California Management Review

California Management Review is a premier professional management journal for practitioners published at UC Berkeley Haas School of Business.

Amit Joshi

Image Credit | Kalyakan

In business-to-business (B2B) domains, bundling service contracts with products has become a standard practice for capital-intensive equipment, such as gas turbines, aircraft engines, and healthcare devices like magnetic resonance imaging (MRI) and computed tomography (CT) scanners. While product sales in these domains often remain stable or decline gradually, service contracts have become a critical source of recurring revenue for Original Equipment Manufacturers (OEMs). These contracts strengthen financial performance and foster deeper customer relationships and loyalty. For instance, before its recent restructuring, GE reported that service revenues accounted for 70% of its total revenue in 20231.

David Sjödin, Vinit Parida, and Ivanka Visnjic, “How Can Large Manufacturers Digitalize Their Business Models? A Framework for Orchestrating Industrial Ecosystems,” California Management Review, 64/3 (2021): 49-77.

Alessia Correani, Alfredo De Massis, Federico Frattini, Antonio Messeni Petruzzelli, and Angelo Natalicchio, “Implementing a Digital Strategy: Learning from the Experience of Three Digital Transformation Projects,”

California Management Review, 6/4 (2020): 37-56.

To enhance service delivery, OEMs have significantly invested in remote monitoring and diagnostics (RM&D) technologies, collectively called predictive technology. These tools enable real-time monitoring of globally deployed assets, leveraging artificial intelligence and vast datasets to identify potential failures pre-emptively. Predictive technology improves service efficiency, reduces downtime, and informs product design enhancements. This proactive approach empowers OEMs to deliver reliable and efficient customer service, reinforcing trust and confidence in their offerings.

Over the last couple of decades, our capacity to increase the number of transistors on an integrated circuit has significantly lowered the cost of predictive technology, making it more accessible to Original Equipment Manufacturers (OEMs). With this greater accessibility and the potential of such technology, we explore the implications for OEMs aiming to leverage predictive technology to enhance their traditional revenue streams in three specific use cases.

Advancing digital technologies and lower costs now make predictive solutions accessible to more OEMs. Traditionally, OEMs avoided service contracts due to risks and capability constraints, relying on standard warranties. Predictive technology transforms this model, enabling recurring revenue and enhanced customer value.

B2B organizations that sell capital-intensive assets, such as gas turbines and aircraft engines, employ Remote Monitoring and Diagnostics (RM&D) as a form of predictive technology to transition from reactive to proactive maintenance. By leveraging artificial intelligence(AI) and machine learning(ML), predictive technology facilitates the analysis of sensor data to anticipate failures, thereby enhancing efficiency and preventing costly breakdowns. These advancements minimize revenue loss— for example, reducing the forced breakdown cost of a gas turbine from $2M to $0.13M2.

Many organizations integrate predictive technology into service contracts and operations. GE Power’s Atlanta-based Monitoring and Diagnostics Centre, the world’s largest of its kind, oversees 5,000 turbines across 950 power plants in 75 countries3. Siemens Healthineers’ Smart Remote Services (SRS) enables real-time system monitoring and faster remote service4. Similarly, Baker Hughes’ Bently Nevada system provides predictive maintenance through continuous machine health monitoring5. Predictive technology is thus widely used in service contracts for capital-intensive assets, helping OEMs minimize failure costs and reduce the expense of administering these contracts.

Recent advancements have dramatically lowered the cost of predictive technology, making it more accessible for OEMs. The widespread adoption of cloud computing has eliminated the need for costly on-premise infrastructure by offering flexible, pay-as-you-go models6. Additionally, open-source software like TensorFlow and PyTorch reduces the need for expensive proprietary tools7, while edge computing minimizes data transfer costs by processing information locally8. Further, the cost of IoT sensors has decreased, making data collection more affordable9. Finally, pre-trained AI models and AutoML tools have streamlined the process of creating predictive models, reducing the need for specialized expertise10. Together, these innovations have lowered the cost and complexity of deploying predictive technology.

We explore how OEMs can use these dropping costs in predictive technology to drive additional revenues from service contracts either by (1) entering hitherto untouched markets, (2) choosing products in their existing portfolio for offering service contracts, or (3) reevaluating their market segmentation strategy.

An intriguing question to consider is: “Can OEMs leverage predictive technology to generate additional revenue from remote service markets?” These markets are classified as ‘remote’ due to the relative inaccessibility of OEMs’ supply chains for repair and service, presenting a significant obstacle for decision-making from headquarters. Serving products in remote markets brings numerous challenges for manufacturers. Insufficient infrastructure hinders efficient operations. Regulatory restrictions and high initial costs for deploying products complicate issues further in regions with limited financial and policy support. Additionally, aging products demand more frequent maintenance, but the absence of local expertise and facilities in remote areas makes prompt repairs challenging.

However, OEMs are approached for product service in such domains from time to time. With the potential offered by predictive technology, should OEMs reconsider such markets for service? For example, in 2018, a significant customer in a hitherto embargoed Southeast Asian country approached the OEM of power plant equipment to restore a part of its 20-year site. The OEM had an engineering base in India. Still, most commercial decisions, part shipments, and approvals came from the United States or Europe headquarters, highlighting the slow decision-making process in such markets.

In the meantime, a fringe firm, present in such markets and comprising enterprising local people, played a crucial role in keeping the plant operational. They achieved this by buying necessary spares from their sources and developing the capability to make repairs. The bespoke country possessed abundant hydroelectric energy, and post-upgrade word-of-mouth publicity of a higher-than-expected failure rate might drive existing power-plant users to abandon their wearing equipment for this abundant electricity source. Like other markets in developing countries, the market size was also sensitive to the firms’ service prices and the fringe firm’s capability to repair the equipment.

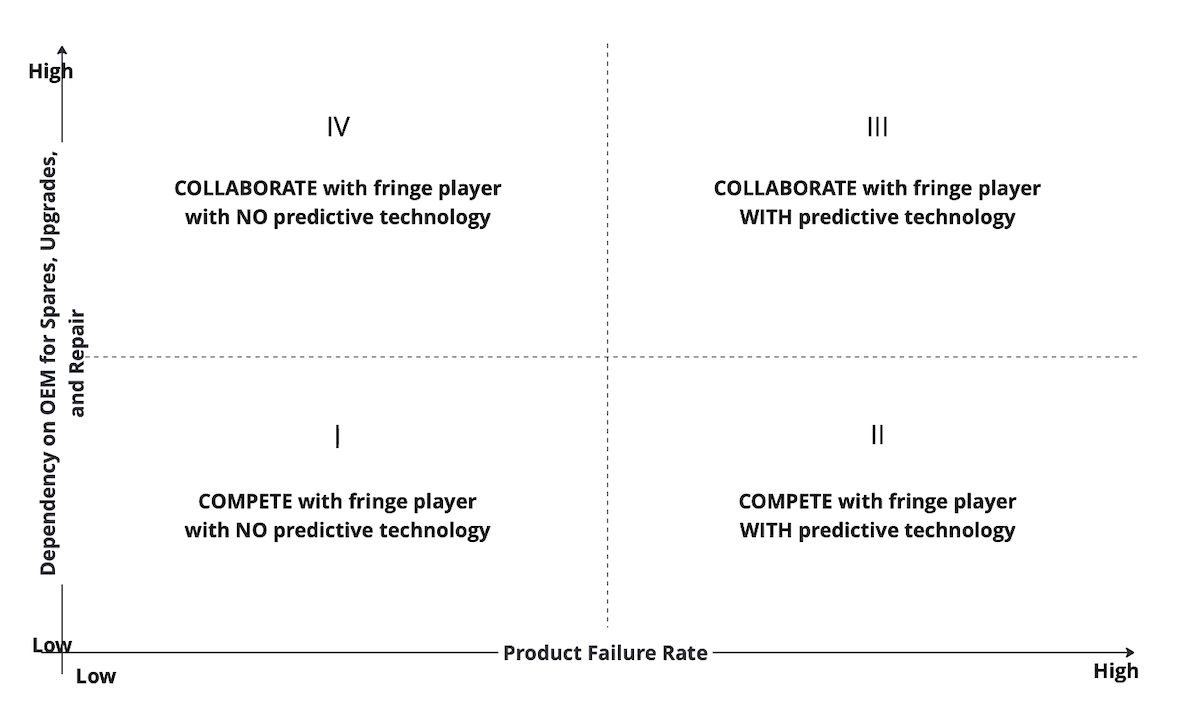

The anecdote above allowed us to characterize remote product service markets on two dimensions: (1) the product failure rate driven by the operation and maintenance practices of the customer and (2) the customer’s dependence on the OEM for spares, upgrades, or repairs typically driven by the nature of the product technology. Thus, a high-technology product is not easily reparable or upgraded in a remote product service market, driven by the use or need of specialized spare parts or tools, driving dependence on the product OEM for service. In such remote markets, the OEM has multiple strategic options available, such as,

Based on an analytical model11, we arrive at a 2x2 decision matrix on two dimensions depicted in Figure 1.

Figure 1: Strategic options for operating in remote service markets with a fringe player

Typically, high-technology products, such as the latest generation combined cycle power plants, operated in remote markets could have high failure rates if not operated appropriately. In such situations, the customer’s dependence on the OEM for spares, upgrades, and repairs is high. The OEM will be better served in such situations by providing the fringe firm with spares and the know-how to repair and upgrade the products while letting the fringe firm do the actual service. In Figure 1, Quadrant III accommodates such scenarios.

Conversely, customers owning lower-technology products, such as uninterrupted power supplies, tend to be less dependent on OEMs for spares, upgrades, or repairs. OEMs servicing such products are better off competing with the fringe firm while using predictive technology, considering that the product is still likely to have a high failure rate given overuse in such remote markets. In Figure 1, quadrant II accommodates such scenarios.

Following the same logic, lower failure rates indicate a reliable product, thus pre-empting the need for predictive technology. Therefore, for scenarios in quadrant IV, where there is high dependence on the OEM for product spares but a reliable product, the OEM can collaborate with the fringe firm without using predictive technology.

Finally, in scenarios in Quadrant I, the OEM will be forced to compete with the fringe player. Here, the product is reliable, and spares and service expertise are easily obtained.

We further demonstrate our framework by discussing microgrid solutions provided by power management companies like Eaton and Schneider to remote and off-grid communities. A microgrid combines renewable energy technologies with the local electricity grid to improve these communities’ energy independence, reliability, and sustainability. This system uses unique control methods to manage and optimize renewable energy sources with the optional electricity grid. Still, it can be complicated and prone to failure if not properly maintained. Because of this complexity, local communities often rely on original equipment manufacturers (OEMs) for spare parts and maintenance. Therefore, we place microgrids in quadrant III of Figure 1. Our framework suggests OEMs setting up and operating microgrids collaborate with local players using predictive technology, an approach hinted at by such OEMs as well12.

In B2B domains, conglomerates stand out for their unique structure, typically comprising a parent company and multiple subsidiaries operating in diverse markets. These conglomerates, often vast and multinational, serve as original equipment manufacturers (OEMs) for various products and services. Predictive technology is frequently touted as a universal solution, prompting companies to leverage it strategically. A key question arises: “How should conglomerates identify which products in their portfolio should be integrated with predictive technology?” Additionally, “Which products stand to gain the most from being bundled with service contracts?”

Identifying the optimal products for predictive technology in the portfolio involves crucial factors, as highlighted by industry experts. The effectiveness of predictive technology in enhancing service and product development efficiencies relies heavily on real-time access to product data. The ability to access this data hinges on two primary factors:

Equipping a product with the appropriate level of predictive technology necessitates:

However, gaining data ownership can present challenges, mainly when the product is part of a broader solution end customers use. In such cases, the end user of the final solution, which incorporates the product, typically holds sole ownership of the data. Access to this data is contingent upon the position of the product manufacturer in the value chain relative to the end user. The concept of “distance”13 between the OEM decision-maker and the end-user in the business-to-business (B2B) domain plays a crucial role in data ownership dynamics. For instance, for a truck gearbox manufacturer, the truck’s owner is the sole owner of the data it generates. Further, the truck OEM, which integrates the gearbox, is the truck owner’s first point of contact. Thus, the gearbox manufacturer’s distance from the truck owner is higher than the truck manufacturer’s distance from the owner.

The farther the OEM decision-maker is from the end user in the value chain, the more challenging it becomes to access real-time data. Consequently, ensuring proximity to the end user is a pivotal consideration for conglomerates when selecting products for predictive technology implementation. Although products distanced from end users can still benefit from predictive technology integration, the primary focus should be on products closely tied to end users.

Switching gears to service contracts, the impact of predictive technology on service productivity prompts key OEM decision-makers to explore service verticals for each OEM segment. However, at least two product characteristics deserve attention when considering service offerings.

We identify a “product criticality” dimension to define the above two characteristics. Thus, batteries inside uninterrupted power supplies and truck gearboxes are critical to the UPS and truck operation, respectively. In contrast, the truck headlamp is less vital to its operation than the gearbox. Critical products are more suited to offering service contracts. Such products will also benefit from predictive technology.

Overall, the decision-making process for service contracts and predictive technology in conglomerates hinges on two dimensions: distance from the end-user and product criticality. By carefully assessing these dimensions, conglomerates can strategically position their products and services in the market, as visualized in the comprehensive decision-making matrix depicted in Figure 2.

Figure 2: Identifying products for predictive technology and service contracts

Highly critical products with low distance to the end-customer, such as gas turbines and aircraft engines, deserve to be equipped with predictive technology and offered with service contracts. These fall in quadrant II of Figure 2. The microgrid, highlighted in the previous section, also falls in the same quadrant. Similarly, highly critical products far from the end user fall in quadrant III. Such products are candidates for predictive technology, but when offering service contracts, the OEM needs to be cognizant of the other players in the value chain. Truck gearboxes, batteries in UPS systems, and Aerospace line replaceable units fall into this category. Products falling in quadrant IV are typically consumables and should be left alone. Finally, the OEM should offer a “pay-as-you-go” service or extended warranty contracts for products in Quadrant I to ensure end-user satisfaction. Typical examples of such products are consumer products offered with extended warranties. However, predictive technology for such products has yet to take off significantly.

Profit-maximizing OEMs selling products with or without service contracts segment their markets to meet their customers’ diverse needs. Offering services on products enables recurring revenue streams on all future product sales and the existing installed base. In this context, how does offering service contracts on products change an OEM’s market segmentation strategy? Further, can predictive technology be used to the OEM’s advantage in such a context?

During our research on service contracts and predictive technology, we found that products sold with service contracts tend to be sold in fewer market segments along the product performance dimension, with the most premium segment having the highest performance. For instance, gas turbines, always sold with service contracts, are offered in two segments created along the power rating of the turbines (<200 MW and >200 MW)14. In contrast, induction motors sold only with equipment warranty are sold in innumerable segments along the horsepower dimension, so much so that market research firms do not segment this product line on the mentioned dimension15. This simple finding led us to ask, “What drives an OEM’s ability to create a premium segment when selling products with service contracts?”

Bundling service contracts with products exposes the OEM to the customers’ lifetime failure opportunity cost, an entity directly related to the per-event failure cost of the product. Through a mathematical model, we found that the proposed premium segment product’s failure opportunity cost is the biggest hindrance to offering it16. The higher this failure opportunity cost, the lower the OEM’s ability to offer a premium segment product in markets with a lower proportion of premium customers. A gas turbine OEM offered its premium product in China, Pakistan, and Bangladesh at the same time frame17,18,19, with only the Chinese market having a substantial number of premium customers for these products, most likely due to the premium segment failure opportunity cost being lower than a threshold.

However, sometimes, this failure opportunity cost becomes so prohibitive that it renders the entire business value proposition of selling the premium product completely unviable, as was found by the now-defunct Enron power company that deployed natural gas-operated turbines in Dabhol in India in the late 90s. Enron installed the then state-of-the-art premium 9FA gas turbines in collaboration with GE and Bechtel. The project envisaged Enron transporting liquefied natural gas from Qatar to operate these gas turbines. While this transport facility was being built, the turbines would be operated with Naphtha, a liquid fuel with high operating costs20. Either way, the failure opportunity cost of these turbines needed to be lowered. In the 90s, the proportion of premium customers in India could be deemed low. In hindsight, our model could have easily highlighted the infeasibility of introducing these turbines in the Indian market.

Predictive technology helps OEMs reduce the mentioned cost, enabling them to offer premium products in markets with a lower proportion of premium customers. If it had been available in the 1990s, such technology could have helped Enron, provided the cost of failure was significantly lowered. Interestingly, our model also revealed that with predictive technology, the OEM will likely opt to sell only the premium product in markets with far fewer premium customers.

Integrating predictive technology in service contracts presents a significant opportunity for OEMs in B2B domains to enhance profitability and customer satisfaction. By strategically segmenting markets, targeting the right products, and overcoming challenges in remote markets, OEMs can leverage these technologies to gain a competitive edge. This article provides actionable insights and frameworks to guide OEM decision-makers in this transformative journey.

Spotlight

Sayan Chatterjee

Spotlight

Sayan Chatterjee

Spotlight

Mohammad Rajib Uddin et al.

Spotlight

Mohammad Rajib Uddin et al.