California Management Review

California Management Review is a premier professional management journal for practitioners published at UC Berkeley Haas School of Business.

Paul Strebel, Angeliki Papasava, and Patrick Reinmoeller

Image Credit | Studios

During the industrial era, companies were the primary forces behind wealth creation, generating value for shareholders, creating employment, and benefiting consumers and communities. Consequently, management studies centred on corporate strategy, marketing, and manufacturing. Researchers have extensively explored how businesses build relationships, optimise supply chains, and collaborate through alliances to develop and deliver new products efficiently (Visnjic et al., 2016).

K. Randhawa, J. West, K. Skellern, & E. Josserand, “Evolving a Value Chain to an Open Innovation Ecosystem: Cognitive Engagement of Stakeholders in Customizing Medical Implants,” California Management Review, 63/2 (2021): 101-134.

I. Visnjic, A. Neely, C. Cennamo, & N. Visnjic, “Governing the City: Unleashing Value from the Business Ecosystem,” California Management Review, 59/1 (2016): 109-140.

Stakeholder engagement has become a key concept in business and society research, offering a framework for understanding relationships between organisations and their stakeholders, including employees, customers, suppliers, competitors, and local communities. Following the widely accepted definition of stakeholders as those who affect or are affected by organisational activities, research highlights stakeholder engagement’s role in value creation, strategic planning, innovation, learning, accounting, and corporate social responsibility (Kujala et al., 2022)

When managers fail to recognize their critical stakeholders’ role in value creation, they risk undermining their organization’s value proposition. Undercutting the value proposition for critical stakeholders damages the value of other assets. Soft assets like the brand appeal and capabilities are especially vulnerable because their decline often remains undetected.

Leading and coaching executives from around the world in an online strategy program, we frequently encountered managers unaware of their value-critical stakeholders and unable to make progress on strategic issues. Their problem was not one of strategy but the lack of critical stakeholder involvement in the cycle of value creation.

Because stakeholder involvement and the quality of assets are not readily visible, the underlying problem often is incorrectly diagnosed. When financial performance is at stake, shareholders and owners demand cost cutting and their support for sharing whatever value is created becomes lukewarm at best. But without shared value the support of other stakeholders to ensure a sustainable future shrinks and a vicious cycle sets in. In two decades of working with top teams on their strategic challenges one of us has come across numerous downward spirals in stakeholder confidence.

Management must avoid the blind spots preventing the creation of value with stakeholders and identify the leverage points where stakeholder involvement will have the largest positive impact on value creation. Then they need to integrate the relevant stakeholders, share value, and keep score (Strebel et al., 2024).

Managerial lack of awareness is widespread concerning the appeal of the company to its stakeholders, how they affect the creation of both soft and hard assets, as well as the quality of the processes linking the stakeholders to the organization. There are four major blind spots that we have seen repeatedly while accompanying executives in making their strategic decisions.

In a leading European equipment company known for its construction site solutions, management didn’t see how competitive pressure and the lack of resources was eroding morale of the critical sales force. An aggressive lower price competitor was introducing new products rapidly and eating into the company’s market share. The Global Head of Marketing couldn’t get top management support to expand the sales force by adding sales people focussed on selling product items in addition to those selling solutions, nor for ramping up the innovation of complementary price-competitive products.

Potentially worse than not supporting your value-critical stakeholders is to become hostage to monopolistic stakeholders who extract value. A global port management company expanded rapidly with a decentralized structure organized around port terminal directors with mostly unionized stevedores. The downside was cost duplication which ate into margins. When management tried to streamline the global operations across the ports, they were blocked by the terminal directors who depended on the unions that monopolized the activity at each port and were unwilling to accept any risk to their compensation.

When profit-maximization is the objective, directors often become hostage to their shareholders’ short term interests. They ignore the impact on their value-critical stakeholders. When an American private equity firm acquired a premium Italian olive oil producer they prioritized dividend payouts. They loaded the firm with debt, reduced staff, and streamlined operations to increase the payout. The effects of being hostage to the short-term objectives of the acquiror soon became apparent. The quality of the value proposition declined, the brand image suffered, and the private equity firm was forced to restructure the acquisition.

Not seeing the value of soft assets, obscures the role of the related stakeholders. Senior management in a global pharma company didn’t appreciate how the expertise in its Oncology Diagnostics ecosystem could provide the platform for a corporate-wide diagnostics strategy. The latent demand for diagnostics was increasing across more and more of the company’s divisions. But the divisional heads were not willing to allocate part of their budget to a new corporate initiative with uncertain payback outside their control. And senior management didn’t see the value in doing so. This made it impossible for the Director of Oncology Diagnostics to capitalize on the growing demand and spearhead a corporate-wide diagnostics strategy.

When the processes that integrate stakeholders into value creation are ineffective it is very difficult to create value with them. Matrix organization in a German consumer goods company made it impossible to develop a process for creating online value propositions. With only dotted-line reponsibility the new Head of European Online Business was unable to create an internal and external ecosystem to carry out her mandate. She was frustrated by weak portfolio differentiation relative to online competitors, marketing channel conflicts, and a lack of senior management commitment to providing the resources for the development of a team of digital and online account management specialists.

To create value with stakeholders it’s important to consider the positive and negative impact of all stakeholders, including learning, financial and societal partners, whose impact may be less immediately apparent, especially the way they affect talent acquisition and soft assets, like the development of critical capabilities and the brand image.

Working with executives applying the Business Model Canvas, the Value Constellation and other stakeholder frameworks of interest versus influence, we have found they often miss touch points between critical stakeholders and how to create value. This is especially important in platform business models where the same stakeholders may be critical for creating more than one type of asset. An assessment that is complementary to the business model is needed highlighting the multiple points at which the same stakeholders may affect value creation.

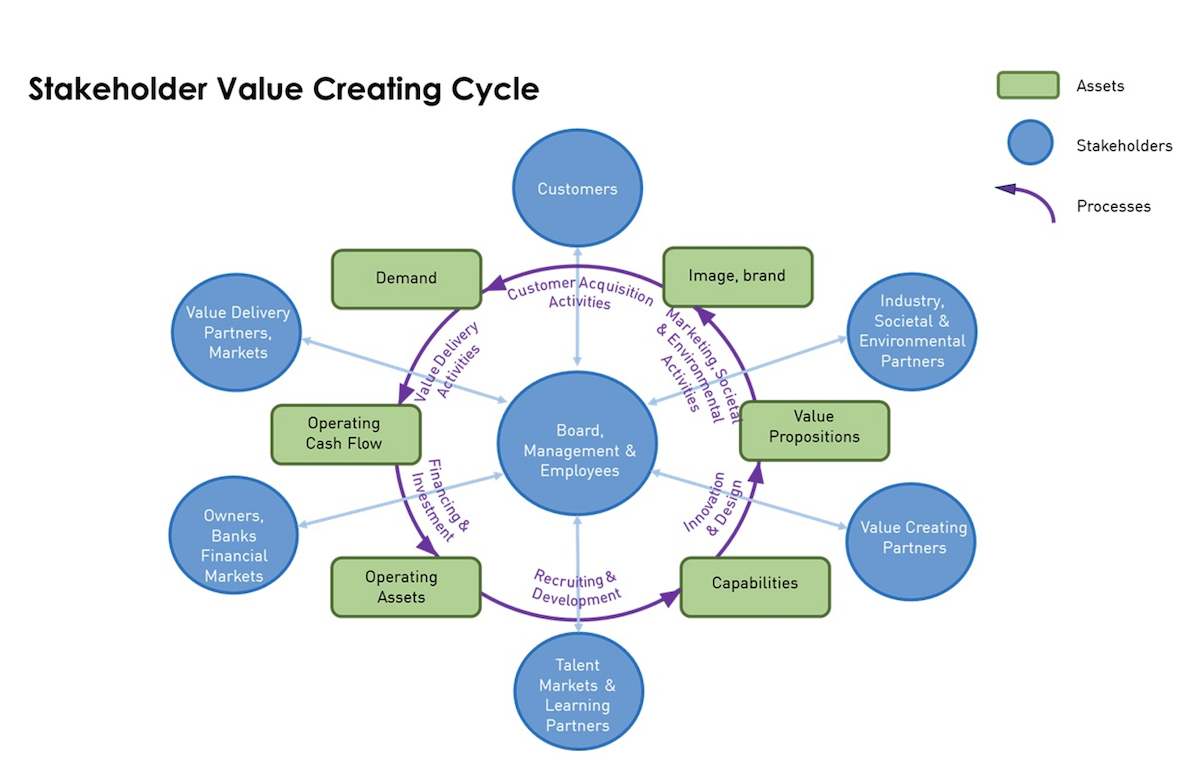

We developed the Stakeholder Value Creating Cycle to help executives focus on where stakeholders can have the biggest impact on the creation of both the soft and hard assets essential for long term value creation. This encourages executives to assess the attractiveness of the company for its stakeholders, as well as the processes that link the stakeholders to the organization and how these activities contribute to value creation for the company. In our article” How Stakeholders Break or Make Strategy: The Stakeholder Value Creating Cycle”, we present the model in detail (Strebel et al., 2024).

Using a circular diagram of the Stakeholder Value Creating Cycle (SVCC) to visualize how external stakeholders are an integral part of the ecosystem of value creation makes it easier to identify the most important leverage points.

The creation of the soft assets in the green rectangles on the right hand side and hard assets on the left of the value creating cycle in the diagram depends on the commitment of the internal and external stakeholders in the blue circles. Getting this commitment requires effective processes to integrate the stakeholders into the value creating cycle.

The SVCC highlights the critical external stakeholders for the development of each asset type. The state of the asset, increasing or decreasing in value, reflects the quality of the corresponding stakeholder relationships with the company and whether the stakeholders are really creating value.

Wei Ling, the HR-VP of the Asian division of a global healthcare company (a pseudonym), faced a challenge from her regional CEO: mediating a conflict between Global Research and Asian Marketing over the roll-out strategy for a groundbreaking new treatment. Research pushed for a rapid launch to outpace competitors, while Marketing argued that demand was insufficient.

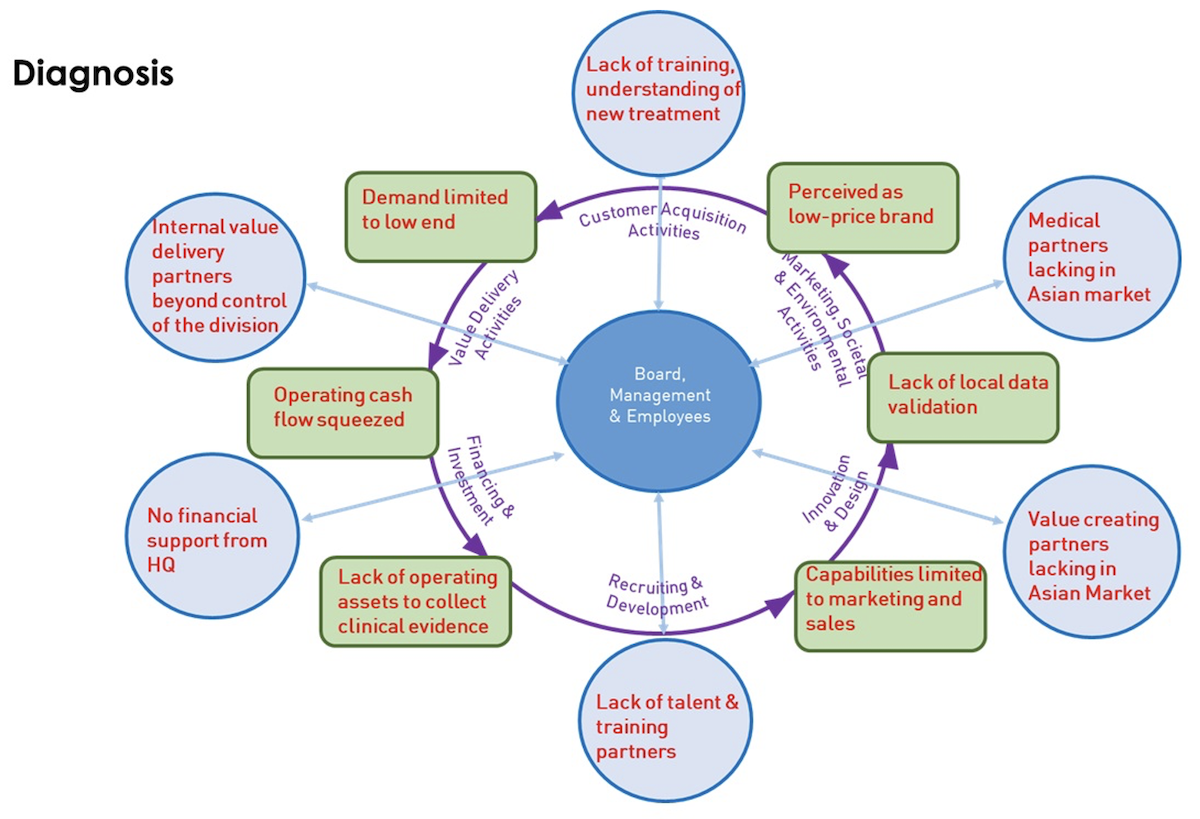

Before stepping in, Wei Ling applied the SVCC framework to investigate Marketing’s concerns. Tracing demand backward through the cycle, she identified six interdependent pain points that were constraining adoption of the new treatment. Tracing demand backward through the cycle, as shown in points 1 through 6 below, she identified six interdependent pain points shown in red print in the Diagnosis exhibit, that were constraining adoption of the new treatment.

The biggest value creating opportunities are those stakeholder relationships and processes most constraining the asset creating potential. Loosening these constraints can unleash a wave of value creation, as the effect of removing the limitation cascades through the value creating cycle.

Filling out a blank SVCC highlighting the pressure points for her division, it became clear to Wei Ling that the origin of the strategic dispute was not the hubris of R&D, nor the conservatism of Marketing, but the division’s lack of three specific categories of critical stakeholder: a digital clinical data team, a team of customer educators, and especially an Asian network of healthcare professionals.

Applying the SVCC Wei Ling saw that an Asian network would enhance asset creation at three points in the value creating cycle: as value creating partners participating in the validation of the value proposition, as societal partners enhancing the brand value by participating in online dialogue about heathcare, and as customers creating the demand for the company’s offerings. The division’s most value-critical stakeholders indeed were a missing network of Asian healthcare professionals.

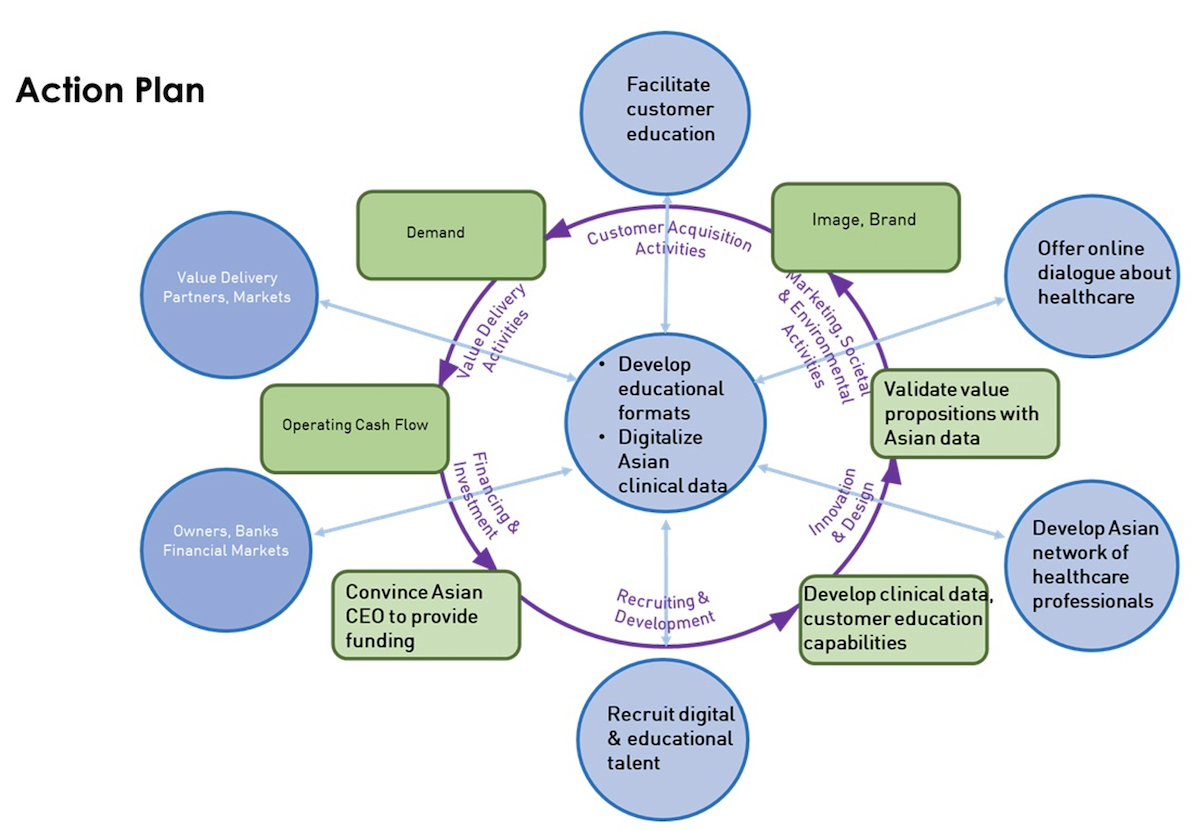

Wei Ling held the key to resolving the dispute between Research and Marketing. Beyond Finance’s refusal to fund additional stakeholder activities, the main constraint on the SVCC was the division’s recruiting process. Loosening this constraint offered significant potential for value creation.

Using the circular SVCC diagram, Wei Ling effectively highlighted the three missing stakeholder categories and developed the action plan shown in the exhibit and described below. This helped the Asian CEO recognize that improving recruitment—both for talent and healthcare partners—was the quickest way to drive value. Seeing the potential benefits, he took the risk of reallocating limited resources to invest in new talent, despite profit pressures.

To optimize the ecosystem represented by the Stakeholder Value Creating Cycle you must do three things:

Key stakeholders were actively involved in developing soft assets (Strebel et al., 2020). To strengthen the brand’s presence in Asia, Wei Ling collaborated with Marketing to address regulatory differences by gathering and analyzing clinical data to validate new value propositions.

The company established two internal teams to engage with external networks:

To enhance brand engagement, the digital team facilitated online discussions, extending beyond professionals to include patients in conversations about healthcare needs.

To sustain stakeholder commitment, shared value creation is essential, as developing quality soft assets requires long-term dedication.

Beyond access to the new treatment, healthcare professionals received online access to scientific resources, field updates, and best practices. They also participated in events and conferences on medical innovations, while patients joined experience-sharing sessions to support informed health decisions.

Wei Ling leveraged the company’s employee development program to attract talent to the digital and education teams. This included integration into the corporate digital network, AI training, and promotion opportunities based on contributions to clinical trials and customer adoption of the treatment.

With financial markets focused on quantitative data, monitoring soft asset quality and stakeholder engagement requires special attention. A strong stakeholder ecosystem helps maintain engagement in developing soft assets.

In healthcare, a well-managed network of employees, technology and industry partners, healthcare professionals, and patients ensures that value propositions, brand image, and critical capabilities remain a priority for executives.

Value creation and value capture function differently in healthcare. While the primary goal is to enhance long-term patient welfare efficiently, weak or distorted price signals make it challenging to assess the contributions of individual stakeholders (Randhawa et al., 2021).

To avoid blind spots, boards and top teams need open communication channels and leaders attuned to frontline developments. For the global healthcare company, this meant executives who balanced R&D risk-taking with market communication in Asia. Wei Ling addressed a gap in headquarters communication by recruiting ecosystem experts who highlighted the importance of local clinical data and training.

The true measure of stakeholder value is long-term financial performance. Once clinical data was available, Wei Ling’s division intensified marketing, boosting the company’s local image, revenue, and ROI. She proved the power of identifying key stakeholders, integrating them effectively, sharing value, and measuring impact.

Kujala, J., Sachs, S., Leinonen, H., Heikkinen, A., & Laude, D. “Stakeholder Engagement: Past, Present, and Future. Business & Society,” Business & Society 61/5 (2022): 1136-1196.

Randhawa, K., West, J., Skellern, K., & Josserand, E. “Evolving a Value Chain to an Open Innovation Ecosystem: Cognitive Engagement of Stakeholders in Customizing Medical Implants.” California Management Review, 63/2 (2021): 101-134.

Strebel, P. Cossin, D.& Khan, M. “How to Reconcile your Shareholders with Other Stakeholders,” MIT Sloan Management Review 62/1 (2020): 63-69.

Strebel, P. Papasava A. & Reinmoeller, P.” How Stakeholders Break or Make Strategy: The Stakeholder Value Creating Cycle.” IbyIMD, (2024) 40-44.

Visnjic, I., Neely, A., Cennamo, C., & Visnjic, N. “ Governing the City: Unleashing Value from the Business Ecosystem.” California Management Review, 59/1 (2016): 109-140.

Spotlight

Sayan Chatterjee

Spotlight

Sayan Chatterjee

Spotlight

Mohammad Rajib Uddin et al.

Spotlight

Mohammad Rajib Uddin et al.