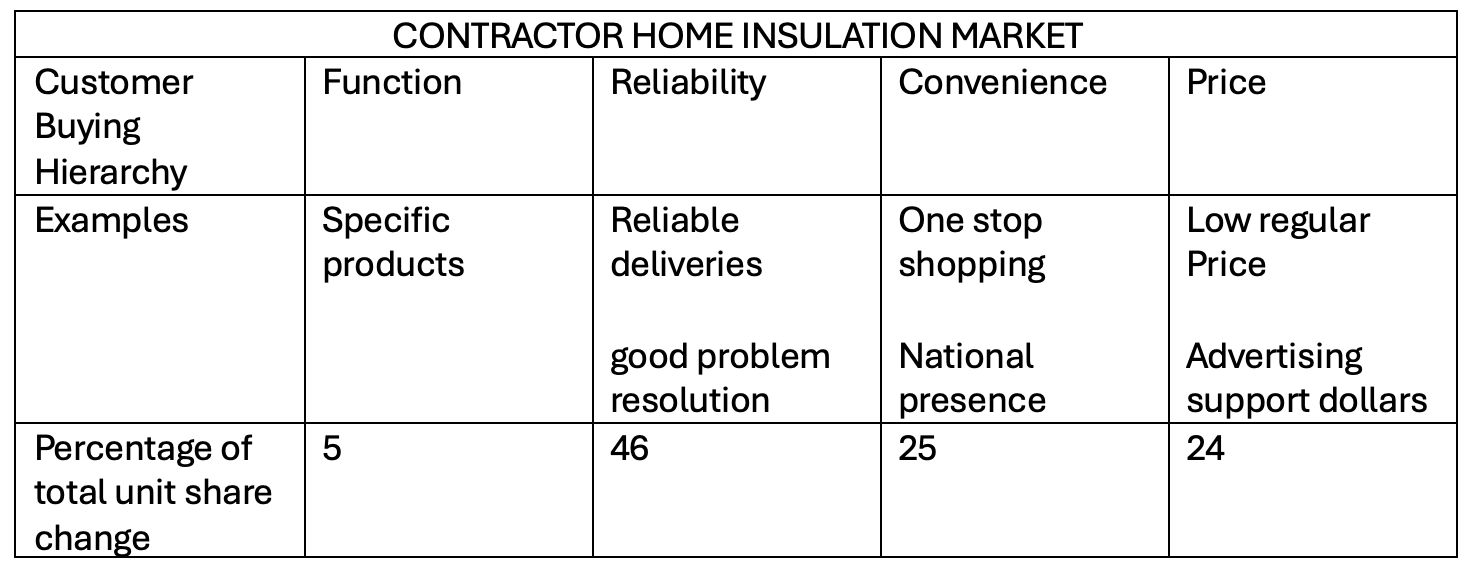

This picture of the contractor home insulation market (see table above) illustrates a typical market. It enjoyed moderate growth and average returns on investment. In this market, unique Functions have a minimal impact on changing market share. Various aspects of Reliability dominate share movement, accounting for 46% of share shifts, underscoring the importance of consistent performance. Convenience plays an important role, with 25% of the unit share shifts. Clearly, contractors value short order cycle times. Finally, Price drives 24% of market share fluctuations. Price sensitivity remains a factor in the market. Overall, this analysis reveals that contractors prioritize dependable relationships and ease of product access above all, Reliability and its complement, Convenience.

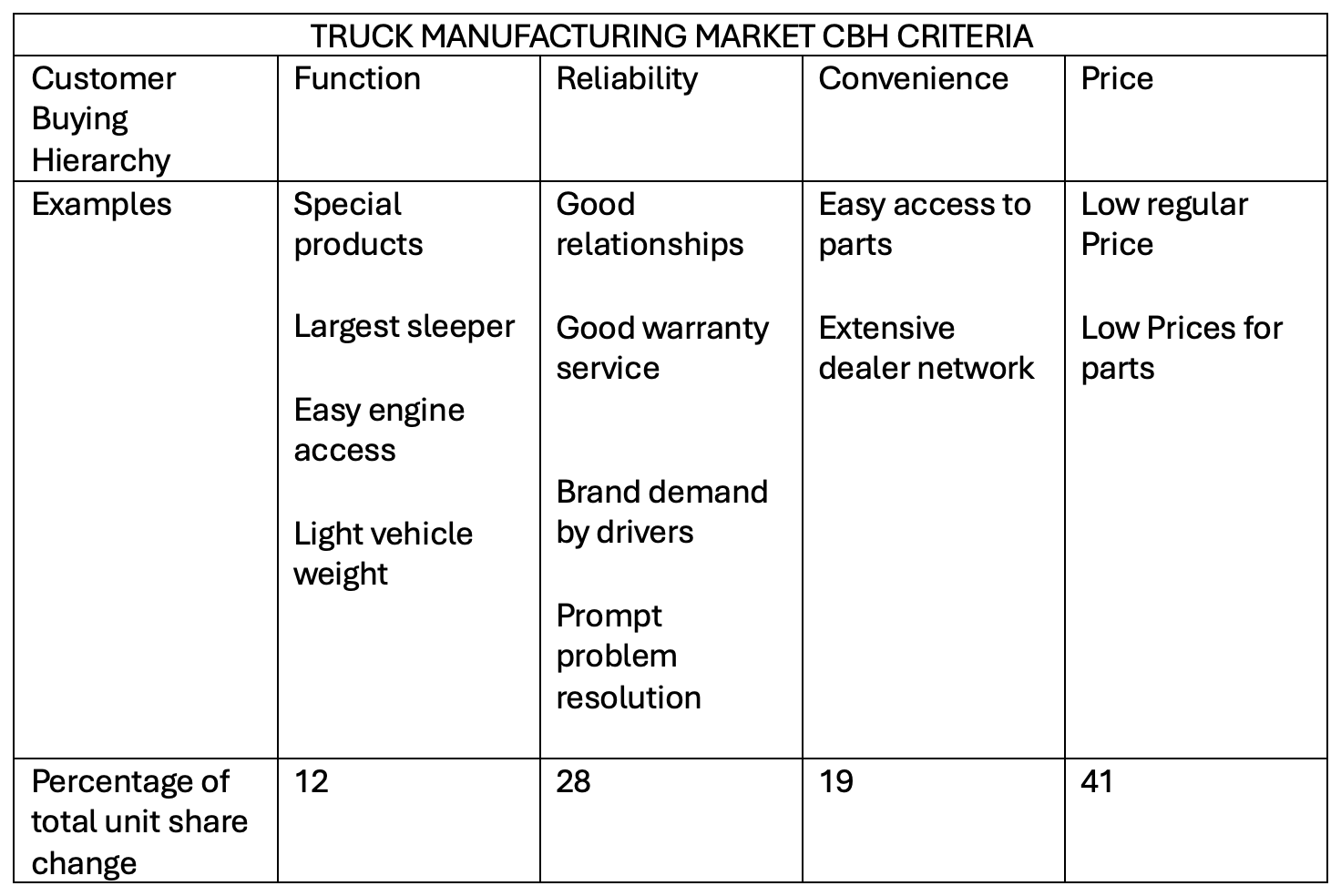

The truck manufacturing industry example (see table below) demonstrates another industry with moderate growth but with an unusual distribution in customer decisions.

Function was relatively feeble in moving share at this stage of the industry’s development. There are usually Function differences in any marketplace. And they certainly existed here. But these Function differences were not significant enough to bring about much share change among competitors. The industry competitors had largely neutralized any unique Function benefits by copying them.

Most of the share changes were due to a combination of Reliability and Convenience criteria. In practical terms, these two criteria are often closely related. They may even be interchangeable in the customer’s mind, though Reliability is the more important benefit and is higher on the hierarchy.

The anomaly in this industry is the outsized role of Price in driving market share shifts. Price was the single major driver of share change, 41% of the total. Normally, we would expect the Price criterion to represent no more than 25% of total unit volume purchases. A low Price in a typical market is unlikely to gain significant share over a longer period. Even in an average market, competitors learn they must parry low Prices or else lose share.

This lofty result for the Price criterion tells us that some suppliers were holding their Prices high in the face of discounting competitors. These high-Priced suppliers were trying to protect their margins but were losing share along the way. This is a common phenomenon, which we have called a Leader’s Trap, where an industry leader(s) tries to ignore a discounting competitor(s) who is gaining share with low Price. This occurs in many industries that are about to turn hostile, where Prices are low and returns unattractive.

Once these industry leaders realize the futility of their current pricing strategy, they will reduce their Prices dramatically to preserve and recover share. The industry will suffer a period of low Prices and poor returns until industry pricing stabilizes and improves again.

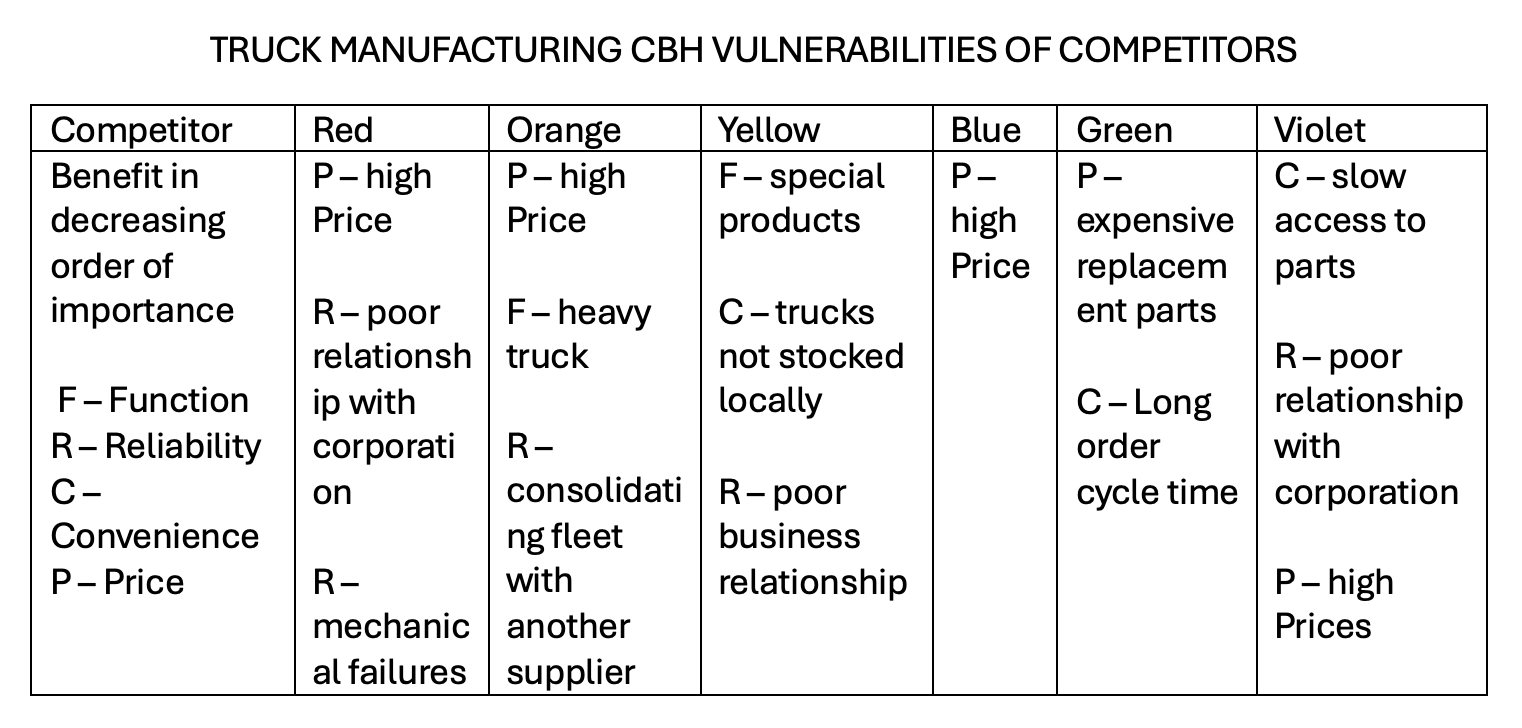

The Customer Buying Hierarchy can also inform us of the strengths and, especially, the weaknesses of each competitor in the market. It is easier to gain share by attacking weakness than by confronting strength. Knowledge of a competitor’s weakness directs the sales and marketing initiatives against that competitor.

The exhibit below shows the top three weaknesses of each competitor in the market, ranked by the order of greater to lesser weakness. Here we can see that the red, orange and blue competitors were those holding Prices high and losing share. The red competitor also had dangerous Reliability issues as did the violet competitor. A company would attack the key vulnerabilities of each competitor with the expectation that these attacks would lead to a greater probability of a gain in share.

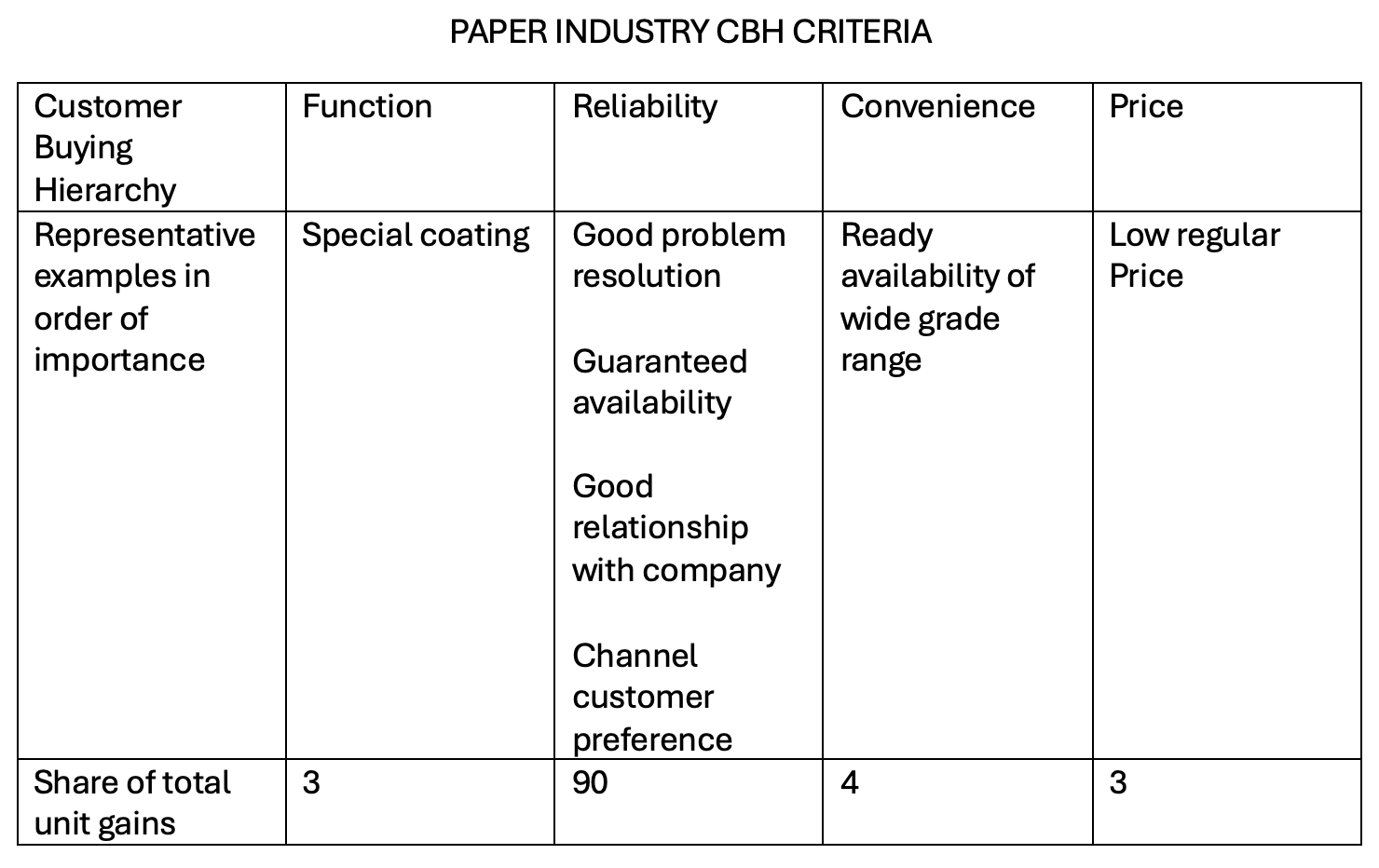

Our next industry is one of the paper industries from several years ago. In this example, the industry was in hostility, with slow growth, overcapacity, and poor returns on investment. The table below shows the Customer Buying Hierarchy criteria for share movement in the industry.

Characteristics of Reliability dominated share movement in this industry. Function, represented by special coating, caused 3% of the share change. Reliability, in the form of superb problem resolution, guaranteed product availability, good relationship with the company and channel customer preference accounted for 90% of the share movement in the industry. Convenience, represented by the ready availability of a broad range of grades, accounted for 4% of the share movement. Price represented only 3% of the industry’s share movement. These results are representative of a slow-growing, hostile market.

The pathway to success in this industry was Reliability. The low contribution of Function indicates that customers perceive little differentiation in product performance across competitors. Reliability had several characteristics of note. The most important benefit was that customers sought first good problem resolution. Note that customers did not cite quality of product as a Reliability issue. Apparently, customers viewed the quality of all suppliers as acceptable. Nor was either Convenience or Price important in current customer decision-making. Customers appear to have had ready access to products with little delay. Price moved very little share because most or all the competitors in the industry had learned not to lose customer purchases to a discounting competitor. In this industry, “last look” and Price matching were the rules.

We have seen several broad trends in reviewing specific industries and how industries evolve over time as revealed by the Customer Buying Hierarchy. First, unique Functions and low Prices are powerful incentives for share movement. Our fast growth market illustrates the power of unique Function. The truck manufacturing industry illustrated the power of low Prices. Second, the problem with unique Functions and low Prices is that they often have relatively short lives. Competitors learn to copy unique Functions and counter low Prices. Then, neither Function nor Price will yield much share change. They are so important in the customers’ buying criteria that competitors must learn to copy them to neutralize them. Third, as markets mature aspects of Reliability and Convenience come to dominate the operations of the industry.

Many of us have become accustomed to thinking of a commodity market as one in which the products are all the same so Price decides who wins the customer’s purchase. The true definition is the opposite. Over time, the Price becomes nearly a commodity, virtually all the same for everyone, but product differences dictate industry winners.

The Customer Buying Hierarchy shows that product differences may not always be visible, but they are real, and they explain success and failure. The results from a long-term look at industries as they evolve from fast growth to slow growth serve as a warning: Reliability eventually becomes very important to customer purchase decisions. A reputation for Reliability requires several years to develop. A company does not become superb in problem resolution nor establish trusting relationships with its customers in a short period of time. These characteristics take a few years of positive customer experience to embed themselves in the customers’ minds. A company anticipating a competitive future would wisely develop a reputation for Reliability sooner than later.

Spotlight

Sayan Chatterjee

Spotlight

Sayan Chatterjee

Spotlight

Mohammad Rajib Uddin et al.

Spotlight

Mohammad Rajib Uddin et al.